Overview of PayTraQer Settings for Braintree

November 17, 2025

Braintree settings guide in PayTraQer

This article explains every Braintree specific setting in PayTraQer and how it affects posting in QuickBooks.

Use it when you want to review or change how Braintree sales, fees, expenses, and payouts are synced.

1. Where to find Braintree settings

Sign in to PayTraQer.

Go to Settings → Sync settings.

Select the Braintree connector.

You will see these sections:

Sales

Product

Tax

Fees

Expense

Payout

General Settings like Auto Sync, duplicate check, and time zone are shared across all connectors. Use Settings → General for those.

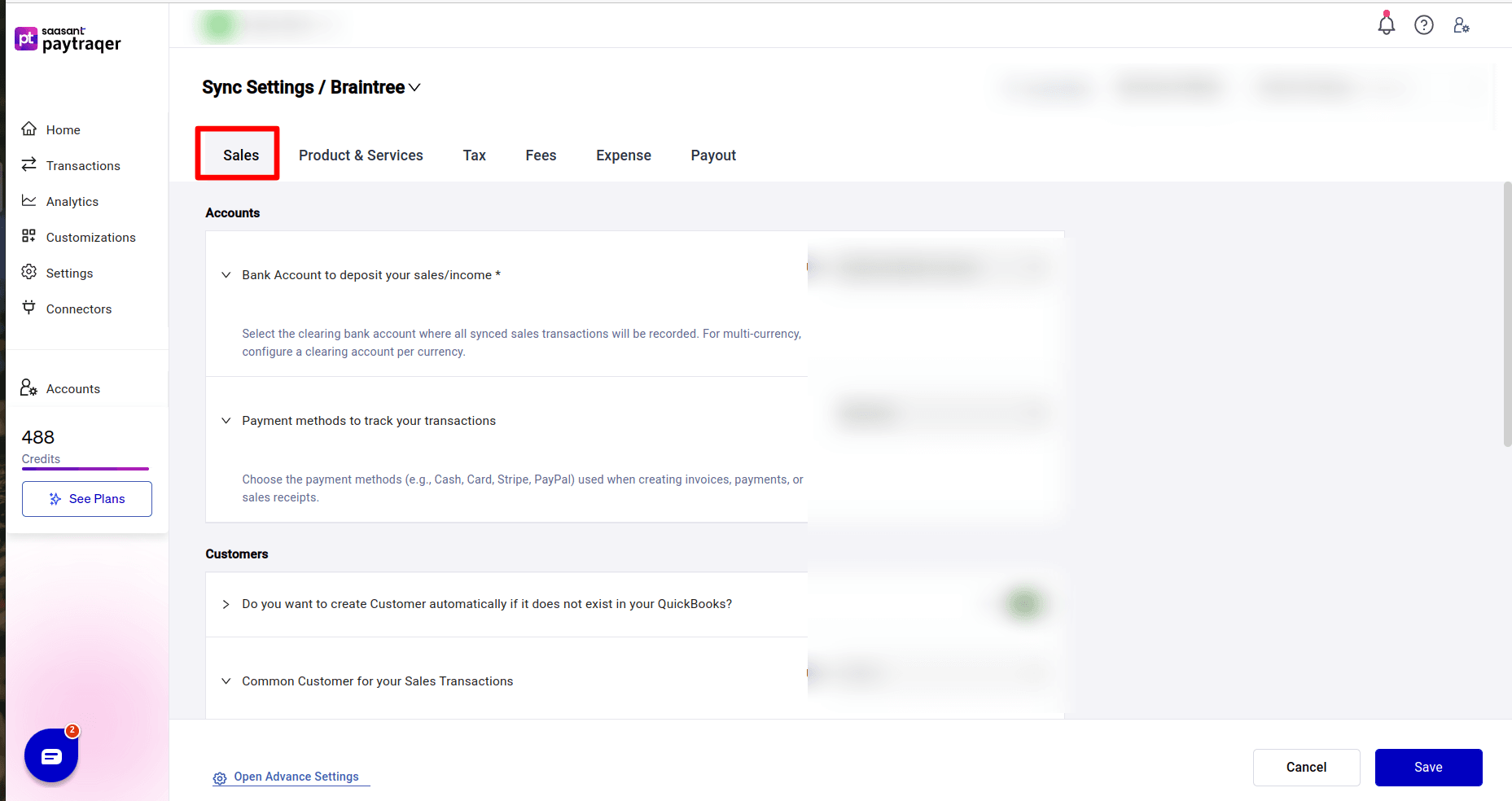

2. Sales settings for Braintree

Path: Sync settings → Braintree → Sales

These options control how Braintree payments become sales entries in QuickBooks.

2.1 Accounts

Bank Account to deposit your sales/income

Example: Braintree Bank Account (USD)

This is your Braintree clearing bank in QuickBooks.

All Braintree sales go here.

For multi currency, pick a clearing account per currency.

Tip: Use the same clearing account here and in Fees and Expense settings so the account nets correctly.

2.2 Payment method

Payment methods to track your transactions

Set to Braintree.

This value appears as the Payment Method on Sales Receipts or Payments in QuickBooks.

2.3 Customers

Do you want to create Customer automatically if it does not exist in your QuickBooks

Set to Yes to let PayTraQer create customers when there is no exact name match.

Set to No only if you maintain all customers manually in QuickBooks.

Common Customer for your Sales Transactions

Optional.

Turn on and select a customer if you want all Braintree sales under one name, for example “Braintree Sales”.

Useful for summary style posting when you do not need per customer reporting.

Customize Customer Matching

Use Add Customer Matching to map Braintree customer names to existing QuickBooks customers.

Helps avoid duplicates when names differ slightly between systems.

2.4 Tracking

Location/Department for your Sales transactions

Class for your Sales transactions

Assign a fixed Location/Department and Class to every Braintree sale.

Use this if you report by channel, branch, or practice area.

Leave blank if you do not use these fields in QuickBooks.

2.5 Sync scope

Do you want to skip the sales & process the associated fees only

No by default.

Set to Yes only when another integration already creates the Braintree sales and you want PayTraQer to bring in fees only.

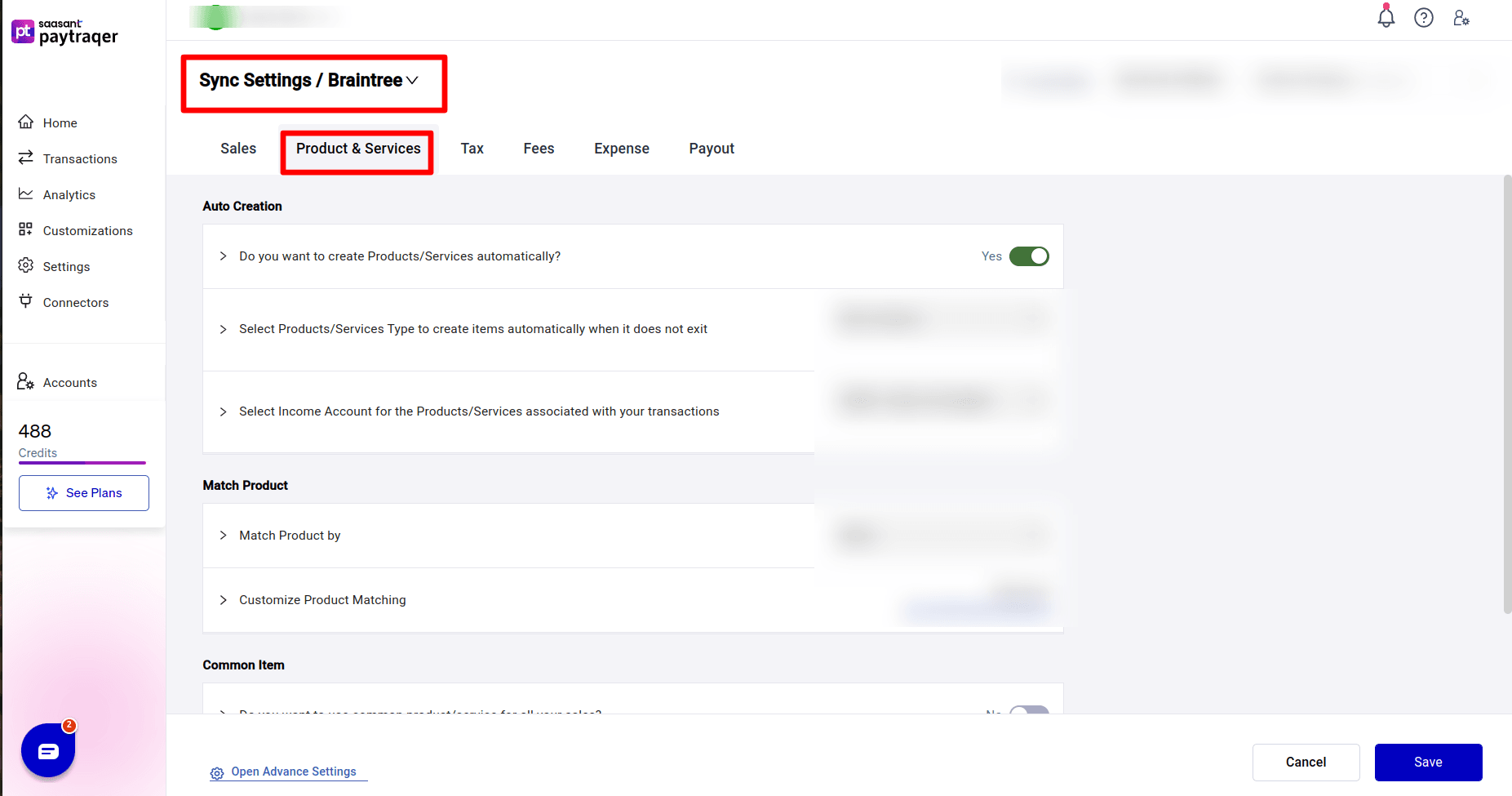

3. Product settings for Braintree

Path: Sync settings → Braintree → Product

These settings control how items from Braintree are handled in QuickBooks.

3.1 Auto creation

Do you want to create Products/Services automatically

Yes to auto create new items when there is no exact name match.

Prevents sync failures when new products appear.

Select Products/Services Type to create items automatically

Choose Non Inventory or Service for auto created items.

Select Income Account for the Products/Services associated with your transactions

Choose the income account to link to auto created items.

The example screenshot shows a liability account, but you should pick the revenue account that fits your Braintree sales.

3.2 Product matching

Match Product by

Set to Name by default.

Switch to SKU if you keep consistent SKUs between Braintree and QuickBooks.

Customize Product Matching

Use Add Product Matching to map Braintree item names to existing QuickBooks items when naming is different.

3.3 Common Item

Do you want to use common product/service for all your sales

No by default.

Set to Yes if you want to post all Braintree sales under one item, then choose it in Select common product/service.

Useful for summary sync when item level reporting is not needed.

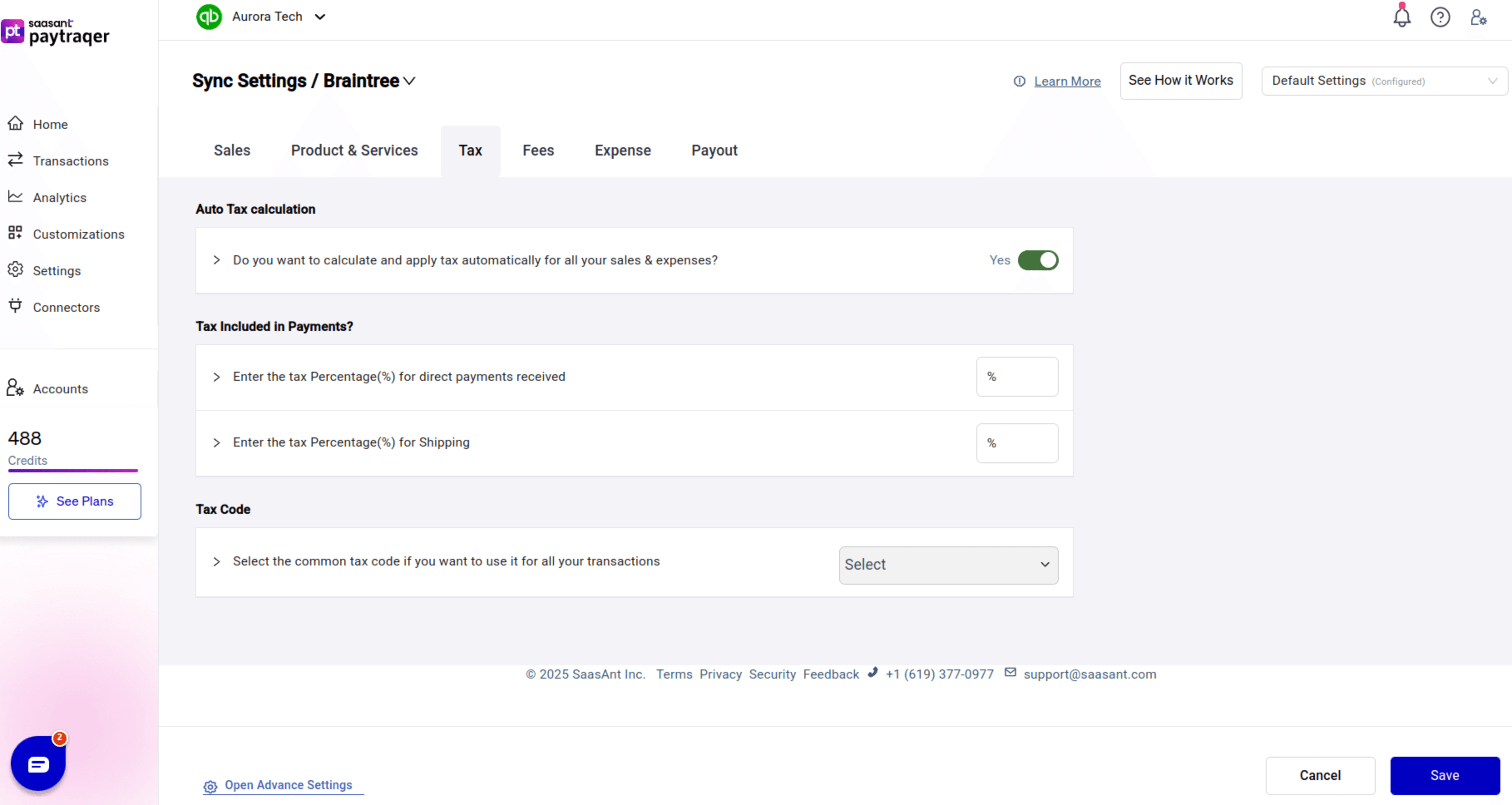

4. Tax settings for Braintree

Path: Sync settings → Braintree → Tax

These settings control how tax is calculated and mapped.

Do you want to calculate and apply tax automatically for all your sales & expenses

Yes to let PayTraQer find and apply tax where needed.

Tax Included in Payments

Enter the tax percentage for direct payments if your Braintree charges are tax inclusive.

PayTraQer uses this to identify the correct tax code.

Enter the tax Percentage(%) for Shipping

Set a separate tax percentage for shipping amounts when shipping is taxable.

Tax Code

Choose a default tax code if you want one common code for all Braintree transactions.

This overrides automatic tax detection when set.

Always test with a sample transaction in QuickBooks after changing tax settings.

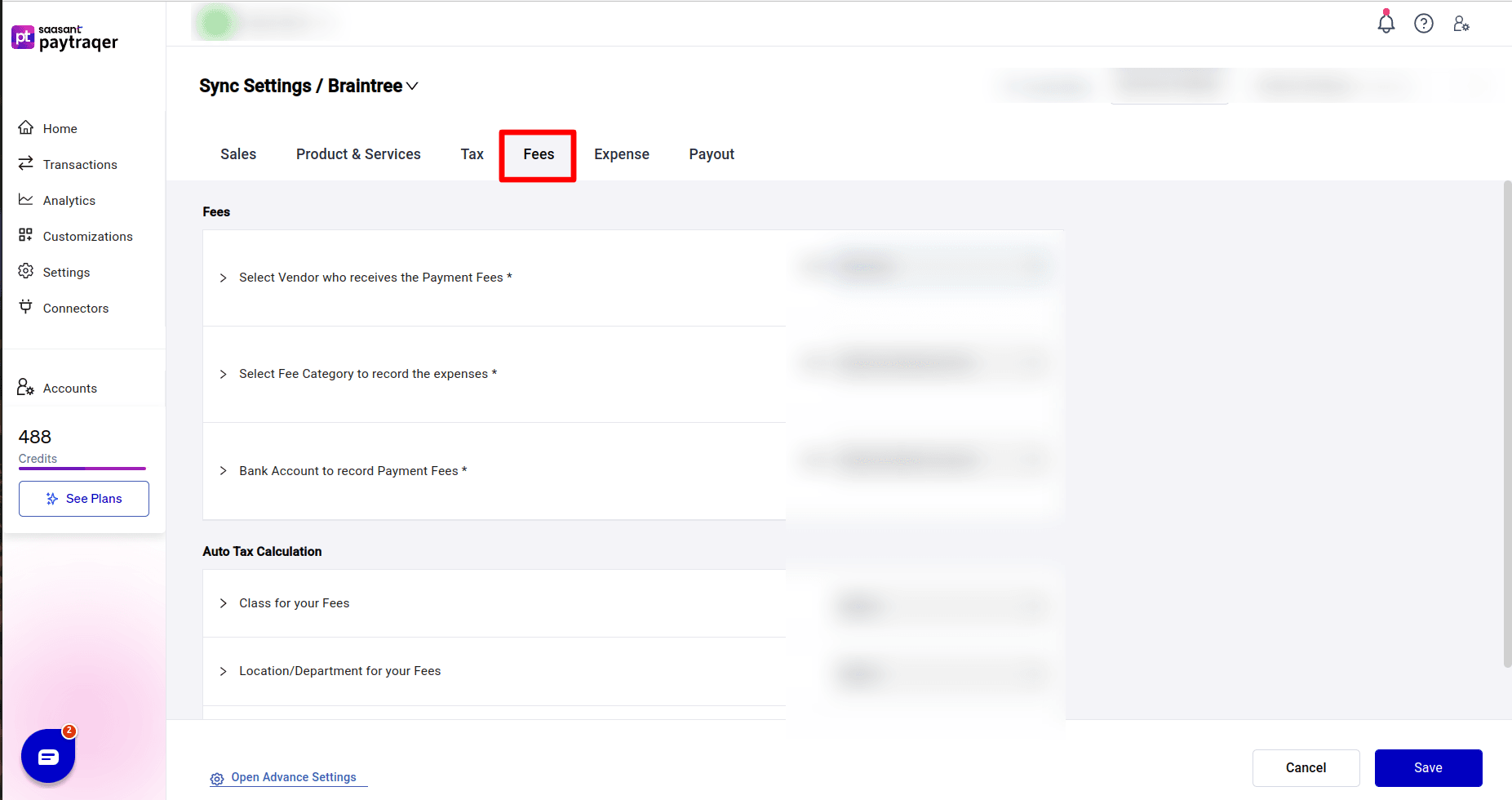

5. Fees settings for Braintree

Path: Sync settings → Braintree → Fees

These settings describe how Braintree fees are recorded.

Select Vendor who receives the Payment Fees

Set to Braintree.

All fee expenses will use this vendor.

Select Fee Category to record the expenses

Choose your Braintree fee expense account, for example Braintree Fees.

Bank Account to record Payment Fees

Set to Braintree Bank Account.

This keeps sales and fees in the same clearing account.

Class for your Fees

Location/Department for your Fees

Optional tracking fields for fee expenses.

Do you want to skip the fee details from syncing

No by default.

Set to Yes only if you do not want individual fee lines to post.

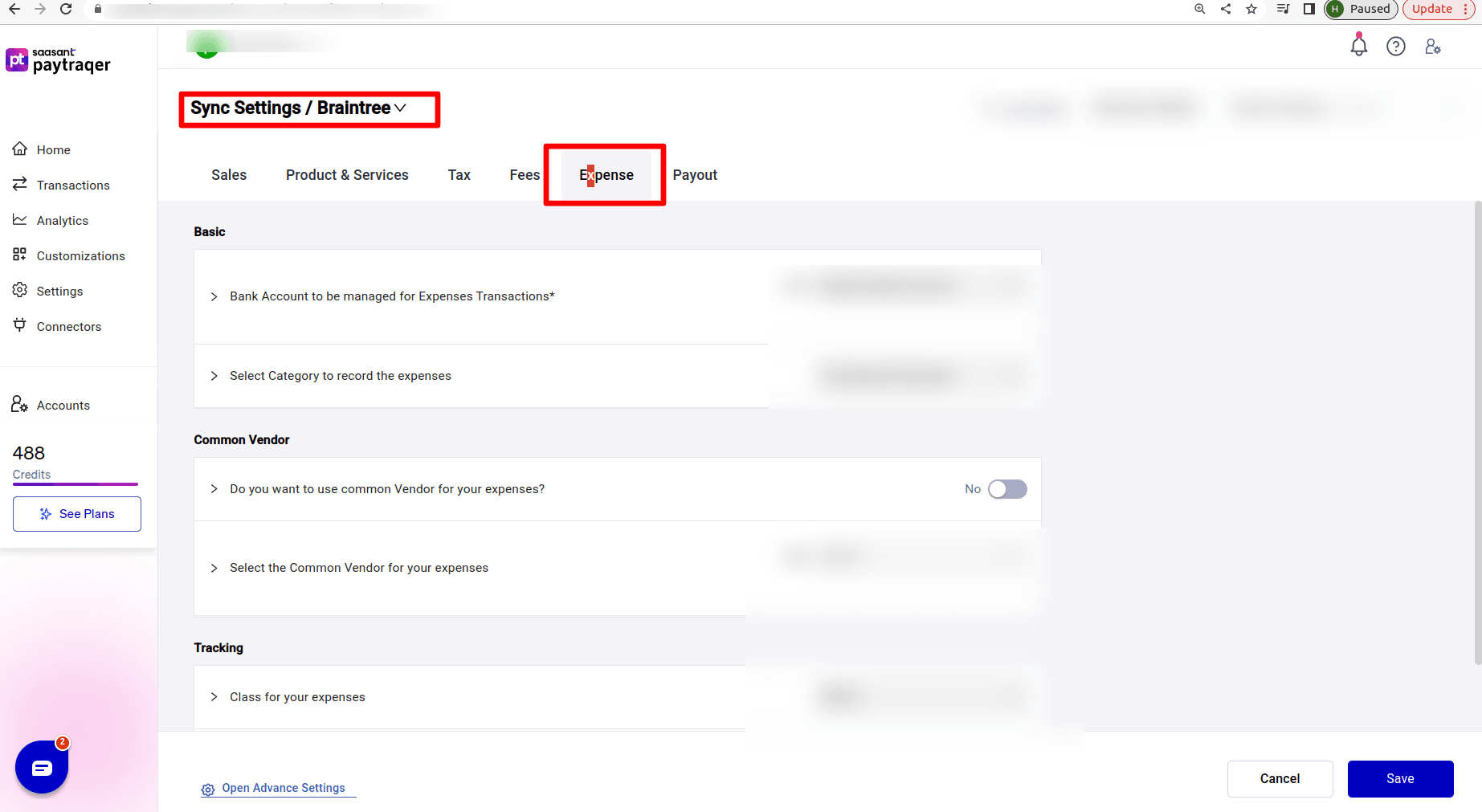

6. Expense settings for Braintree

Path: Sync settings → Braintree → Expense

Used for extra expenses that are not per transaction fees.

Bank Account to be managed for Expenses Transactions

Set to Braintree Bank Account so these expenses affect the same clearing account.

Select Category to record the expenses

Choose an expense account such as Uncategorized Expense or a Braintree specific expense account.

Do you want to use common Vendor for your expenses

No by default.

Set to Yes if you want all such expenses under one vendor, then choose it in Select the Common Vendor for your expenses.

Class for your expenses

Location/Department of your expenses

Optional tracking fields for these expenses.

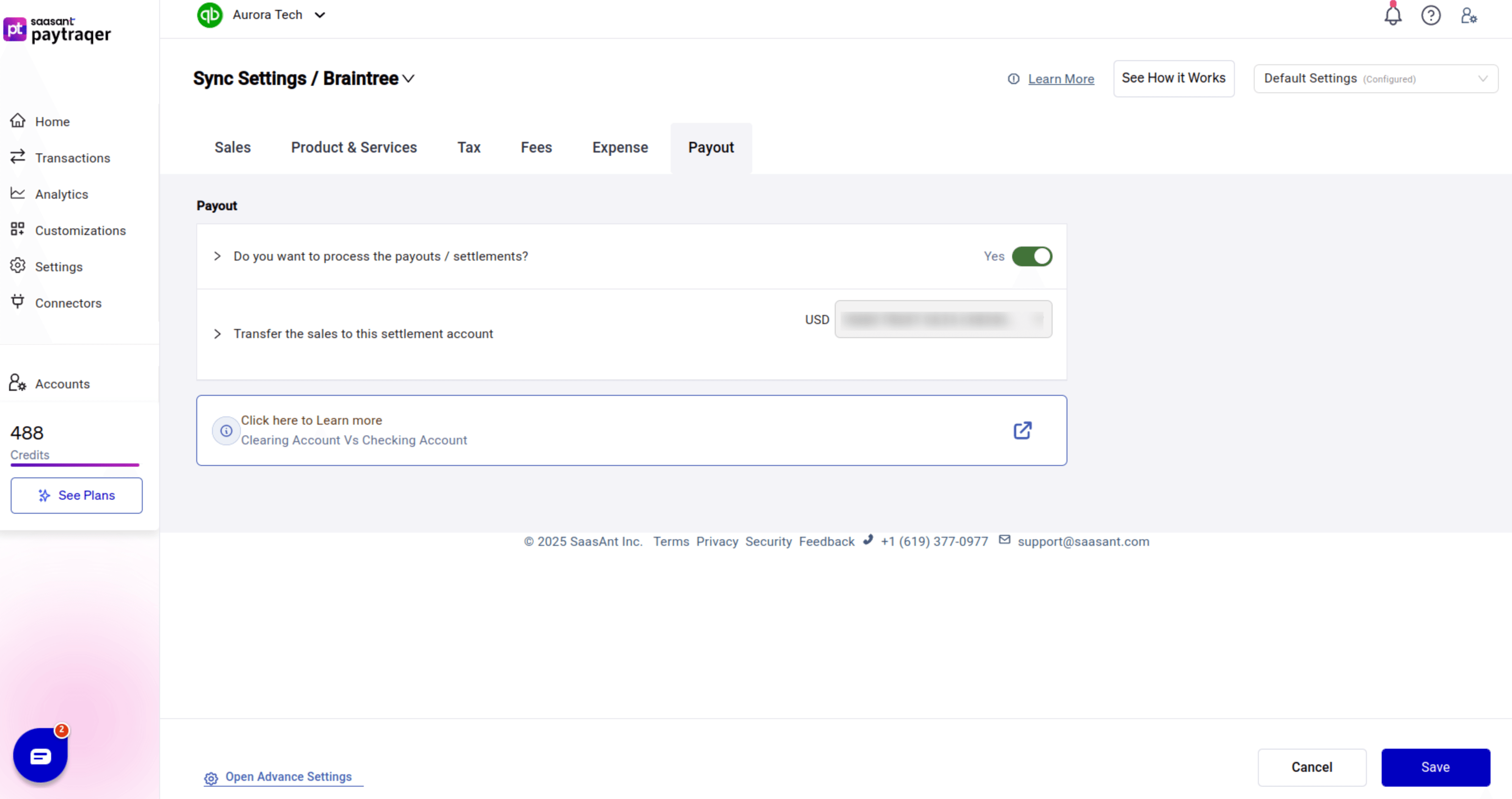

7. Payout settings for Braintree

Path: Sync settings → Braintree → Payout

These settings handle how Braintree settlements move from the clearing account to your real bank.

Do you want to process the payouts / settlements

Yes to sync payouts and settlements as transfer transactions.

Transfer the sales to this settlement account

Choose your settlement bank account, for example a checking or trust account:

How it works:

Sales and fees post to Braintree Bank Account.

When Braintree sends a payout, PayTraQer creates a Bank Payout or Transfer from Braintree Bank Account to the chosen settlement account.

That transfer amount should match the deposit in your bank feed.

8. How Braintree transactions map to QuickBooks

For reference, here is how Braintree transaction types become QuickBooks entries:

Payment system | QuickBooks entry created |

Invoice Payment | Invoice, Fees as Expense |

Subscription Payment | Sales Receipt, Fees as Expense |

Payment | Sales Receipt, Fees as Expense |

Recurring Payment | Invoice, Payment, Fees as Expense |

Customer Refund | Refund |

Payouts are handled separately in the Payout section as Bank Payout or Transfer entries.

9. Test and review

After you adjust Braintree settings:

Use Download historical transactions for a short date range.

Sync that range.

In QuickBooks, verify:

Sales post to Braintree Bank Account with Payment Method Braintree.

Customers and items are created or mapped as expected.

Fees and extra expenses hit the correct expense accounts.

Tax codes and amounts look correct.

Payout transfers match bank deposits and reduce the Braintree clearing balance.

Once the results look right, you can turn on Auto Sync in General Settings to keep Braintree and QuickBooks in sync going forward.