How to Sync Amazon Pay Sales and Expenses into Xero?

January 1, 2025

Syncing Modes:

You can sync your Amazon Pay sales and Payment transactions into Xero in a couple of ways

A) Manual sync.

B) Automatic sync.

Manual Sync

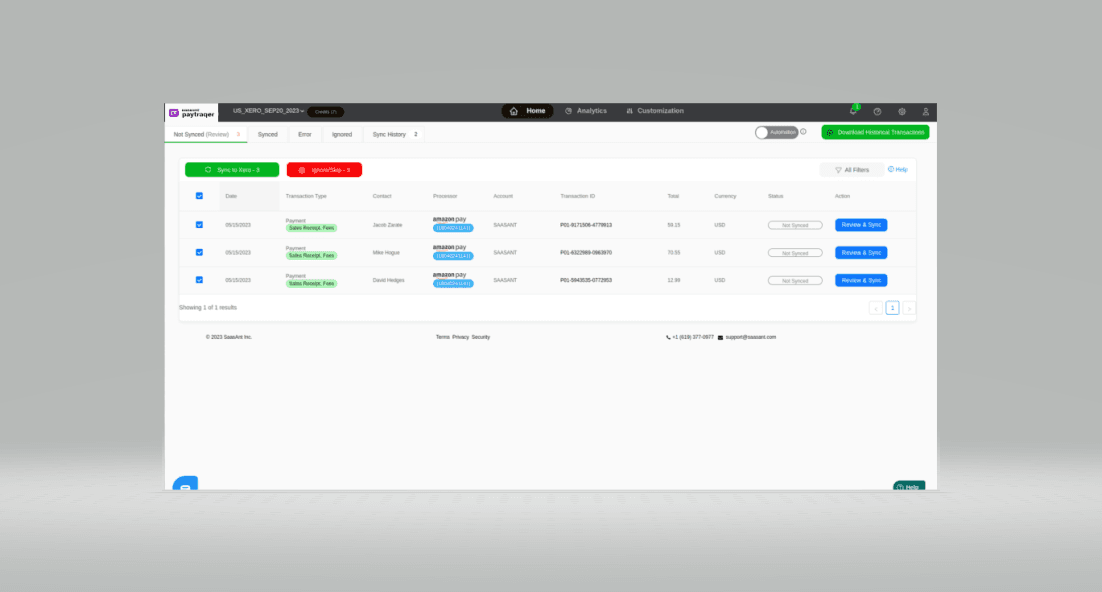

All the downloaded Amazon Pay transactions will appear on the screen in a grid view.

All you have to do is read each transaction and choose the ones that you want to sync into Xero.

Once you have made the selection, Select the Sync to Xero button. PayTraQer will sync all the selected transactions into Xero.

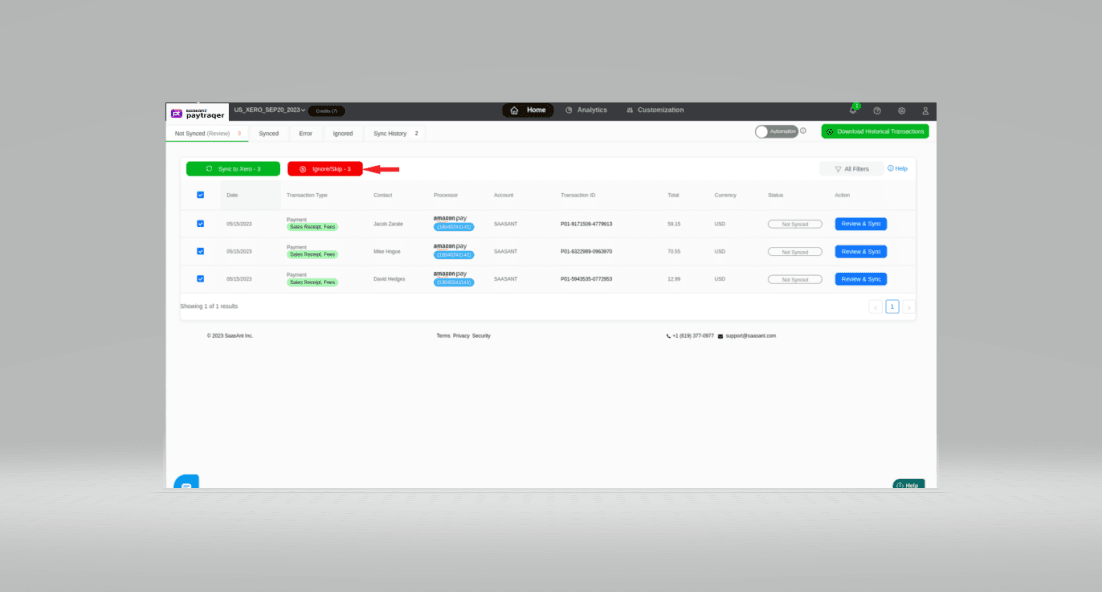

Ignore Transactions

It explains that in case there are specific transactions that you do not wish to synchronize with Xero, you have the option to select them and use the Ignore/Skip button.

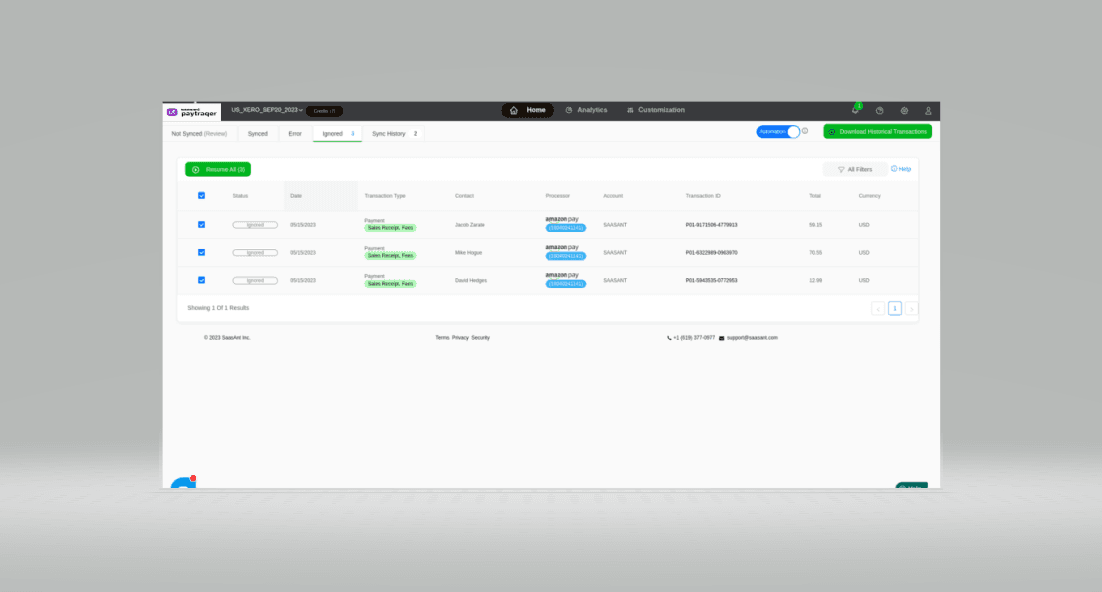

All the ignored transactions will be listed under the Ignored tab. You can choose to synchronize them at a later time by selecting the Resume Selection button.

Automatic Sync

With the automatic sync feature, you can sync all your Amazon Pay transactions into Xero as they occur.

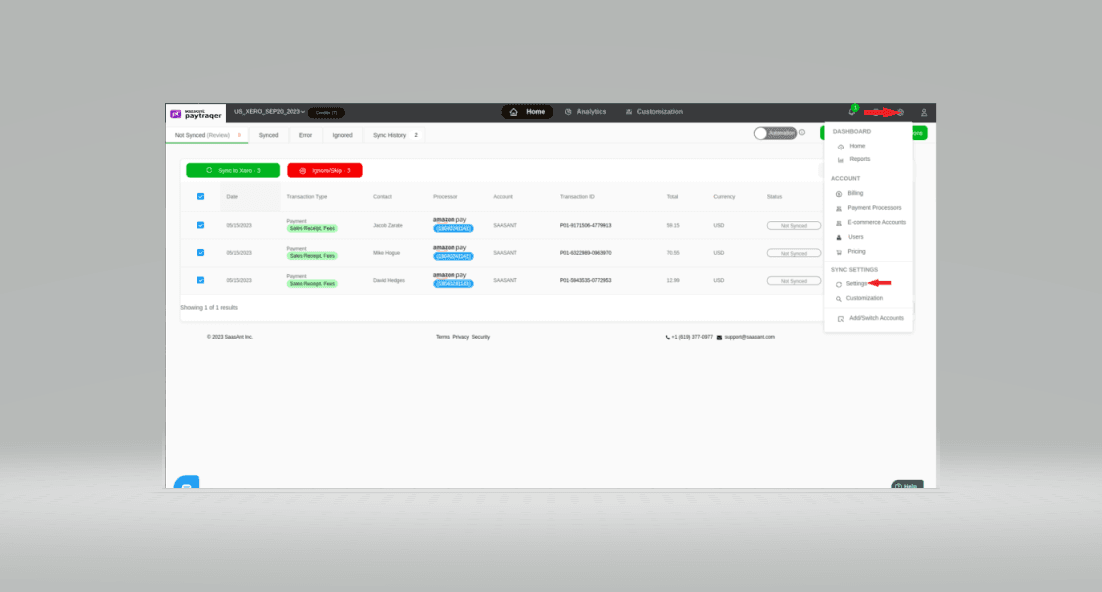

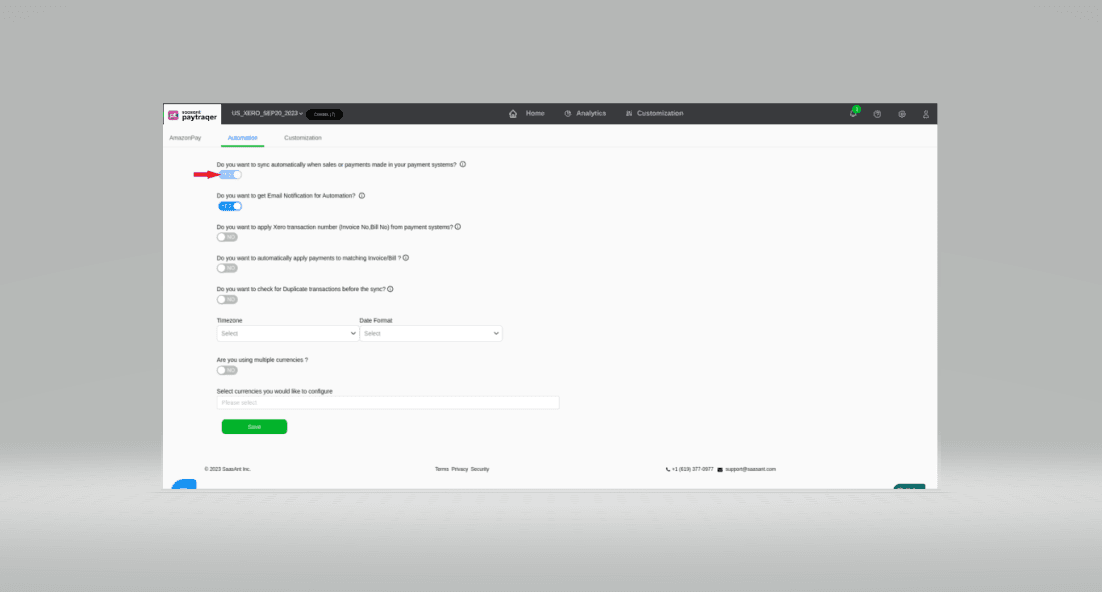

To enable this feature, simply switch on the auto-sync option in the settings. Here's how to do it

Navigate to the Settings icon

> Settings.

> Settings.

Turn ON the automatic sync option to enable this feature.

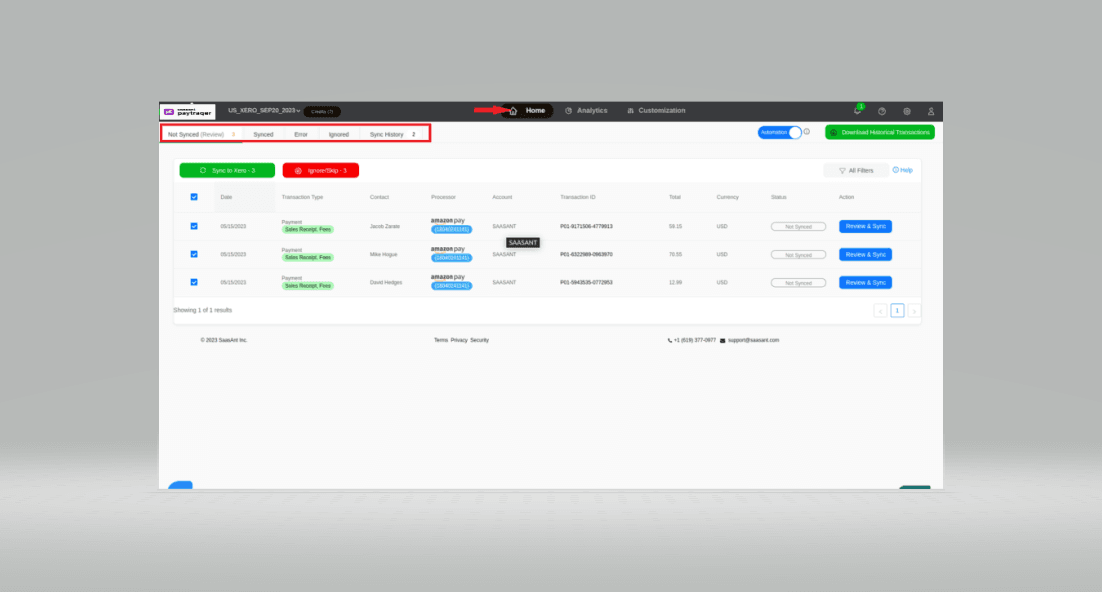

Review Sync

You can check the status of the sync by clicking on the Home button and one of the tabs in the horizontal navigation bar.

Key Points

All the downloaded transactions will be listed under the Not Synced tab.

All the synced transactions will be listed under the Synced tab.

You can click on a transaction to review its details.

Transactions that were not synced due to some error will be listed under the Error tab.

Ignored transactions will be listed under the Ignored tab.

Related articles - Amazon Pay Xero Integration

For more information about how to Sync Historical Amazon Pay Transactions into Xero, refer to this article.

For more information about How to Undo/Rollback Amazon Pay Transactions, refer to this article.

You can reach out to us at support@saasant.com if you are stuck somewhere. You can also schedule a personalized free demo with us if you need better clarity to connect with us by clicking Demo.