How to Import Supplier Credit Notes into Xero

August 21, 2025

Pre Requisites

Connect your Xero account to SaasAnt Transactions (Online) App from Xero App Marketplace by clicking the "Get this app" button and get the 30-day free trial [No credit card required]. Alternatively, you can log in with your Xero account directly through this link - https://apps.saasant.com/eti-importer-login/index.html.

Steps to Import Supplier Credit Note into Xero

To import Supplier Credit Notes into Xero using the SaasAnt Transactions (Online) application, follow the steps below.

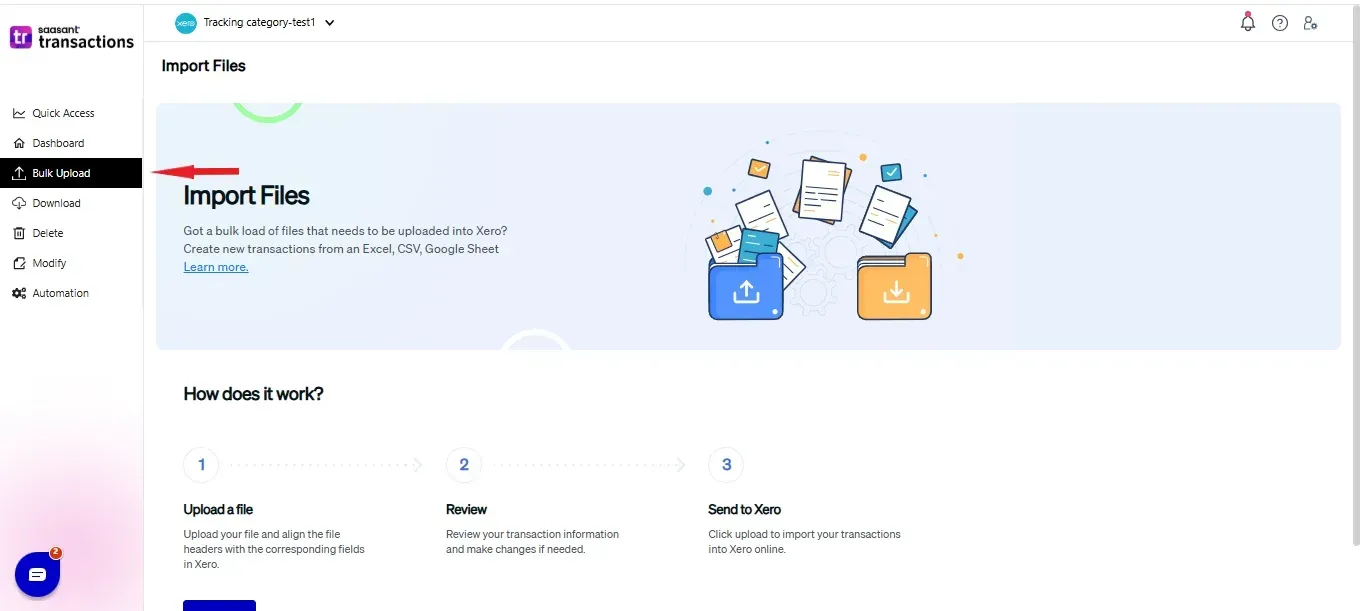

Step 1: Click on the "Bulk Upload" Menu to upload your file.

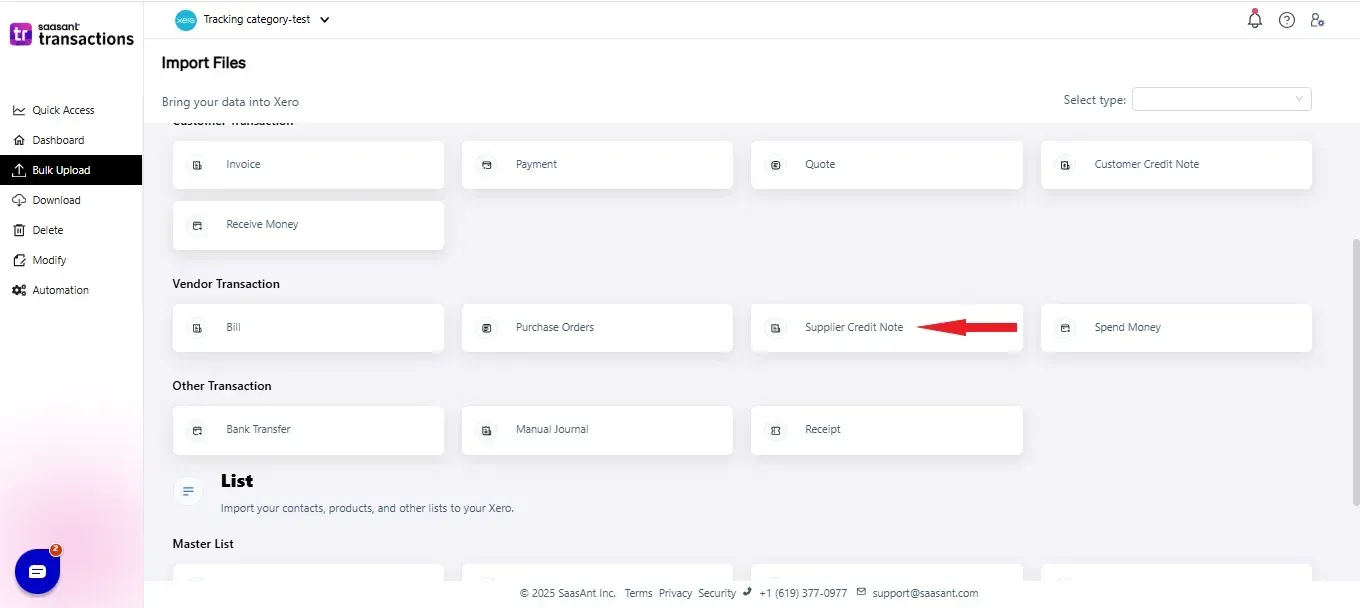

Step 2: Select Supplier Credit Note as the Xero entity.

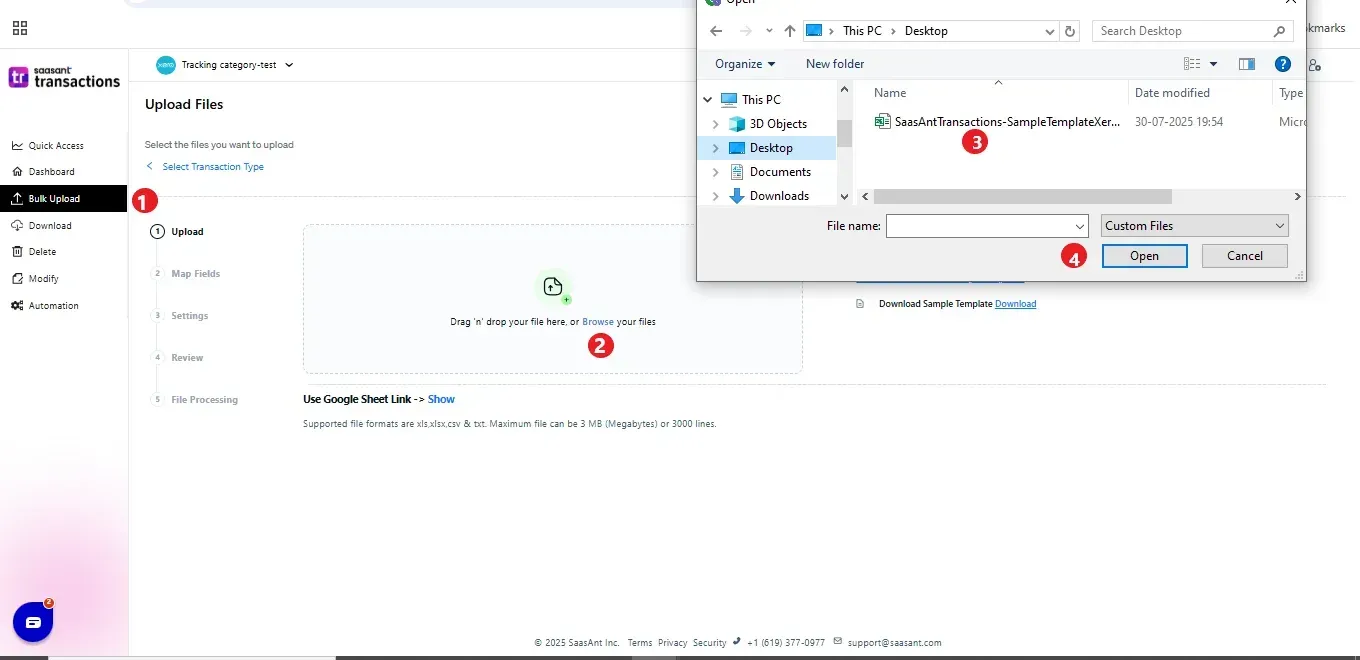

Step 3: Select your file and spreadsheet which has the Supplier Credit Note that you want to import.

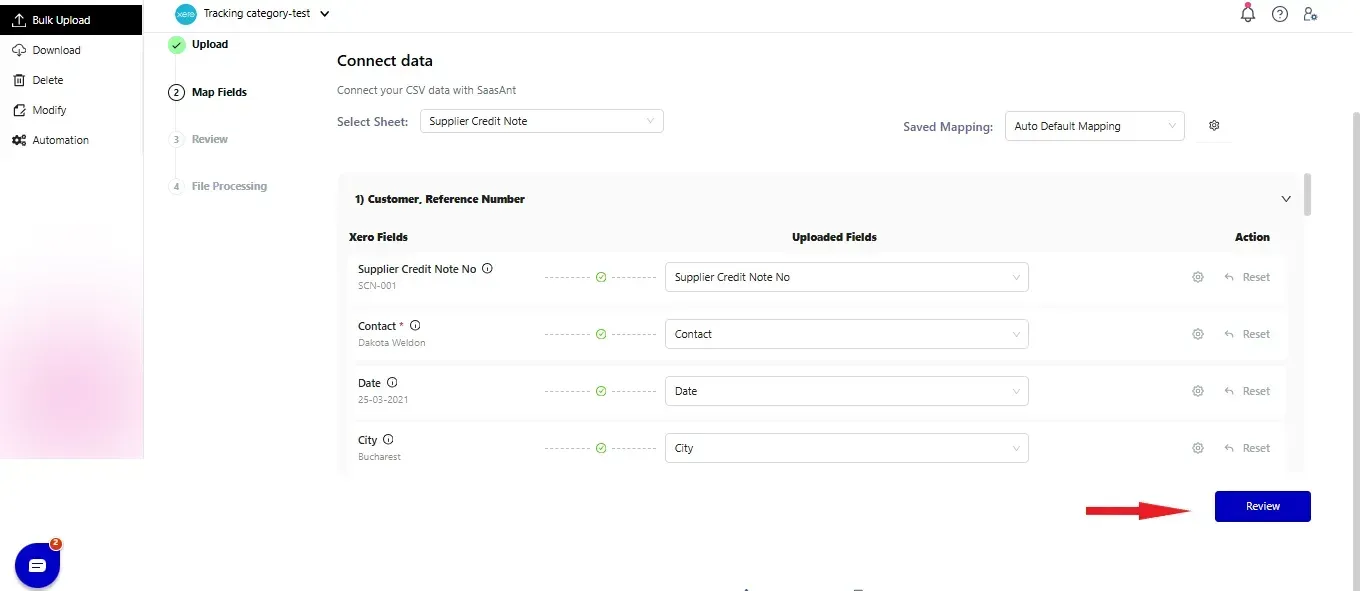

Step 4: Set up the mapping of the columns in your Supplier Credit Note import file to the corresponding fields in Xero.

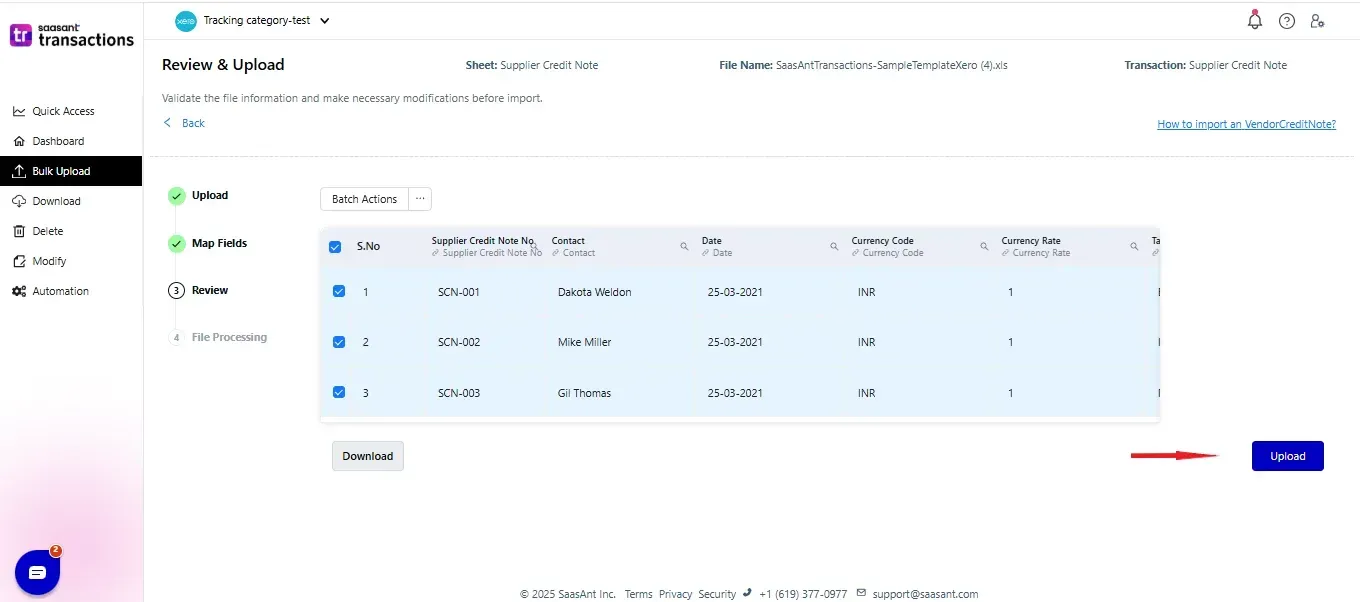

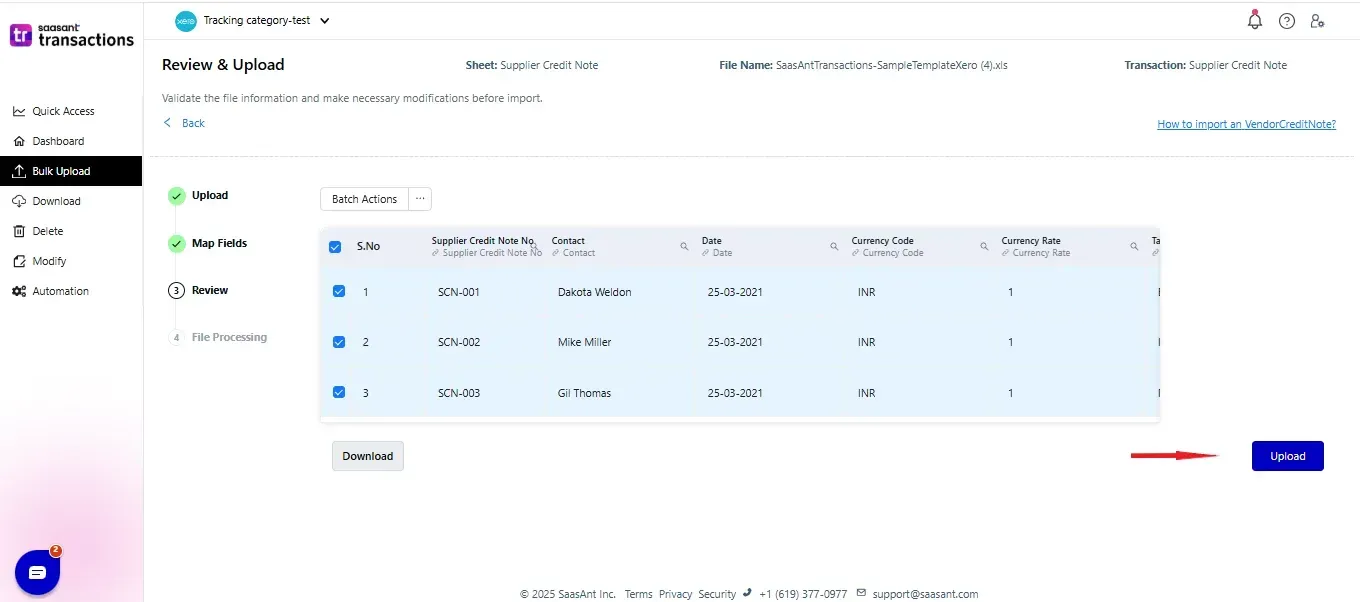

Step 5: Click Upload and your Supplier Credit Note will be directly added to your Xero account.

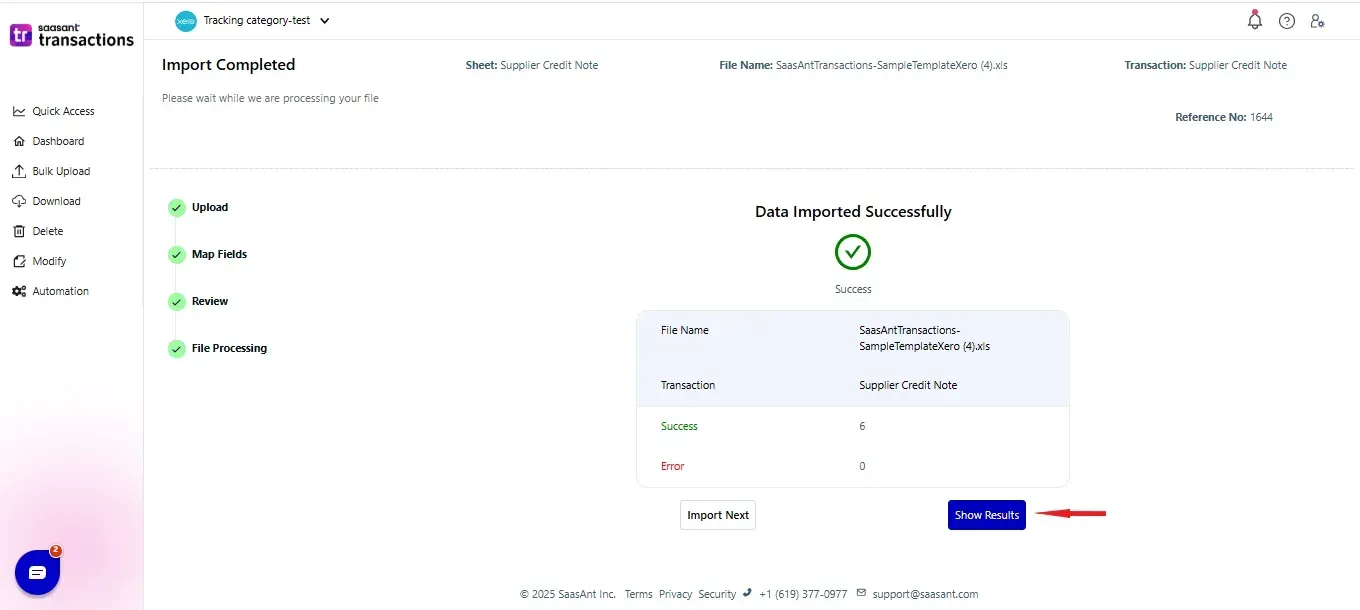

Step 6: Your data is successfully imported into Xero.

Step 6: Your data is successfully imported into Xero.

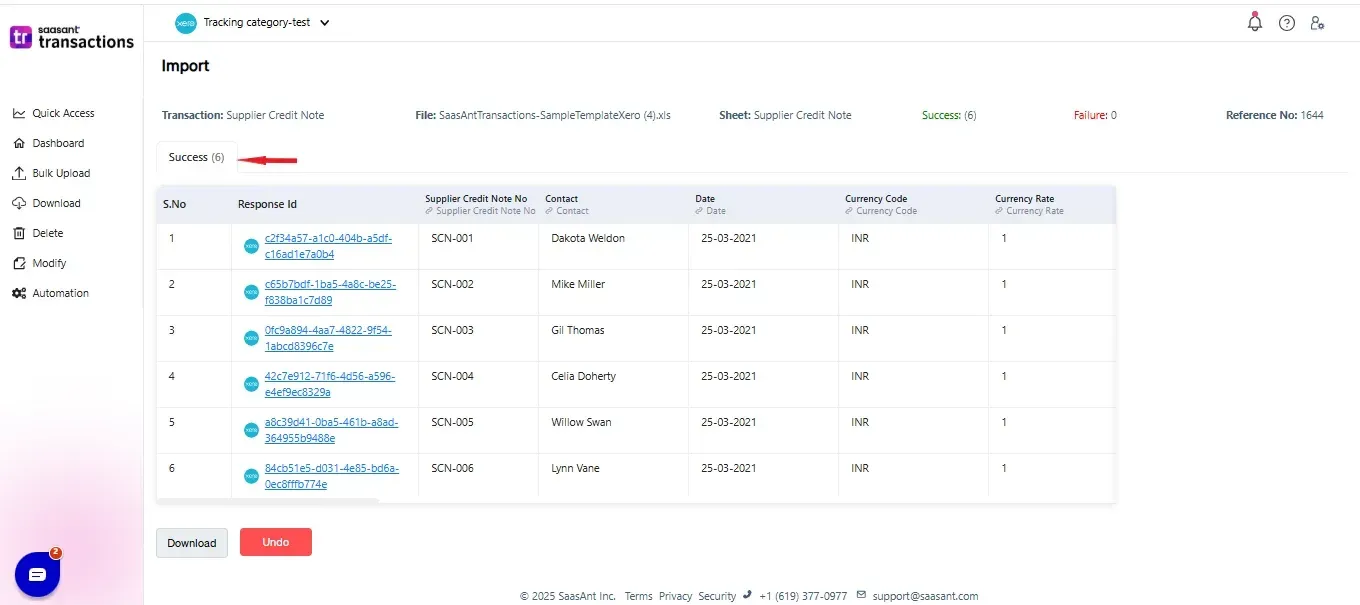

Step 7: You can Undo the import if the data is incorrectly imported.

Step 7: You can Undo the import if the data is incorrectly imported.

Please refer basics of field mappings for more info. If you have any confusion or doubts, feel free to drop an email to support@saasant.com.

SaasAnt Transactions (Online) Fields

Field Name | Format | Description |

Supplier Credit Note No. | 255 Characters | Reference number for the transaction. By default, this number is used only within SaasAnt Transactions, and Xero auto-generates a new number. |

Contact | Characters | Name of the Supplier. |

Supplier Credit Note Date | Date | Date of the transaction. |

Address Line 1 | 500 Characters | First line of the Supplier address |

Address Line 2 | 500 Characters | Second line of the Supplier address |

Address Line 3 | 500 Characters | Third line of the Supplier address |

Address Line 4 | 500 Characters | Fourth line of the Supplier address |

City | 255 Characters | City of the Supplier address |

Postal Code | 50 Characters | Postal Code of the Supplier address |

Country | 50 Characters | Country of the Supplier address |

255 Characters | Email address should be in a valid format. | |

Line Item | 50 Characters | Item Name |

Line Item Description | 4000 Characters | Item Description |

Line Item Quantity | Decimal | Number of items for the line |

Line Item Unit Price | Decimal | Unit Price of the item for the line |

Line Item Discount Percent | Decimal | Item Discount Percentage |

Line Item Account | 150 Characters | Item Account |

Line Item Tax Rate | 255 Characters | Item Tax Rate |

Tracking Category 1 | Characters | Tracking Category name 1 |

Tracking Category Option 1 | Characters | Tracking Category Option name 1 |

Tracking Category 2 | Characters | Tracking Category name 2 |

Tracking Category Option 2 | Characters | Tracking Category Option name 2 |

Tax Type | Characters | Possible Values: |

Currency Code | 3 Characters | Currency Code for the Vendor Credit Note |

Currency Rate | Decimal | Currency Rate for the Vendor Credit Note |

Status | Characters | The status would be default if the status is not given |

Possible Failures & Troubleshooting Tips

The currency of the transaction is invalid for the customer/vendor/account.

The given Currency is different from the default currency of the Supplier. Please refer to the Supplier's Currency in Xero & update the same currency in the Currency field.

Email Address is not valid.

Kindly verify the given email address format. It should be in xxxx@xx.xx format.

Amount is missing in the request.

The Line Item amount is missing for the particular line item.

Date is missing in the request.

The Date is missing for the transaction.

Unit Price is missing in the request.

The Line Item unit price is missing for the particular line item.

Quantity is missing in the request.

The Line Item quantity is missing for the particular line item.

One or more transaction lines do not have a tax code. Please assign a tax code for those lines.

You have chosen either Inclusive or Exclusive in the Tax Type, but the Tax code is missing for the line item. Please change the Tax Type to "No Tax" or provide a valid Tax Code for each line item.

No matching reference found for this Supplier.

There is no match found for the given Supplier Name.

Please enable the "Auto Creation of List Entities (Customer, Supplier)" feature in import settings to create the customer automatically.

Click here to start a Free Trial.

FAQ

What file types does SaasAnt Transactions Online support for Xero Online imports?

For almost all entities in Xero, SaasAnt Transactions Online supports XLS, XLSX, XLSM, CSV, and TXT. You can also schedule imports by sending CSV or Excel files via Email, Zapier, or FTP.