Configuring Additional Settings for PayTraQer Summary Sync

November 20, 2025

Introduction:

In PayTraQer, managing other settings allows you to configure how various transaction types, such as adjustments, deposits, and miscellaneous transactions, are categorized and recorded in QuickBooks. This article provides a comprehensive guide on how to customize these settings to accurately reflect your financial transactions.

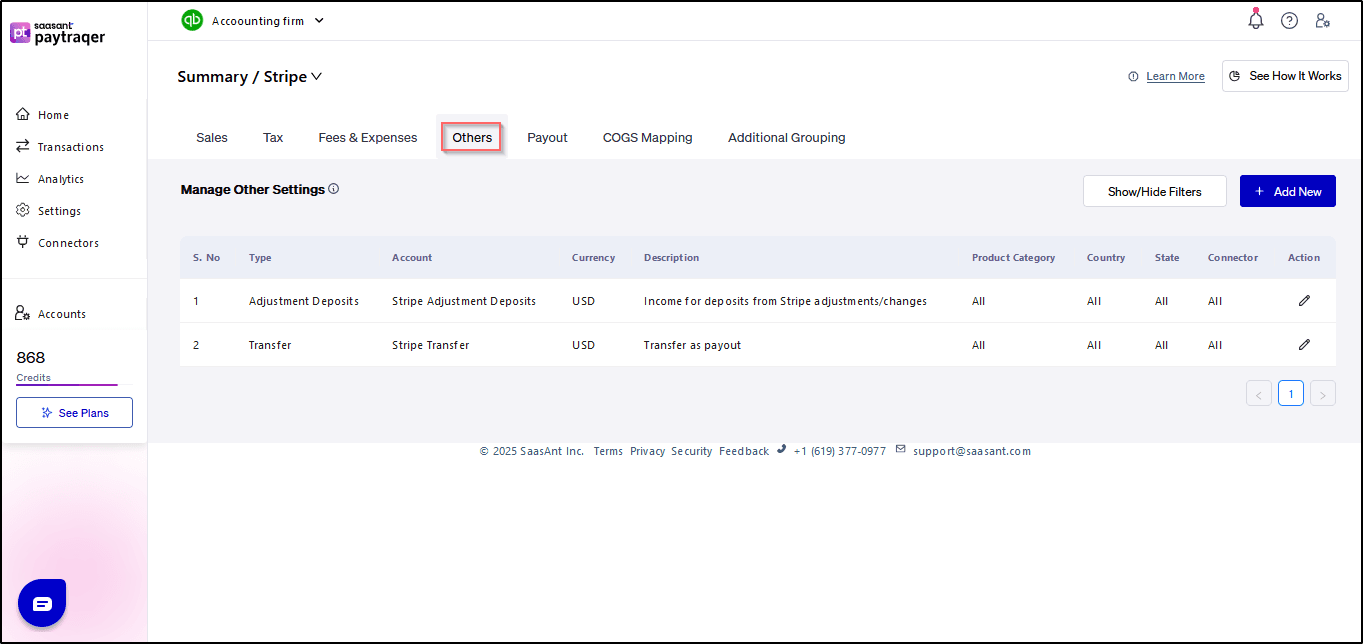

To access the "Other" settings in PayTraQer, follow these straightforward steps:

Click the gear icon.

Go to Settings.

Select the payment processor (Stripe).

Click on "Others.

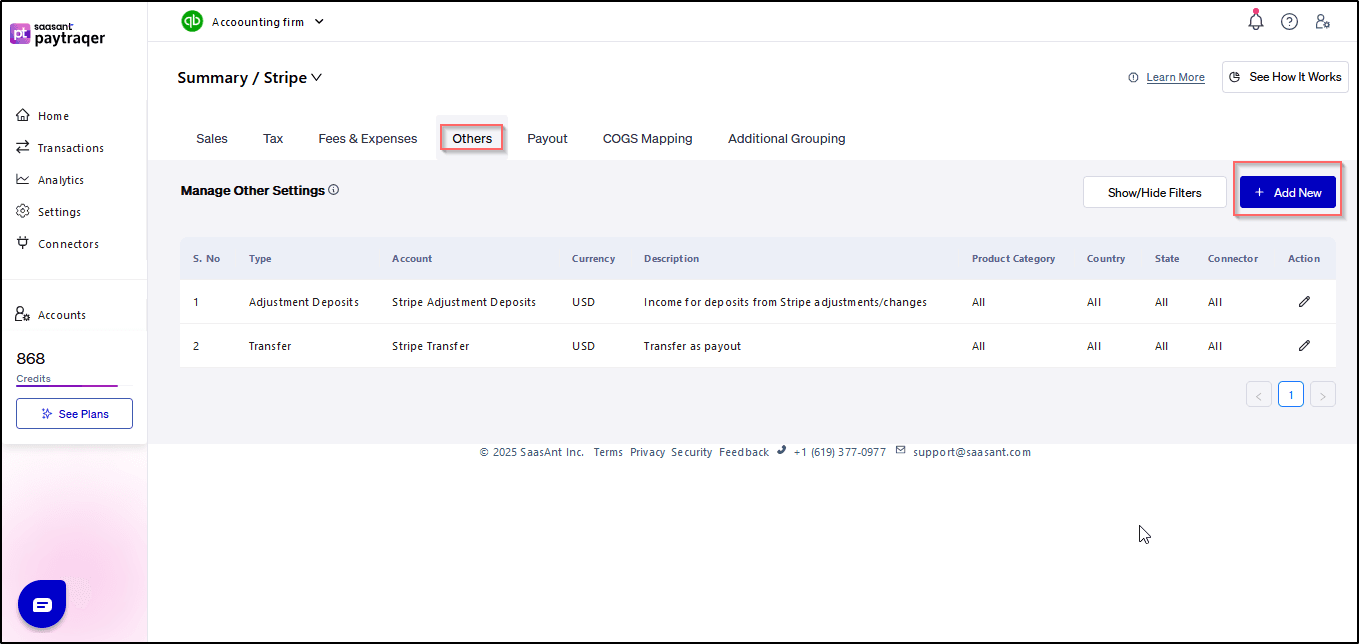

Add New:

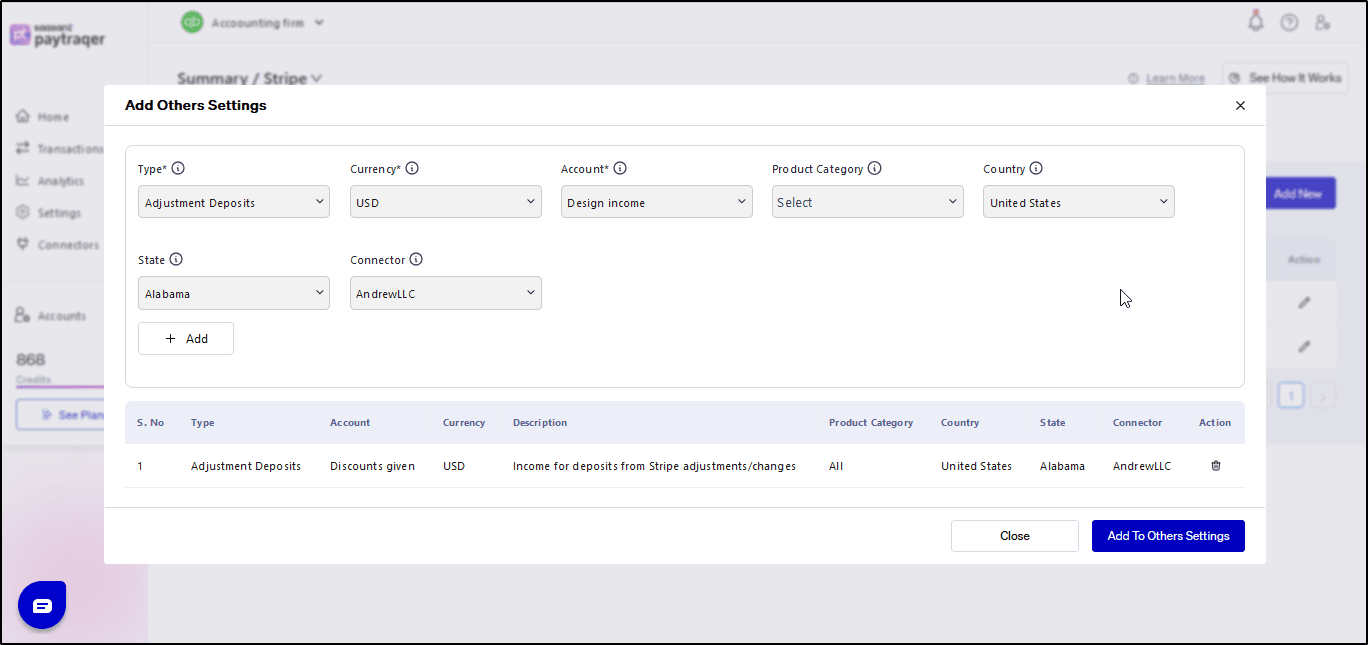

1. Type:

The "Type" setting enables you to specify the transaction type for each rule related to other transactions. Different transaction types may include adjustments, deposits, or other miscellaneous transactions. Here's how to configure the transaction type setting:

Select the appropriate transaction type from the dropdown menu.

Save the changes to apply the selected transaction type.

2. QuickBooks Account:

Configuring the QuickBooks account ensures that other transactions are recorded accurately in your accounting software. You can designate specific accounts within QuickBooks to record adjustments, deposits, or miscellaneous transactions. Follow these steps to set up the QuickBooks account:

Choose the relevant account from the dropdown list.

Save the changes to assign the selected QuickBooks account.

3. Country:

Applying settings to transactions from specific countries allows you to customize transaction categorization based on geographic location. This feature is particularly useful for businesses operating in multiple countries. Here's how to apply the setting to transactions from a particular country:

Choose the country from the dropdown menu.

Save the changes to apply the settings to transactions originating from the selected country.

Conclusion:

By following the steps outlined in this article, you can effectively manage other settings in PayTraQer to ensure accurate categorization and recording of adjustments, deposits, and miscellaneous transactions in QuickBooks. For further assistance or inquiries, don't hesitate to contact our support team for guidance.

Related PayTraQer Articles:

1) Please refer to this article: PayTraQer - Sales Settings Configuration

2) Please refer to this article: Configuration of Tax Settings for Summary Sync in PayTraQer

3) Please refer to this article: Configuration of Fees and Expenses for Summary Sync in PayTraQer

4) Please refer to this article: Configuring Additional Settings for PayTraQer Summary Sync

5) Please refer to this article: Configuration of Payout Settings for Summary Sync in PayTraQer

6) Please refer to this article: Configuration of COGS Matching for PayTraqer Summary Sync

You can reach out to us at support@saasant.com if you are stuck somewhere.