An Overview of PayTraQer Settings for Authorize.Net

January 1, 2025

Overview of PayTraQer Settings for Authorize.Net

Each section shows what the setting controls, a safe default, when to change it, and a quick check.

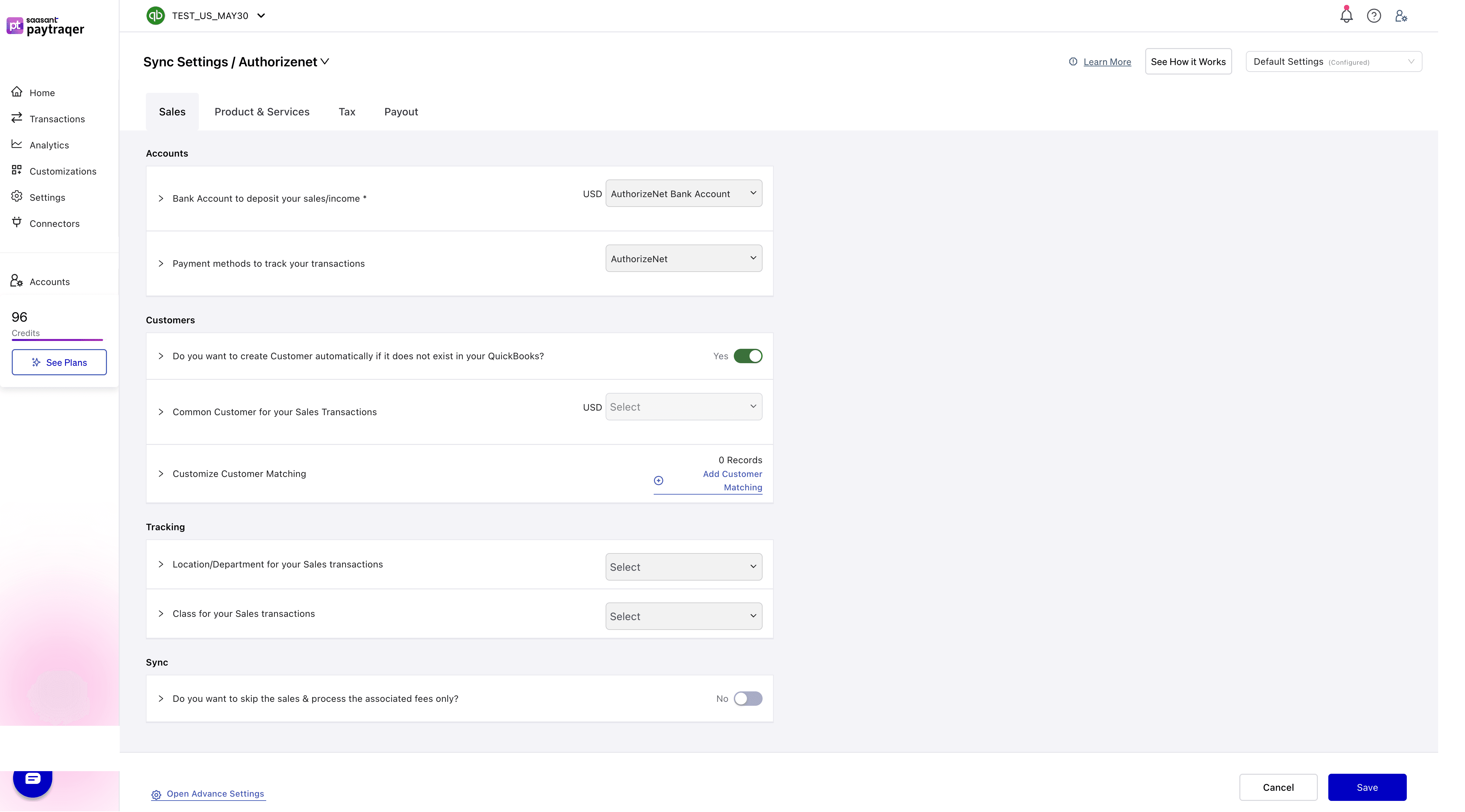

Sales settings

Accounts

Bank Account to deposit your sales/income

Default: AuthorizeNet Bank Account per currency.

Change when: You keep separate clearing banks by currency or brand.

Check: Sales and refunds land in the same clearing bank.

Payment method

Payment methods to track your transactions

Default: AuthorizeNet.

Check: Payment Method shows AuthorizeNet on created sales.

Customers

Do you want to create Customer automatically if it does not exist

Default: Yes.

Check: No import errors for missing customers.

Common Customer for your Sales Transactions

Default: Off.

Use when: You run summaries or do not need per-customer detail.

Customize Customer Matching

Use when: Payer names differ from your QuickBooks customers.

Check: Repeat payers map to a single customer record.

Tracking

Location/Department and Class

Default: Not set.

Use when: You track by location or class.

Check: New sales carry the selected values.

Sync scope

Do you want to skip the sales & process the associated fees only

Default: No.

Use when: Sales are posted by another system and you only want fee expenses.

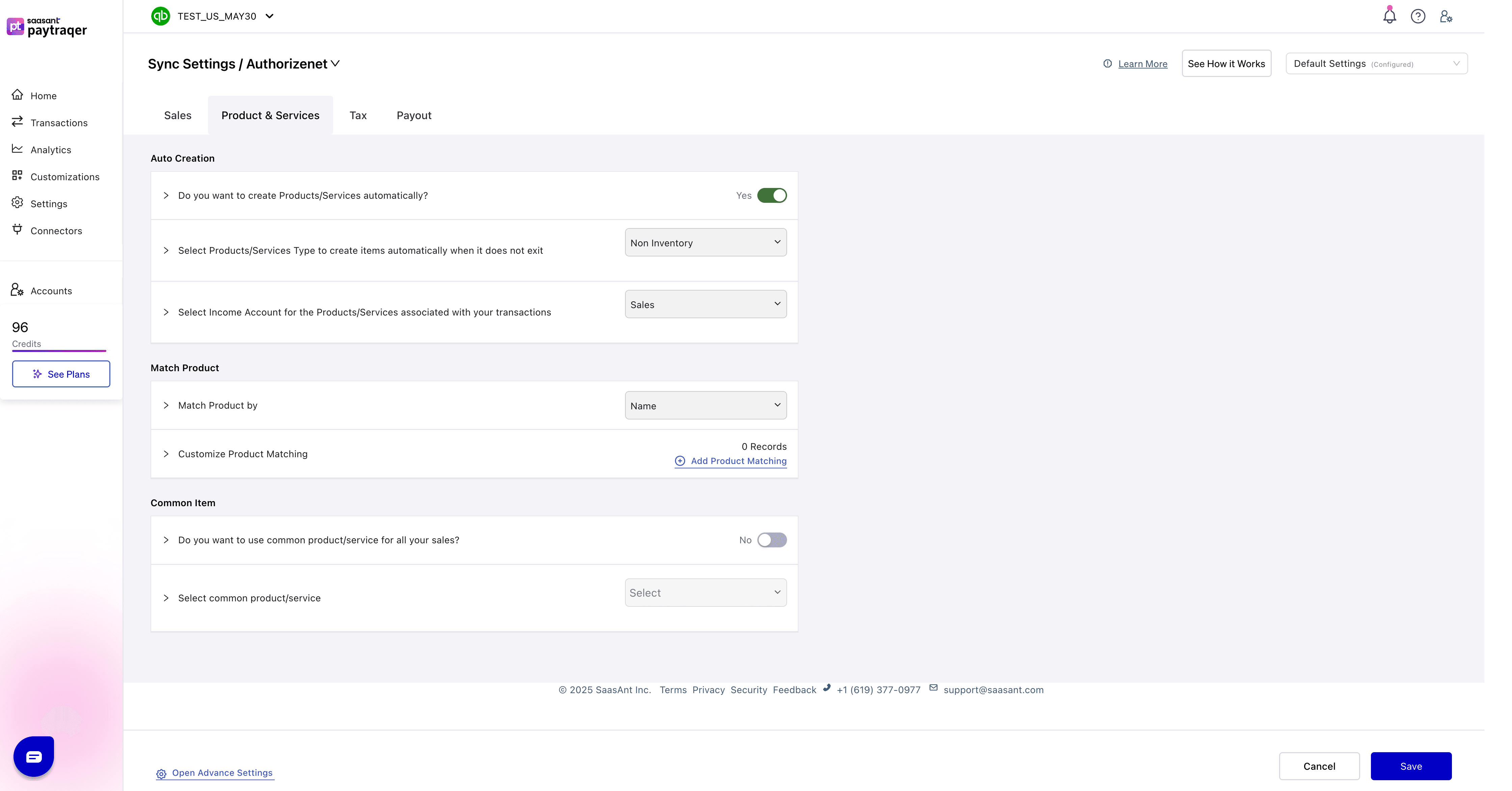

Products and services Settings

Auto Creation

Do you want to create Products/Services automatically

Default: Yes to avoid missing item errors.

Select Products/Services Type

Default: Non-Inventory or Service.

Select Income Account

Default: Sales.

Check: New items point to the chosen income account.

Match Product

Match Product by

Default: Name. Use SKU if both catalogs use stable SKUs.

Customize Product Matching

Use when: Names differ between your source and QuickBooks.

Check: No duplicate items appear.

Common Item

Do you want to use common product/service for all your sales

Default: No.

Use when: You post summaries or do not need item detail.

Then: Select common product/service to pick the default item.

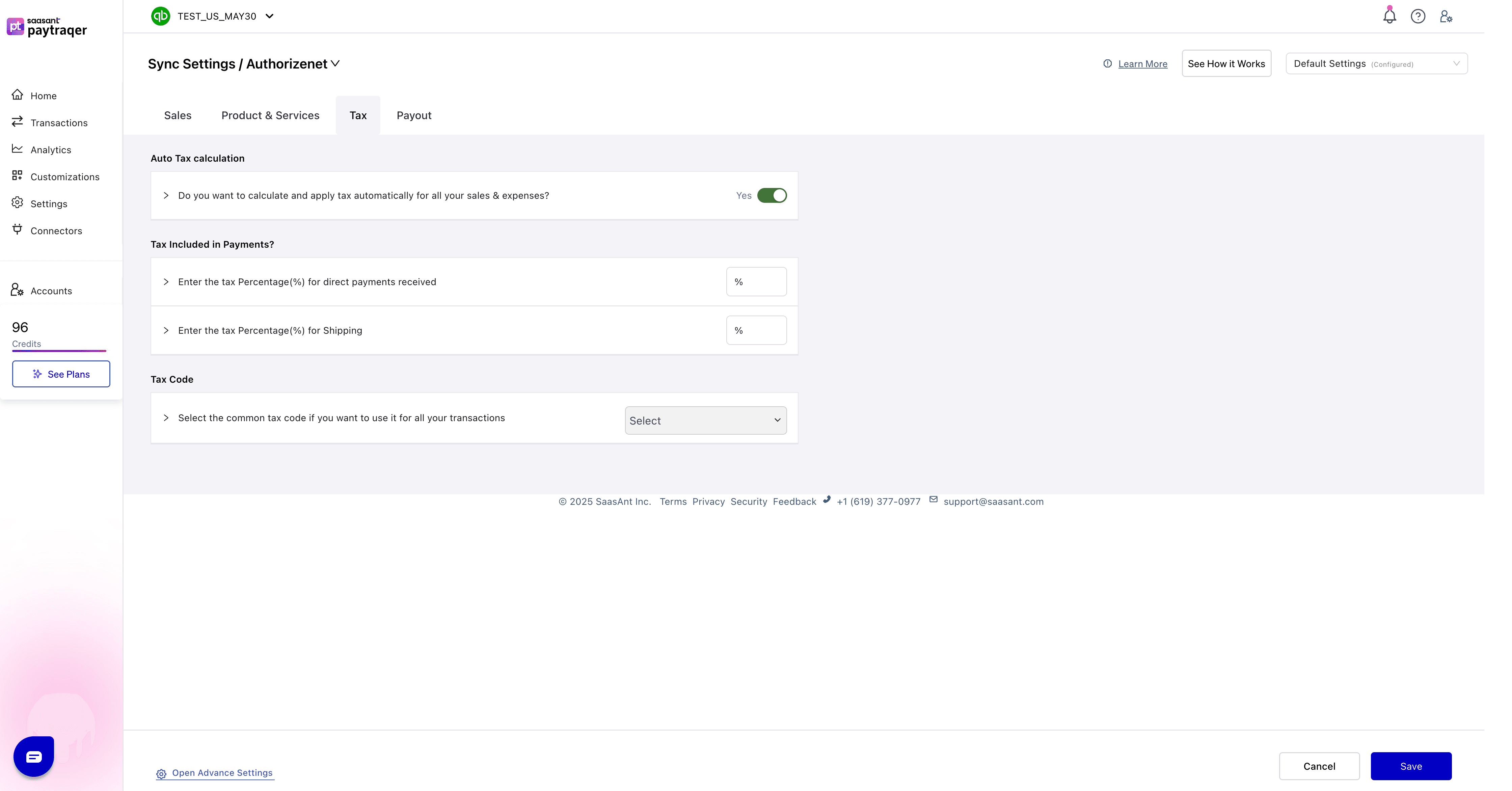

Tax settings

Auto Tax calculation

Default: Yes to detect and apply tax on synced sales and expenses.

Tax included settings

Tax Included in Payments

Enter the Tax Percentage (%) for direct payments if tax is included.

Shipping tax percentage

Enter the Tax Percentage (%) for shipping amounts if shipping is taxable.

Default Tax Code

Tax Code

Choose a common tax code to apply to all transactions.

This overrides automatic detection.

Check: Open a synced sale and confirm the tax code and amount.

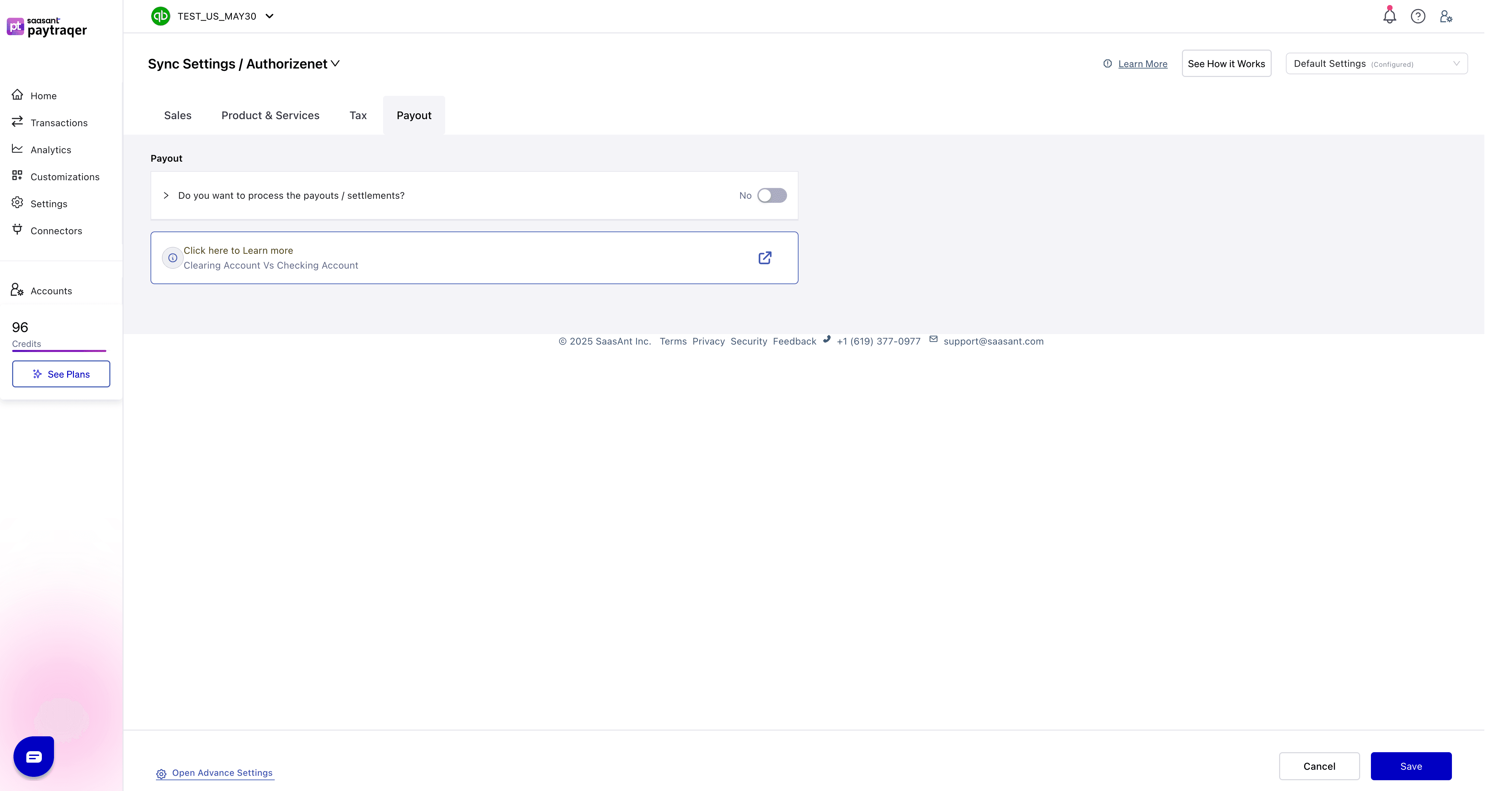

Payouts and settlements

Do you want to process the payouts/settlements

Default: No. Turn On to create Bank Transfer transactions from the AuthorizeNet clearing bank to your real checking account.

Check: Transfers match deposits in your bank feed when enabled.

Clearing account vs checking account

The clearing account holds Authorize.Net sales inside QuickBooks.

The checking account is your real bank that receives the deposit.

When payouts are on, transfers move money from clearing to checking so the clearing account nets to zero.