How to Integrate Pin Payments Transactions into QuickBooks Online Using PayTraQer

November 21, 2025

How to connect Pin Payments with QuickBooks Online using PayTraQer

This guide walks you through connecting your Pin Payments account to PayTraQer, entering your API key, and choosing the right sync settings so that sales, fees, and payouts land in the correct places in QuickBooks Online.

1. Before you start

Make sure you have:

An active QuickBooks Online company with admin access

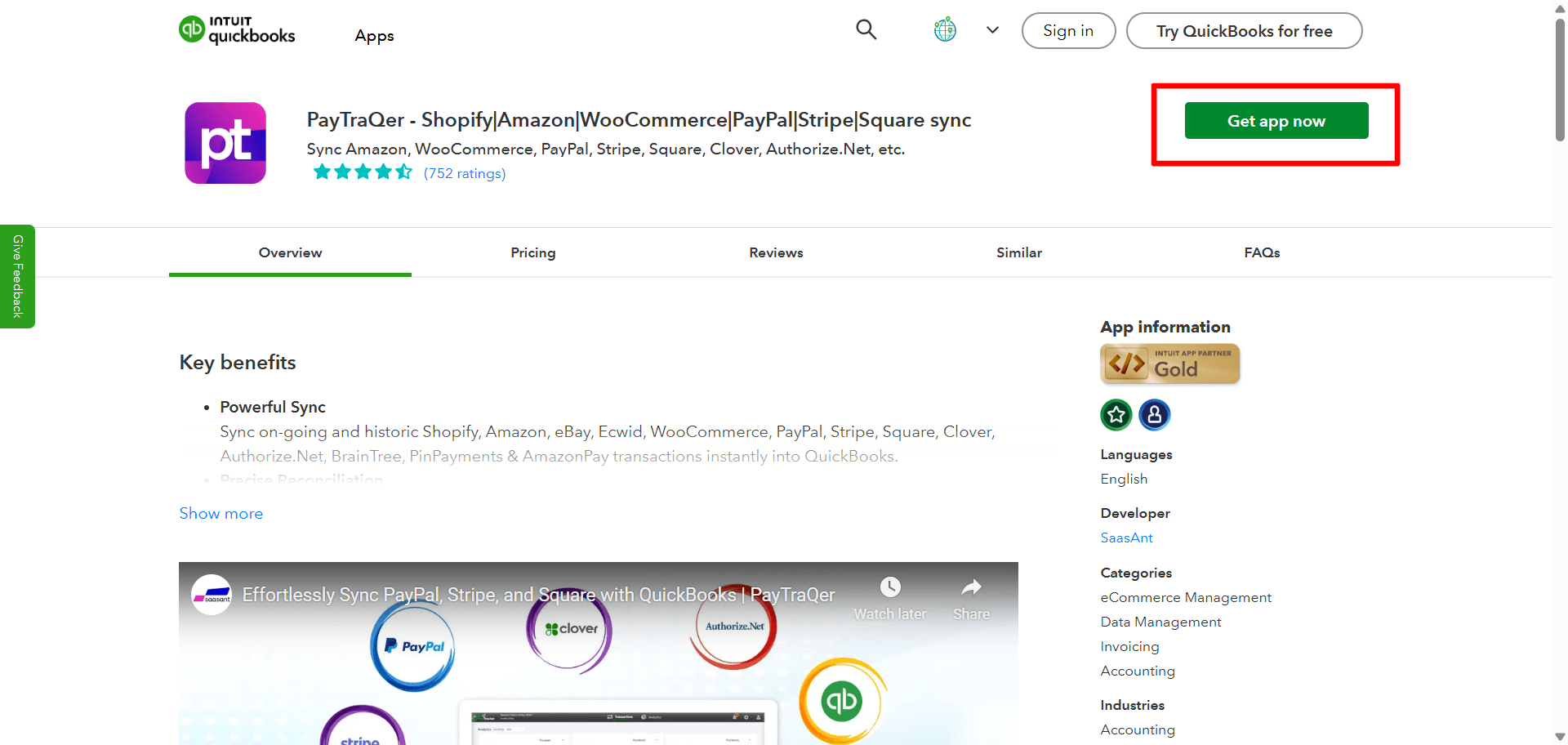

PayTraQer installed from the QuickBooks App Store and opened from within QuickBooks

A live Pin Payments account

Your Pin Payments API key (test or live)

Tip: If you are new to the integration, start with a recent date range and sync a small batch first.

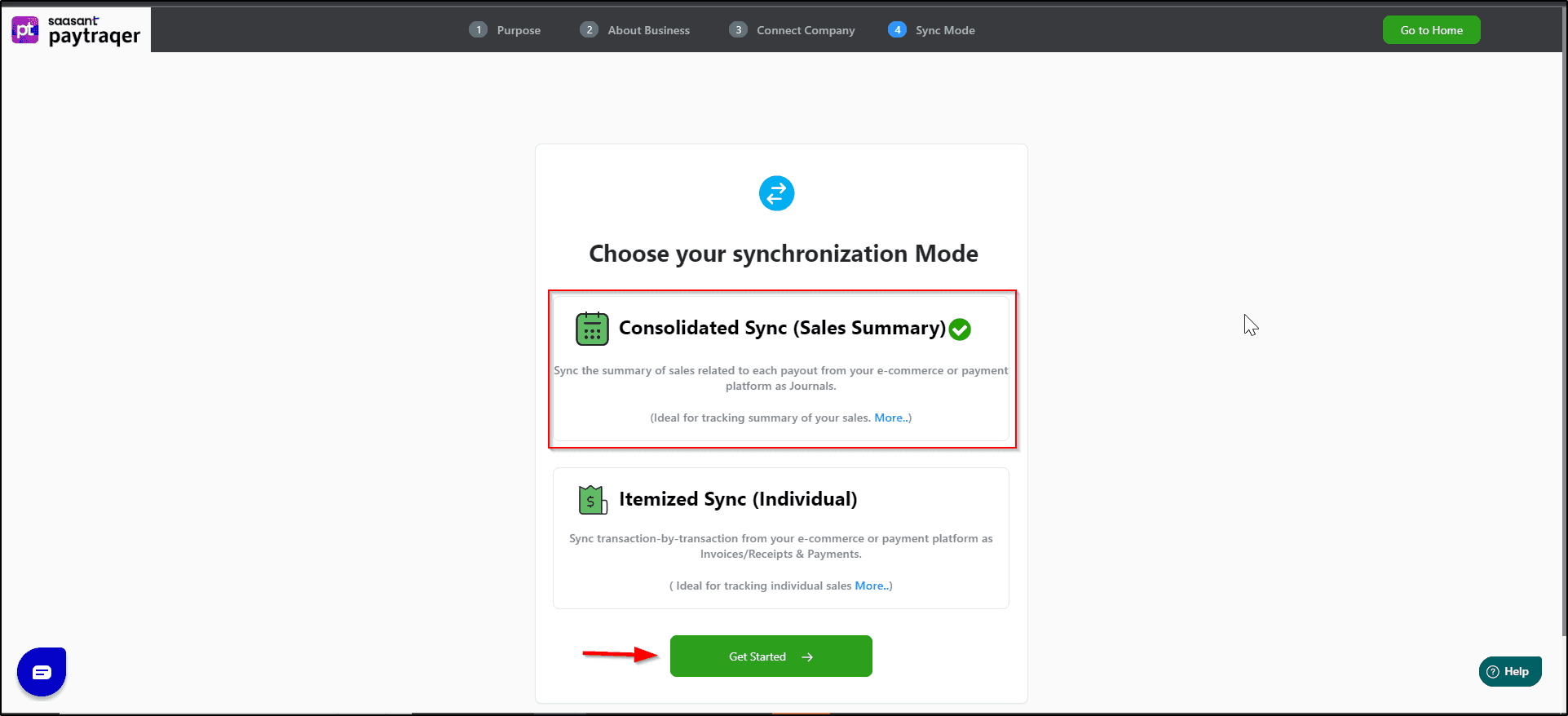

Pick your Sync Mode

Right after connecting to QuickBooks, choose how PinPayments data should post.

Consolidated Sync (Sales Summary): fewer entries and faster reconciliation

Itemized Sync (Individual): customer and item detail in QuickBooks

Select one and click Get Started. You can change this later in settings.

2. Get your Pin Payments API key

Log in to your Pin Payments dashboard.

Go to the Developers / API keys section.

Copy the Secret API key you want to use.

Use test keys for testing.

Use live keys when you are ready for real data.

Keep this key handy. You will paste it into PayTraQer.

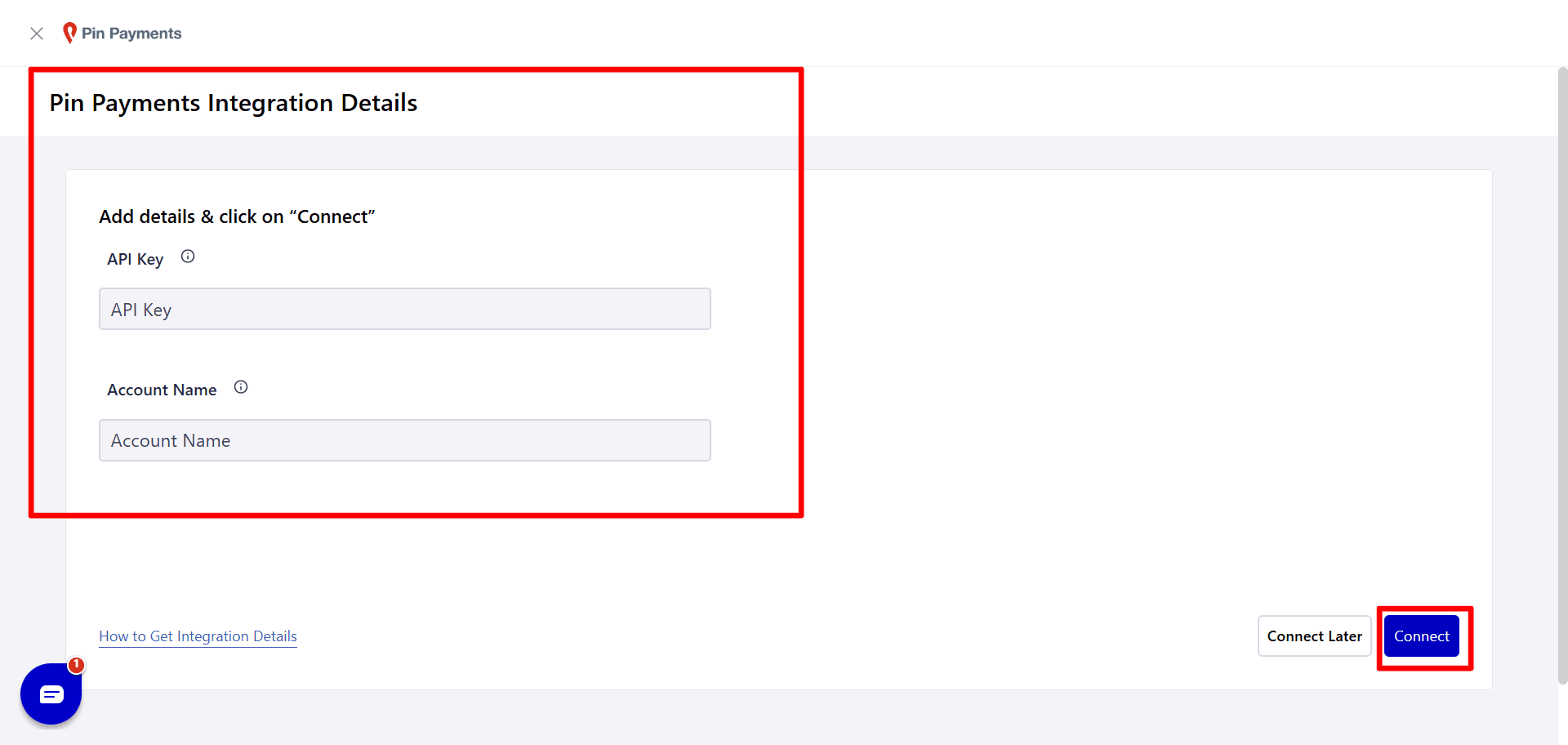

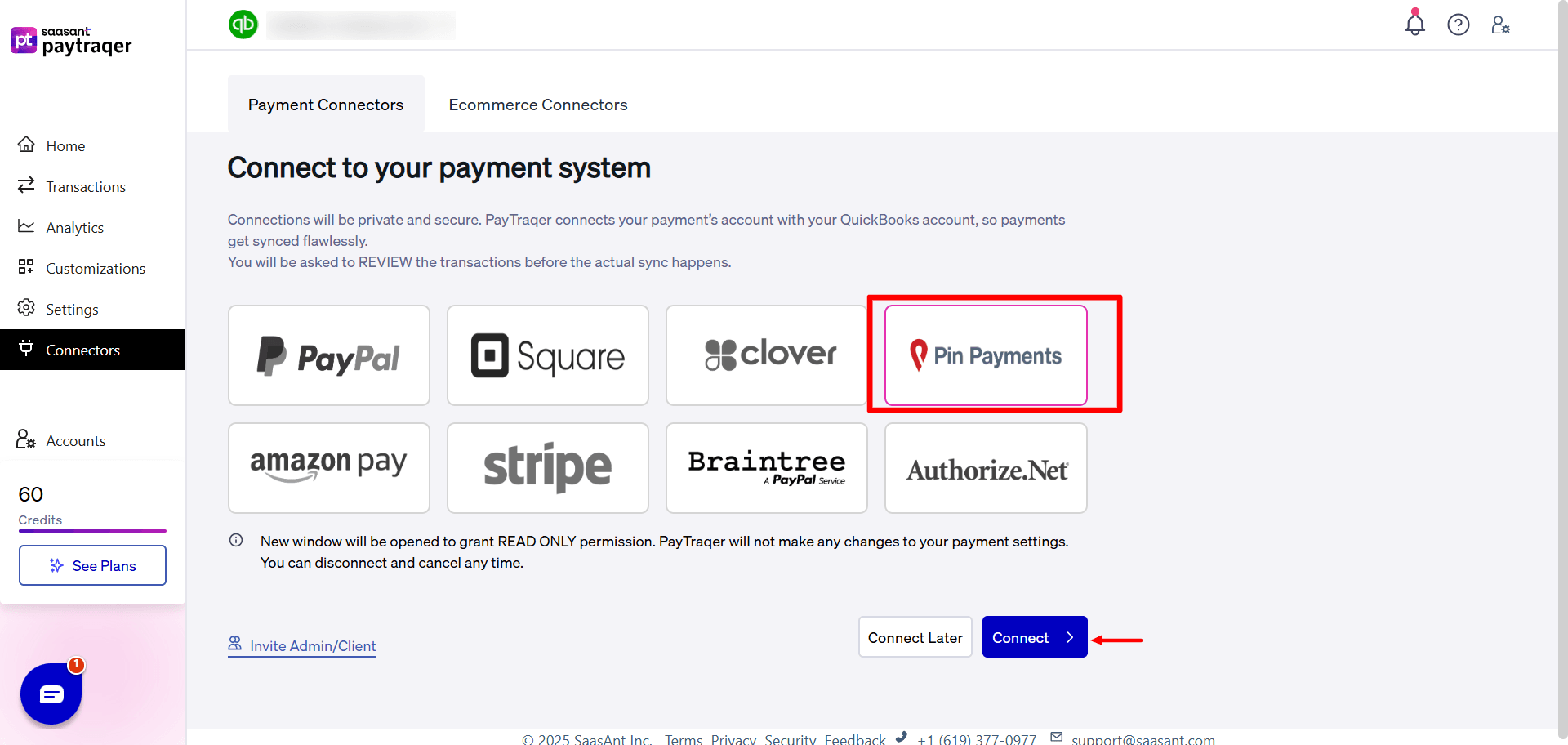

3. Connect Pin Payments to PayTraQer

In QuickBooks Online, go to Apps and open PayTraQer.

In PayTraQer, choose Connect to Payment Systems.

Select Pin Payments from the list of connectors.

Paste your Pin Payments API key into the field provided.

Confirm and complete the connection.

After a successful connection, PayTraQer will open the Pin Payments Express Settings page.

4. Express Settings for Pin Payments

On the Express Settings screen you tell PayTraQer where to record your Pin Payments activity.

Your sales will be recorded in

Select your PinPayments Bank Account or another clearing account. This is the holding account that collects all synced sales before payouts move funds to your real bank.Fees will be recorded in

Choose an expense account such as PinPayments Fees.Do you want to process the payouts / settlements

Turn On if you want PayTraQer to create transfer transactions from the PinPayments clearing account to your actual checking account.

Leave Off if you prefer to handle payouts manually.

Click Save Settings to continue to the detailed sync settings.

Auto download

After saving, PayTraQer automatically downloads the last 60 days of PinPayments data.More history

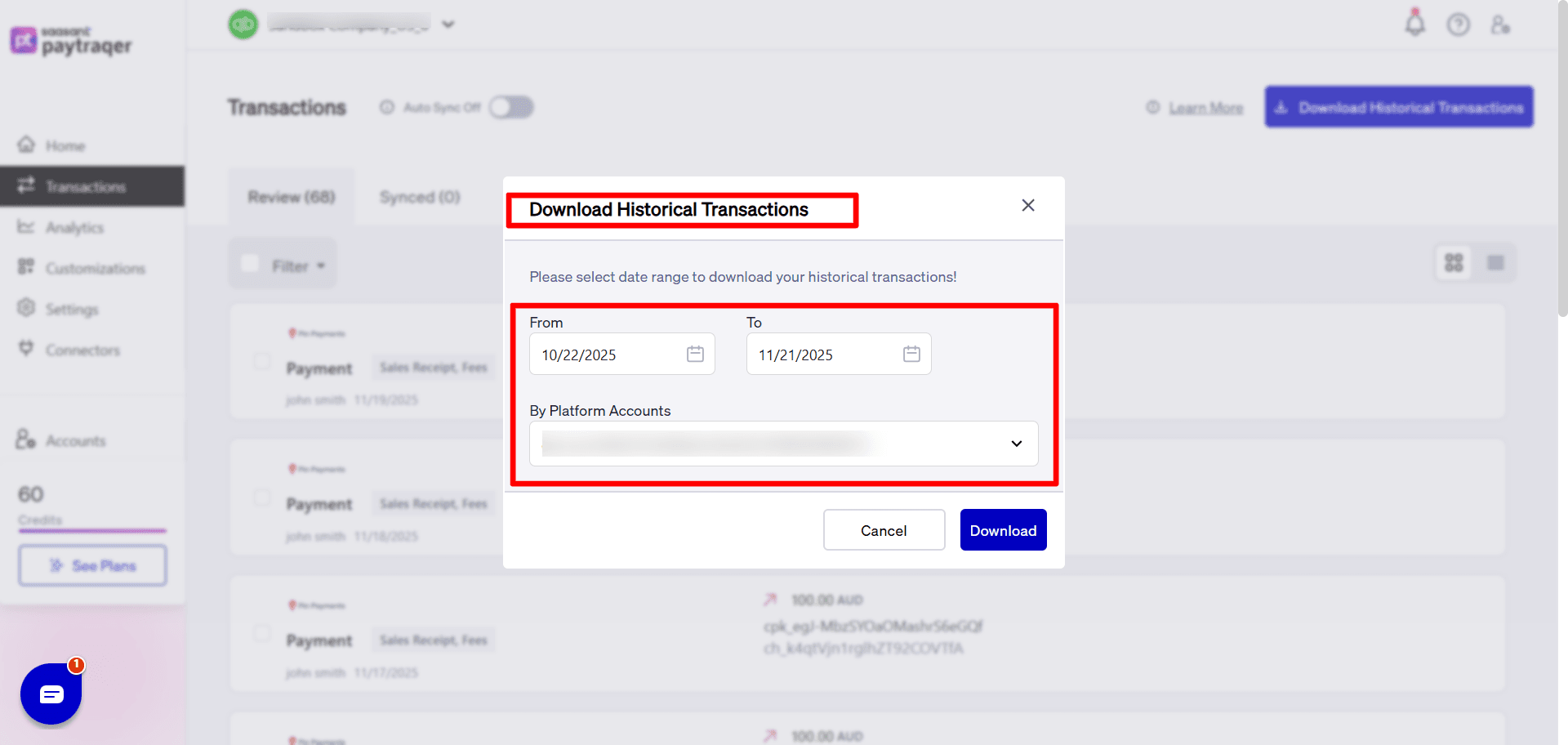

Use Download historical transactions to pull other date ranges with From and To filters.

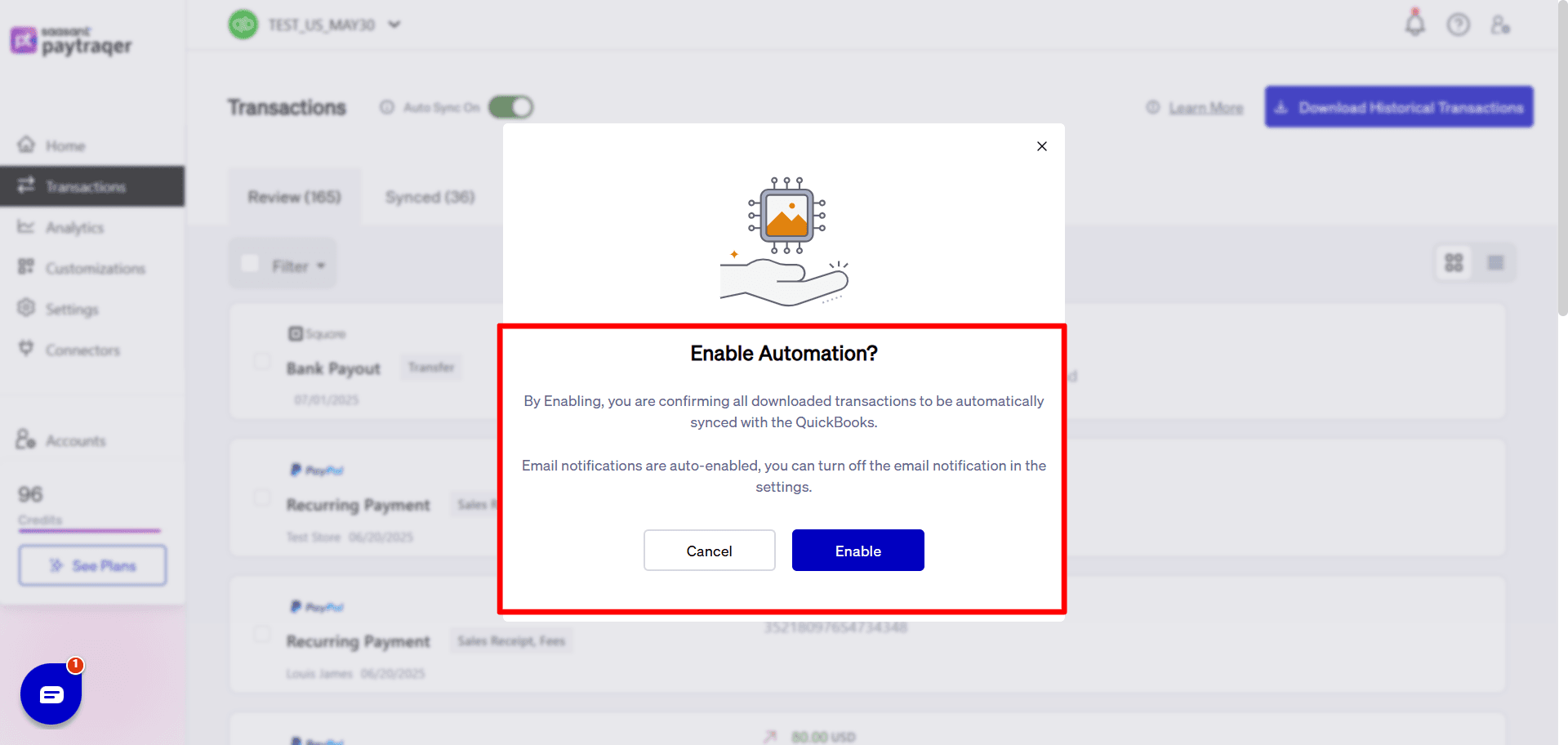

Auto Sync

Turn on Auto Sync to download and post new transactions at the interval you set.

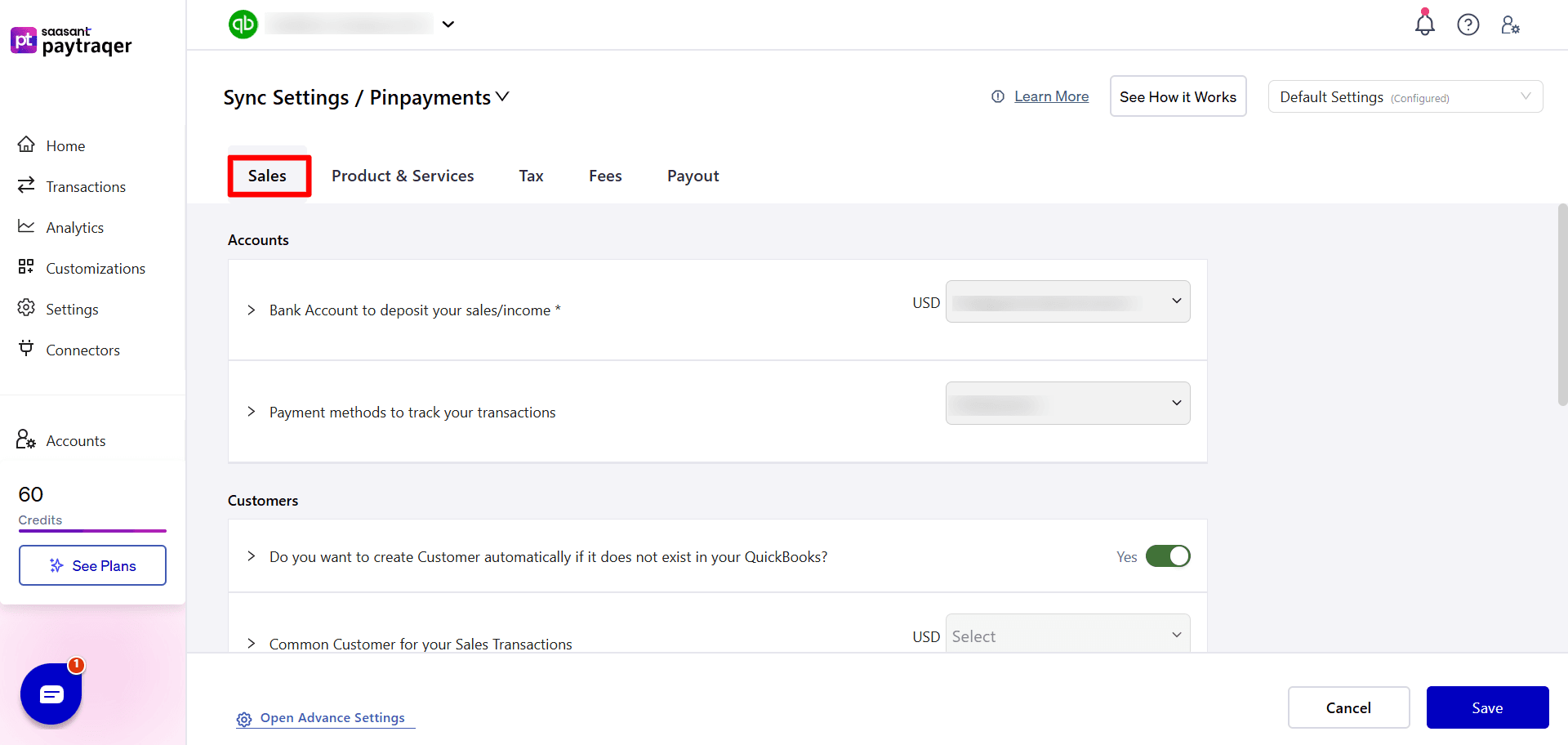

5. Sales settings for Pin Payments

Go to Sync Settings → Pin Payments → Sales.

Accounts

Bank Account to deposit your sales/income

Choose the PinPayments Bank Account (clearing account). For multi currency, create a separate clearing account per currency.Payment methods to track your transactions

Select PinPayments or any other method label you want to use. This is the payment method that will appear on invoices, payments, or sales receipts created in QuickBooks.

Customers

Do you want to create Customer automatically if it does not exist in your QuickBooks

Turn On to let PayTraQer create a new customer when it cannot find a name match.

Turn Off if you prefer to map everything to a common customer or maintain customers manually.

Common Customer for your Sales Transactions

Choose a single customer record (for example, Online Sales Customer) if you want all Pin Payments sales to use one customer instead of creating thousands of individual customers.Customize Customer Matching

Use Add Customer Matching to map names from Pin Payments to existing QuickBooks customers. This is useful if names differ slightly between systems.

Tracking

Location/Department for your Sales transactions

Pick a fixed Location or Department if you want every Pin Payments sale to carry the same location.Class for your Sales transactions

Choose a Class such as Online Sales so you can filter reports by channel.

Sync

Do you want to skip the sales and process the associated fees only

Turn On if you only want to bring in Pin Payments fees and keep sales entries manual.

Leave Off for full sales and fees sync.

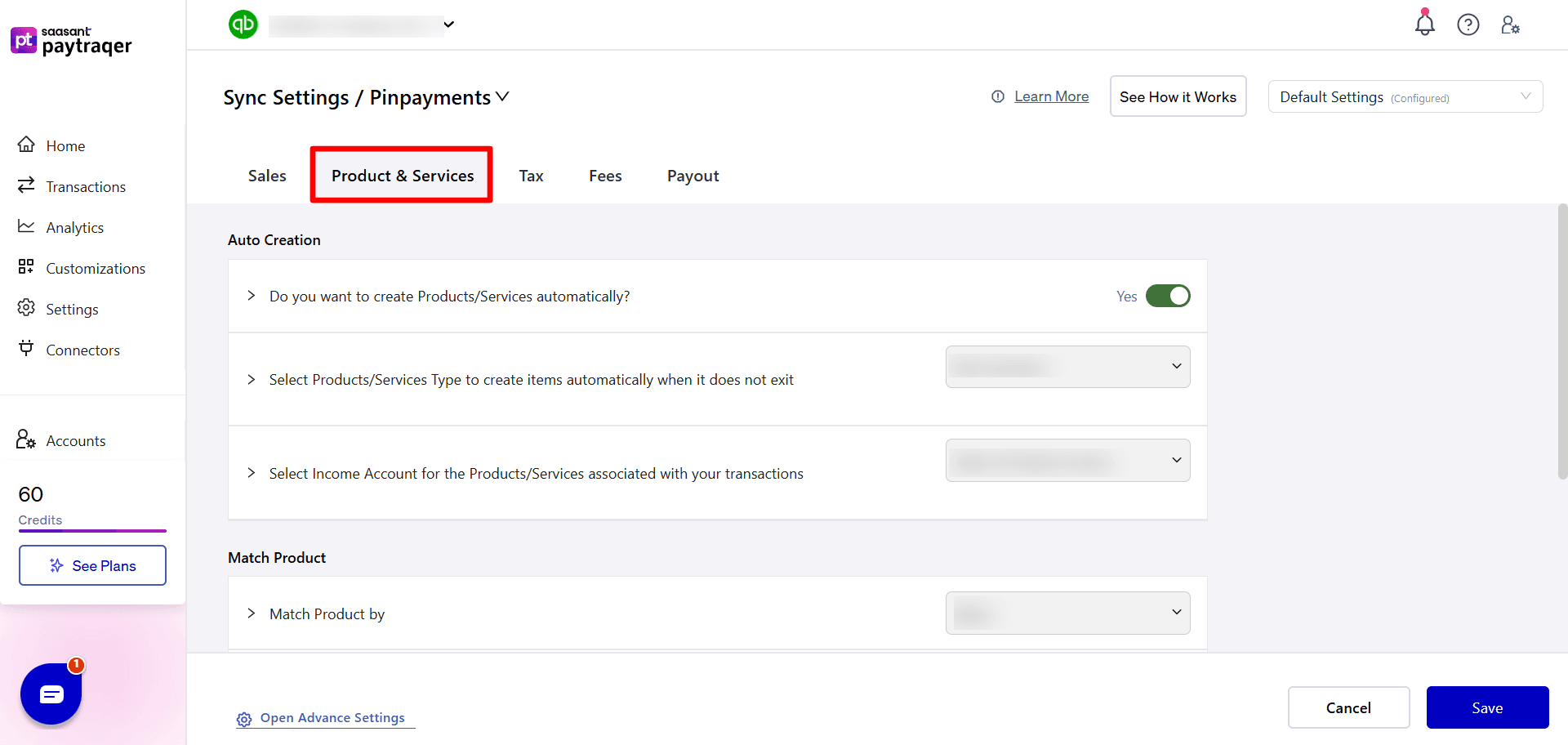

6. Product and Service settings

Go to Sync Settings → Pin Payments → Product & Services.

Auto Creation

Do you want to create Products/Services automatically

Turn On to let PayTraQer create items in QuickBooks when it cannot find an exact name match.Select Products/Services Type to create items automatically when it does not exist

Choose Non Inventory or Service based on how you track your items.Select Income Account for the Products/Services associated with your transactions

Choose an income account such as Sales of Product Income. All auto created items will point here.

Match Product

Match Product by

Pick Name or SKU based on how your items line up between Pin Payments and QuickBooks.Customize Product Matching

Use Add Product Matching to set manual mapping rules for product names that are not identical.

Common Item

Do you want to use common product/service for all your sales

Turn On if you want to post every sale to one generic item like Online Sales.Select common product/service

Choose the default item that should be used when common item is enabled.

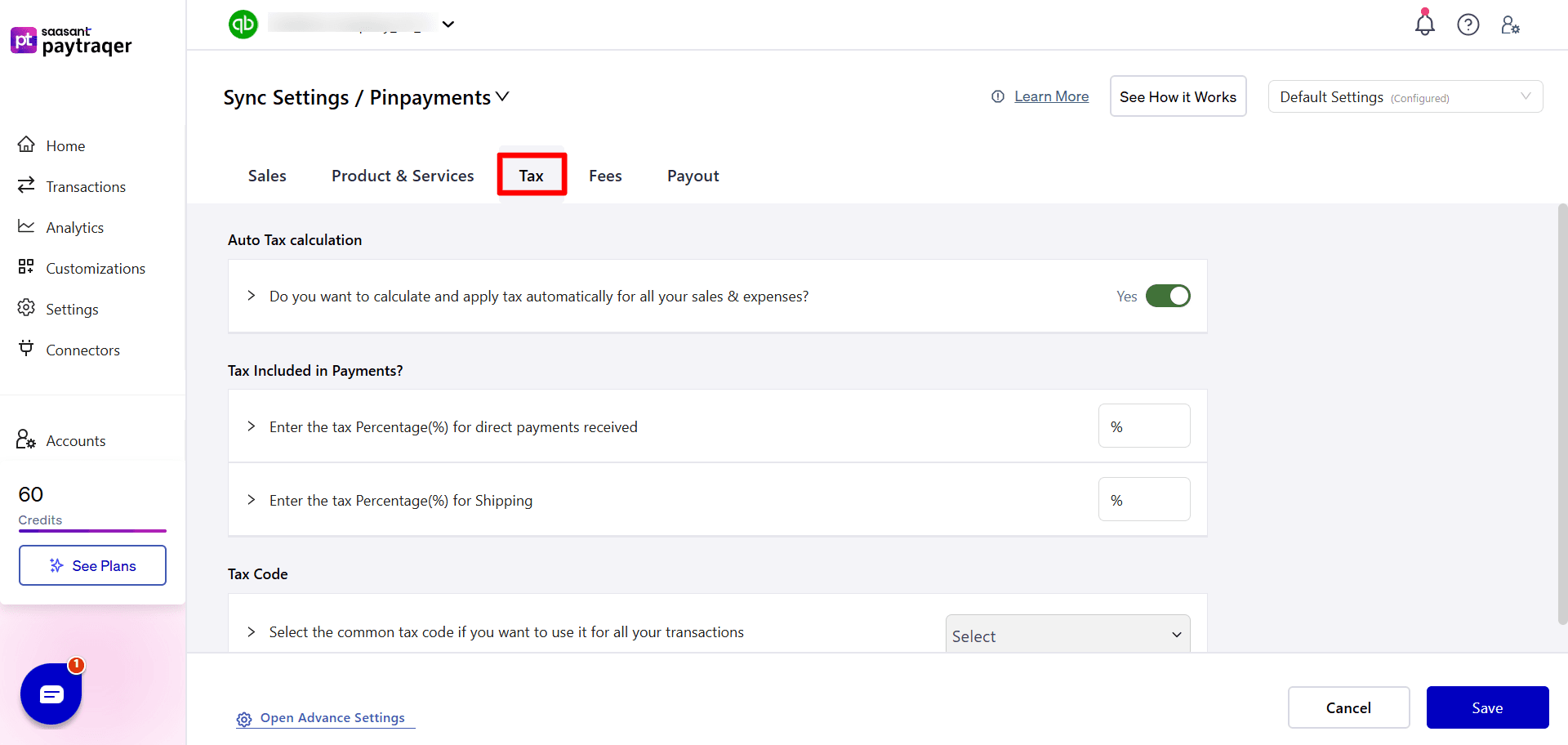

7. Tax settings

Go to Sync Settings → Pin Payments → Tax.

Auto Tax calculation

Do you want to calculate and apply tax automatically for all your sales & expenses

Turn On to let PayTraQer detect tax from each transaction and apply the right tax amount.

Tax included in payments

Enter the tax Percentage(%) for direct payments received

Use this if you want to force a fixed tax rate for all direct payments. If left blank, PayTraQer uses the tax in each transaction where possible.Enter the tax Percentage(%) for Shipping

Set a default tax rate for shipping charges if needed.

Tax Code

Select the common tax code if you want to use it for all your transactions

Choose a single QuickBooks tax code if you prefer one code for every synced transaction. This will override automatic tax detection.

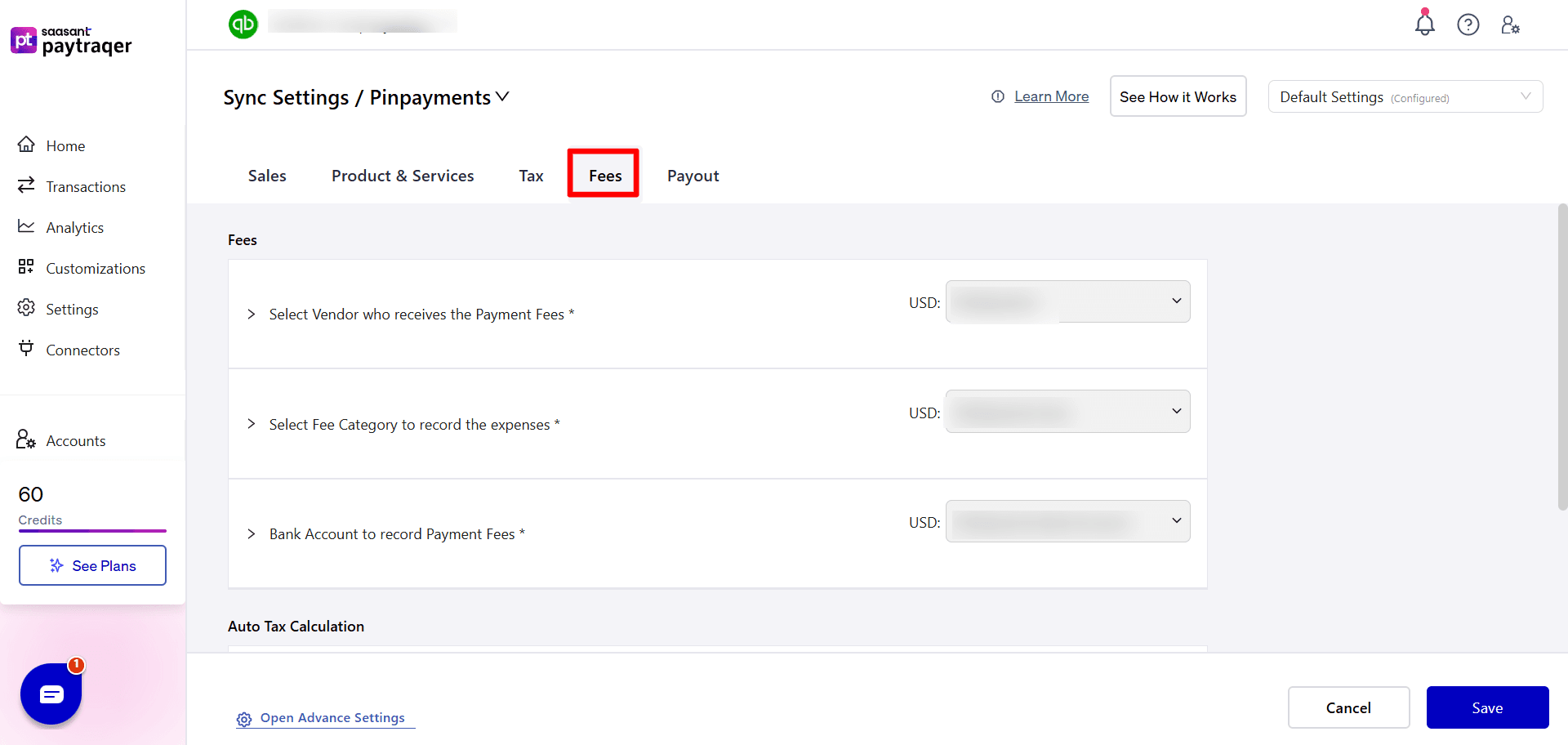

8. Fees settings

Go to Sync Settings → Pin Payments → Fees.

Fees

Select Vendor who receives the Payment Fees

Choose PinPayments or another vendor name. All fee expenses will be recorded under this vendor.Select Fee Category to record the expenses

Pick an expense account such as PinPayments Fees.Bank Account to record Payment Fees

Select the bank or clearing account where fee expenses should post. Often this is the same PinPayments Bank Account used for sales.

Auto Tax Calculation for fees

Class for your Fees

Apply a fixed Class to all fee expenses if you track them by class.Location/Department for your Fees

Apply a fixed Location or Department for fee expenses.Do you want to skip the fee details from syncing

Turn On if you do not want individual fee lines synced. Leave Off to bring all fee breakdowns into QuickBooks.

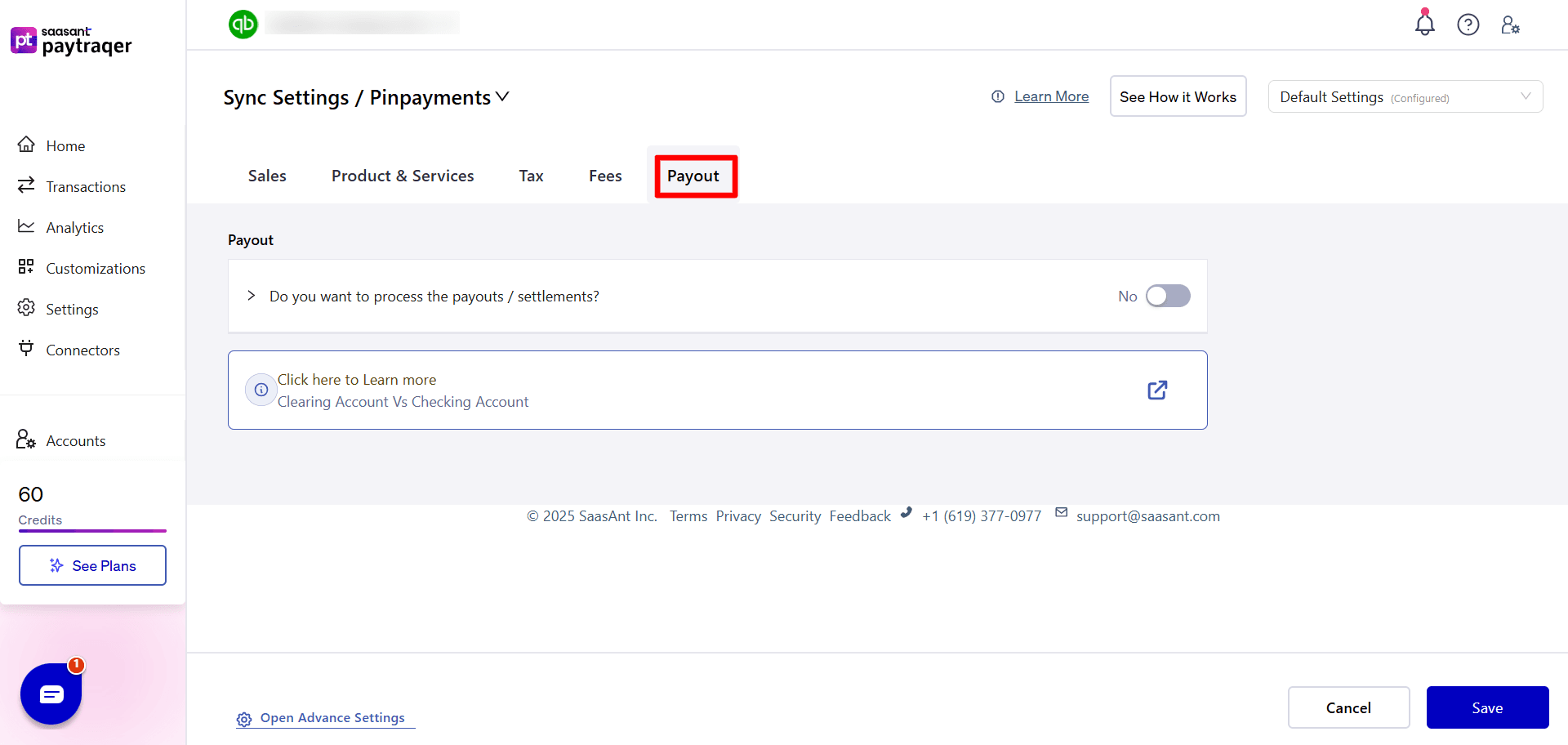

9. Payout settings

Go to Sync Settings → Pin Payments → Payout.

Do you want to process the payouts / settlements

Turn On to have PayTraQer create transfer transactions from the PinPayments Bank Account to your real checking account each time a payout is sent.

This makes it easier to match bank deposits in QuickBooks during reconciliation.

Leave Off only if you plan to handle these transfers yourself.

Click Save after you finish each tab.