How to Undo/Rollback Synced Transactions in PayTraQer?

October 28, 2025

SaasAnt PayTraQer - #1 user rated and Intuit trusted automation tool built exclusively for QuickBooks Online to synchronize payments processor data with QuickBooks Online. With PayTraQer, reconciling payment processor transactions into QuickBooks online is just a click away. PayTraQer synchronizes payment processor's Customers, Sales, Expenses, Payouts, Fees, Taxes, etc.. with your QuickBooks Online, keeping your books accurate and precise without the hassles of manual data entry.

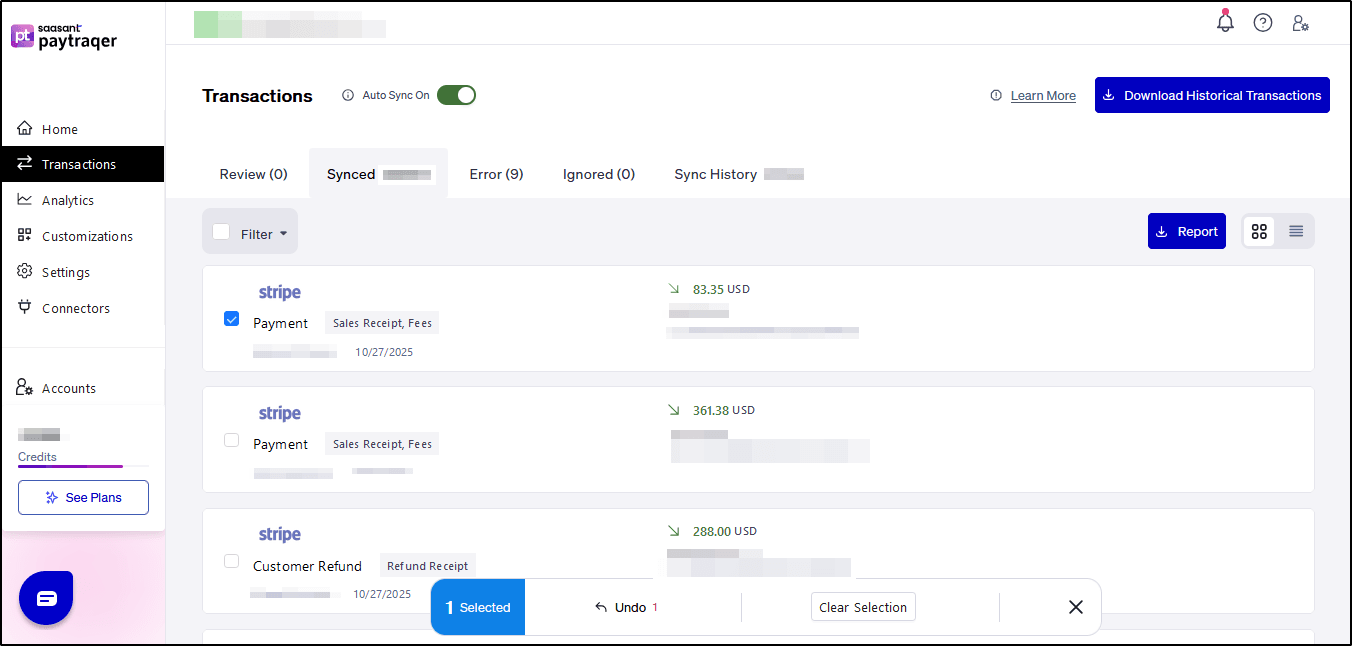

This article explains how to undo or Rollback your synced transactions from QuickBooks Online. You have absolute control over your synced data and can be rolled back(removed) from QuickBooks Online in case of any issues. You can do this from the Synced/ Error tab in the PayTraQer Transactions dashboard. All your synced data from your historic transactions will be available for you and can audit or rolled back at any time.

To undo the synced transactions, Select the records to be rolled back and click the "Undo Selected" button. This will open up a confirmation form asking to click either "Undo Transactions" or "Undo All".

Undo Synced Transactions in QuickBooks Online

Clicking "Undo Transactions" will rollback only the newly created transactions in QuickBooks Online leaving the associated list entities (created new, if any) like Customer, Item, etc..

Undo All Transactions in QuickBooks Online

Clicking "Undo All" will rollback the entire transactions along with the associated list entities (created new, if any)

Note: This will rollback your QuickBooks Online to a state as it was earlier before the sync.

This feature makes sure that sync data can be wiped off cleanly so that you can have absolute control over your books.