How to Import Manual Journals into Xero

August 21, 2025

Pre Requisites

Connect your Xero account to SaasAnt Transactions (Online) Xero App from Xero App Marketplace by clicking the "Get this app" button and get the 30-day free trial [No credit card required]. Alternatively, you can log in with your Xero account directly through this link - https://apps.saasant.com/eti-importer-login/index.html.

Steps to Import Manual Journal into Xero

To import Manual Journals into Xero using the SaasAnt Transactions (Online) application, follow the steps below.

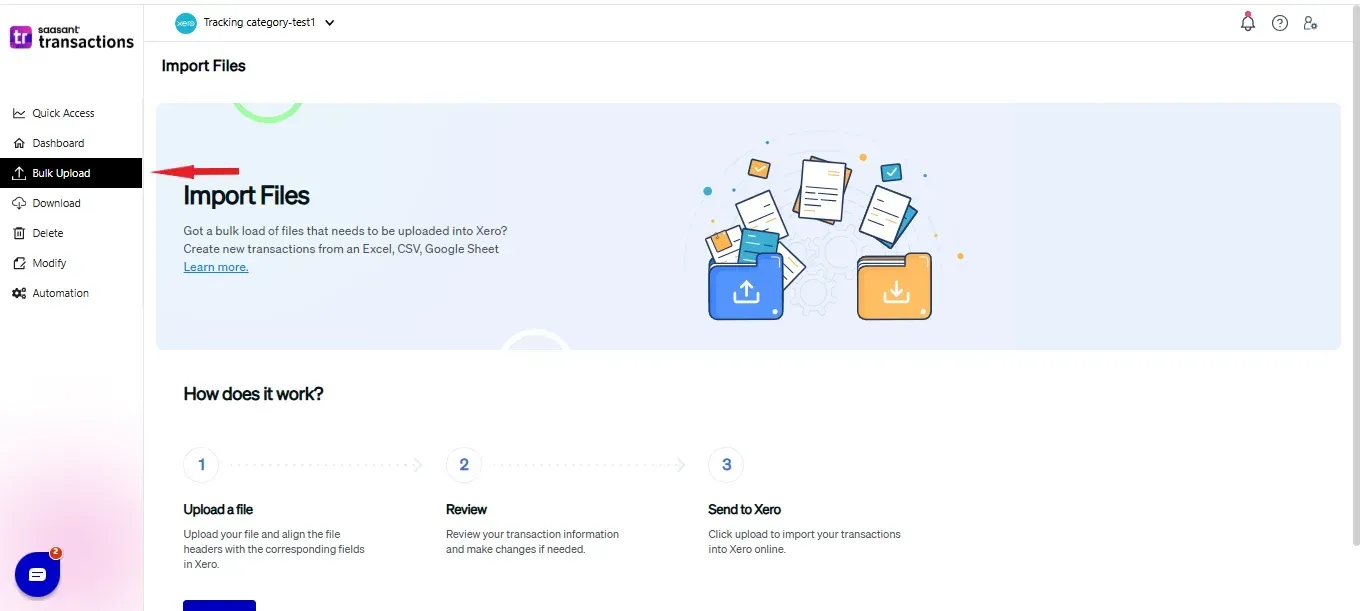

Step 1: Click on the "Bulk Upload" Menu to upload your file.

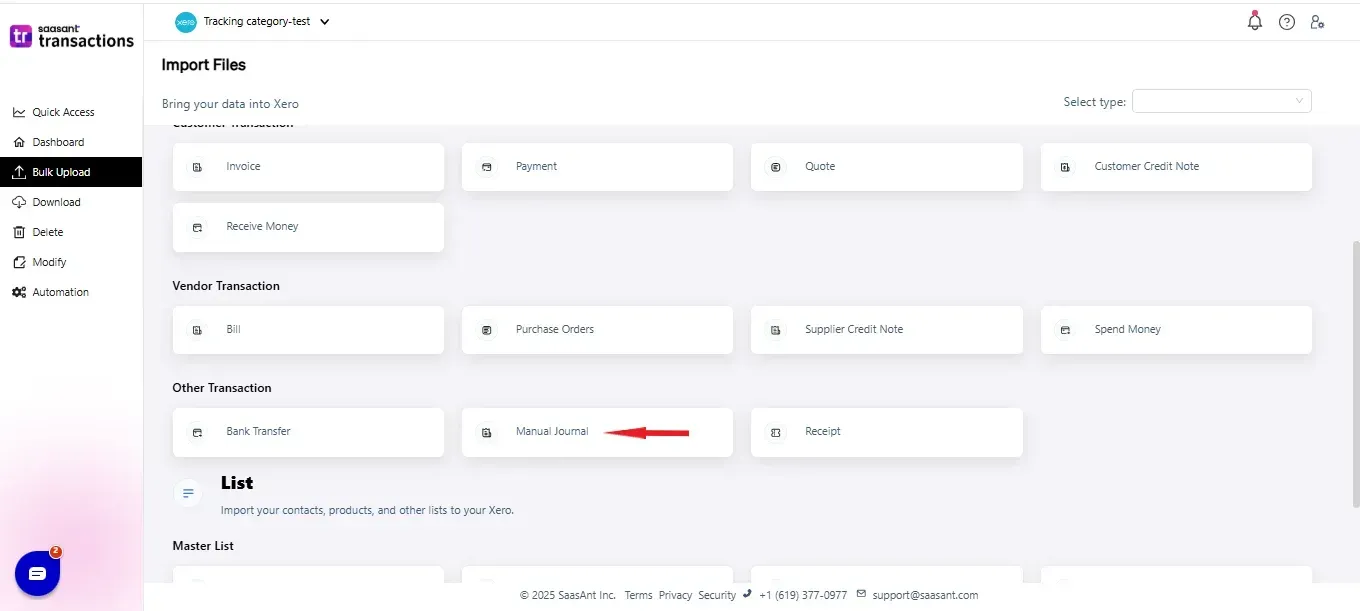

Step 2: Select Manual Journal as Xero entity.

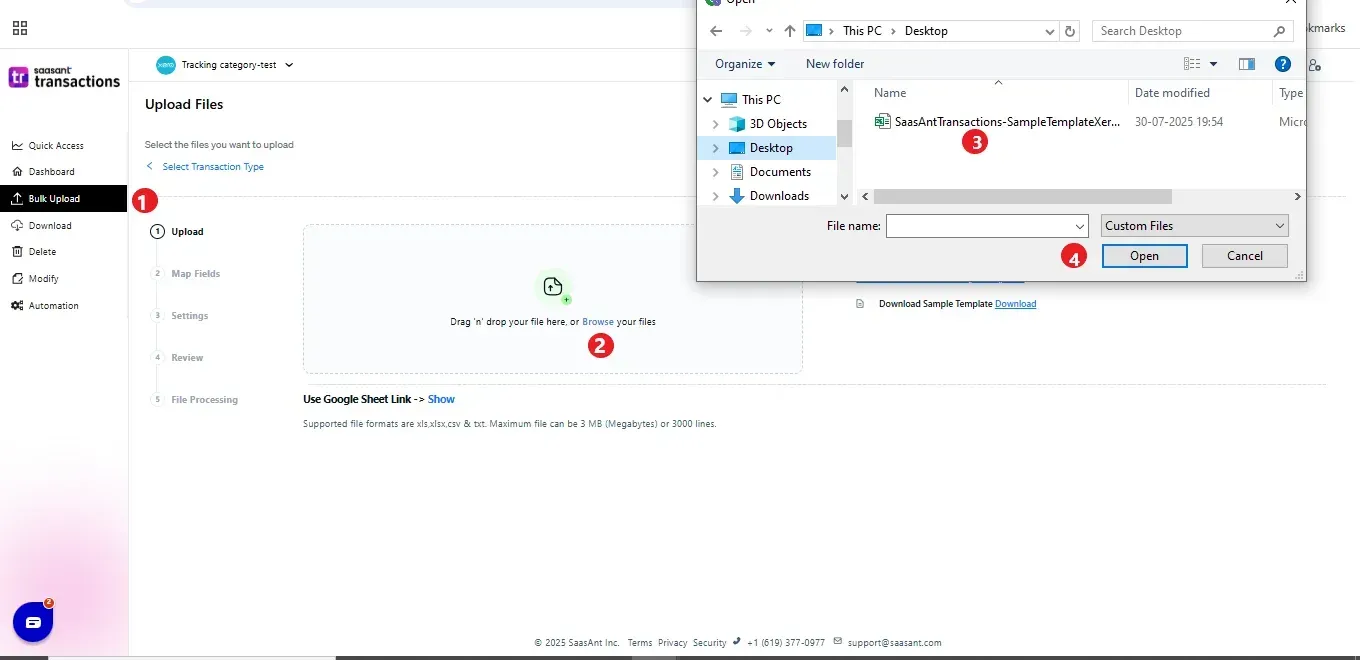

Step 3: Select your file and spreadsheet which has the Manual Journal that you want to import.

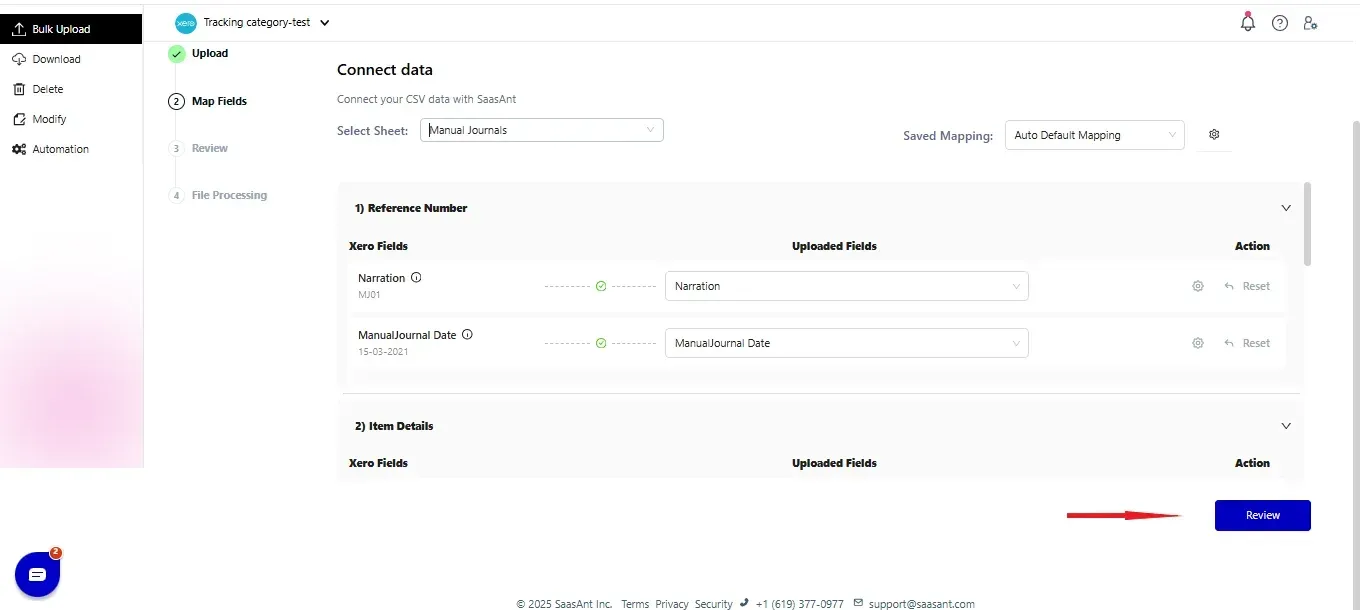

Step 4: Set up the mapping of the columns in your Manual Journal import file to the corresponding fields in Xero.

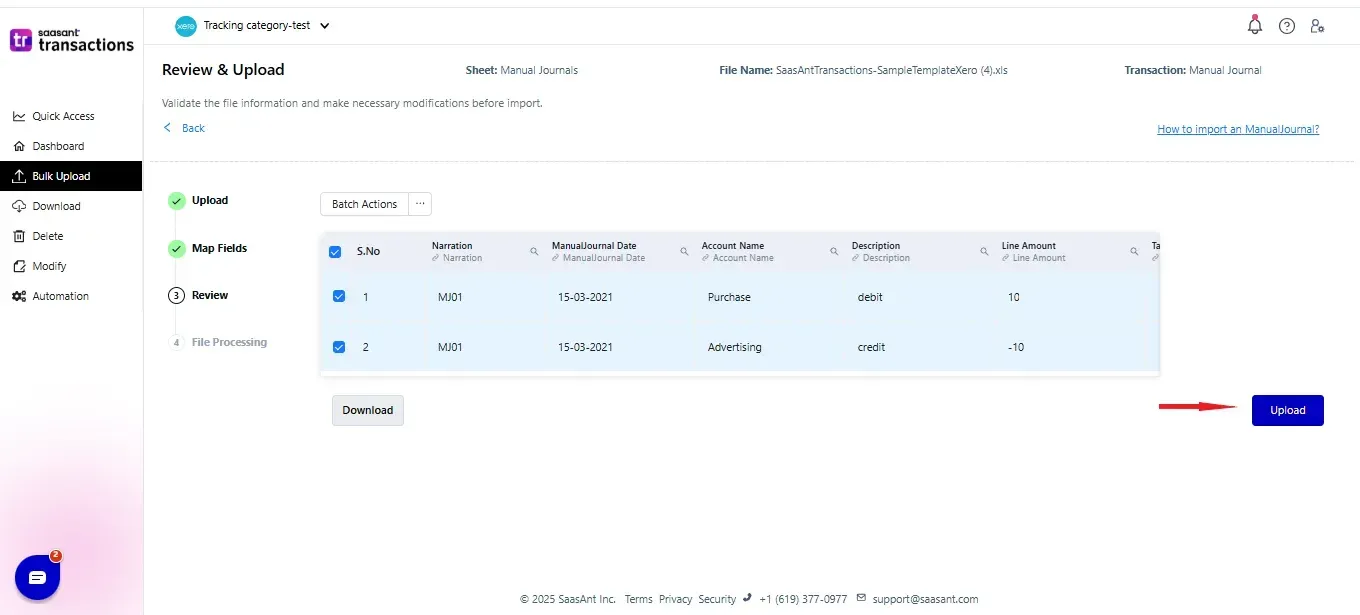

Step 5: Click Upload and your Manual Journal will be directly added to your Xero account.

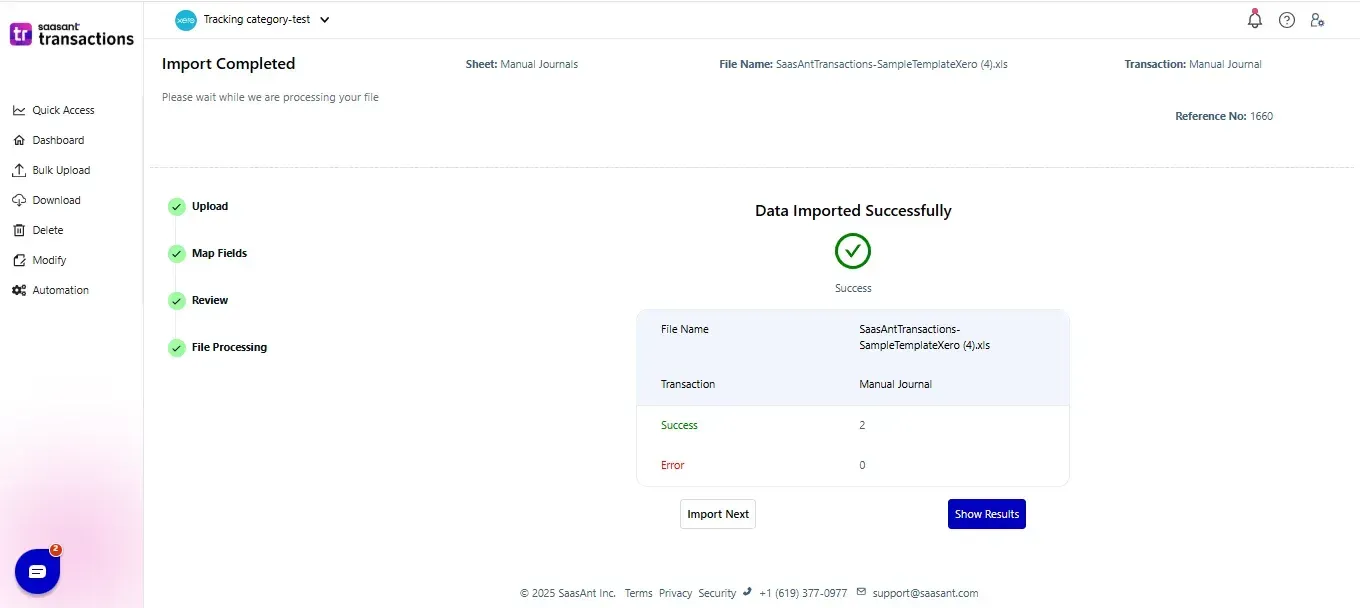

Step 5: Your data is successfully imported into Xero.

Step 5: Your data is successfully imported into Xero.

Please refer basics of field mappings for more info. If you have any confusion or doubts, feel free to drop an email to support@saasant.com.

SaasAnt Transactions (Online) Fields

Field Name | Format | Description |

Narration | 255 Characters | Reference number for the transaction. By default, this number is used only within SaasAnt Transactions, and Xero auto-generates a new number. |

Manual Journal Date | Date | Date of the transaction. |

Description | 4000 Characters | Item Description |

Account Name | 150 Characters | Item Account |

Line Amount | Decimal | Item Amount |

Tax Rate | 255 Characters | Item Tax Rate |

Tracking Line 1 | Characters | Tracking Line 1 for Line Item |

Tracking Line 2 | Characters | Tracking Line 2 for Line Item |

Tax Type | Characters | Possible Values: |

URL | Characters | Should be a valid URL |

Status | Characters | The status would be default if the status is not given |

Possible Failures & Troubleshooting Tips

Line Amount is missing in the request.

The Line amount is missing for the particular line item.

Date is missing in the request.

The Date is missing for the transaction.

One or more transaction lines do not have a tax code. Please assign a tax code for those lines.

You have chosen either Inclusive or Exclusive in the Tax Type, but the Tax code is missing for the line item. Please change the Tax Type to "No Tax" or provide a valid Tax Code for each line item.

The Line Amount must be tallied.

Please tally the line amounts in Line Item Amount Field for Debits & Credits corresponding to each entry.

Click here to start a Free Trial.

FAQ

What file types does SaasAnt Transactions Online support for Xero Online imports?

For almost all entities in Xero, SaasAnt Transactions Online supports XLS, XLSX, XLSM, CSV, and TXT. You can also schedule imports by sending CSV or Excel files via Email, Zapier, or FTP.