PayTraQer - Tax Settings Configuration for Xero

January 1, 2025

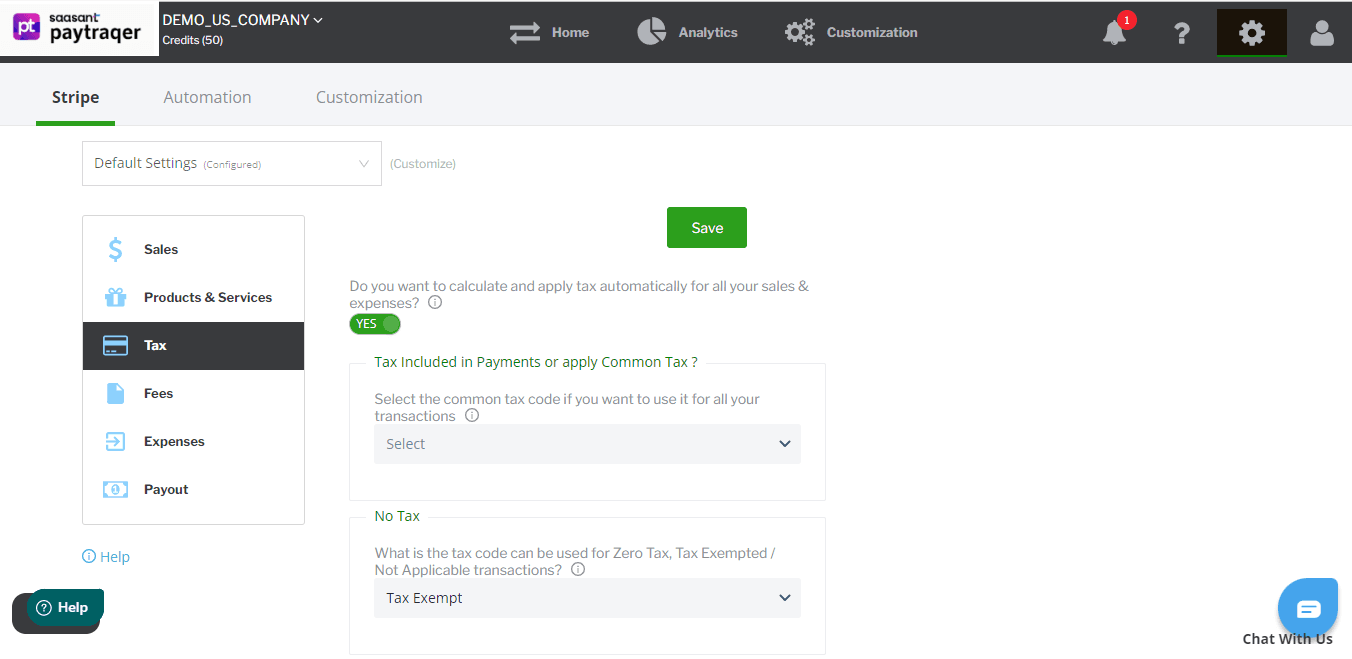

PayTraQer - Tax Settings

To access the tax settings, click the settings icon located at the top right corner of the PayTraQer Screen.

Configuration for Tax Settings is common across all the payment channels. For illustration purposes, Stripe settings are shown here. However, the same configurations will be available for Paypal & Square.

1. Enable Tax Processing

TURN ON this feature to bring the sales tax information from Payment Systems & eCommerce Platforms into Xero.

ON: When turned on, PayTraQer sets the exact sales tax amount for your invoices and sales receipts in Xero. PayTraQer handles inclusive or exclusive tax settings in Payment Systems & eCommerce Platforms. It finds the accurate tax code (percentage) in your Xero based on the tax amount.

OFF: When turned off, PayTraQer adds the sales tax amount to the transaction total amount.

2. Common Tax Code

You can set the common/default tax code for all your sales if you don't want to have complex tax codes in your sales.

3. Exemption Tax Code

There could be non-taxable or exempted items in your sales. To sync non-taxable details accurately, you need to select the Exemption/Zero tax, Tax Code.

4. The Inclusive Tax Processing

Enable "Do you want to apply Inclusive tax automatically for direct payments" to apply the inclusive taxes for your transactions.

Recommended when your payment systems do not record the taxes.