How to sync Amazon Historical Transaction with Xero?

January 1, 2025

Historic Transactions for the Past 1 Year

When you sign up for PayTraQer and connect your Amazon seller account, your previous Amazon sales and transactions for the past One Year will be automatically downloaded to PayTraQer.

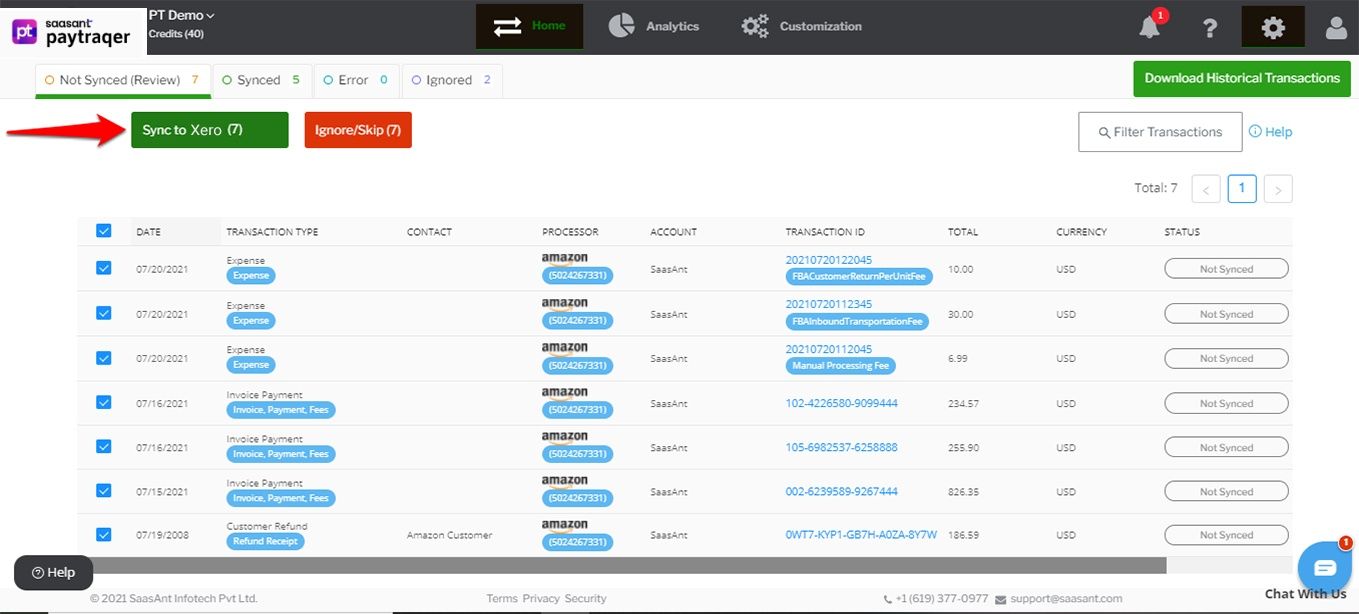

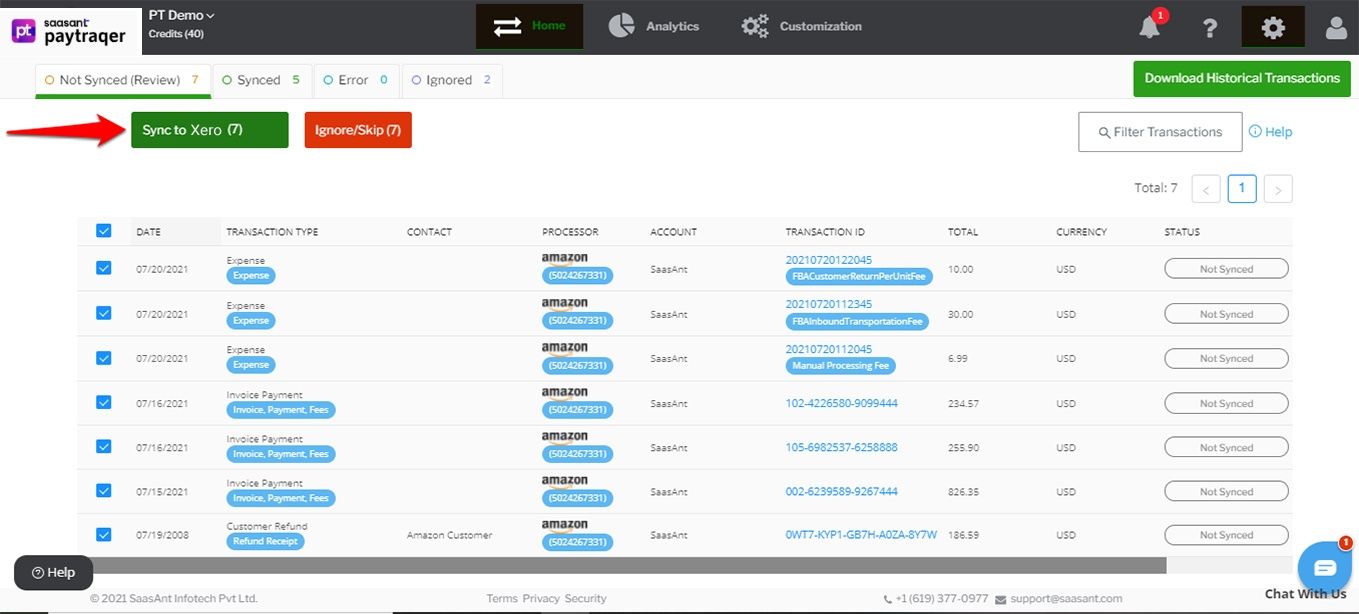

All the downloaded transactions will appear on the dashboard.

You can read each transaction and choose the ones that you want to sync into QuickBooks Online.

Click the Sync to QuickBooks Online button.

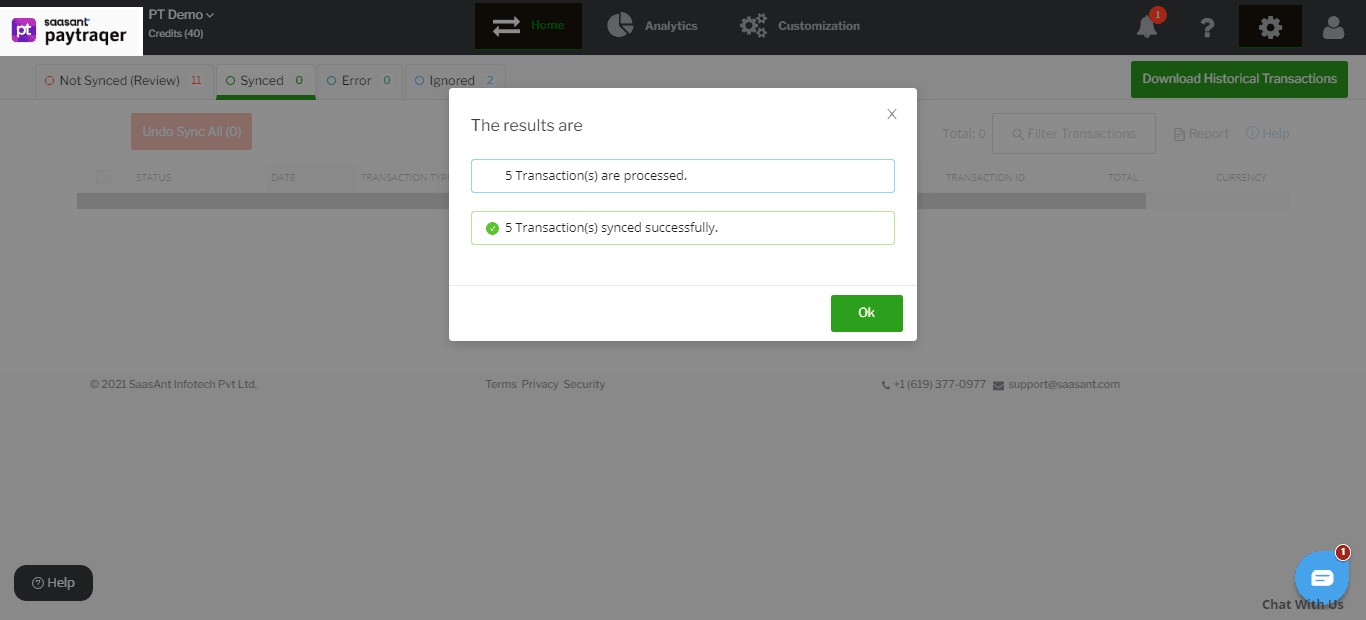

All the chosen transactions will be synced into QuickBooks Online.

Download and Sync Older Transactions

You can download and sync your Amazon transactions for the past 90 days using PayTraQer. Here is how to do it.

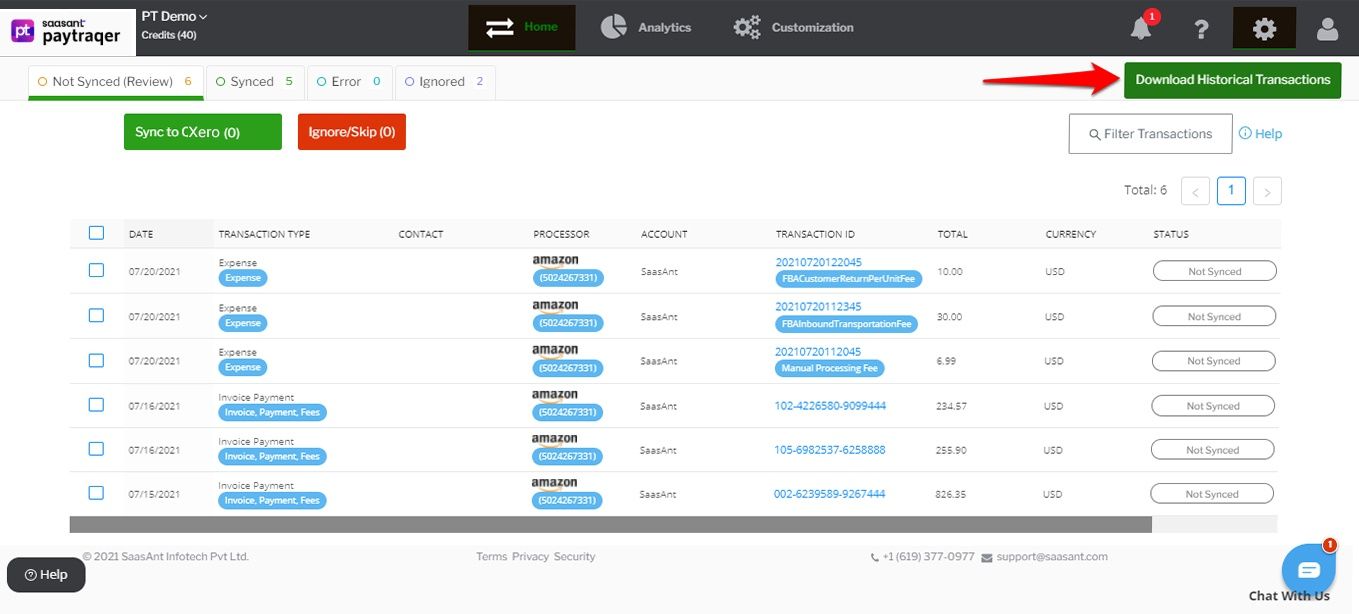

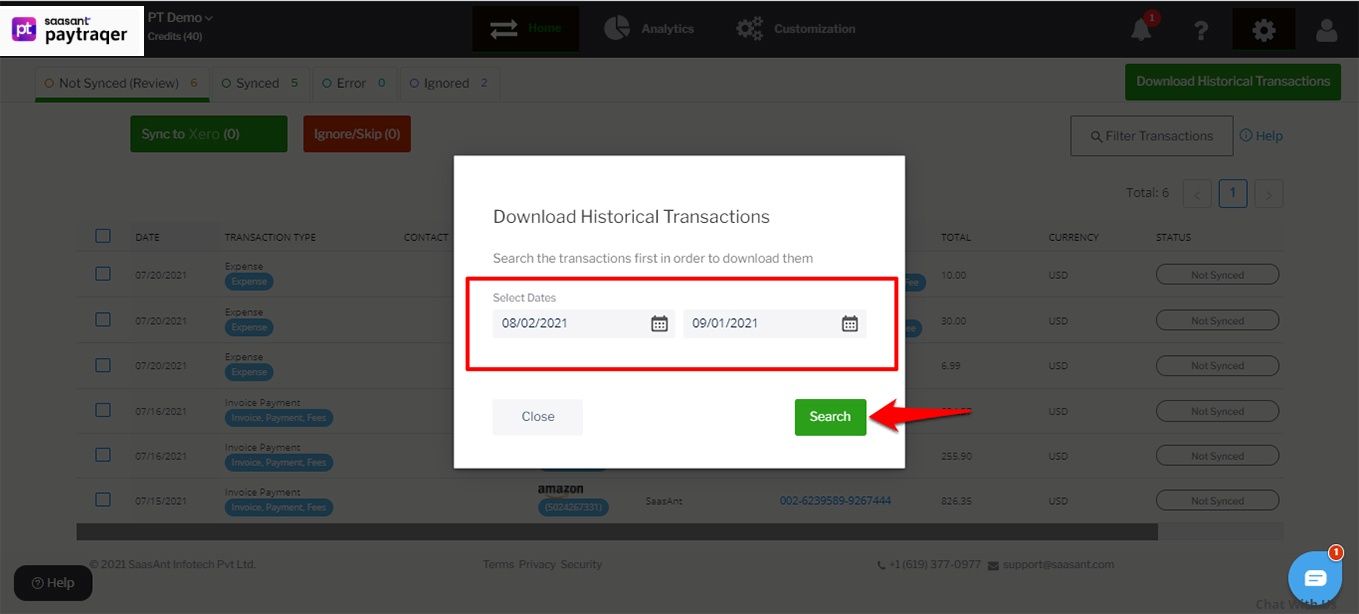

Click the Download Historical Transactions button.

Specify the Date Range and hit Search

All the transactions that happened within the specified date range will appear on the screen in a grid view.

All the transactions that happened within the specified date range will appear on the screen in a grid view.

You can choose the transactions that you want to sync into QuickBooks Online or choose all and click the Sync to QuickBooks Online button. All the selected transactions will be synced into QuickBooks Online.

Related articles - Amazon Pay QuickBooks Online Integration

For more information about How to Connect Amazon to QuickBooks Online, refer to this article.

For more information about How to Undo Amazon Sync In PayTraQer, refer to this article.

You can reach out to us at support@saasant.com if you are stuck somewhere. You can also schedule a personalized free demo with us if you need better clarity to connect with us by clicking Demo.