How to Import Invoices into QuickBooks Desktop?

August 25, 2025

How to Import Invoice to QuickBooks Desktop?

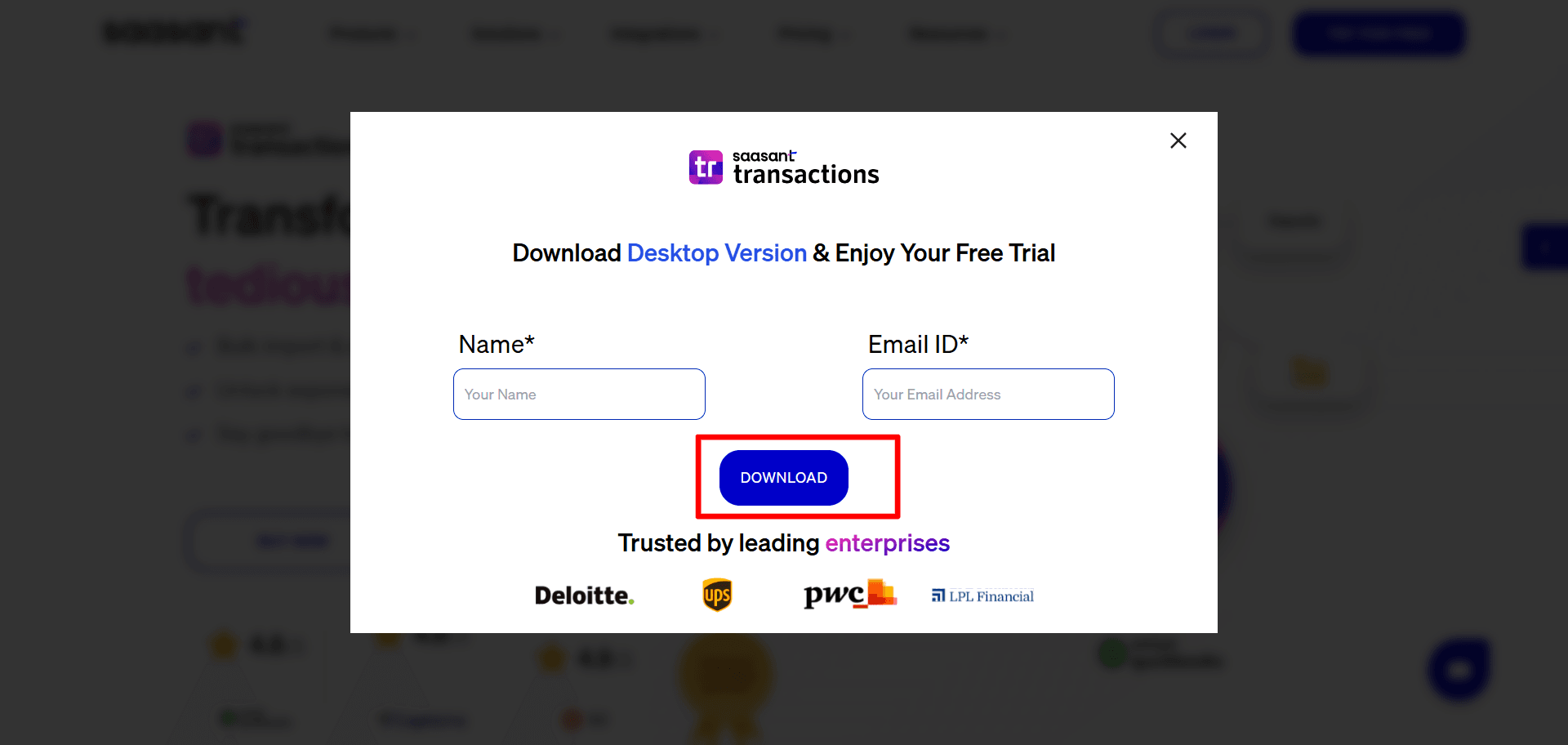

Import bulk/batch invoices from Supported File Formats directly into QuickBooks Desktop using SaasAnt Transactions (Desktop) application - #1 user-rated and Intuit-trusted bulk data automation tool built exclusively for QuickBooks.

SaasAnt Transactions (Desktop) supports QuickBooks Pro, Premier, Enterprise, and Accountant Editions.

You can download the free trial of the software directly from the SaasAnt Website. Follow this article for detailed installation instructions.

Steps to Import Invoices into QuickBooks Desktop

This guide outlines the complete process of importing data into QuickBooks Desktop, from downloading the application to reviewing the final results.

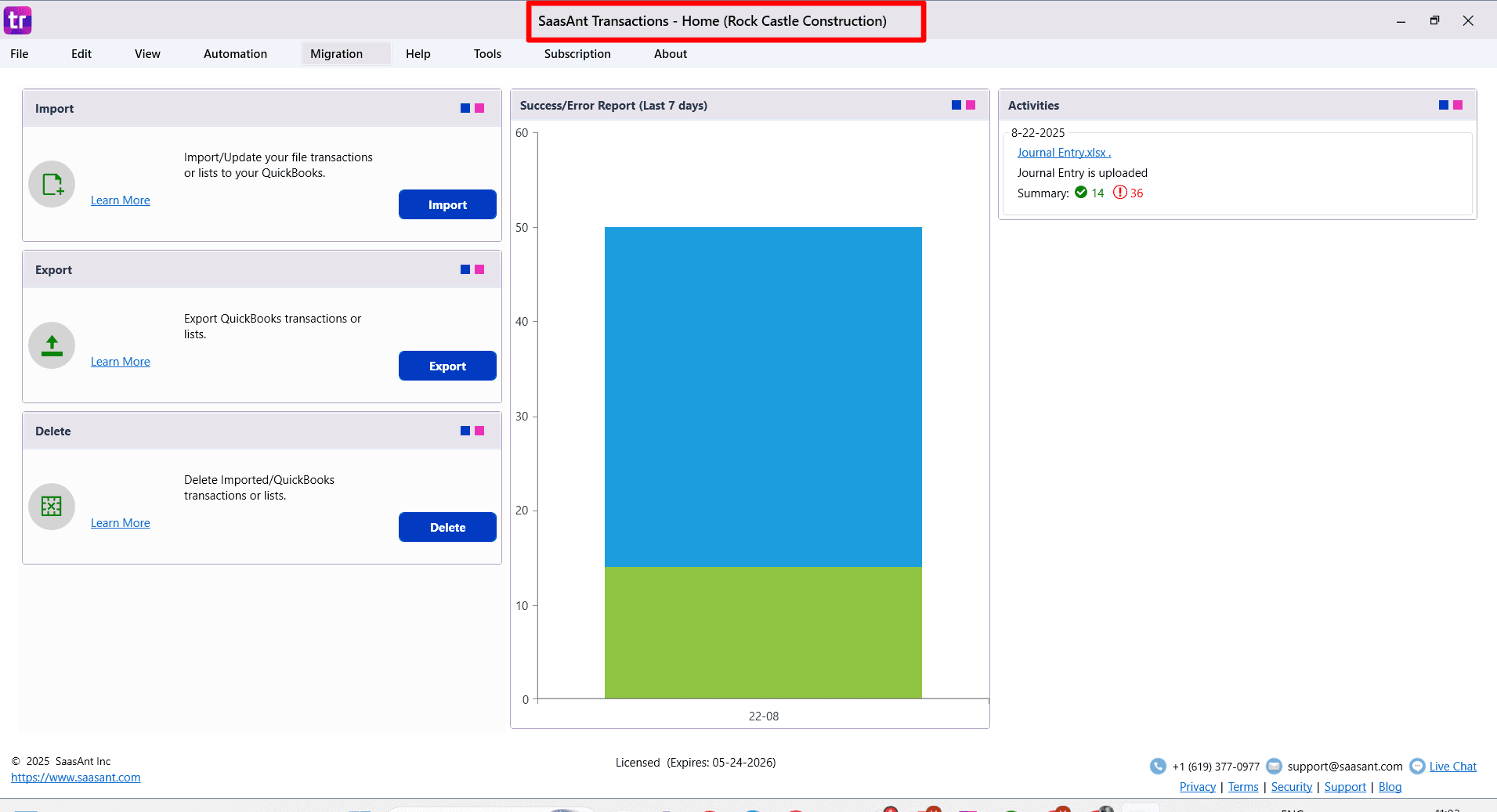

Step 1: Download, Install, and Connect Saasant

Before you can import, you need to set up the Saasant Transactions application.

Download: Go to the Saasant.com website and download the Saasant Transactions Desktop application.

Install: Run the installer and complete the installation on your computer.

Connect: Open the Saasant application and connect it to your QuickBooks Desktop company file by following the on-screen instructions. This will authorize Saasant to access and import data into your file.

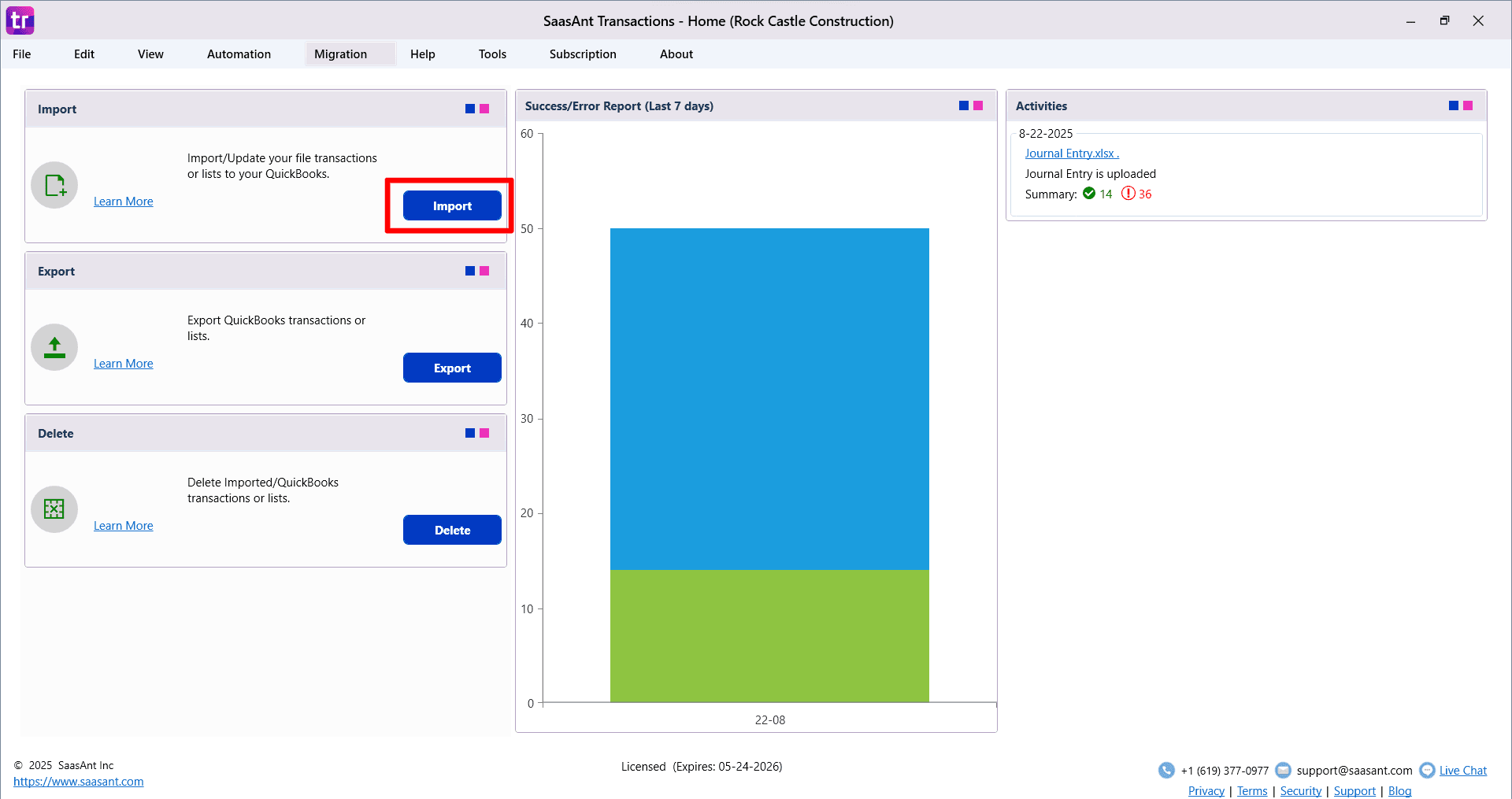

Step 2: Start the Import Process

From the Saasant home screen, you have two options to begin:

Click the Import button.

Go to the File menu and select Import.

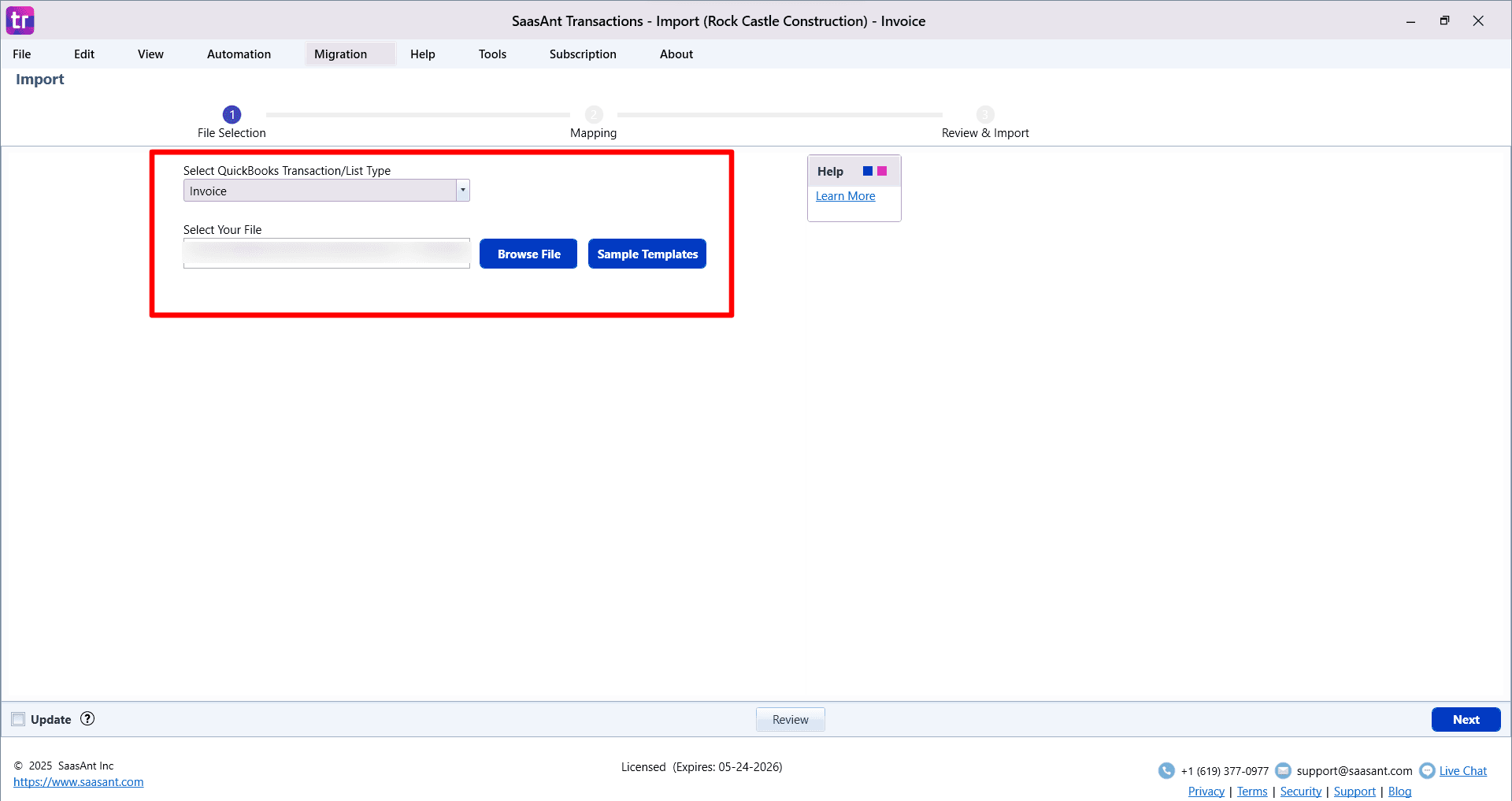

Step 3: Select Your Transaction Type and File

On the first screen, you will need to define what you are importing.

Choose Transaction/List Type: Use the dropdown menu to select the type of data you want to import “Invoice”

Download a Sample Template (Optional): You can download a sample CSV/spreadsheet file. This template shows you the correct column structure and formatting for a successful import.

Select Your File: Click Browse File to locate and select the CSV or spreadsheet file you want to import from your computer.

Step 4: Map Your File to QuickBooks Fields

On this screen you tell SaasAnt which column in your file should go into each QuickBooks field.

The screen is a table. Each row represents one QuickBooks field that is available for the transaction type you selected, such as:

Invoice No

Customer

Invoice Date

Product/Service

AR Account

Amount, Tax, Class, and so on

For each row you will see:

QuickBooks Field: The name of the field in QuickBooks

File Column: A dropdown with your file headers

Customize: A dropdown with rules you can apply to that field

Custom input: A text box used by some rules

Reset: Clears the rule and brings the field back to “normal” behavior

4.1 Basic mapping

Go through each QuickBooks field row.

In the File Column dropdown, pick the column from your CSV or Excel file that contains the data for that field.

Example: Map your “InvoiceNumber” column to the QuickBooks field Invoice No.

Example: Map your “CustomerName” column to the QuickBooks field Customer.

Make sure all mandatory fields (marked in the field mapping reference) are mapped before you continue.

If you make a mistake, click Reset in that row and reselect the correct file column.

4.2 Customize how values are imported

For each mapped field you can apply a rule using the Customize dropdown.

The Custom input box in that same row is where you type the value, condition, or expression for that rule when needed.

Below is what each option does, in simple terms.

Set value if empty

Use this when some rows in your file are blank and you want a default value instead.

Behavior: If the file value for that field is empty, SaasAnt will use the value in Custom input.

Example: Terms is blank in some rows. Choose Set value if empty and type Net 30 in Custom input so every invoice has a term.

Override

Use this when you want the same value for every row, regardless of what is in the file.

Behavior: SaasAnt ignores the file value for that field and always uses the value in Custom input.

Example: You want all invoices in this batch to go to the AR account Accounts Receivable USD. Choose Override and type that account name.

Replace if matches

Use this when you want to change one specific value to something else.

Behavior: If the original value in that field matches the condition you define in Custom input, SaasAnt replaces it with the new value you set for this rule.

Typical use: Clean up old codes or labels, for example convert OLD TAX to Standard Tax.

Skip if matches

Use this when you want to completely skip rows that have an exact value in that field.

Behavior: If the value in that field exactly matches what you define in Custom input, SaasAnt will skip that row and not import it.

Example: You have test rows where Product/Service is TEST. Choose Skip if matches and set Custom input to TEST so those rows never reach QuickBooks.

Skip if contains

Use this to skip rows where the field contains certain text anywhere inside it.

Behavior: If the value in that field contains the text in Custom input, the whole row is skipped.

Example: Your Memo column has lines like “Sample only, do not post”. Choose Skip if contains and type do not post.

Merge

Use this when you want to combine values from more than one file column into a single QuickBooks field.

Behavior: You map more than one file column to the same QuickBooks field and choose Merge for those rows. SaasAnt joins those values together in the order you mapped them.

Example: You have “ShipAddress1” and “ShipAddress2” in the file and want them together in the QuickBooks shipping address field.

Expression

Use this when you want to build or transform a value using a simple expression.

Behavior: SaasAnt uses the logic you define in Custom input to generate the value instead of using the raw file text.

Typical use:

Add prefixes or suffixes, such as INV- + invoice number.

Build memos like Web order + PO number.

Format text values into a consistent pattern.

Skip if greater than

Use this when you only want to import rows where a numeric value is under a certain limit.

Behavior: If the numeric value in that field is greater than the number you type in Custom input, SaasAnt skips that row.

Example: You want to exclude any invoice line where Amount is more than 10000 from this batch.

Trim

Use this when your file has extra spaces before or after values that might create duplicates in QuickBooks.

Behavior: SaasAnt removes leading and trailing spaces from the values in that field before import.

Example: Customer names like "ABC Corp " (with a trailing space) are cleaned to "ABC Corp" to avoid creating a second customer.

If you change your mind about a rule, click Reset in that row. This removes the Customize choice and Custom input for that field and takes it back to using the file values as they are.

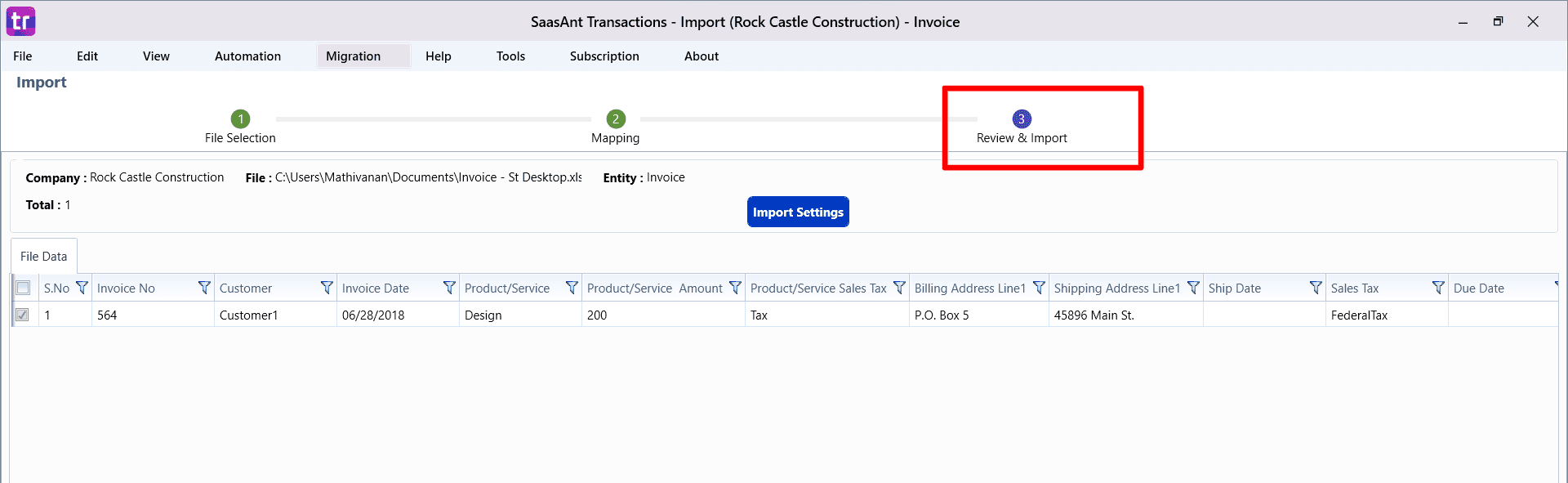

Step 5: Review, Edit, and Configure Settings

The final screen, "Review and Import," gives you a last chance to check and modify your data before it goes into QuickBooks.

Review Your Data: Your data is displayed in a spreadsheet-like grid. You can review all entries for accuracy.

Make Final Edits: The fields in the grid are editable, allowing you to make last-minute corrections directly within Saasant.

Filter Data: If you have a large file, use the filter options to find and review specific lines or make bulk changes.

Selective Import: Use the checkboxes next to each row to select or deselect specific lines you want to import or skip.

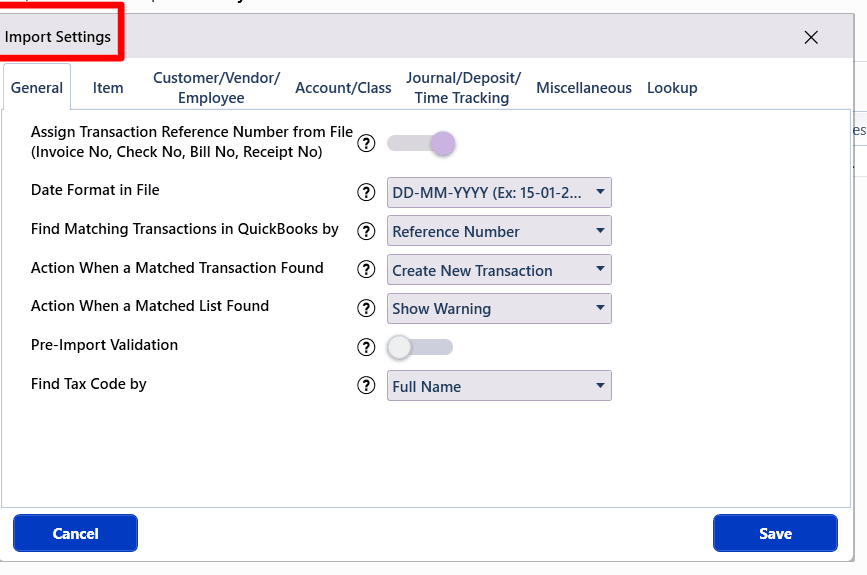

Configure Import Settings: Click Import Settings to access powerful automation features:

Assign transaction numbers from your file.

Specify the date format used in your file.

Set rules for finding and handling matching transactions already in QuickBooks.

Automatically create new Customers, Vendors, Products/Services, or Accounts if they don't already exist.

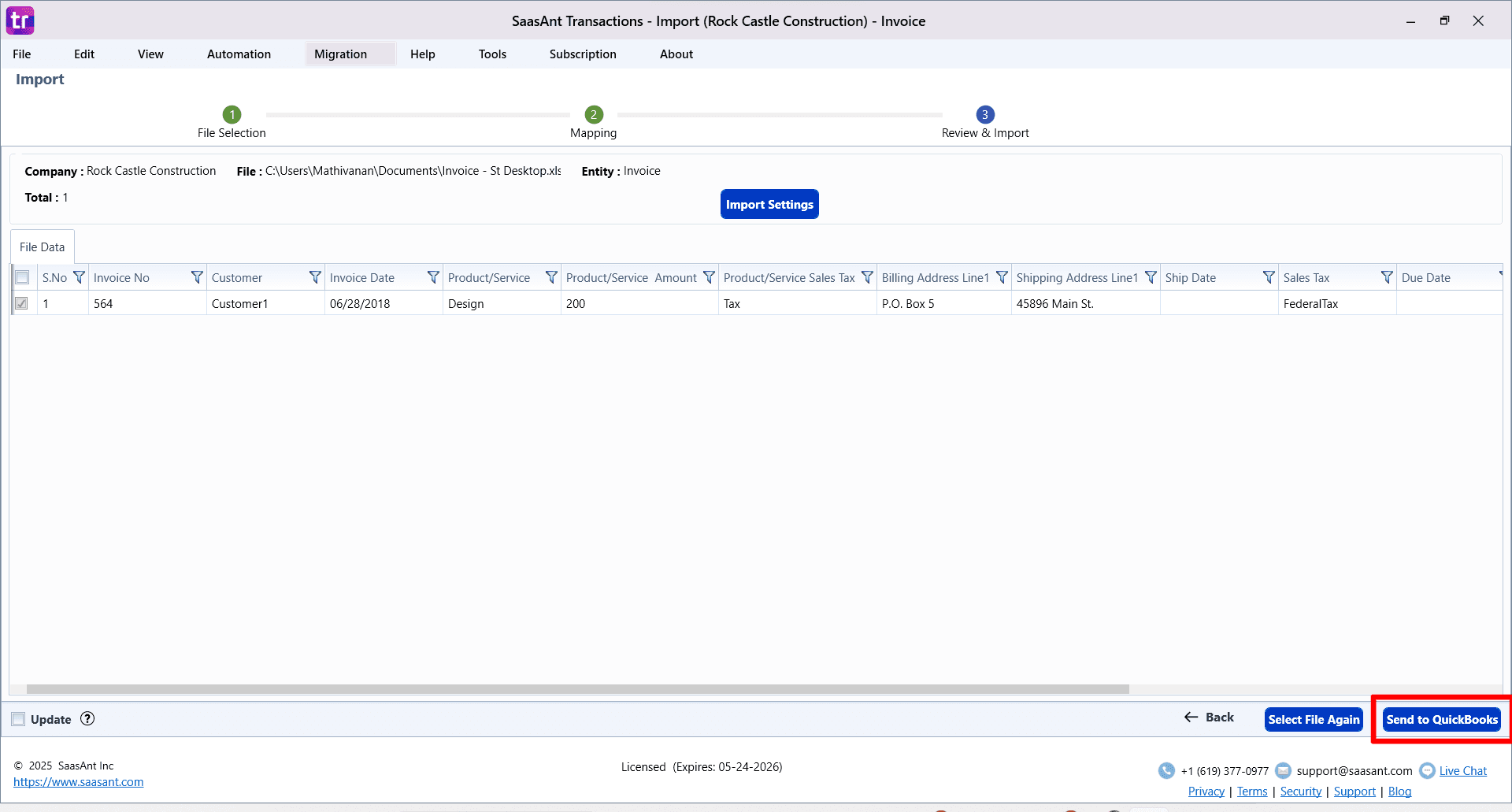

Step 6: Send to QuickBooks and Monitor Results

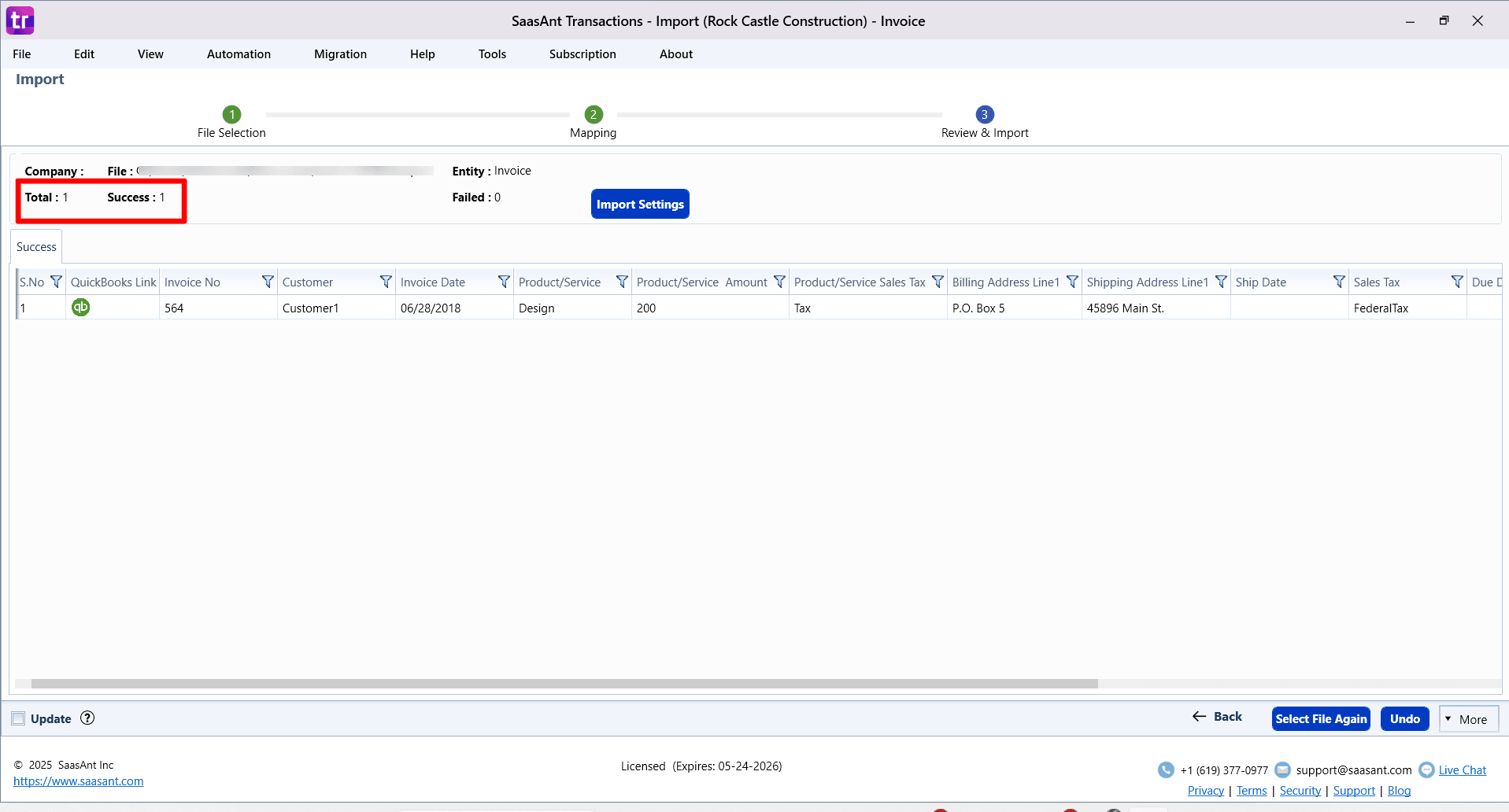

Once you are satisfied with the review and settings:

Click the Send to QuickBooks button to start the validation and import process.

If you need to start over, click Select file again.

After the import, a results screen will appear, clearly showing which lines were successful and which failed with errors.

Step 7: Handle Errors and Finalize

The import results screen provides tools for troubleshooting and finalizing the process.

Fix Errors: For each failed line, an error message will explain the problem (e.g., "No account found in the specified name").

Click the Fix button next to the error to correct the data in the table directly.

After making corrections, you can attempt to re-import only the failed lines.

Undo Import: If there are major issues with the entire import, click the Undo button. This will safely delete all records created in QuickBooks during this specific import session.

View Logs: You can access detailed Warning and Error Logs for further analysis.

How to Map QuickBooks Fields?

Field Name | Format | Description |

|---|---|---|

Invoice No | Text (Max Length: 11 Characters) | Reference number for the transaction. By default, this value is used only for internal processing by SaasAnt Transactions , and QuickBooks auto-generates a new value. This can be changed in the import settings. |

Customer * | Reference Text (Max Length: 41 Characters) | Reference to the customer. |

Invoice Date | Date | Date of the transaction. |

Due Date | Date | Date when the payment of the transaction is due. |

Terms | Text (Max Length: 11 Characters) | Payment Terms |

PO No | Reference Text | Purchase Order number |

Ship Date | Date | Date when the item is shipped. |

Shipping Address Line 1 | Text (Max Length: 41 Characters) | First line of the shipping address. |

Shipping Address Line 2 | Text (Max Length: 41 Characters) | Second line of the shipping address. |

Shipping Address Line 3 | Text (Max Length: 41 Characters) | Third line of the shipping address. |

Shipping Address City | Text (Max Length: 31 Characters) | Shipping address - City |

Shipping Address State | Text (Max Length: 21 Characters) | Shipping address - State or Province |

Shipping Address Postal Code | Text (Max Length: 13 Characters) | Shipping address - Postal Code |

Shipping Address Country | Text (Max Length: 41 Characters) | Shipping address - Country |

FOB | Text (Max Length: 13 Characters) | FOB destination |

Billing Address Line 1 | Text (Max Length: 41 Characters) | First line of the billing address. |

Billing Address Line 2 | Text (Max Length: 41 Characters) | Second line of the billing address. |

Billing Address Line 3 | Text (Max Length: 41 Characters) | Third line of the billing address. |

Billing Address City | Text (Max Length: 31 Characters) | Billing address - City |

Billing Address State | Text (Max Length: 21 Characters) | Billing address - State or Province |

Billing Address Postal Code | Text (Max Length: 13 Characters) | Billing address - Postal Code |

Billing Address Country | Text (Max Length: 41 Characters) | Billing address - Country |

Sales Rep | Reference Text | Reference to the SalesRep associated with the transaction |

Shipping Method | Reference Text | Reference to the ShipMethod associated with the transaction |

Print Later | Boolean (True/False) | Print Status |

Email Later | Boolean (True/False) | Email Status |

Memo | Text (Max Length: 4095 Characters) | |

Customer Message | Reference Text | Message to the customer from the available list in QuickBooks |

Class | Reference Text (Max Length: 31 Characters) | Transaction Class |

Product/Service * | Reference Text (Max Length: 31 Characters) | Item reference from below options. |

Product/Service Quantity | Decimal | |

Product/Service Rate | Decimal | |

Unit Of Measure | Reference Text | |

Product/Service Description | Text (Max Length: 4095 Characters) | |

Product/Service Amount * | Decimal | |

Product/Service Service Date | Date | Date when the service is fulfilled |

Product/Service Class | Reference Text (Max Length: 31 Characters) | Class reference to this line |

Product/Service Sales Tax | Reference Text | Sales Tax Code to this line |

Other | Text (Max Length: 29 Characters) | |

Other 1 | Text (Max Length: 29 Characters) | |

Other 2 | Text (Max Length: 29 Characters) | |

Sales Tax | Reference Text | Transaction Sales Tax Code |

Customer Sales Tax Code | Reference Text | Tax Code corresponding to Transaction |

Template | Reference Text | Template reference to this Invoice |

AR Account | Reference Text | Accounts Receivable account reference to this Invoice |

Product/Service Inventory Site | Reference Text | Reference to the Item Site |

Product/Service Inventory BIN | Reference Text | Reference to the Item BIN corresponding to the Site. Should be specified in the Site:BIN format. |

Currency | Text | Reference to the Currency in which all amounts on the associated transaction are expressed |

Exchange Rate | Decimal | Default is 1, applicable if multi-currency is enabled for the company. |

Tax Inclusive | Boolean (True/False) | Tax calculation method. |

All (*) marked fields are mandatory.

How to Import Settings?

A host of powerful customizations for your file data is available with Import Settings. This is available in the Step 3: Review & Import screen or under the "Edit" Menu in the menubar. Some of the very useful settings for transactions include:

Find Matching Transactions in QuickBooks by: Identifier to locate existing transactions in your QuickBooks.

Action When a Matched Transaction Found: If an existing transaction is found for the above setting identifier, the corresponding action will be taken. You can Duplicate/ Ignore/ Update/ Append existing transactions in your QuickBooks.

Pre-Import Validation: Validate the complete file before importing to QuickBooks. By turning this setting ON, file rows will be imported only after cleaning up all the issues in the file. This option, however, will delay the import.

More details about the settings related to the Automatic creation of Items, Assigning reference numbers from the file, etc, are available in this article.

FAQ's

Most of us would have questions while moving data to your QuickBooks Online. Some of them for your reference below:

I want to import the Invoice into QuickBooks with Invoice Numbers from the File. Is it supported?

Yes. It is supported.

Will your application support multi-line transactions?

Yes. It will. The same Invoice Number must be presented in multiple lines to group the transactions.

I made some mistakes in the Import, and my QuickBooks reports got corrupted. Is there any way to undo or revert my Import?

It is possible to undo the import completely/ partially with the Delete feature.

Does your app support taxes?

Yes. It does.

I don't want to create products automatically for my invoices. I can't develop products before each upload. Is it supported?

Yes. It is. You can auto-create unavailable products/ services Or turn this setting off in the import settings.

My file has some specific date format. I don't want to change the file. Will your product support all date formats?

Yes. You can select the specific date format per your requirement in the import settings.

Do you have any sample templates?

Yes. We do have. Sample Template

What file types does SaasAnt Transactions Desktop support for importing into QuickBooks Desktop?

SaasAnt Transactions Desktop supports XLS, XLSX, XLSM, CSV, TXT, and IIF.

How do I report the issues if I am stuck?

Feel free to drop an email to support@saasant.com