Overview of PayTraQer Summary Sync Settings

August 22, 2025

Getting Started with PayTraQer Settings for Consolidated Summary Sync

Setting up your PayTraQer account is a straightforward process that can be completed in just a few minutes. This article is a comprehensive guide to help you navigate through the various settings screens in PayTraQer, ensuring a smooth setup process and optimal functionality.

Overview of PayTraQer Settings:

PayTraQer settings screens are pivotal in configuring the tool to create and manage transactions, customers, items, expenses, fees, and more. By leveraging these settings, users can seamlessly synchronize data between their payment processor accounts and QuickBooks Online, ensuring accuracy and efficiency in financial record-keeping.

This comprehensive guide facilitates a seamless setup process for your PayTraQer account, covering key settings like Sales, Tax, Fees & Expenses, Payout, and COGS Matching & Grouping. You'll navigate through these settings in just a few minutes, ensuring optimal functionality.

Sales:

Preloaded default accounts facilitate sales tracking through journal entries. Configure your income account to monitor sales income and assign the accounts to a specific payment or e-commerce account. Provide descriptive accounts in journal entries to identify your sales.

Expenses:

Preloaded default accounts enable tracking of fees and expenses via journal entries. Configure your expense account to monitor fees and expenses, then assign these accounts to a specific payment or e-commerce account. Provide descriptive accounts in journal entries to identify your fees and expenses.

Tax:

Preloaded default accounts are set up to track tax information through journal entries. Configure your liability account to monitor tax liabilities and assign these accounts to a specific payment or e-commerce account. Provide descriptive accounts in journal entries to identify the tax liability.

Note: You can navigate to these settings by clicking the Gear Icon→Settings

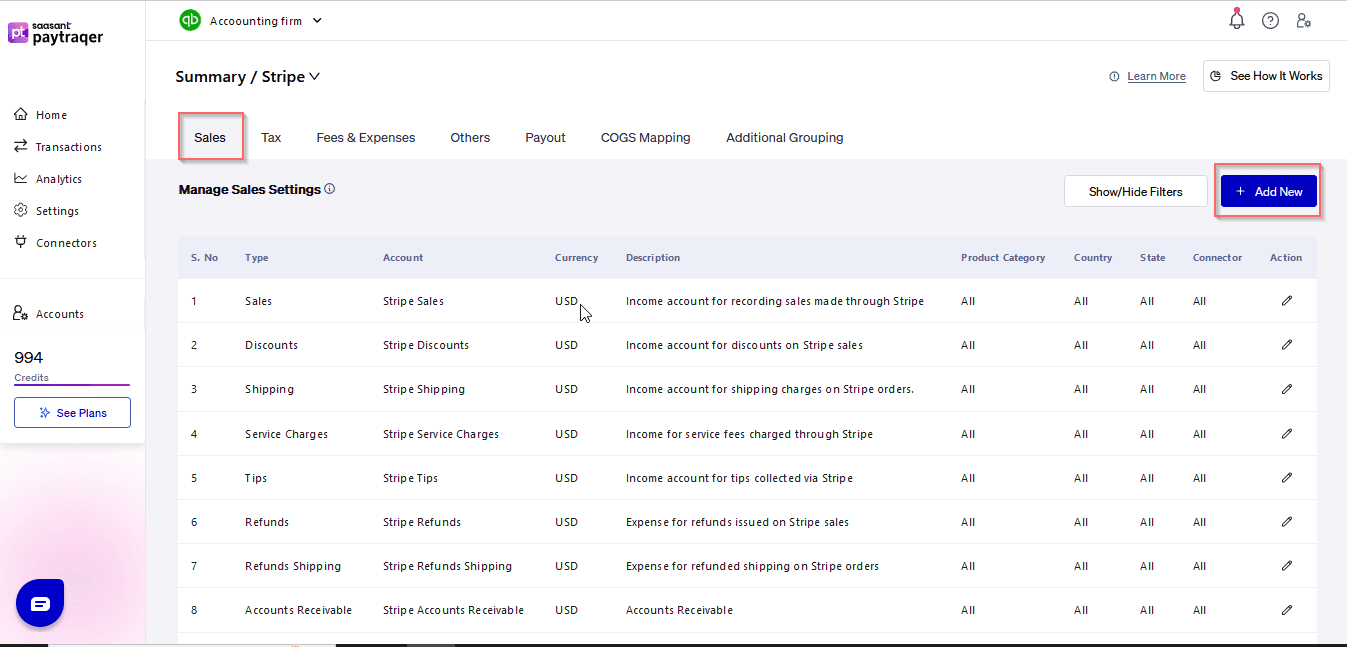

1) Sales Setting:

To identify your sales in the journal entry, provide descriptions for the accounts that are preloaded to track your sales and assign them to specific payment or e-commerce accounts while configuring your income account to track sales income

In the Sales Setting, users can configure fields related to sales transactions, including specifying bank accounts, customers, and other relevant details.

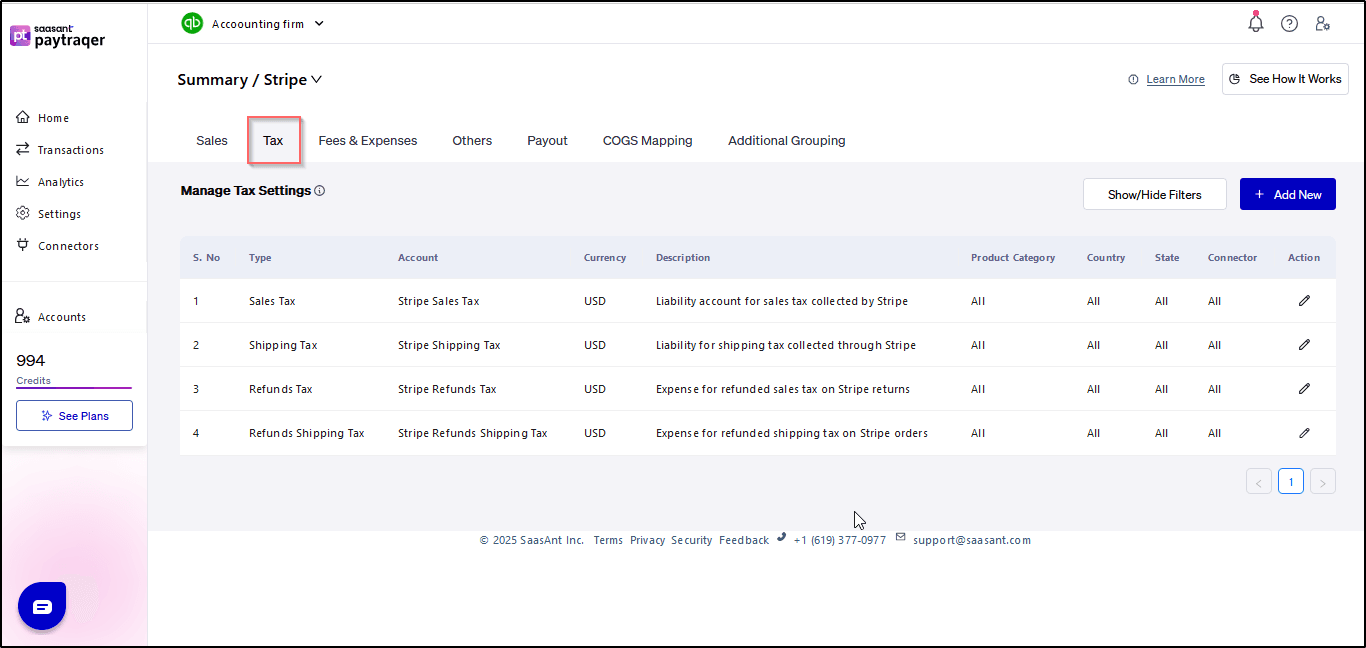

2) Tax Settings:

Tax information from payment transactions (Paypal, Stripe, Square, Shopify, Amazon & eBay) can be accurately recorded into QuickBooks Online using the Tax Settings.

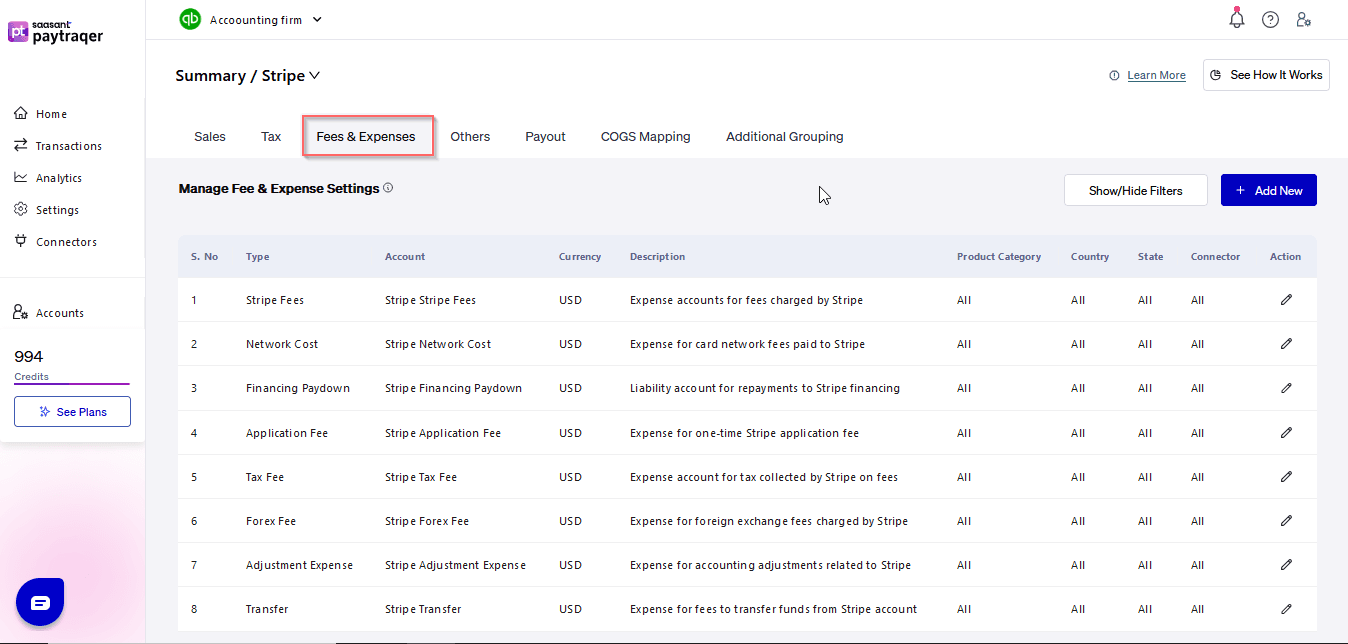

3) Fees Settings & Expense Settings:

Users can record fee information from payment transactions directly into QuickBooks Online using the Fees Settings. Expenses incurred through payment systems can be easily synced with QuickBooks Online via the Expense Settings.

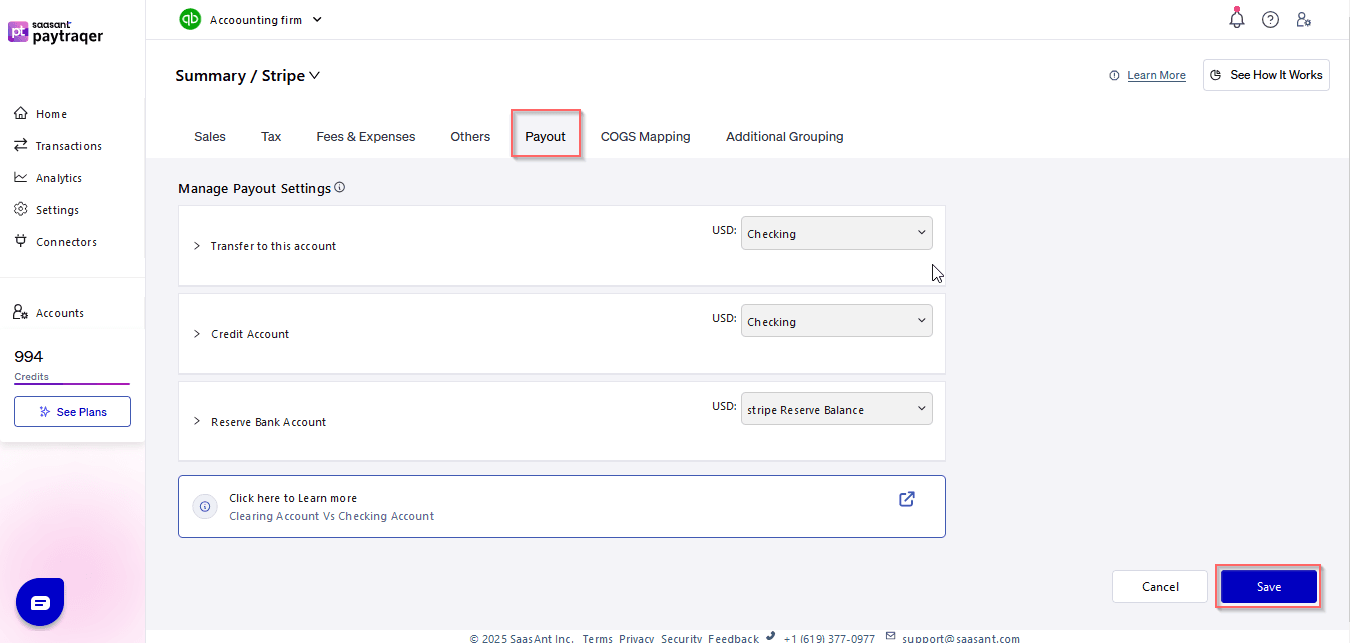

4) Payout Settings:

Ensure that consolidated payouts or deposits from payment systems (Paypal, Stripe, Square, Shopify, Amazon & eBay) are never missed with the Payout Settings.

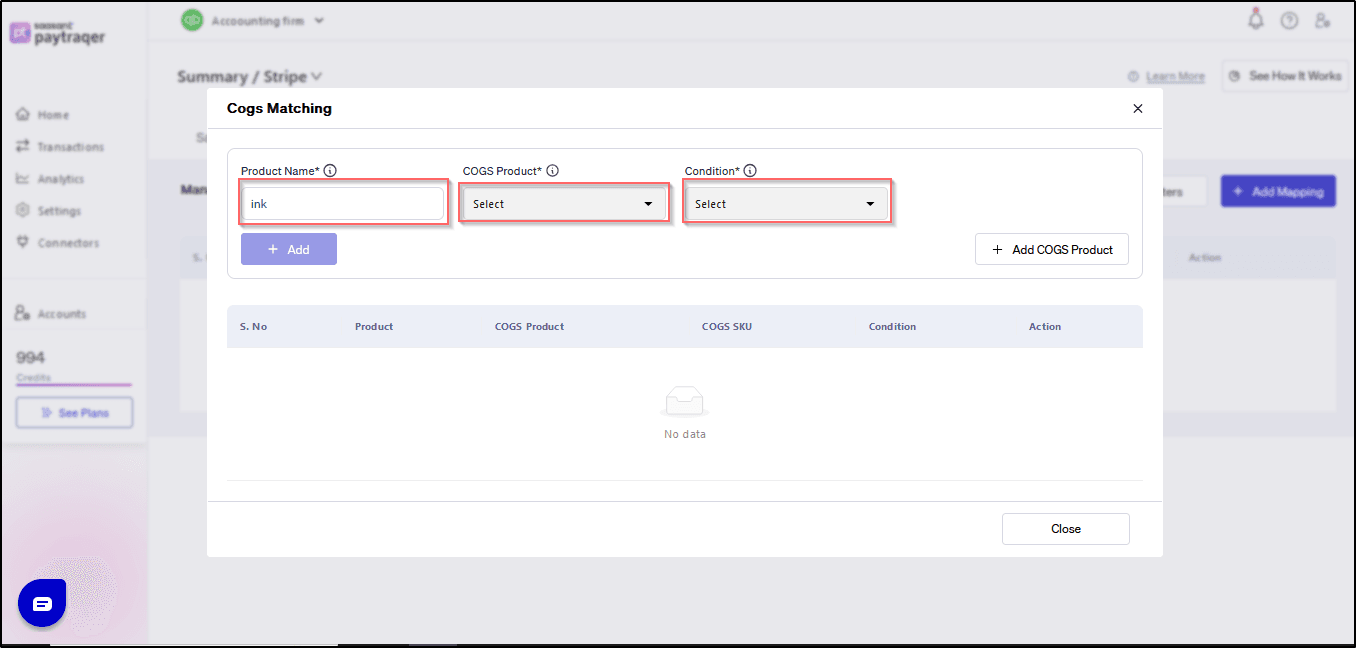

5) COGS Matching:

Configure cost of goods sold (COGS) matching to ensure accurate accounting for inventory-related expenses.

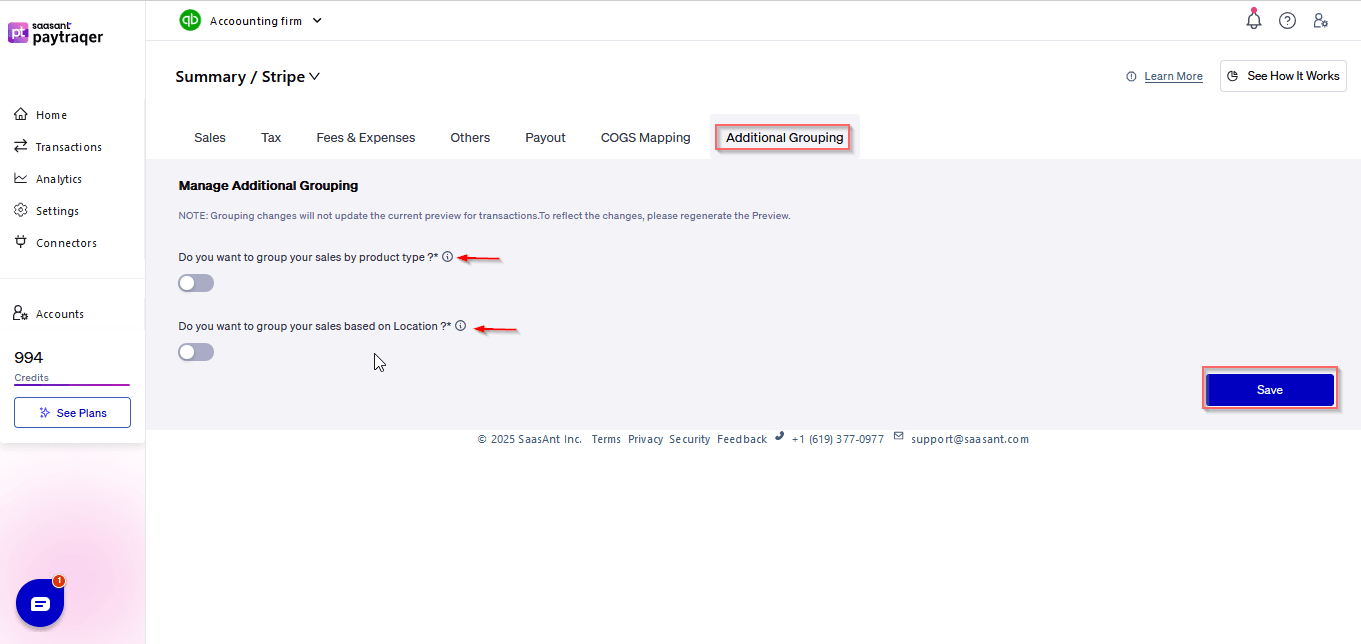

6) Grouping:

Grouping settings allow users to categorize transactions and data efficiently, enhancing organization and analysis capabilities.

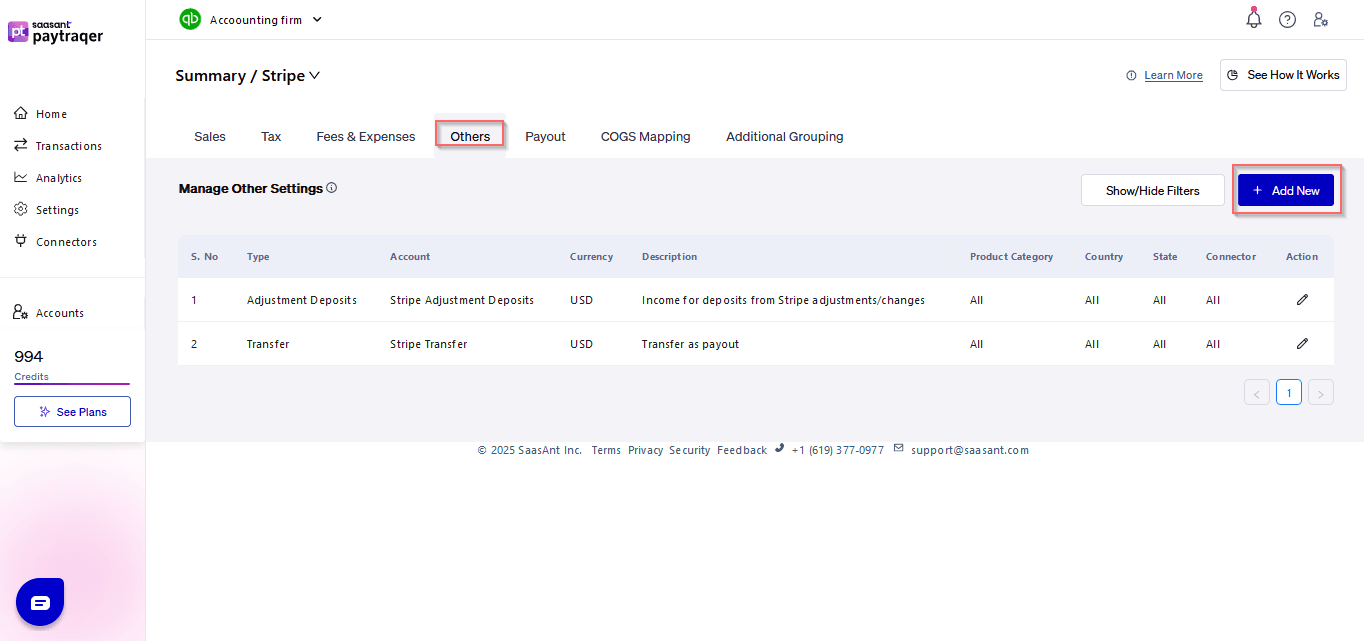

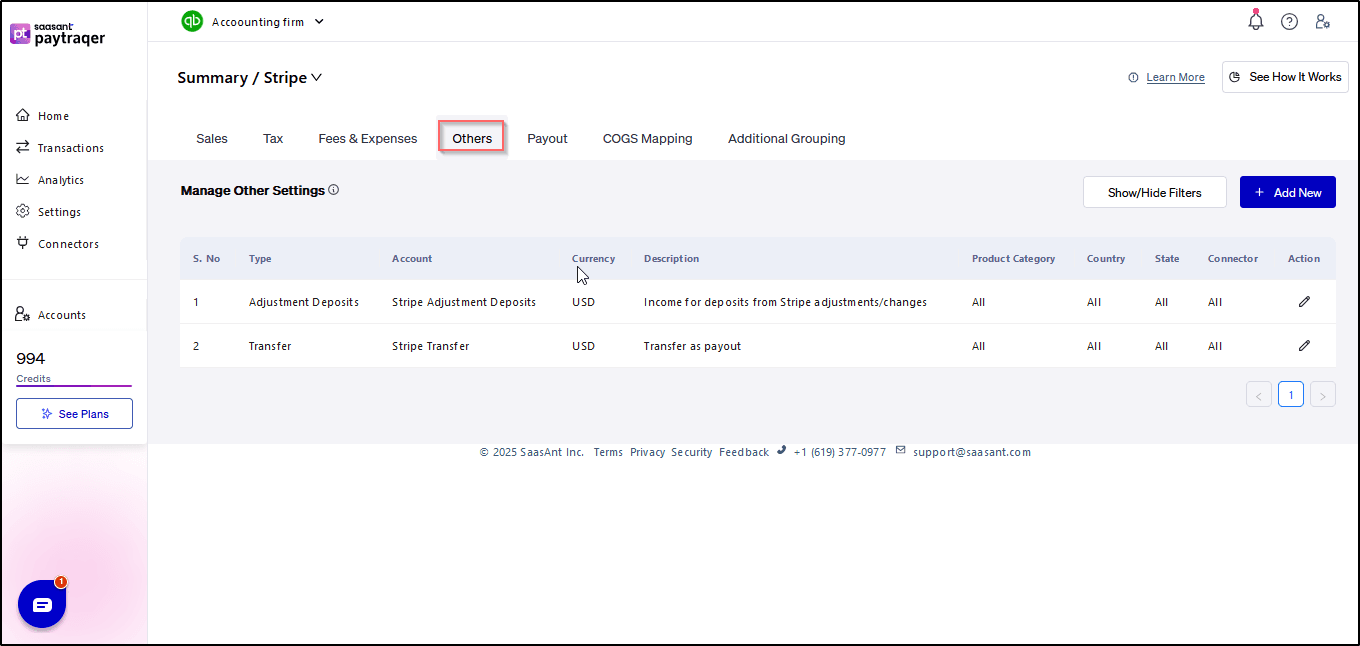

7) Others:

Conclusion:

By familiarizing yourself with the various settings available in PayTraQer, you can streamline your financial management processes and ensure accurate synchronization between your payment processor accounts and QuickBooks Online. Whether configuring sales, taxes, fees, expenses, or other parameters, PayTraQer offers comprehensive settings to meet your business needs.

Related PayTraQer Articles:

1) Please refer to this article How to rollback/undo the Synced transaction in PayTraQer

2) Please refer to this article: How to configure general Settings in PayTraqer

3) Please refer to this article: PayTraQer - Sales Settings Configuration

4) Please refer to this article: Configuration of Tax Settings for Summary Sync in PayTraQer

5) Please refer to this article: Configuration of Fees and Expenses for Summary Sync in PayTraQer

6) Please refer to this article: Configuring Additional Settings for PayTraQer Summary Sync

7) Please refer to this article: Configuration of Payout Settings for Summary Sync in PayTraQer

8) Please refer to this article: Configuration of COGS Matching for PayTraqer Summary Sync

9) Please refer to this article: Configuring COGS Settings for PayTraqer Summary Sync

10) Please refer to this article: Configuring Grouping for PayTraqer Summary Sync

11) Please refer to this article: How to configure general Settings in PayTraqer

12) Please refer to this article: How to Preview and Sync the Transactions into QuickBooks Online

13) Please refer to this article: PayTraQer Consolidated Summary Sync Dashboard Guide

14) Please refer to this article: How to setup PayTraQer for Summary Sync (sales summary

You can reach out to us at support@saasant.com if you are stuck somewhere.