How to Integrate Square with QuickBooks Online using PayTraQer?

November 11, 2025

Connect Square to QuickBooks Online with SaasAnt PayTraQer

Use this guide to install PayTraQer, connect Square, choose how data posts, set your sync rules, pull history, and turn on auto sync.

What you need

Access to install apps in your QuickBooks Online company

A Square account you can authorize

If you are not the admin, be ready to use the Invite admin/client linkSteps for Integrating QuickBooks Online and Square

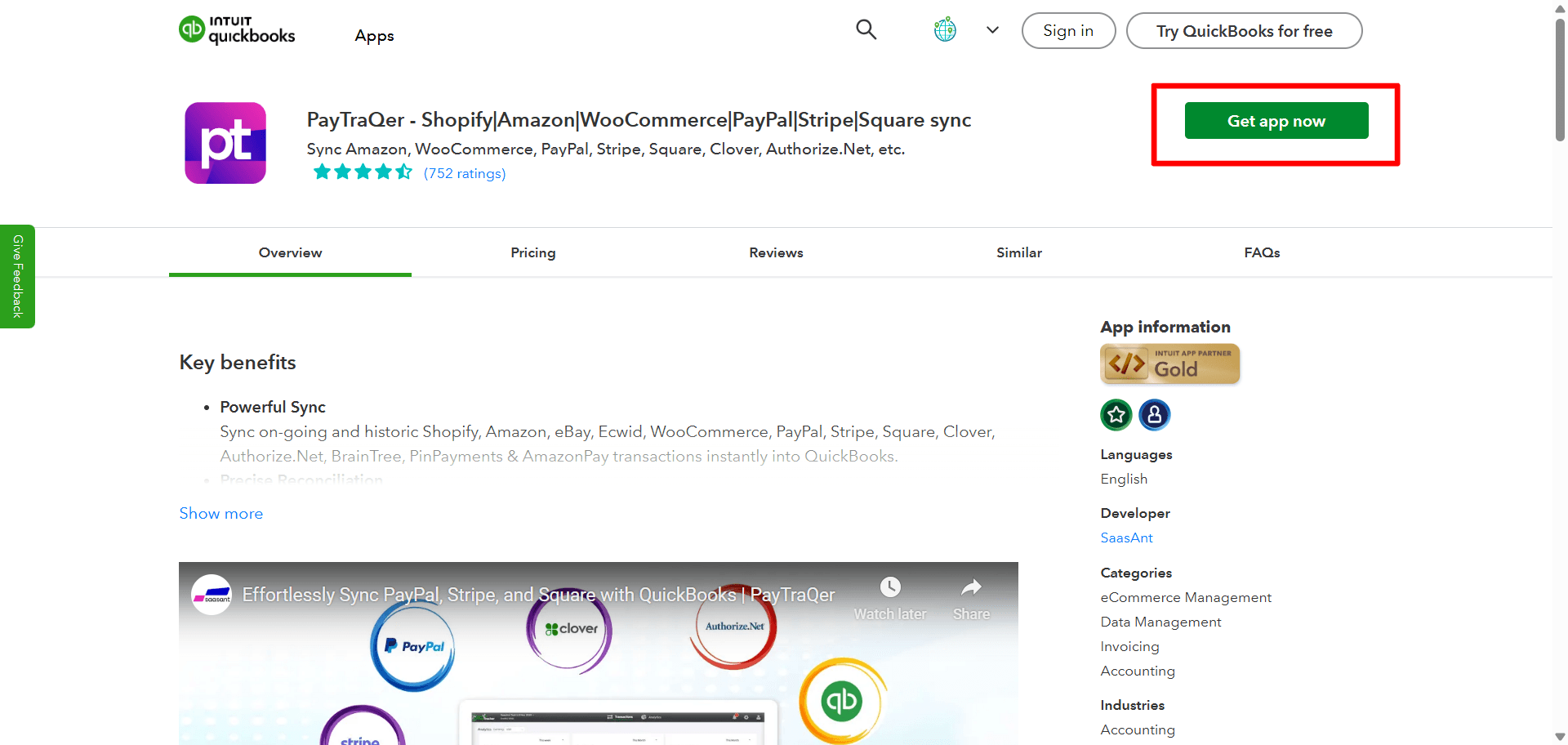

1) Install PayTraQer from QuickBooks

In QuickBooks Online, open Apps.

Search PayTraQer.

Select SaasAnt PayTraQer and click Get app now.

Complete the on-screen steps and Authorize access to your QuickBooks company.

2) Pick your Sync Mode

Right after connecting to QuickBooks, PayTraQer asks how to post your Square data.

Consolidated Sync (Sales Summary): fewer entries and faster reconciliation

Itemized Sync (Individual): customer and item detail in QuickBooks

Choose one and click Get Started. You can change this later in settings.

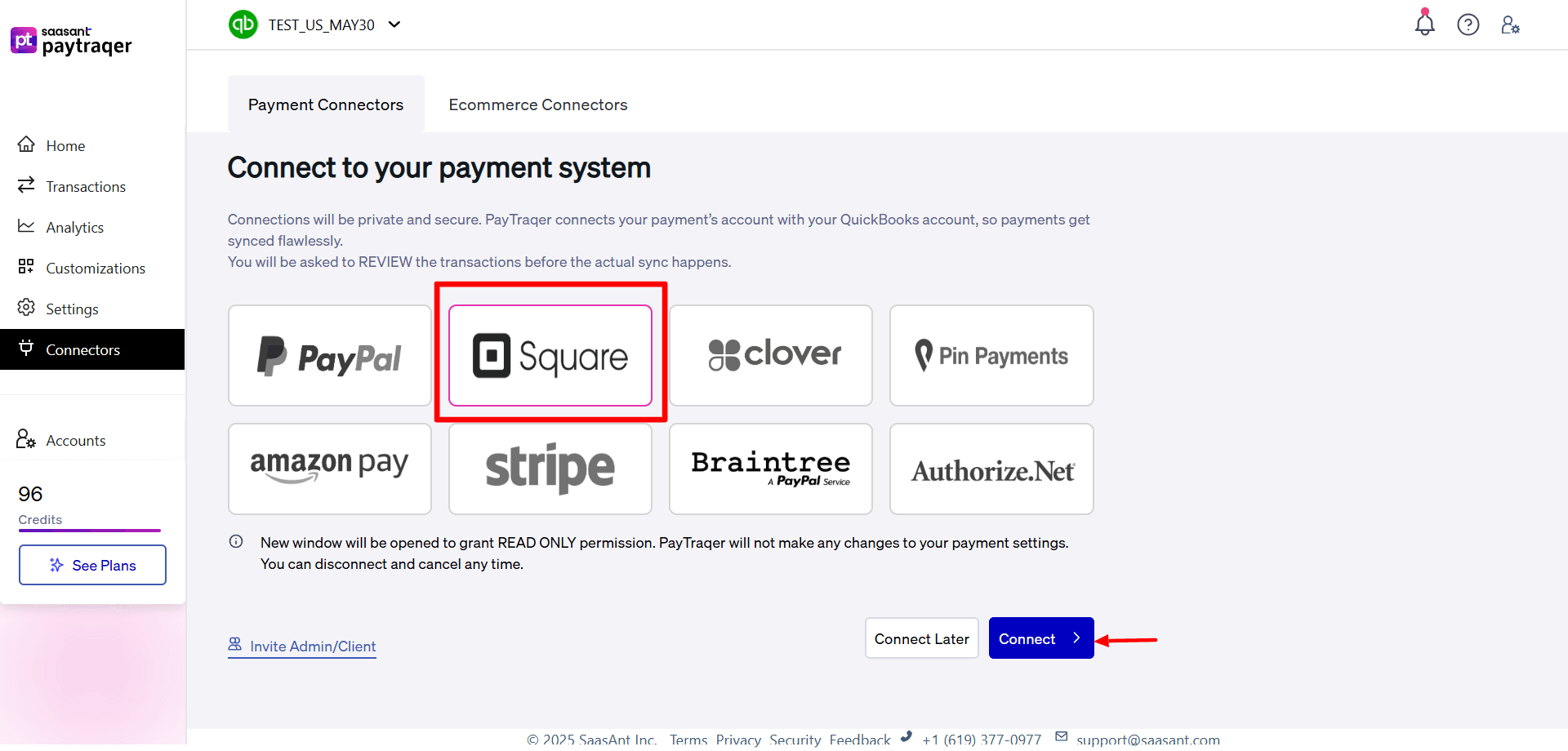

3) Connect Square in PayTraQer

In PayTraQer, go to Connectors.

Open Payment connectors.

Select Square and click Connect.

Sign in to Square and approve access. If asked, pick the Square location.

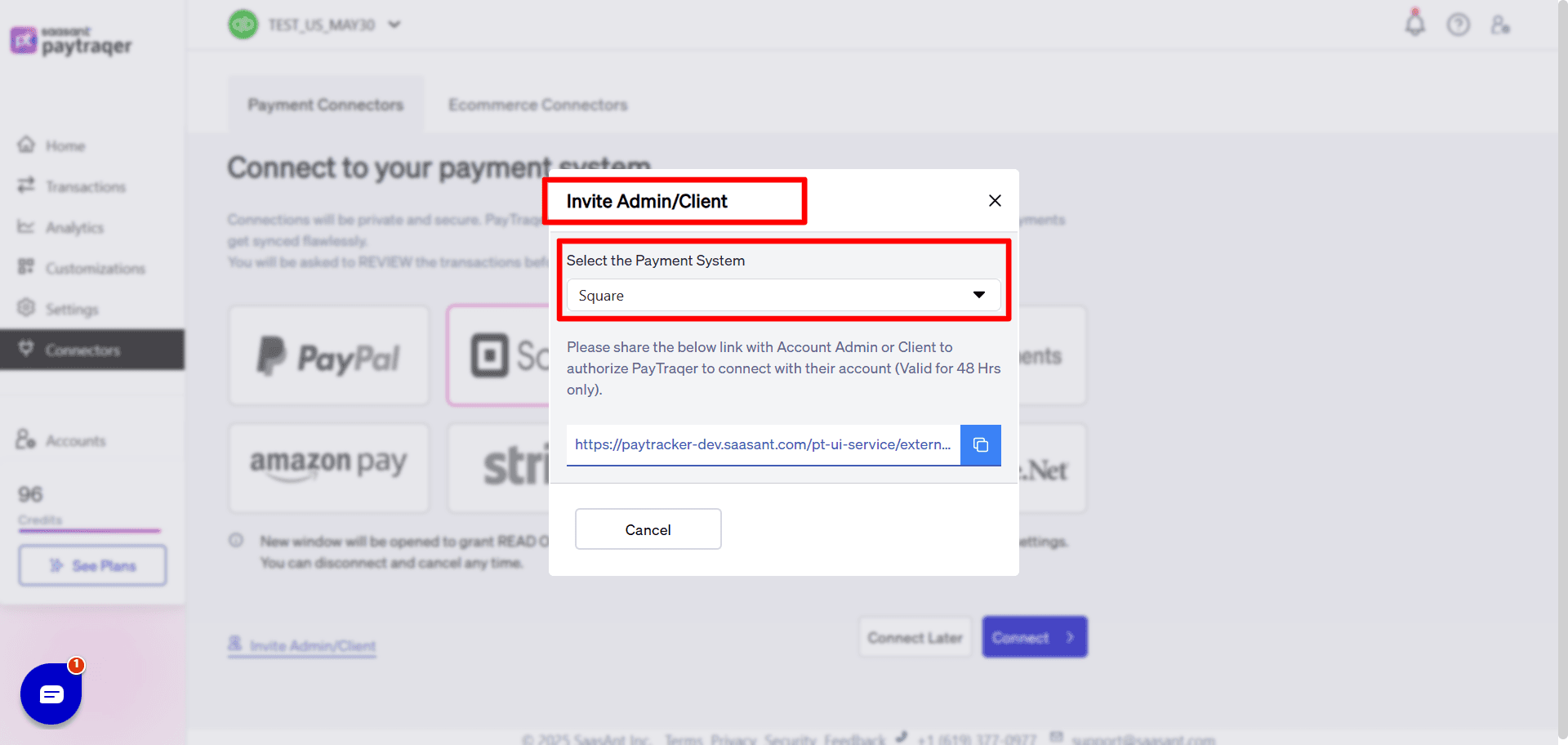

If you are not the admin, use Invite admin/client to send the auth link.

What permissions are used

From Square: read-only access to sales, fees, refunds, payouts, customers, and items

In QuickBooks Online: with your approval, PayTraQer creates and updates the records needed to stay in sync

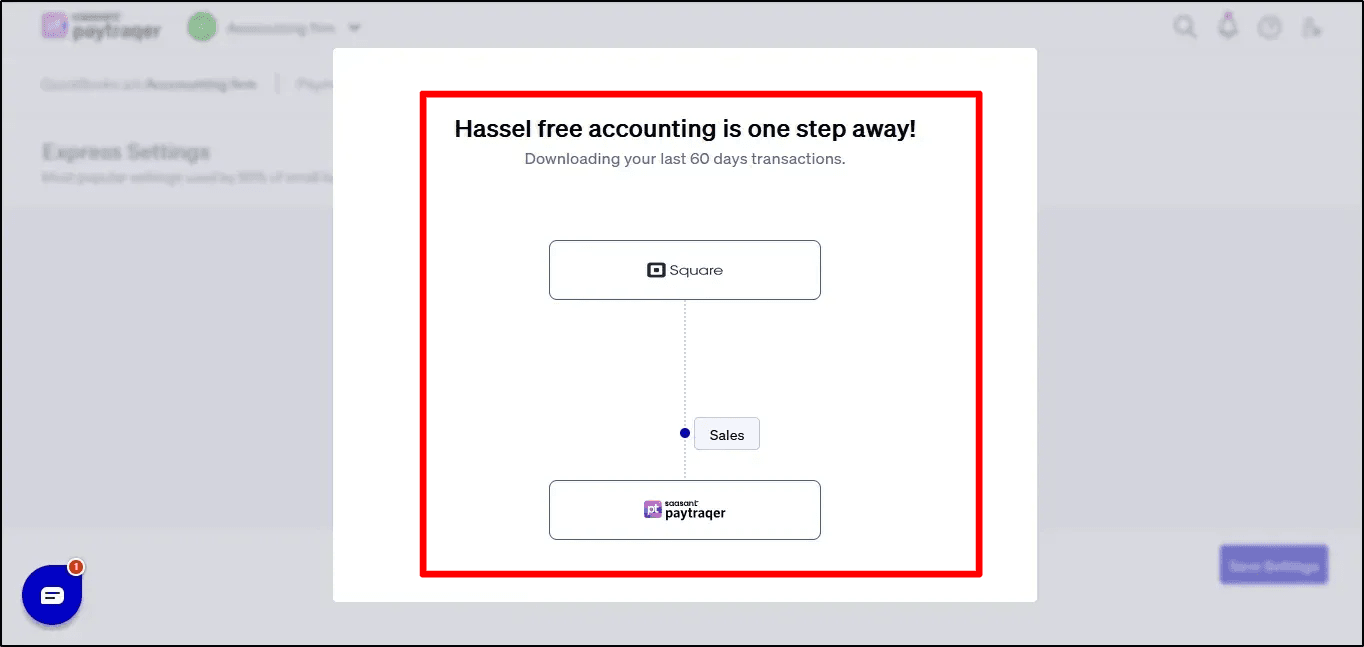

4) First-time settings after Square approval

You are redirected back to PayTraQer to set initial options.

Fees account

Choose the QuickBooks account to record Square fees

Process payments and settlements

Toggle Do you want to process the payment/settlements

When On, select a Bank account that will act as your clearing account

Click Save

Auto download

After you save, PayTraQer automatically downloads the last 60 days of Square data

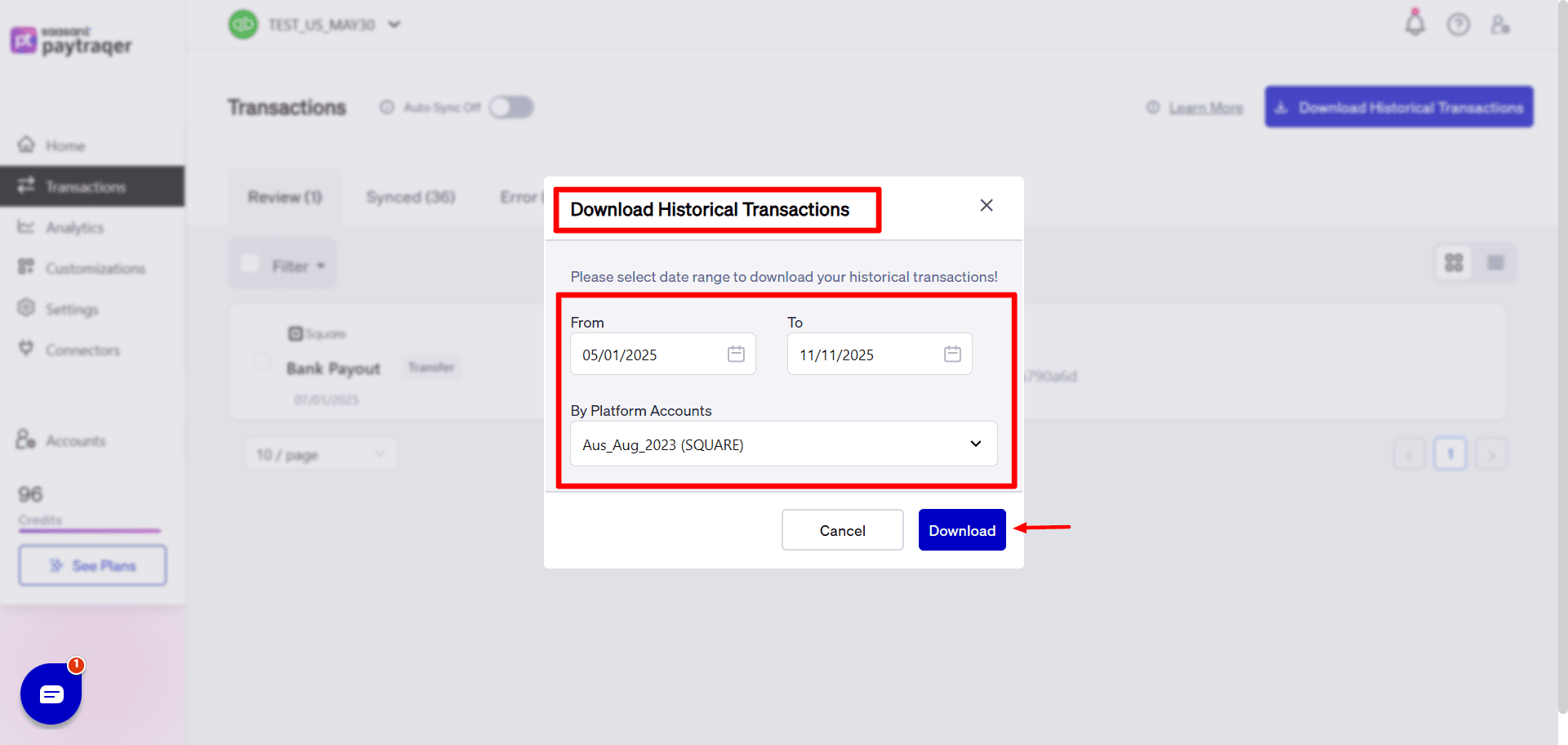

More history

Use Download historical transactions to pull other date ranges with From and To filters.

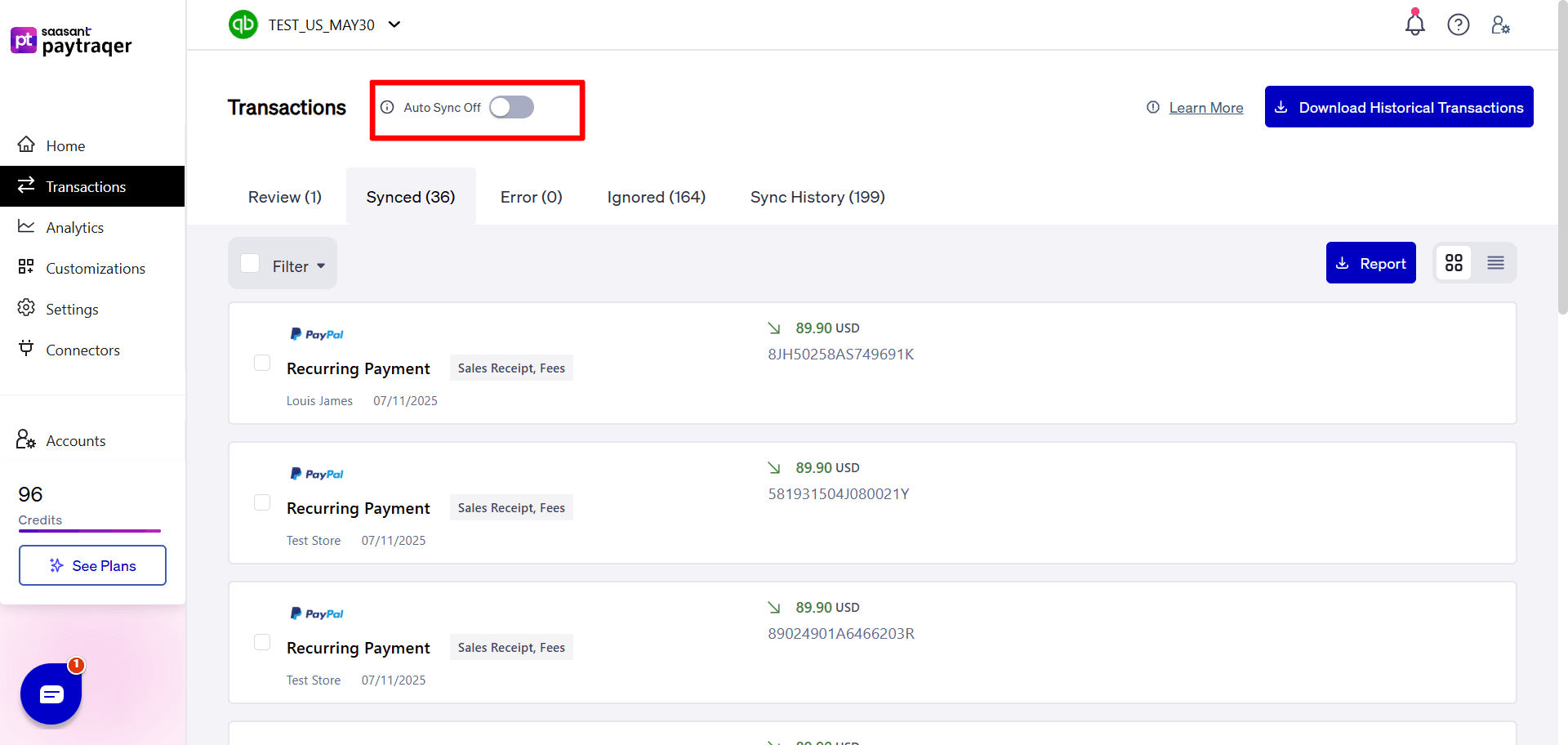

Quick note on Auto Sync

When Auto Sync is on, PayTraQer downloads and syncs new Square transactions to QuickBooks at regular intervals.

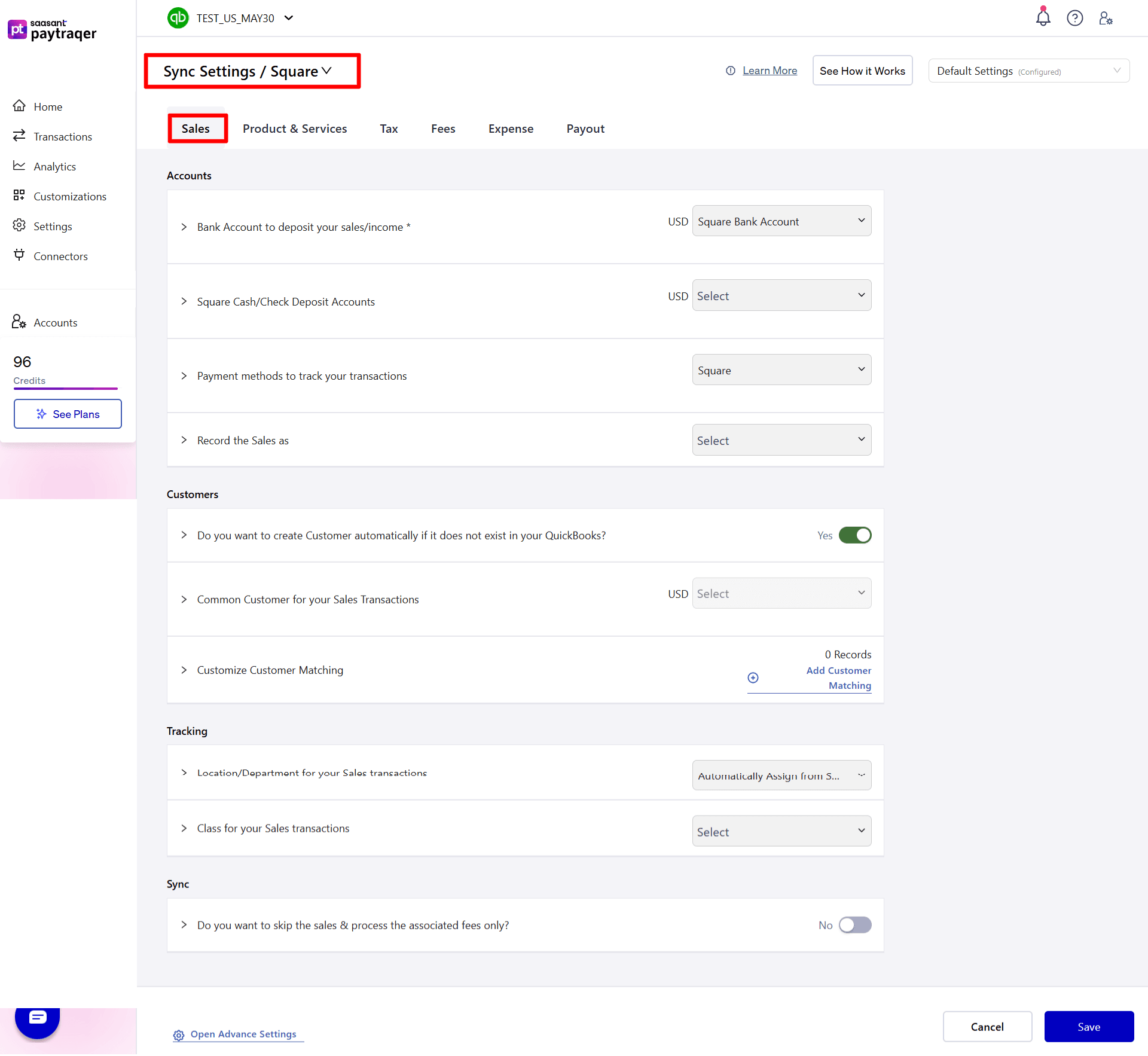

5) Sales sync settings

Bank accounts

Bank Account to deposit your sales/income

Select the clearing Bank account where synced sales will be recorded

If you use multi-currency, set a clearing account per currencySquare Cash/Check Deposit Accounts

Pick the bank account for Square cash or check payments

Payment methods

Payment methods to track your transactions

Choose the payment methods to set on created sales, for example Square, Cash, Card, PayPal, Stripe

How to record sales

Record the Sales as

Choose the QuickBooks sales form that fits your flow

Sales Receipts are common for POS sales. Invoices fit bill-then-pay flows

Customers

Create Customer automatically if it does not exist

Turn on to auto-create customers when no match is found by nameCommon Customer for your Sales Transactions

Use one default customer for all sales if you do not want separate customersCustomize Customer Matching

Add mapping rules from Square names to your preferred QuickBooks customer names

Tracking

Location/Department for your Sales transactions

Automatically assign from Square or pick a fixed valueClass for your Sales transactions

Set a class for all synced sales

Sync scope

Do you want to skip the sales and process the associated fees only

Turn on to post only fee expenses and skip sales details

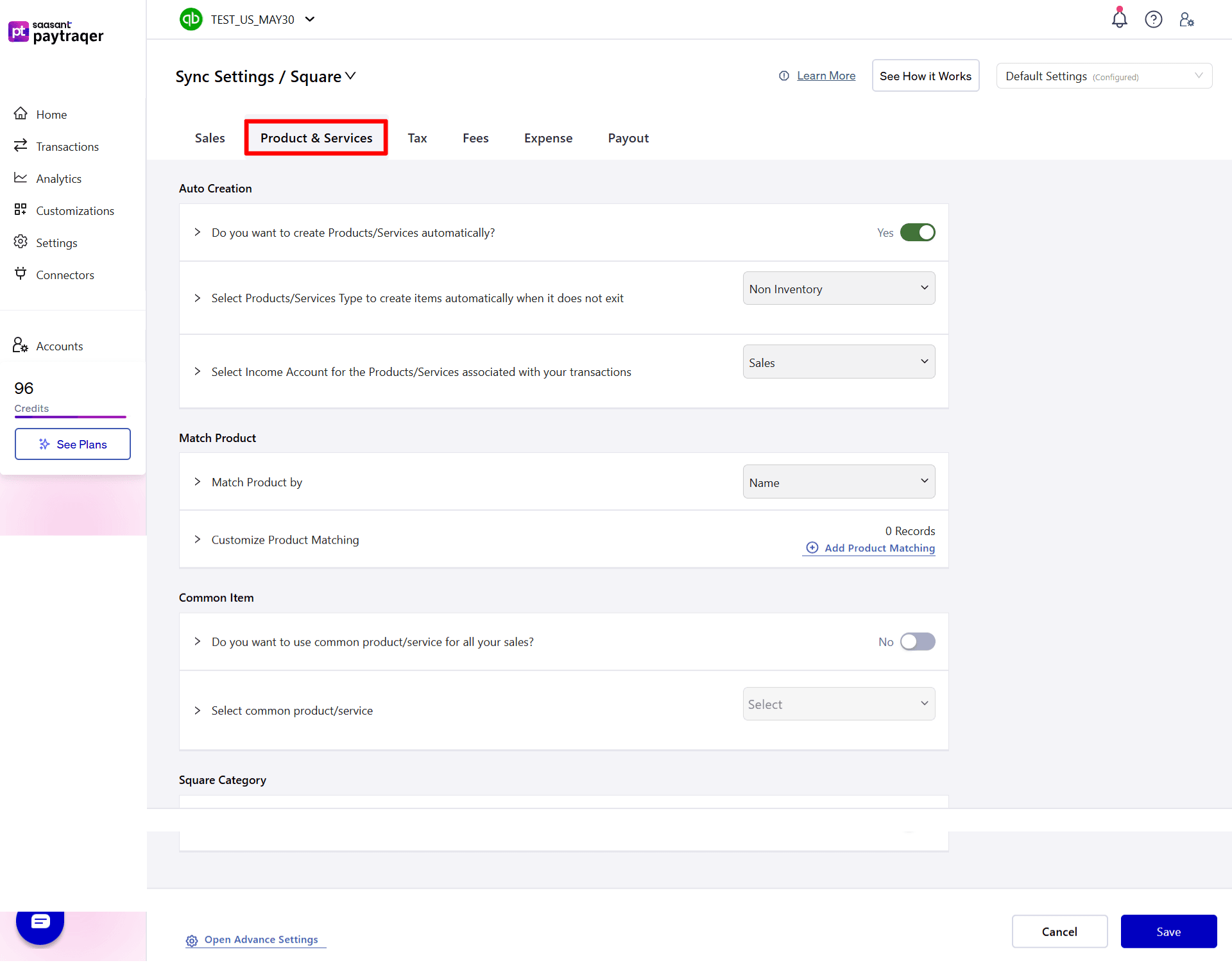

6) Products and services settings

Auto-creation

Do you want to create Products/Services automatically

Turn on to auto-create an item in QuickBooks when no exact match is foundSelect Products/Services Type

Choose Non-Inventory or Service for auto-created itemsSelect Income Account

Choose the income account to link to auto-created items

Matching

Match Product by

Pick Name or SKU

Use SKU if you keep stable SKUs in both Square and QuickBooksCustomize Product Matching

Map a Square name or SKU to a specific QuickBooks product or service

Common item

Use common product/service for all your sales

Turn on to use one default item on every synced sale, then pick the item

Square Category as line item

Use Square Category as Line Item in Sales

Turn on to post each sale line using the Square Category instead of actual products

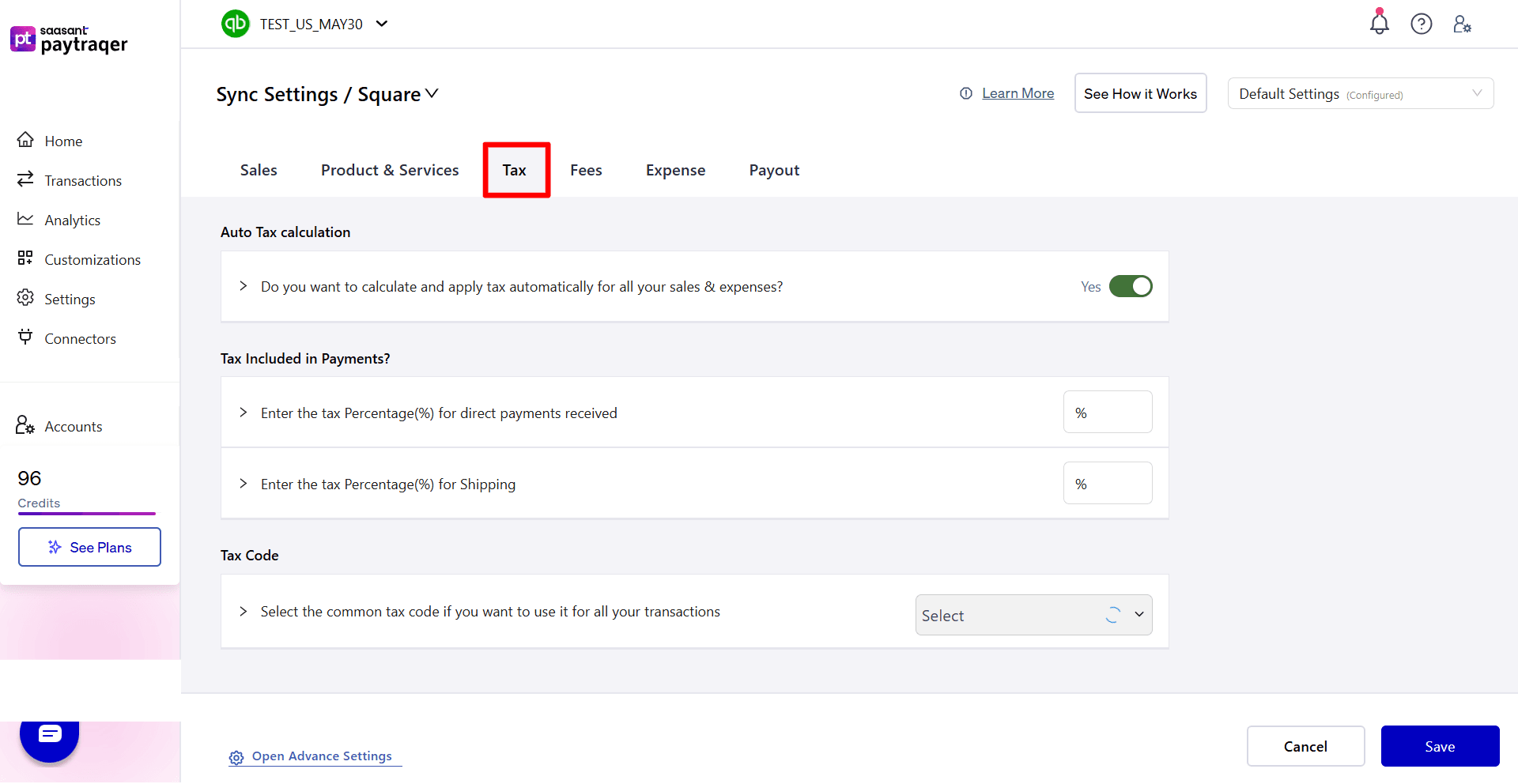

7) Tax settings

Calculate and apply tax automatically

Turn on to let PayTraQer detect and apply tax on synced sales and expensesTax included in payments

Enter the Tax Percentage for direct payments if tax is includedShipping tax percentage

Enter the tax percentage to apply on shipping amountsTax Code

Choose a default tax code for all transactions if you want a fixed code

Setting this overrides automatic tax detection

Tip: Run a short test and open a few sales in QuickBooks to confirm tax codes and amounts.

8) Fees settings

Vendor who receives the payment fees

Choose the vendor that represents SquareFee category

Pick the expense account, for example Square FeesBank Account to record Payment Fees

Choose the bank or clearing account where fee entries will postClass for your Fees

Set a class for all fee expensesLocation/Department for your Fees

Set a location or department for fee expensesSkip fee details from syncing

Turn on to exclude fee lines when syncing sales

Tip: Use the same clearing account for sales and fees to keep reconciliation simple.

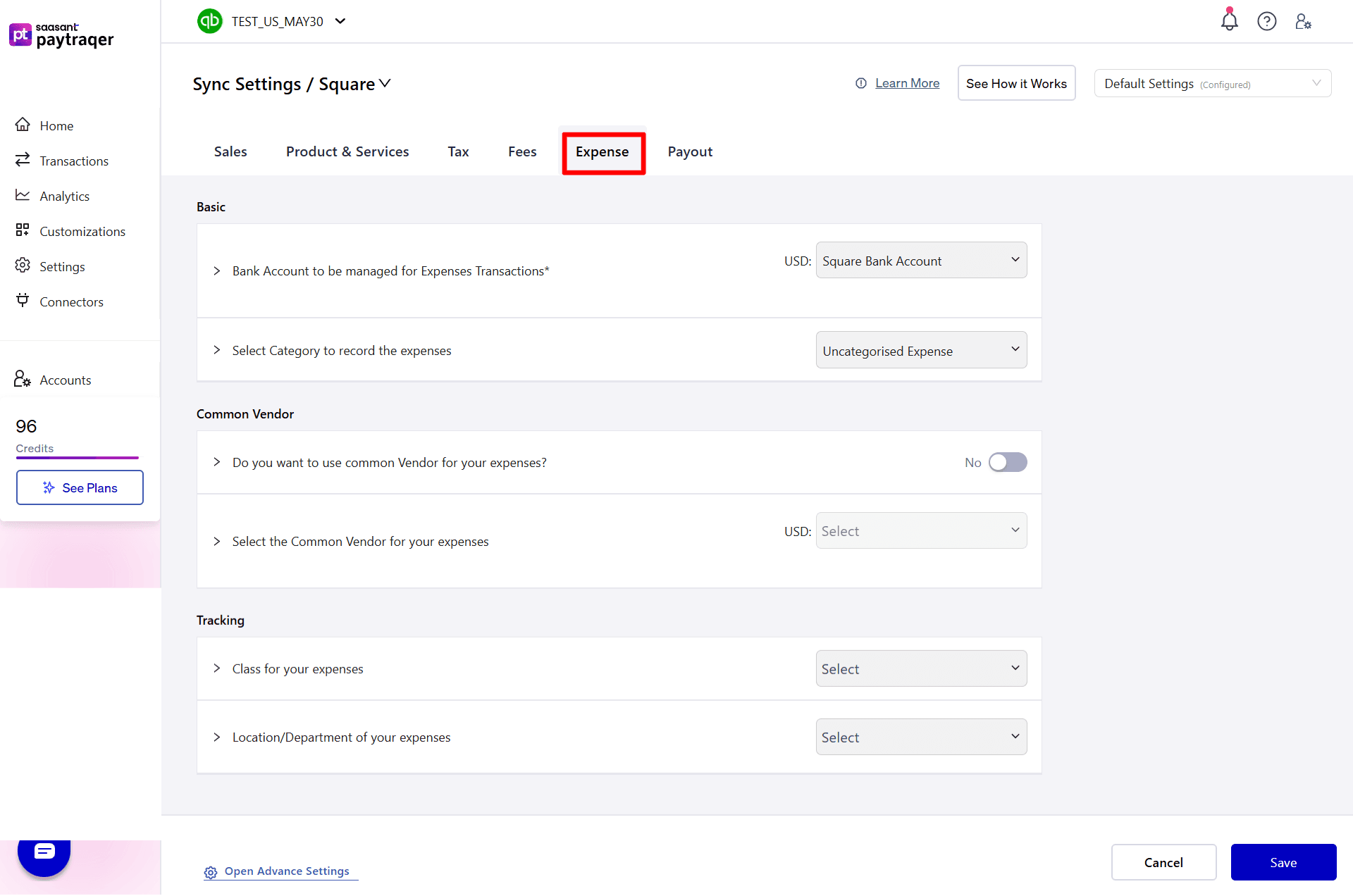

9) Expense settings

Bank Account to be managed for Expenses Transactions

Choose the bank or clearing account where expense transactions should postCategory to record the expenses

Pick the expense category, for example Uncategorised ExpenseUse common Vendor for your expenses

Turn on to apply one vendor to all expense entries, then select the vendorClass for your expenses

Set a class for all expensesLocation/Department of your expenses

Set a location or department for all expenses

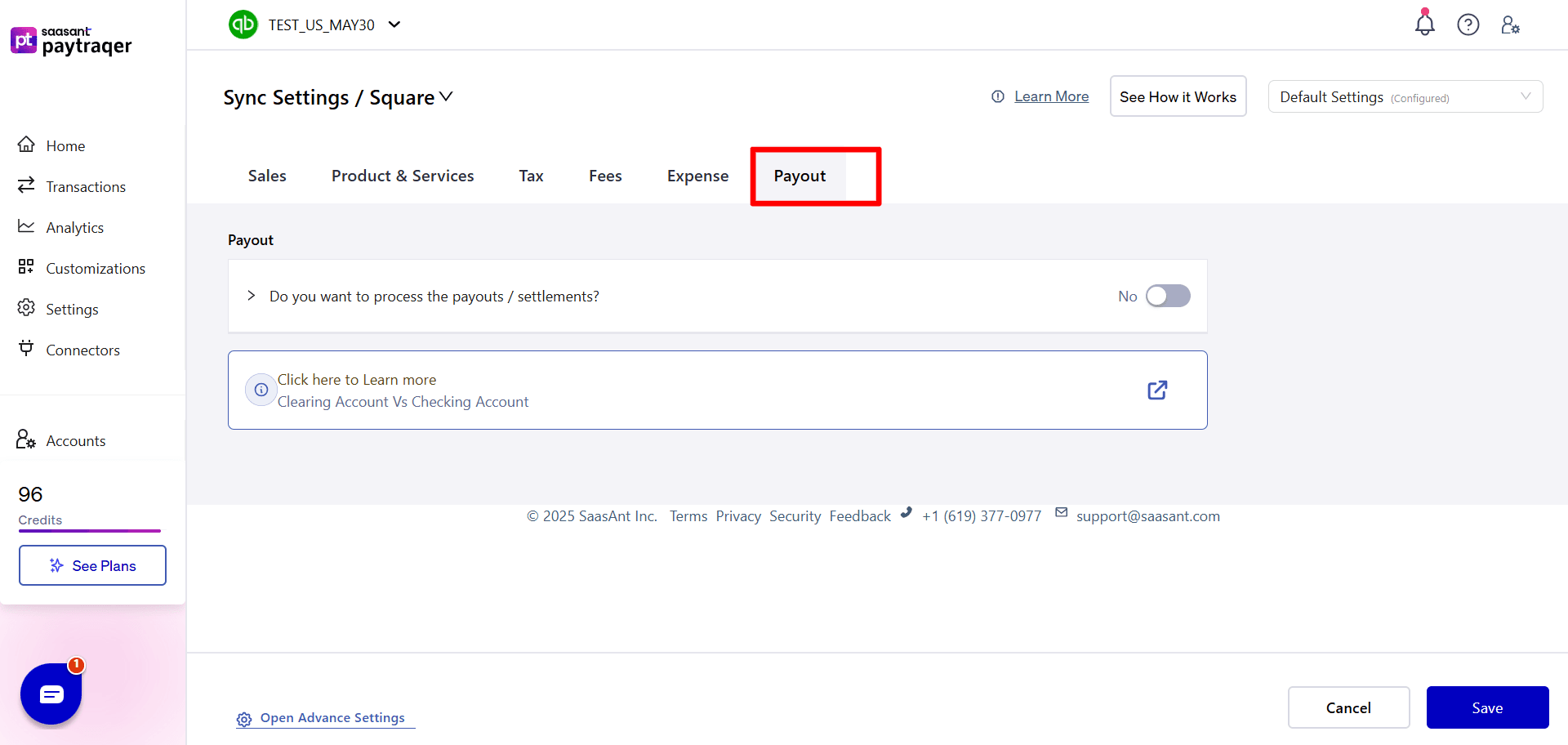

10) Payouts and settlements

Do you want to process the payouts/settlements

Turn on to sync Square payouts as Transfer transactions in QuickBooks

PayTraQer moves money from your Square clearing bank account to your checking account

This helps QuickBooks match the deposit in your bank feed

Setup

Toggle payouts On

Select the checking account that receives Square deposits

Save

Multi-currency

Set the receiving account for each currency if you use more than one

When to keep it off

Leave it off if you record bank deposits by hand and do not want PayTraQer to create transfers