How to Import Checks into QuickBooks Desktop?

August 25, 2025

Import Checks into QuickBooks Desktop

Import Checks from Supported File Formats directly into QuickBooks Desktop using SaasAnt Transactions (Desktop) - #1 user rated and Intuit trusted bulk data automation tool built exclusively for QuickBooks.

SaasAnt Transactions (Desktop) supports QuickBooks Pro, Premier, Enterprise, and Accountant Editions.

You can download the free trial of the software directly from the SaasAnt Website. Follow this article for detailed installation instruction.

How to Import Checks into QuickBooks Desktop Using SaasAnt Transactions

This guide provides a complete walkthrough for importing your check data into QuickBooks Desktop, from setting up the application to finalizing the import.

Step 1: Download, Install, and Connect SaasAnt

Before you can import, you need to set up the SaasAnt Transactions application.

Download: Go to the SaasAnt website and download the SaasAnt Transactions Desktop application.

Install: Run the installer and complete the installation on your computer.

Connect: Open the SaasAnt application and connect it to your QuickBooks Desktop company file by following the on-screen instructions. This authorizes SaasAnt to import data into your company file.

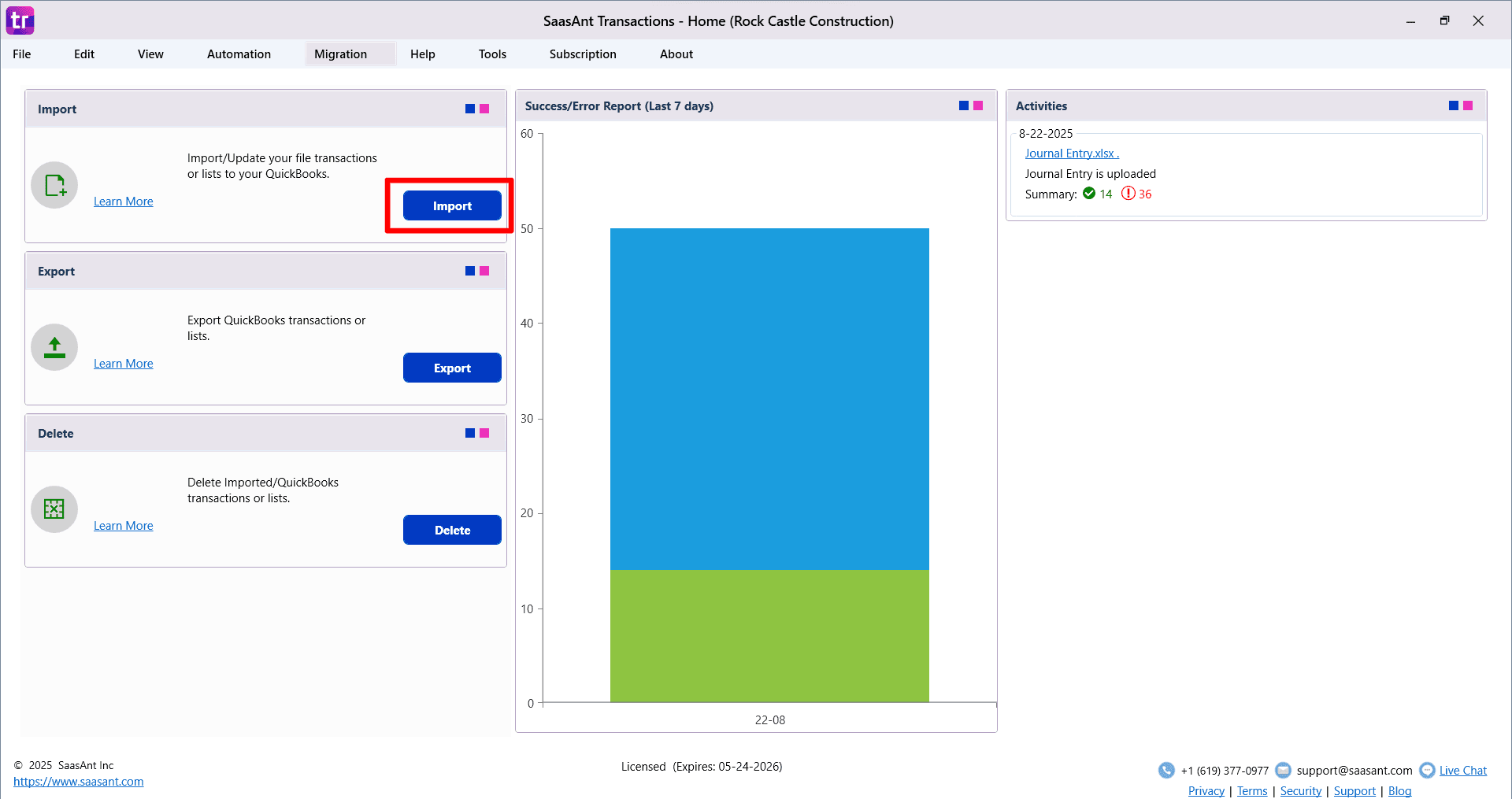

Step 2: Start the Import Process

From the SaasAnt home screen, you have two options to begin:

Click the Import button.

Go to the File menu and select Import.

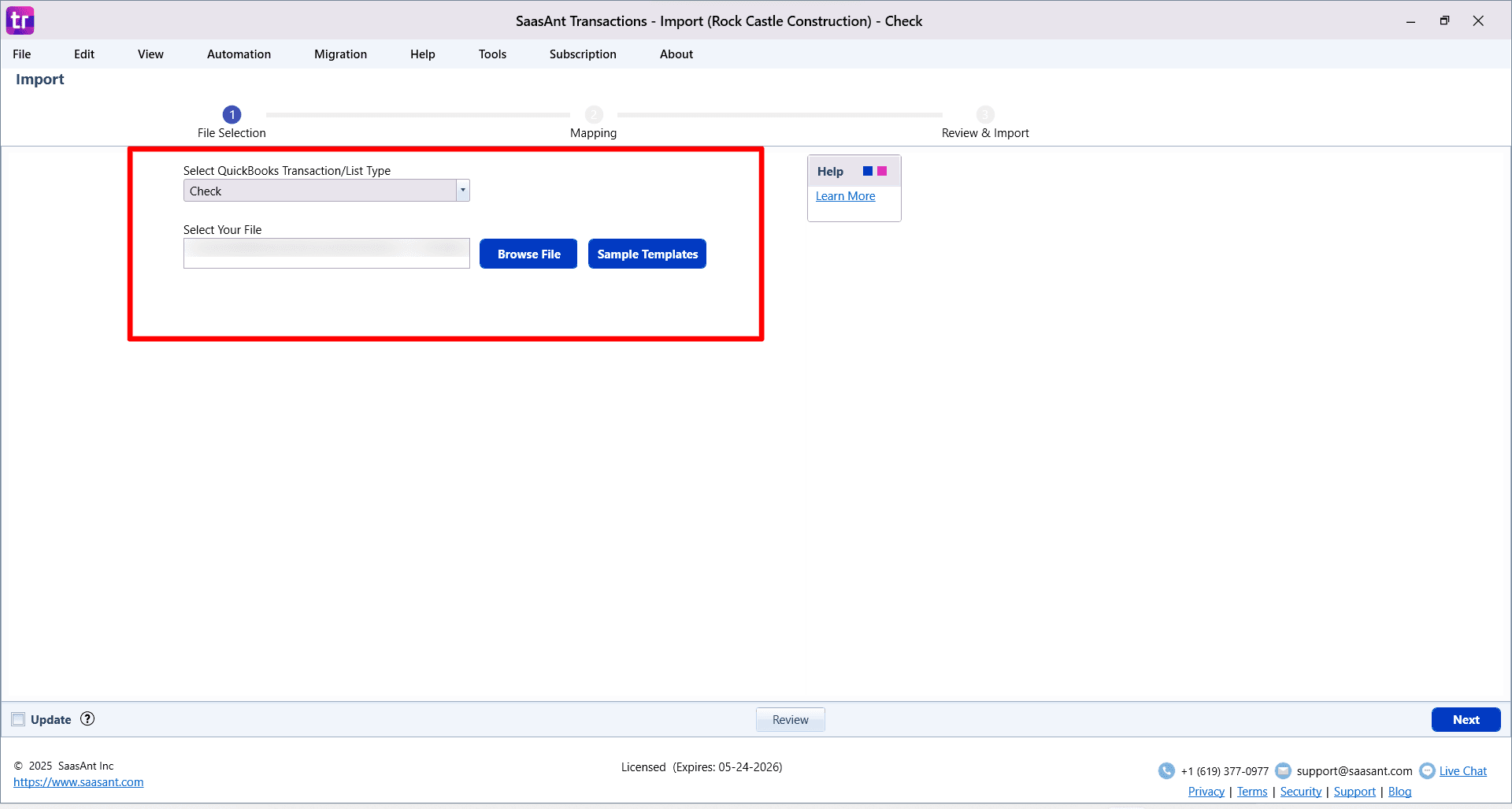

Step 3: Select "Check" and Your Import File

On the first screen, specify that you are importing checks.

Choose Transaction Type: From the dropdown menu, select Check.

Download a Sample Template (Optional): It is highly recommended to download the sample check template. This file will show you the correct columns and formatting needed, such as Payee, Bank Account, Check Number, Date, Amount, and Expense Account.

Select Your File: Click Browse File to locate and select the CSV or spreadsheet containing your check data.

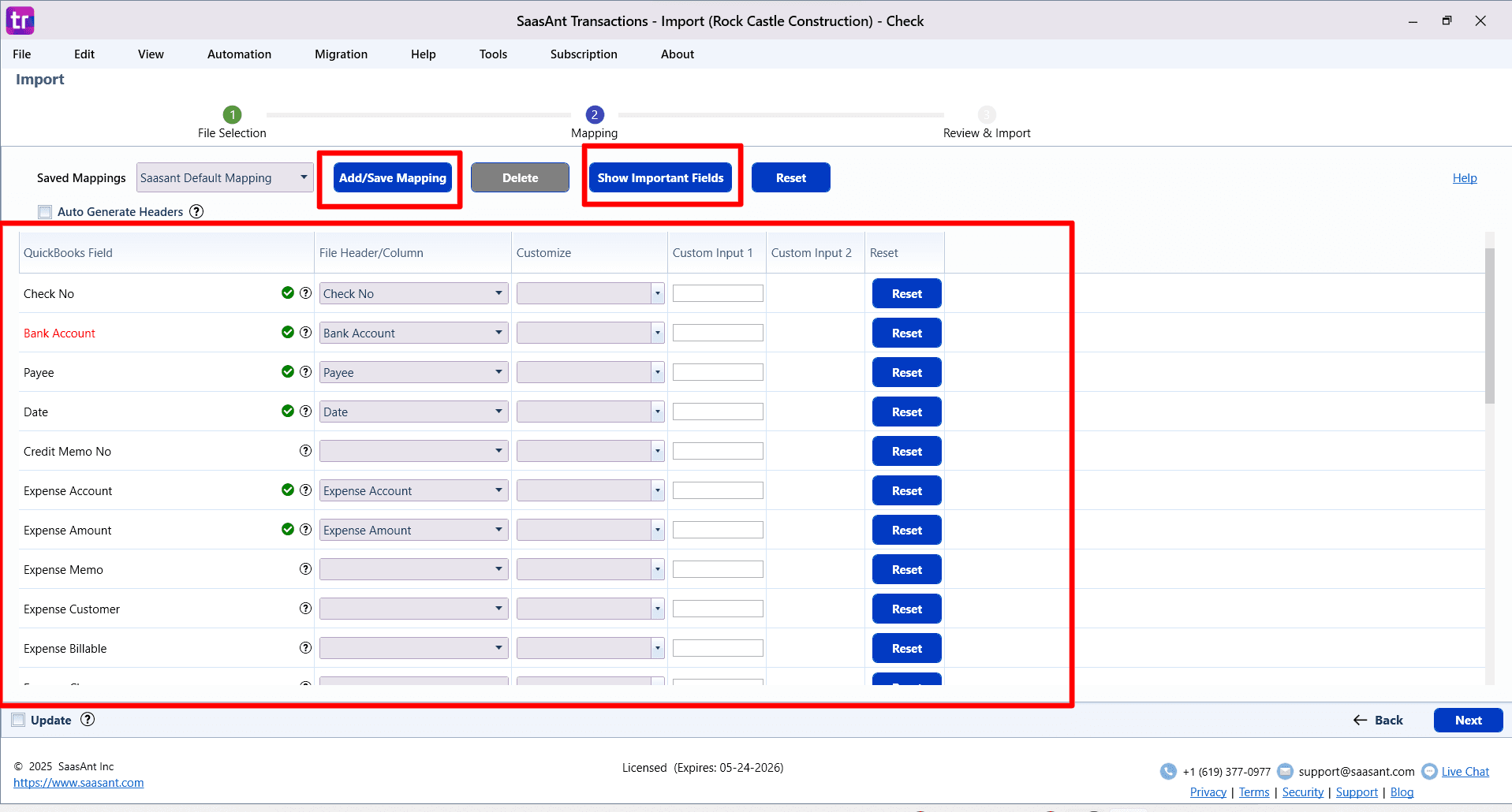

Step 4: Map Your Check Data to QuickBooks Fields

This step links the columns in your file to the corresponding check fields in QuickBooks.

Automatic Mapping: SaasAnt will automatically map columns with familiar headers, such as "Payee Name" to the QuickBooks "Payee" field or "Check Number" to "Check No.".

Manual Mapping: If your column names are different, manually select the correct QuickBooks field from the dropdown list for each of your columns.

View Mandatory Fields: Click the Show Important Fields button to see the fields required for every check, such as Bank Account, Payee, Date, Amount, and Expense Account.

Save Your Mapping: Save your mapping configuration to speed up future check imports using the same file format.

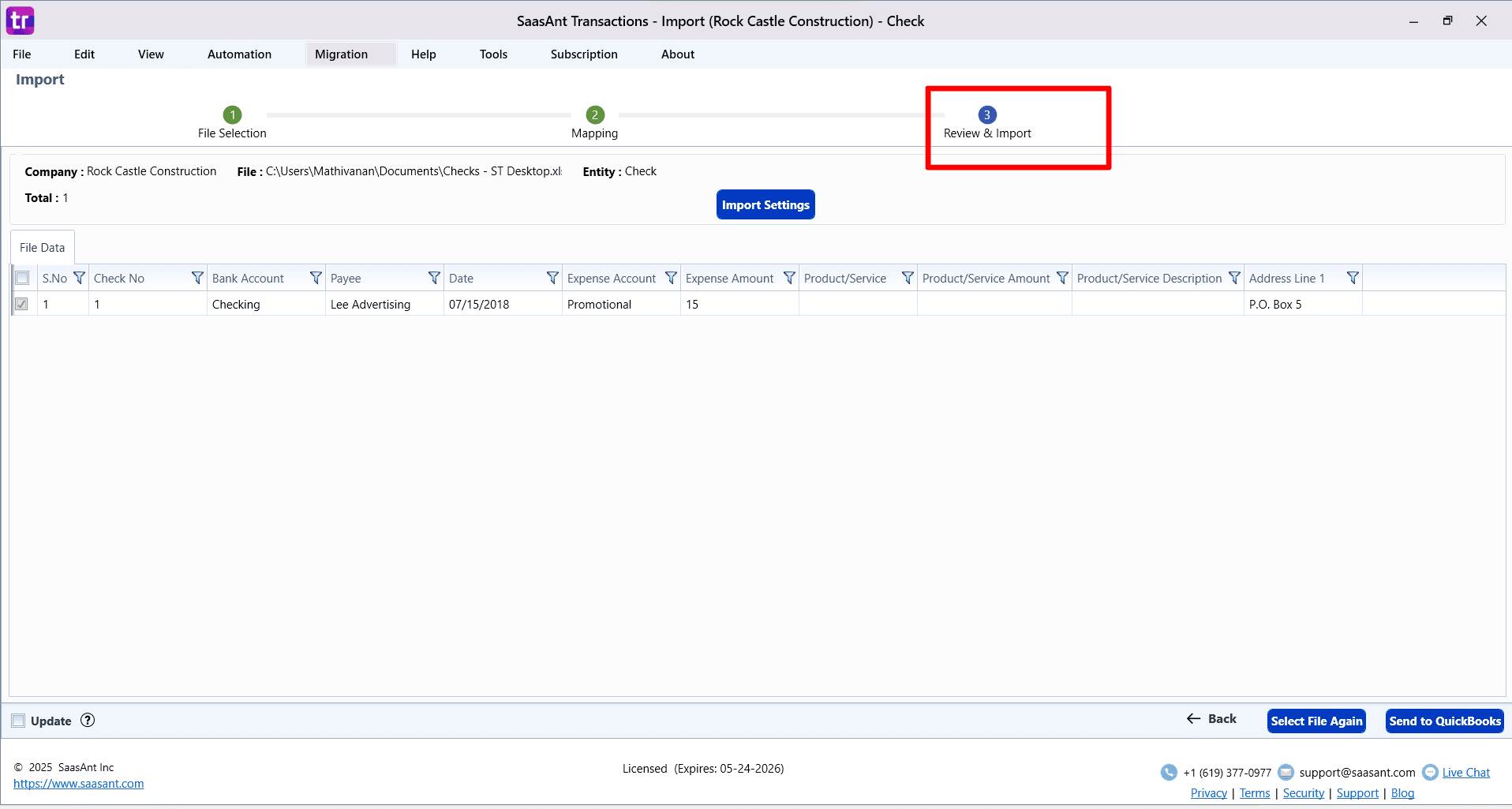

Step 5: Review, Edit, and Configure Check Settings

The "Review and Import" screen is your final opportunity to verify the check data before it goes into QuickBooks.

Review Your Checks: Your check data is displayed in a spreadsheet-like grid. Carefully review all entries for accuracy.

Make Final Edits: You can edit any field directly in the grid to make last-minute corrections.

Filter Data: Use the filter options to quickly find specific checks if you are importing a large batch.

Configure Import Settings: Click Import Settings to fine-tune the import process:

Enable Assign Check No. from file if your spreadsheet contains a column for check numbers.

Set rules to find and handle matching checks to prevent duplicates.

Enable options to automatically create new Vendors (Payees) or Expense Accounts if they don't already exist in your QuickBooks file.

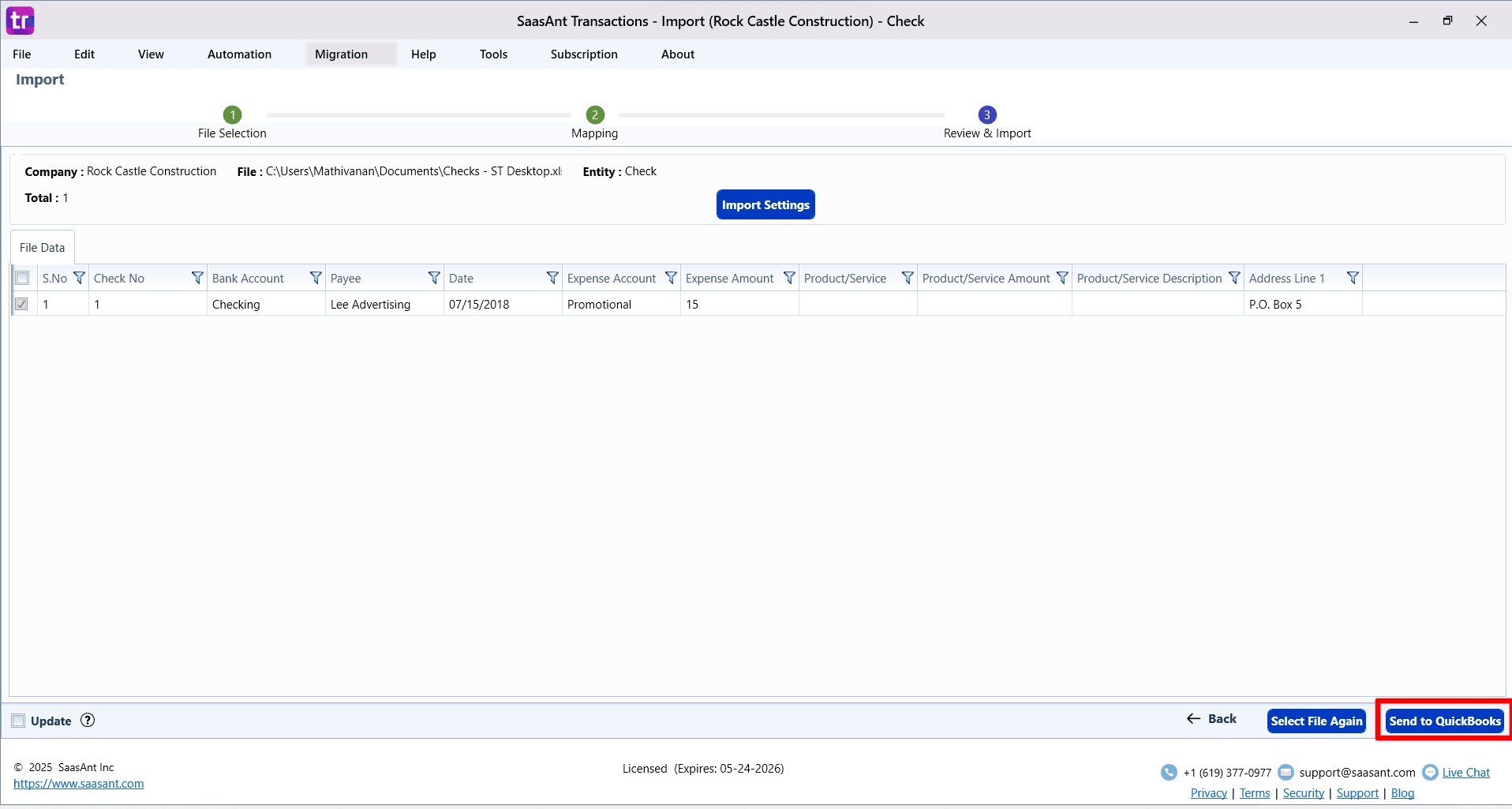

Step 6: Send Checks to QuickBooks and Monitor Results

Once you are confident in your data and settings:

Click the Send to QuickBooks button to begin the import.

SaasAnt will validate the data and begin importing the checks into your company file.

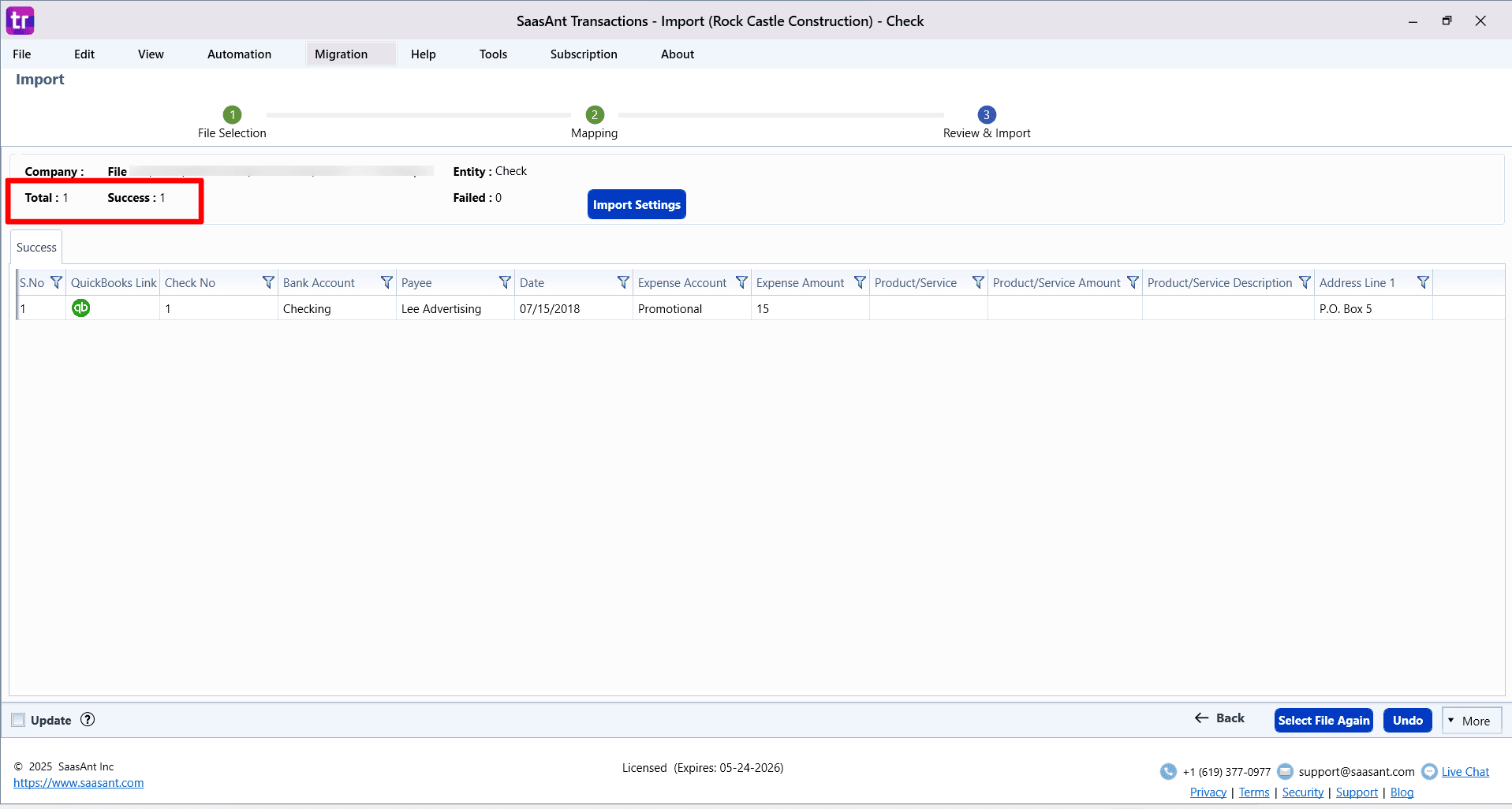

The results screen will appear, showing which checks were imported successfully and which failed with errors.

Step 7: Handle Errors and Finalize

The import results screen helps you troubleshoot any issues.

Fix Errors: Each failed line will have an error message explaining the problem (e.g., "The specified bank account does not exist" or "Vendor not found").

Click the Fix button next to an error to correct the data in the table (e.g., fix a misspelled vendor name or account).

After making corrections, you can re-import only the failed lines.

Undo Import: If there was a major issue, click the Undo button to safely remove all checks that were created in QuickBooks during this import session.

View Logs: For more detailed troubleshooting, you can access the Warning and Error Logs.

Mapping QuickBooks Fields

Check No | Text (Max Length: 20 Characters) | Reference number for the transaction. |

Payee * | Reference Text (Max Length: 41 Characters) | Name of the Vendor / Customer / Employee for this transaction. |

Date | Date | The date entered by the user when this transaction occurred. |

Due Date | Date | Date when the payment of the transaction is due. |

Print Later | Boolean | |

Terms | Text (Max Length: 31 Characters) | Reference to the terms for the Check. |

Address Line 1 | Text (Max Length: 41 Characters) | First line of the address. |

Address Line 2 | Text (Max Length: 41 Characters) | Second line of the address. |

City | Text (Max Length: 31 Characters) | City name. |

State | Text (Max Length: 21 Characters) | Region within a country. |

Country | Text (Max Length: 31 Characters) | Country name. |

Postal Code | Text (Max Length: 13 Characters) | Postal code (zip code for USA and Canada). |

Bank Account * | Reference Text (Max Length: 159 Characters) | Name of the Bank / Credit Card / Cash Account for this transaction. |

Memo | Text (Max Length: 4095 Characters) | The Note about the Transaction. |

Expense Account ** | Reference Text (Max Length: 159 Characters) | Reference to the Expense Account Name associated with the billing. |

Expense Amount ** | Decimal | The amount associated with this expense. |

Expense Memo | Text (Max Length: 4095 Characters) | The Note about the expense. |

Expense Customer | Reference Text (Max Length: 209 Characters) | Reference to the Customer associated with the expense. |

Expense Billable | Billable, NotBillable, HasBeenBilled | The billable status of the expense. |

Expense Class | Reference Text (Max Length: 159 Characters) | Reference to the Class for the Expense. |

Expense Sale Rep | Reference Text (Max Length: 159 Characters) | |

Product/Service ** | Reference Text | Reference to the Item. |

Inventory Site | Reference Text (Max Length: 31 Characters) | Reference to the Item Site |

Inventory BIN | Reference Text (Max Length: 31 Characters) | Reference to the Item BIN corresponding to the Site. Should be specified in the Site:BIN format. |

Product/Service Quantity | Decimal | The Quantity of the Item. |

Product/Service Rate | Decimal | The Unit Price of the Item. |

Product/Service Amount .**

| Decimal | The Total Amount of the Item. Not required if Line Item Quantity & Line Item Rate is present. |

Serial No | Text | |

Lot No | Text | |

Product/Service Description | Text (Max Length: 4095 Characters) | Description of the Item. If it is not provided in the file, it will be populated from QuickBook. |

Unit of Measure | Text | |

Product/Service Customer | Reference Text (Max Length: 209 Characters) | Reference to the Customer associated with the expense. |

Product/Service Billable | Billable, NotBillable, HasBeenBilled | The billable status of the line item. |

Product/Service Sales Rep | Reference Text (Max Length: 5 Characters) | |

Product/Service Class | Reference Text (Max Length: 159 Characters) | The Class name for the Item. |

Currency | The Currency Code for this transaction. | |

Exchange Rate | The exchange rate of the given currency against the home currency. | |

Tax Inclusive | Boolean (True/False) | Tax calculation method. TRUE if the tax is included in the amount. |

All (*) marked fields are mandatory.

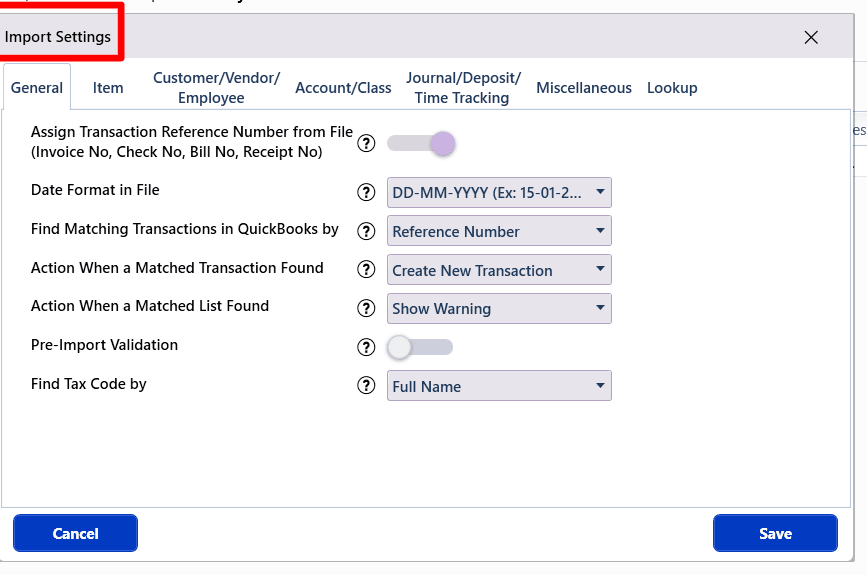

Import Settings

A host of powerful customisations for your file data is available with import settings.. This is available in the Step 3: Review & Import screen or directly under "Edit" Menu in the menubar. Some of the very useful settings for transaction includes:

Find Matching Transactions in QuickBooks by: Identifier to locate existing transactions in your QuickBooks.

Action When a Matched Transaction Found: If an existing transaction is found for the above setting identifier then the corresponding action to be taken. You can choose to Duplicate/ Ignore/ Update/ Append existing transaction in your QuickBooks.

Pre-Import Validation: Validate the complete file before importing to QuickBooks. By turning this setting ON, file rows will be imported only after cleaning up all the issues in file. This option however will delay the import.

More details about the settings related to Automatic creation of Items, Assigning reference number from the file, etc are available in this article.

FAQ's

Most of us would have some questions while moving data to your QuickBooks Online. Some of them for your reference below:

I want to import Checks with Check Numbers from File. Is it supported?

Yes. It is supported.

Will your application support Multi Line Transactions?

Yes. It will.Same "Check No" needs to be present in multiple lines to group the transactions.

I made some mistakes in the Import and my QuickBooks reports got corrupted. Is there any way to undo or revert my Import?

It is possible to undo the import completely/ partially with the Delete feature.

Does your app support taxes?

Yes. It does.

I don't want to create products automatically for my checks. I can't create products before each upload. Is it supported?

Yes. It is. You can auto-create unavailable products/ services Or turn this setting off in the import settings.

My file has some specific date format. I don't want to change the file. Will your product support all date formats?

Yes. You can select the specific date format as per your requirement in the import settings.

Do you have any sample templates?

Yes. We do have. Sample Template

What are the file types supported by your application?

SaasAnt Transactions Desktop supports XLS, XLSX, XLSM, CSV, TXT, and IIF.

How do I report the issues if I am stuck?

Feel free to drop an email to support@saasant.com