Configuring COGS Settings for PayTraqer Summary Sync

January 1, 2025

When you use summary sync in PayTraQer, sales are posted as summarized entries instead of one entry for every single transaction. To keep your margins accurate in this mode, you can configure Cost of Goods Sold (COGS) in PayTraQer.

This article explains:

What COGS means in this context

When to use COGS with summary sync

How to configure COGS accounts and product costs in PayTraQer

This setup is only required if you want PayTraQer to calculate and post COGS for summarized entries.

1. What is the Cost of Goods Sold (COGS)

In this context:

COGS is the total direct cost of the products you sold during a period.

It usually includes the cost of items you sell from inventory.

It is used to calculate gross profit (Sales minus COGS).

In QuickBooks, COGS is normally recorded to a Cost of Goods Sold account type and reduces your profit for the period.

2. When to use COGS in PayTraQer

Use the COGS settings in PayTraQer when:

You are using summary sync for your payment or e commerce channels, and

You want PayTraQer to calculate and post COGS for those summarized sales entries.

If you are only syncing detailed transactions line by line and handling COGS elsewhere, you may not need this configuration.

3. Where to configure COGS in PayTraQer

Sign in to PayTraQer.

Open the Settings in left sidebar.

Go to the Summary Sync / COGS configuration screen.

Locate the section for Cost of Goods Sold (COGS).

4. Enable COGS calculation

To let PayTraQer calculate COGS for summary sync, use this option:

Enable COGS Settings

Calculate the total costs of the products sold in your payment or e commerce platform.

Turn this On if:

You want PayTraQer to compute COGS for summarized entries using product cost data.

When enabled, you must also set:

Expense Account

Inventory Asset Account

Manage Product Costs

5. COGS accounts

Expense Account

Expense Account: Select an Expense account to track the Cost of goods sold.

Choose the account that should hold your COGS postings.

In most QuickBooks setups, this is a Cost of Goods Sold account type (for example “Cost of Goods Sold” or “Product COGS”).

This account will be used when PayTraQer posts COGS for your summary entries.

Inventory Asset Account

Inventory Asset Account: Select an Asset account for tracking inventory reduction from sales.

Choose the inventory asset account that tracks the value of your stock in QuickBooks.

When COGS is calculated for summaries, PayTraQer reduces this account and increases your COGS account.

Use an inventory type asset account that you already use for product stock in QuickBooks.

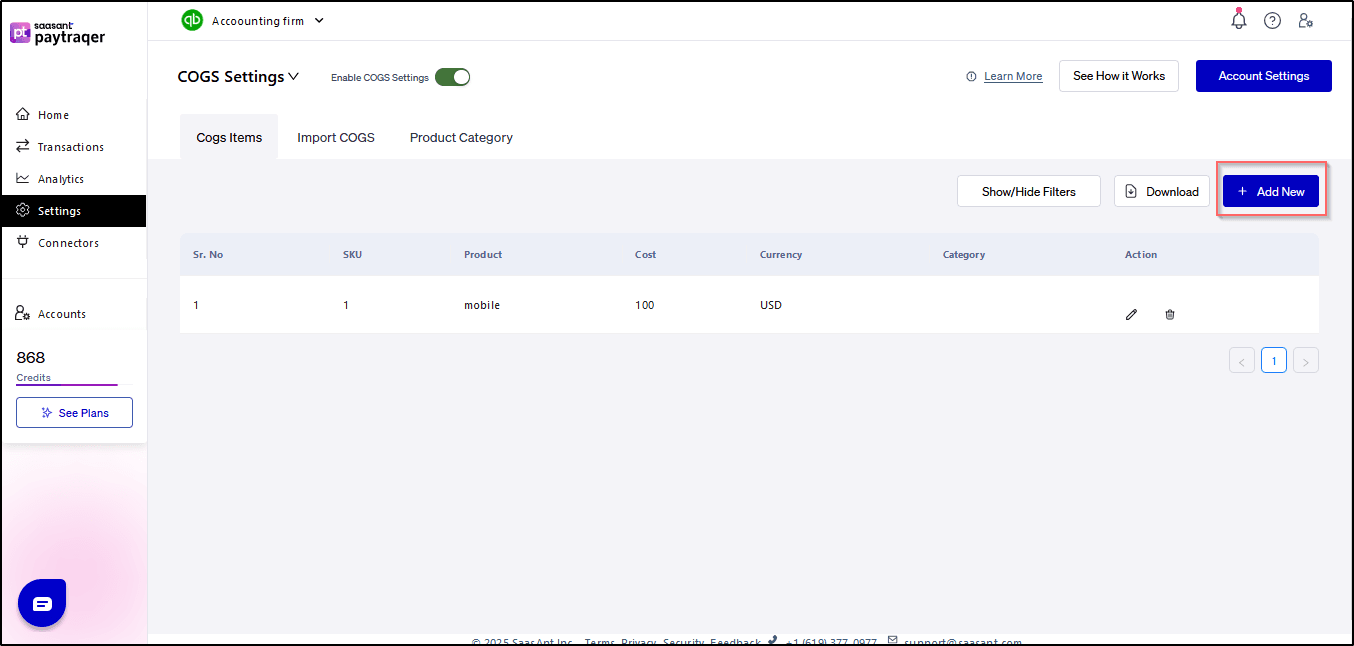

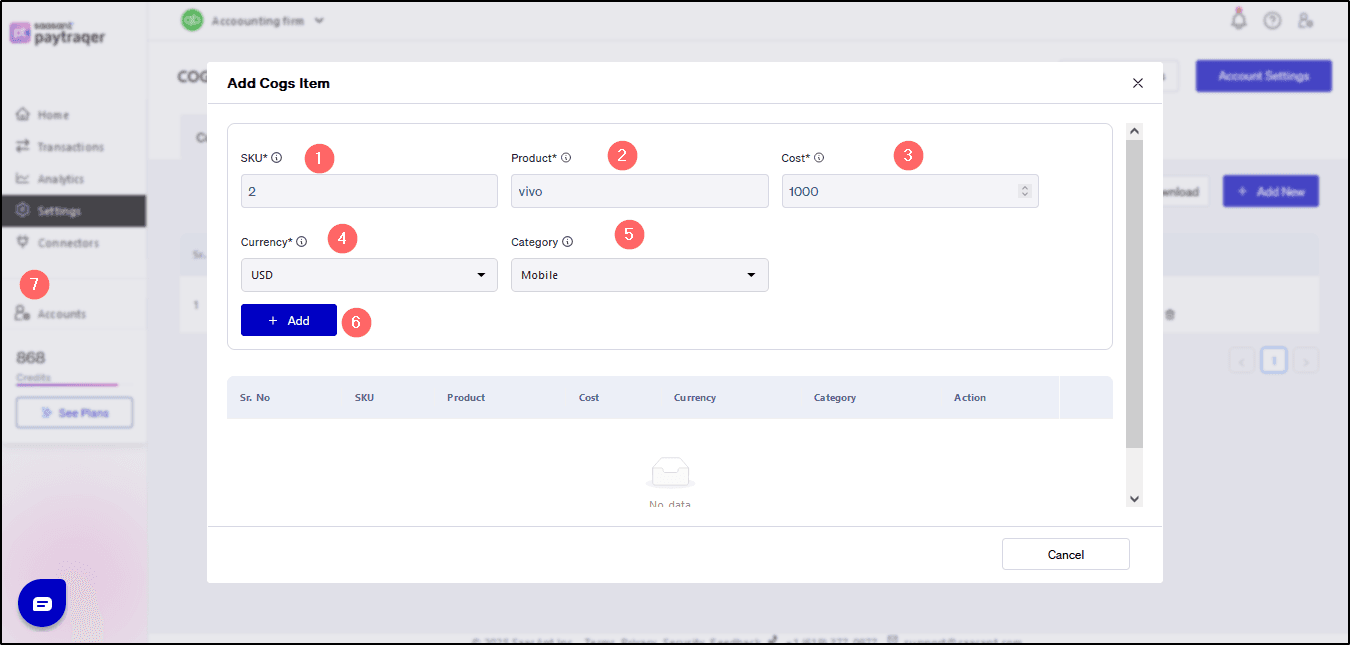

6. Manage product costs

The Manage Product Costs section stores the cost details PayTraQer uses when calculating COGS.

You need to provide the following details for each product:

SKU

Product SKU used in your payment system or e commerce platform.Product Name

Name of the product in your payment system or e commerce platform inventory.Product Cost

The cost of each item sold from your inventory (not the selling price).Currency

The currency used for the items sold from your inventory.

PayTraQer uses this cost data when building COGS for summarized sales entries.

Important note

Cost modifications will not update the cost of goods sold (COGS) for previous transactions.

To reflect changes in cost, you need to regenerate COGS for the affected period.

If you change product costs after summaries are posted, you must run the COGS regeneration process in PayTraQer so that COGS values are updated.

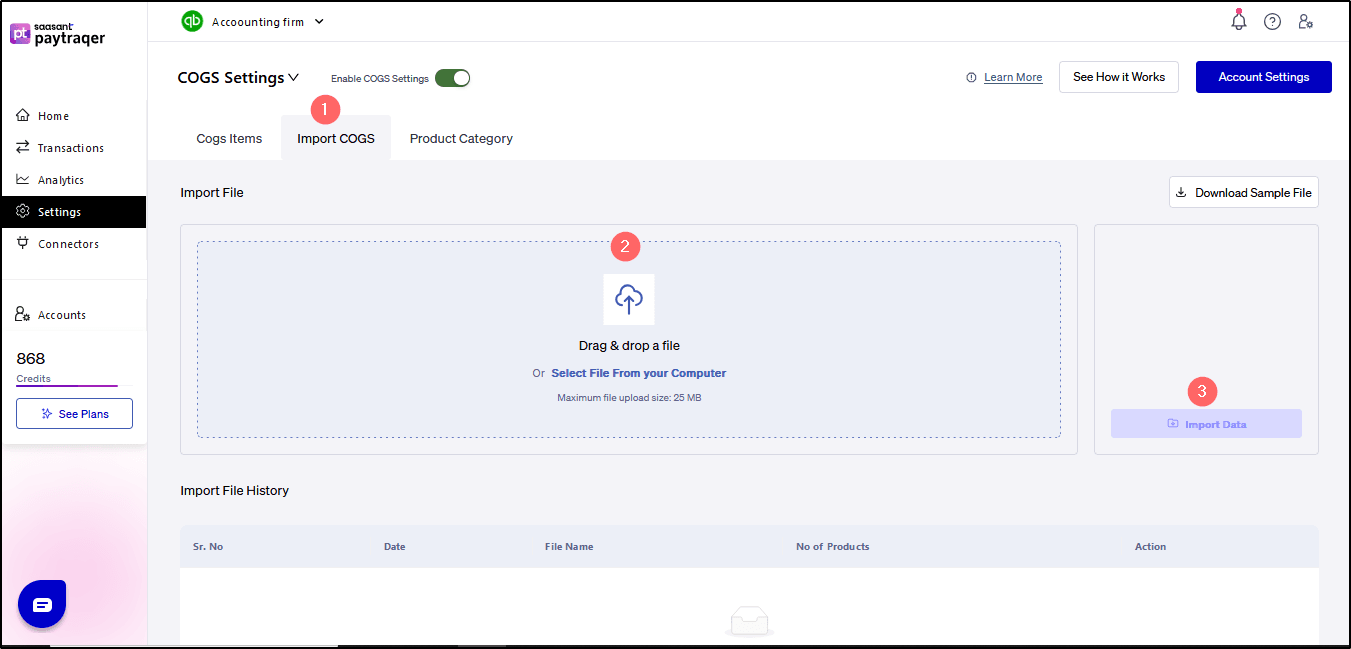

7. Import COGS

If you already maintain COGS data in a file, you can load it into PayTraQer instead of typing it manually.

Import COGS: If you have Cost of Goods Sold (COGS) data saved in a file, you can use the “Import COGS” function to add and save this information in PayTraQer.

(Screenshot reference: 3.png)

Typical flow:

Prepare a file with columns for SKU, Product Name, Product Cost, and Currency.

Click Import COGS in the COGS settings.

Upload the file and map the columns as prompted.

Review and save the imported product cost records.

Imported cost records will be used the same way as manually entered costs when PayTraQer calculates COGS.

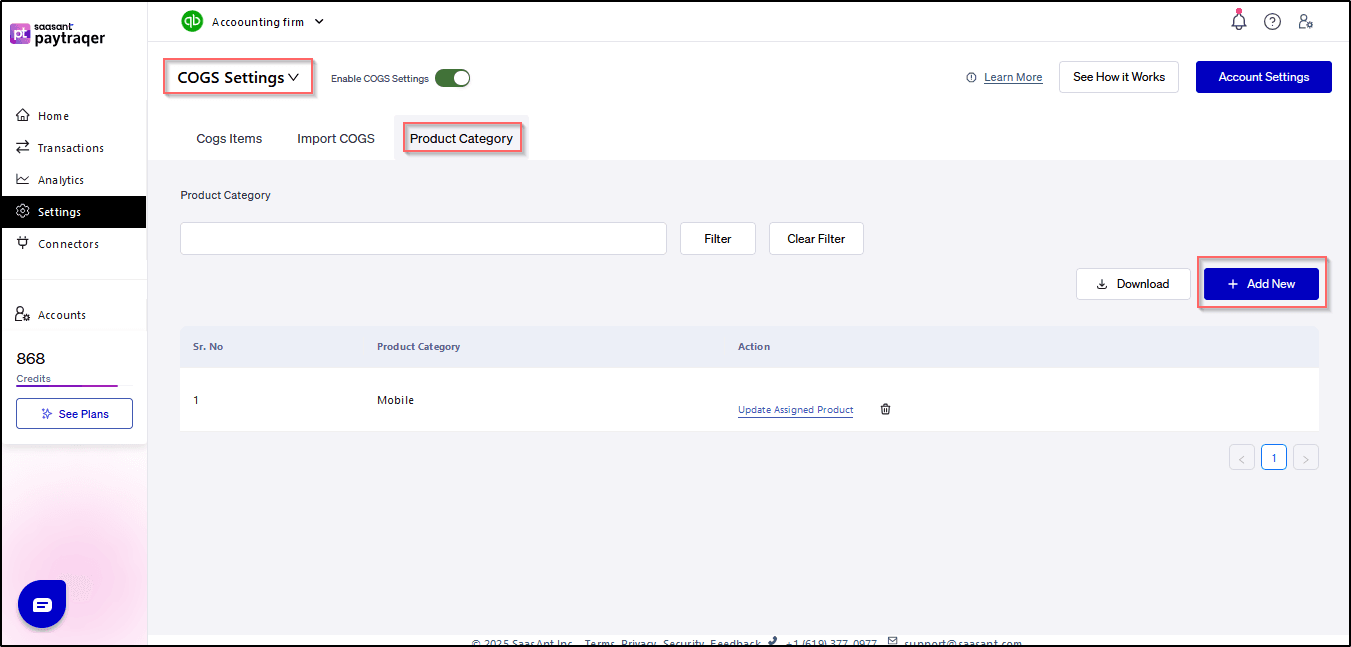

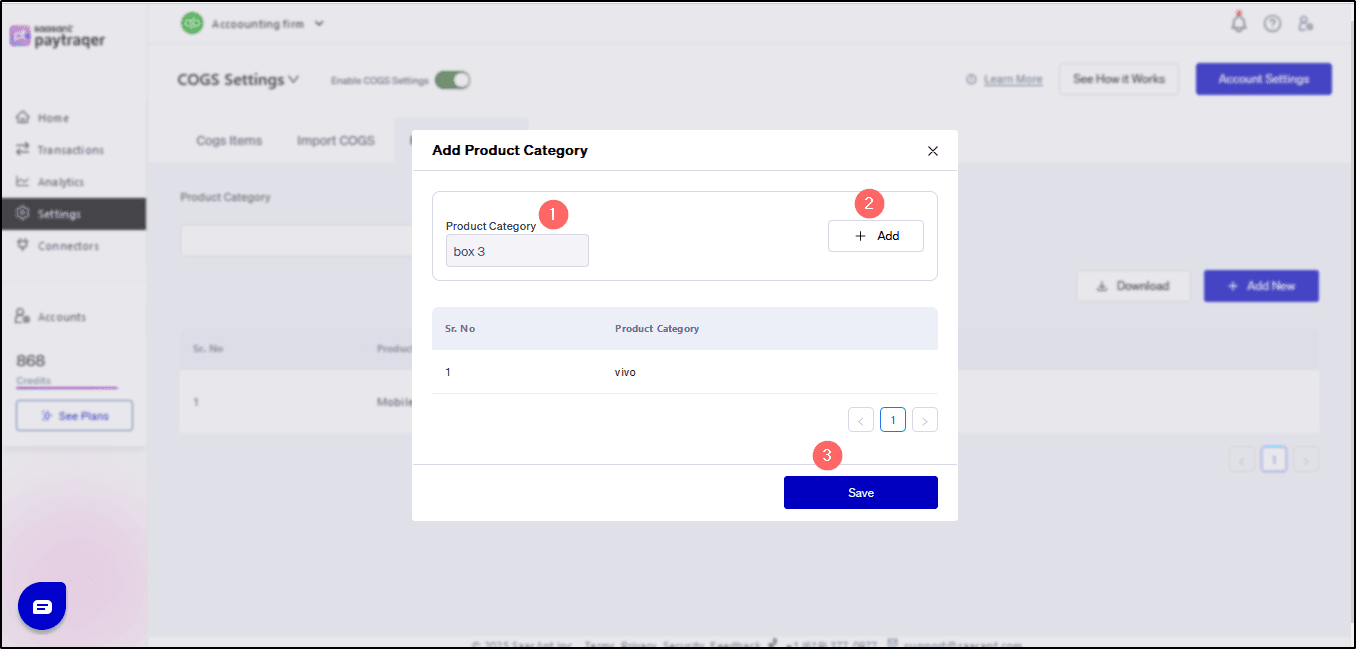

8. Product Category (optional)

You can also manage COGS by product category if you group products that share the same cost behavior.

Product Category: You can add or create a product category manually in PayTraQer.

At a high level, this allows you to:

Create categories for groups of products, and

Assign COGS behavior based on those categories, rather than only per SKU.

For detailed matching between products, categories, and COGS accounts in summary sync, see the separate COGS matching guide.r.

9. After configuring COGS

Once you have:

Enabled “Do you want to calculate the Costs of Goods Sold”

Selected the Expense Account and Inventory Asset Account

Added product costs either manually or via Import COGS

PayTraQer can:

Calculate COGS for your summarized sales, and

Post the correct COGS and inventory movements into QuickBooks as part of summary sync.

If you change product costs later, remember:

New costs will only apply to future COGS calculations.

To update existing summary periods, use the Regenerate COGS option for those periods.

This keeps your gross profit and inventory balances aligned with your actual product costs when using summary sync.

Related PayTraQer Articles:

1) Please refer to this article: PayTraQer - Sales Settings Configuration

2) Please refer to this article: Configuration of Tax Settings for Summary Sync in PayTraQer

3) Please refer to this article: Configuration of Fees and Expenses for Summary Sync in PayTraQer

4) Please refer to this article: Configuring Additional Settings for PayTraQer Summary Sync

5) Please refer to this article: Configuration of Payout Settings for Summary Sync in PayTraQer

6) Please refer to this article: Configuration of COGS Matching for PayTraqer Summary Sync

You can reach out to us at support@saasant.com if you are stuck somewhere.