PayTraQer - Payout Settings Configuration for QuickBooks Online

November 17, 2025

PayTraQer - Payout Settings

Use Payout settings to control how PayTraQer moves money from your payment system clearing accounts to your real bank accounts in QuickBooks.

This matters a lot for bookkeepers and accounting professionals because it is the step that makes:

The deposit in your bank feed matches the sales and fees posted by PayTraQer

If payouts are configured correctly, your reconciliation is simple.

If they are not, clearing accounts do not zero out and deposits are hard to match.

1. What payouts do in PayTraQer

For each connector (PayPal, Stripe, Square, Braintree, Shopify, WooCommerce, etc.), PayTraQer usually works like this:

Sales are posted to a clearing bank account for that connector.

Fees and some expenses are also posted to the same clearing account.

The payment system (for example PayPal) sends a payout or settlement to your real bank account.

PayTraQer reads that payout and, if enabled, creates a Transfer in QuickBooks:

Credit: connector clearing account

Debit: real bank account (settlement account)

The payout amount equals the net that hit your bank:

Sales

minus refunds

minus fees

equals payout (deposit)

That Transfer is what you will match to the deposit in your bank feed.

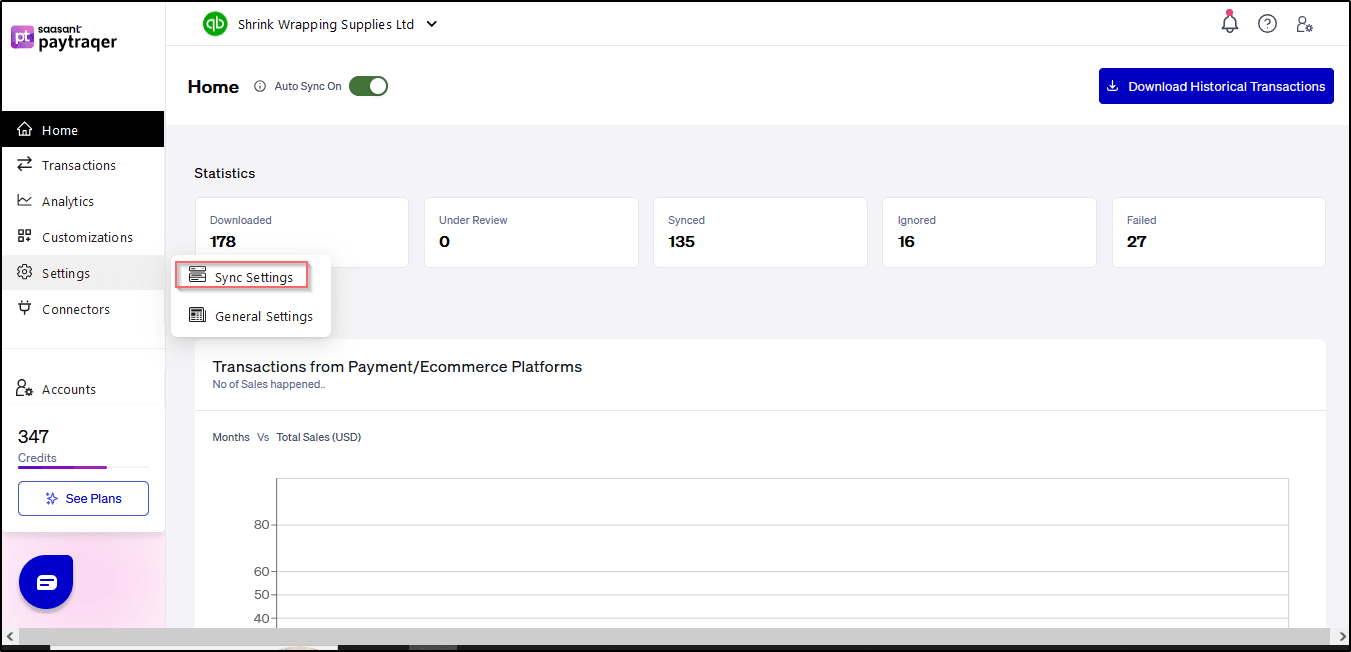

2. How to open Payout settings

2. How to open Payout settings

Sign in to PayTraQer.

Click the Settings icon (top right).

Go to Sync settings.

Select your connector (for example, PayPal, Stripe, Shopify).

Open the Payout tab.

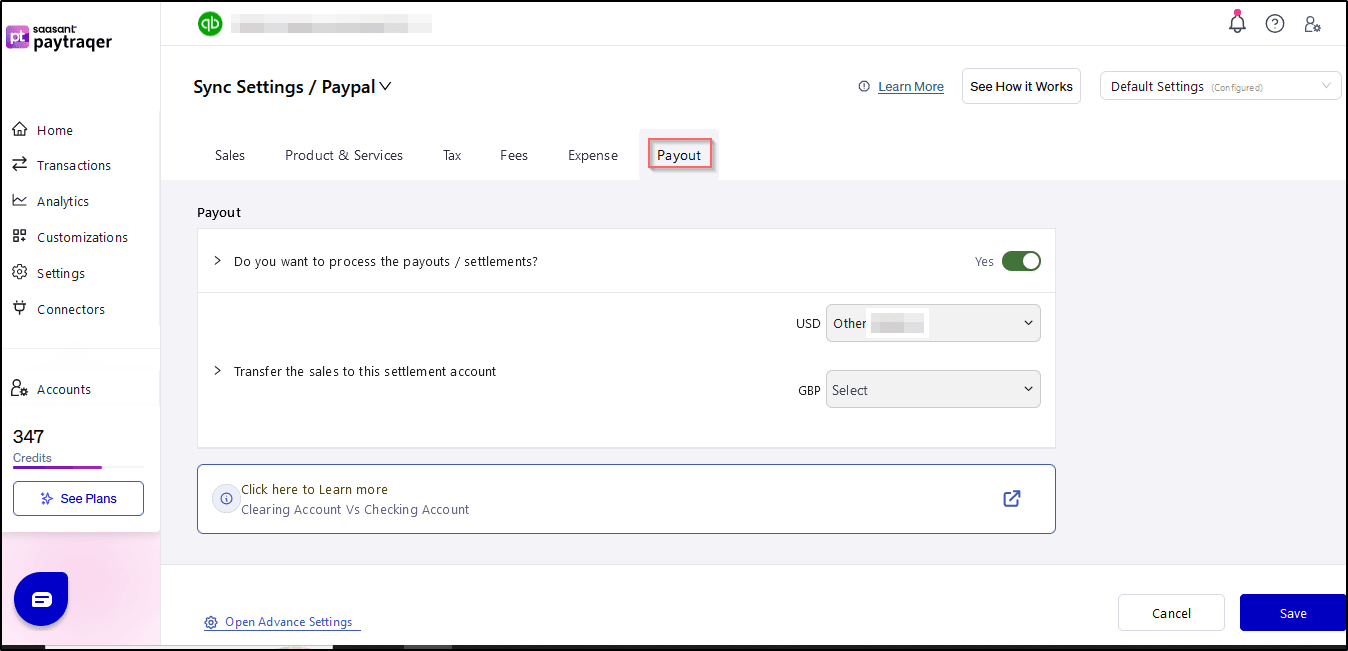

You will see fields similar to:

Do you want to process the payouts / settlements?

Transfer the sales to this settlement account (USD, AUD, etc.)

3. Payout settings fields

3.1 Do you want to process the payouts / settlements?

This switch turns payout entries on or off.

Yes

PayTraQer reads payout or settlement data from the connector.

For each payout, it creates a Transfer from the connector’s clearing account to your selected settlement bank account in QuickBooks.

No

PayTraQer does not create payout entries.

Sales and fees still post to the clearing account.

You must create deposits or transfers manually to move money to your bank account.

Recommended:

Set this to Yes for almost all normal setups.

Without automatic payouts, your clearing accounts will not settle properly and reconciliation will be more manual.

3.2 Transfer the sales to this settlement account

Example label:

Transfer the sales to this settlement account

USD

[Select]

This is the real bank account in QuickBooks where your payout deposits arrive.

Choose the checking, savings, or trust account that matches your bank feed.

For example:

Checking

Main Operating Account

When a payout is processed:

PayTraQer decreases the connector clearing account.

PayTraQer increases this settlement bank account by the net payout amount.

Later, in QuickBooks bank feeds, you match the bank’s deposit to this Transfer entry.

4. What actually posts in QuickBooks

Here is the full flow with a simple example.

Assume for a day:

Sales via Stripe: 10,000

Fees: 300

Net payout from Stripe to bank: 9,700

Step 1 – Sales and fees (from Sales and Fees settings)

Sales are posted to Stripe Bank Account (clearing account).

Fees are posted as Expenses to a fee expense account, with bank side in Stripe Bank Account.

Result in the clearing account:

Stripe Bank Account balance: 9,700 (10,000 sales − 300 fees)

Step 2 – Payout (from Payout settings)

If payouts are enabled and your settlement account is set to “Checking”:

PayTraQer creates a Transfer:

From: Stripe Bank Account

To: Checking

Amount: 9,700

Result:

Stripe Bank Account balance returns to 0 (for that period).

Checking shows a 9,700 increase, which matches your bank feed deposit.

For bookkeepers this means:

Clearing accounts are only temporary holding accounts.

Real bank accounts hold actual cash with deposits matching the statement.

Reconciliation is a straight match between bank feed deposit and PayTraQer Transfer.

5. Multi currency payouts

If you accept payments in more than one currency, PayTraQer can handle that too.

You will see a line for each supported currency under Payout, for example:

Transfer the sales to this settlement account – USD

Transfer the sales to this settlement account – AUD

Transfer the sales to this settlement account – EUR

For each currency:

Create or choose a bank account in QuickBooks for that currency.

For example:

“Stripe Bank USD”

“Stripe Bank AUD”

“Checking EUR”

In Payout settings, select the matching settlement account for each currency line.

As the number of currencies increases, you must:

Enable Multi currency in QuickBooks.

Add separate bank accounts in QuickBooks for each currency.

Map each currency in PayTraQer Payout settings to the correct bank account.

Related Articles - PayTraQer Settings:

Sales Settings: Configure Sales related fields like a bank account, customer, etc.

Products Settings: Create/sync the products/services automatically without any manual effort in QuickBooks Online.

Tax Settings: Record tax information from Payment transactions (Paypal, Stripe & Square) accurately into QuickBooks Online.

Fees Settings: Record fee information from Payment transactions into QuickBooks Online.

Expense Settings: Payments made to your vendors from Payment Systems can be easily synced with QuickBooks Online.

Automation Settings: Automate and fine-tune the sync processes in PayTraQer.