How to Import Vendor Credits into QuickBooks Online (U.S)?

August 20, 2025

You can import Vendor Credits from text files or Excel spreadsheets directly into QuickBooks Online using SaasAnt Transactions (Online) software.

Pre-Requisites:

Connect your QuickBooks Online account to SaasAnt Transactions (Online) App from QuickBooks AppStore by clicking the "Get App Now" button and get the 30 days free trial [No credit card required].

Please refer basics of field mappings for more info. If you have any confusion or doubts, feel free to drop an email to support@saasant.com.

How to Import Vendor Credits into QuickBooks Online using SaasAnt Transactions Online

1) Login into SaasAnt Transaction Online

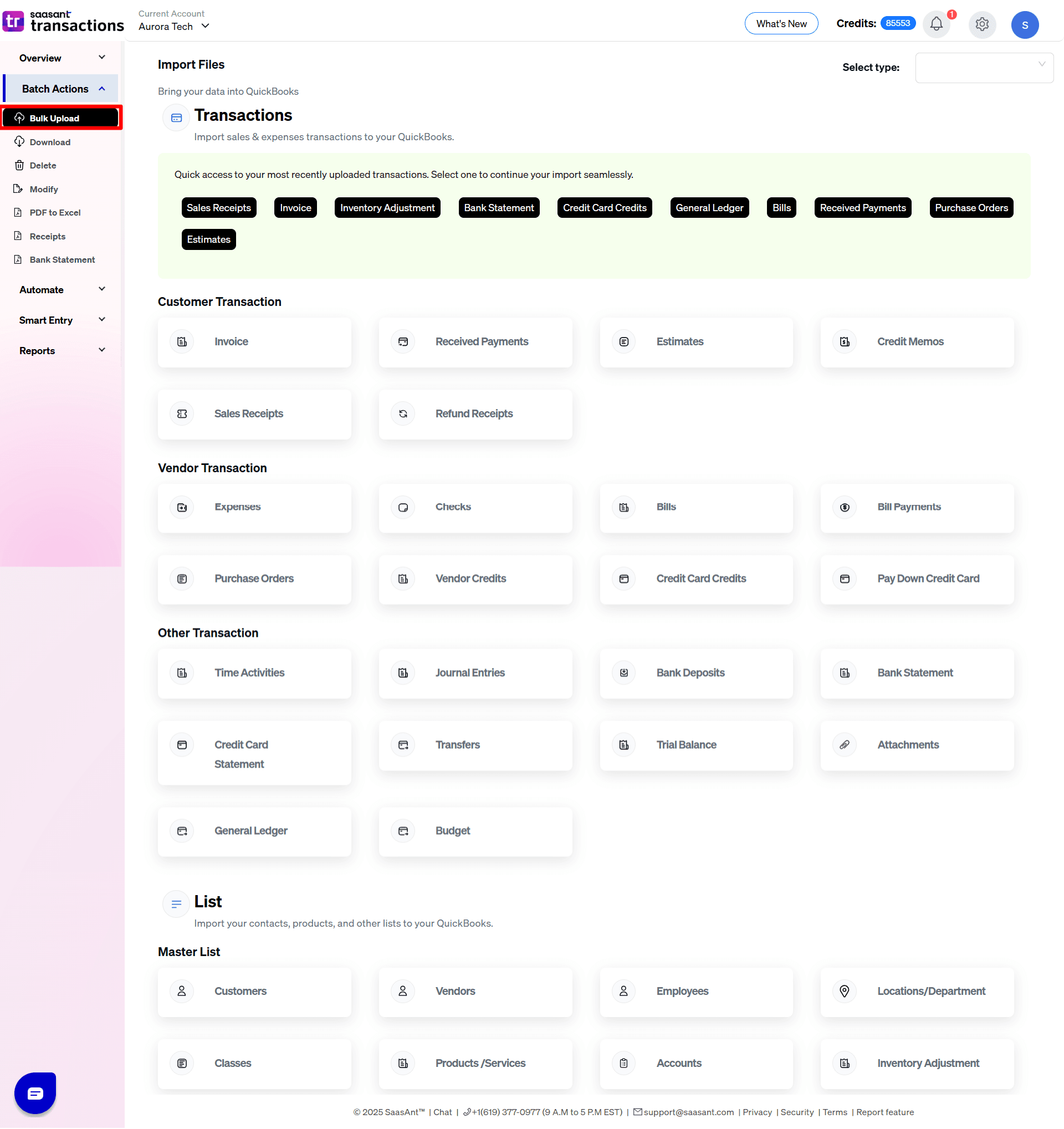

2) Select the Bulk Upload Tab.

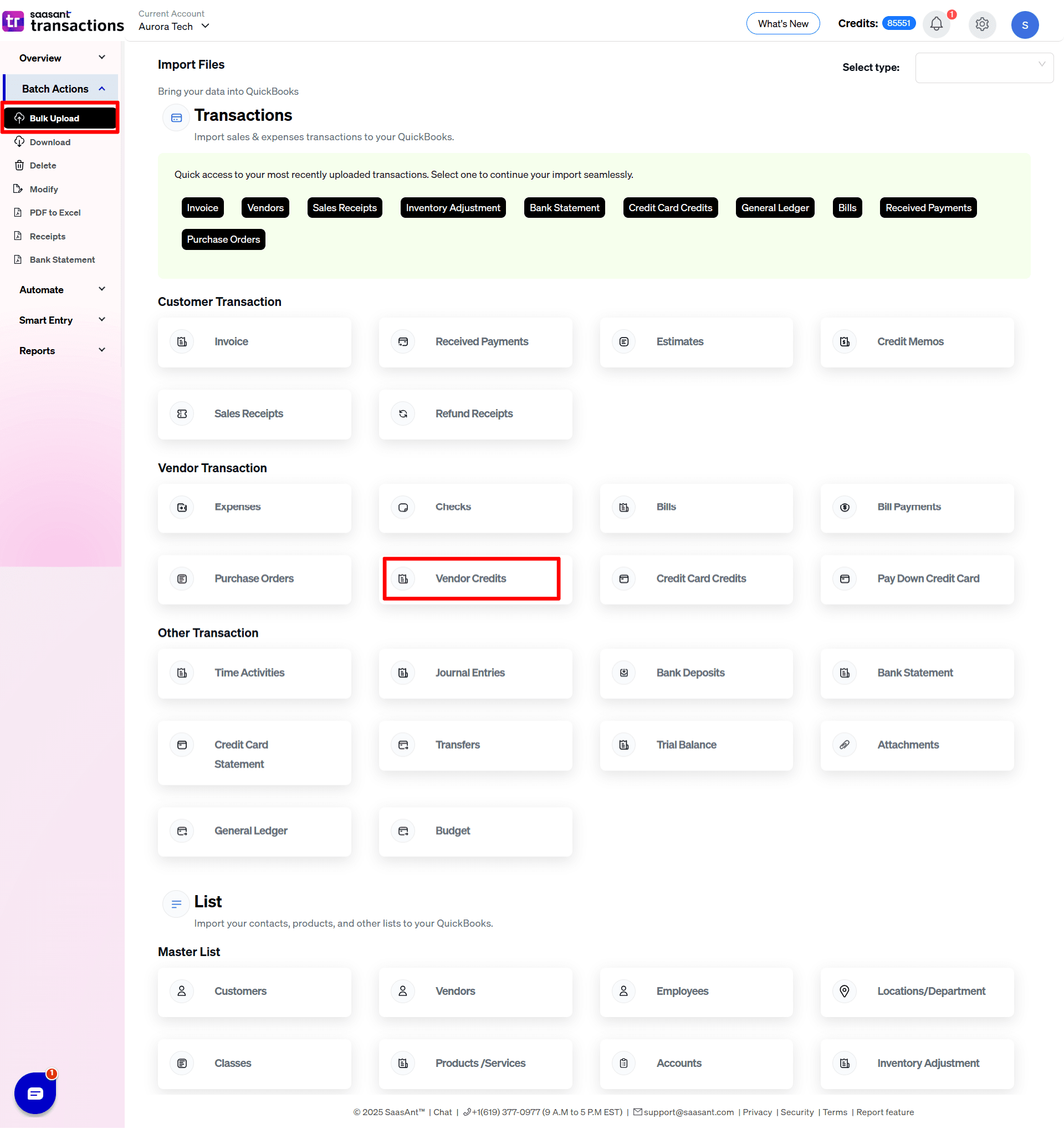

3) Select the QuickBooks entity as "Vendor Credits".

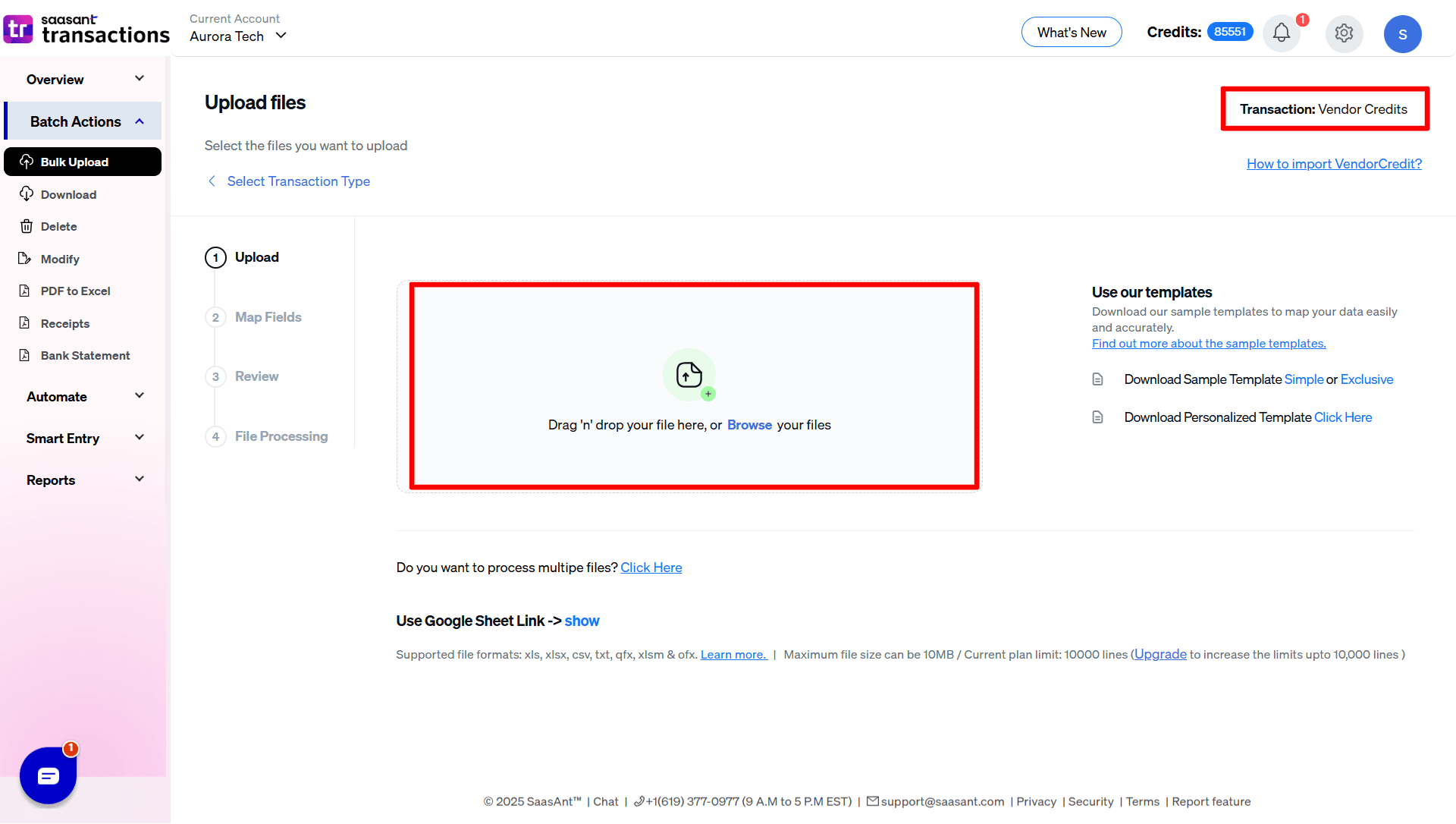

4) Select the files you want to upload.

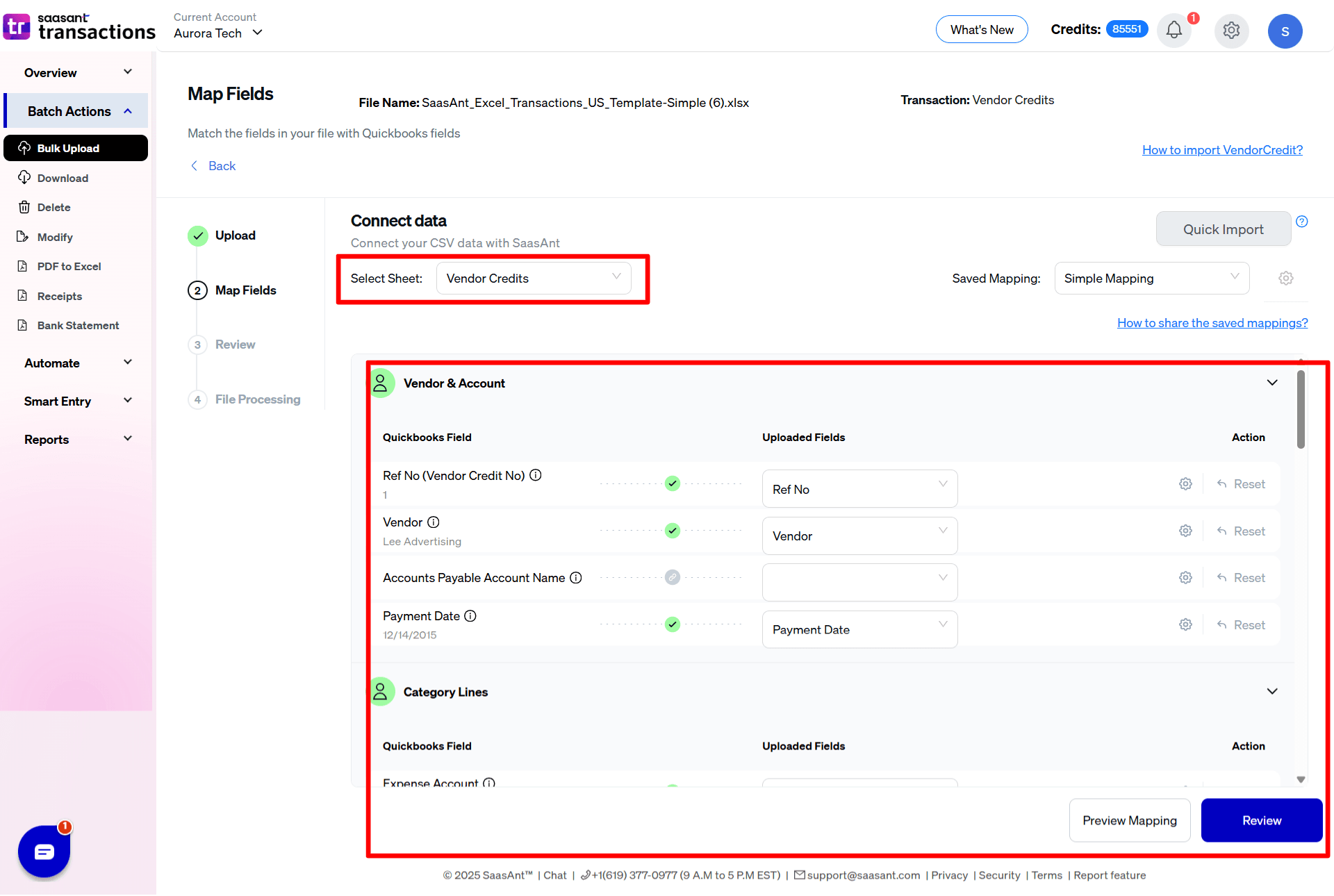

5) Set up the Mapping of the columns in your Vendor Credits.

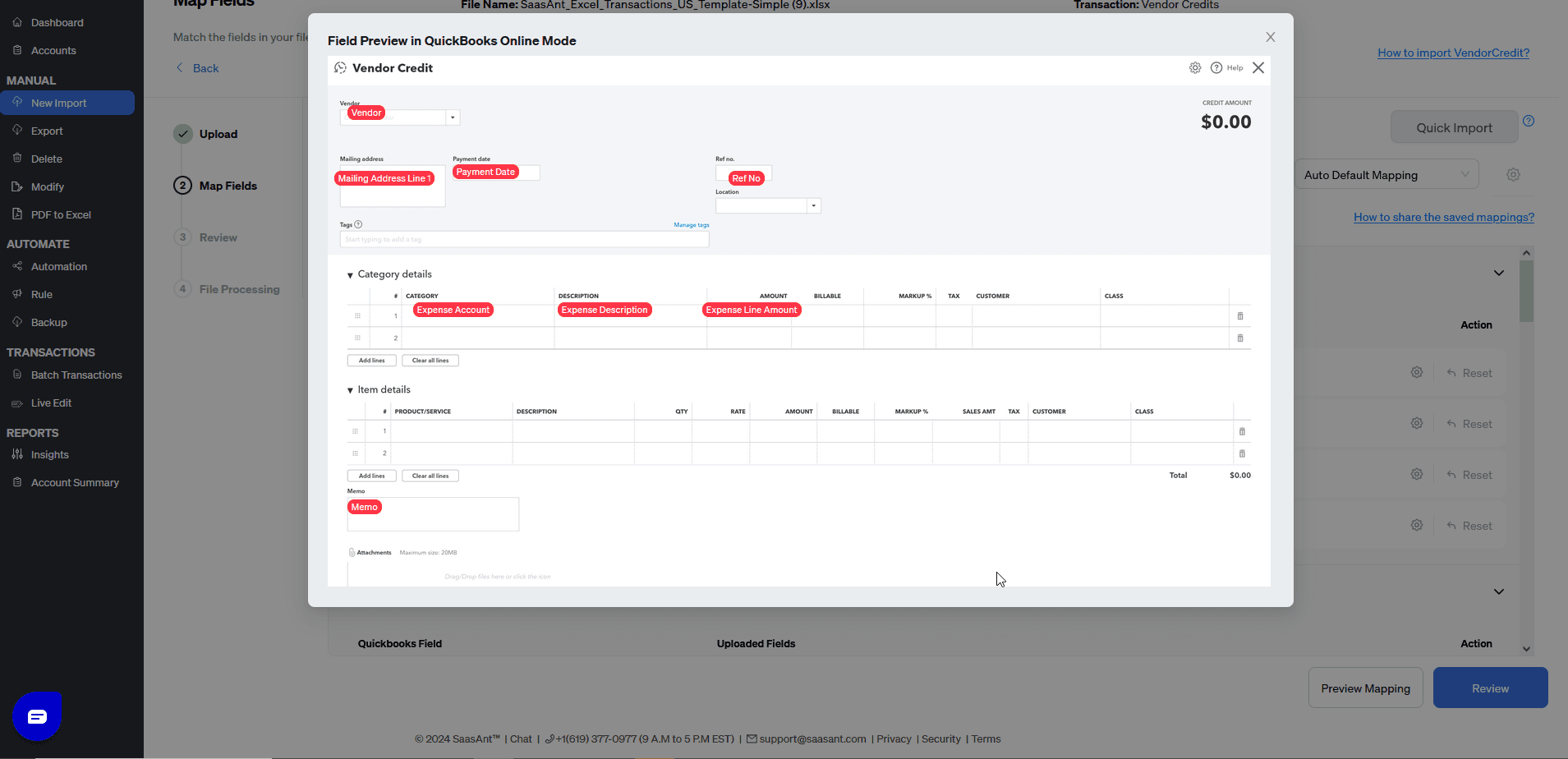

6) Select the "Preview Mapping" button to visualize current mapping based on QuickBooks.

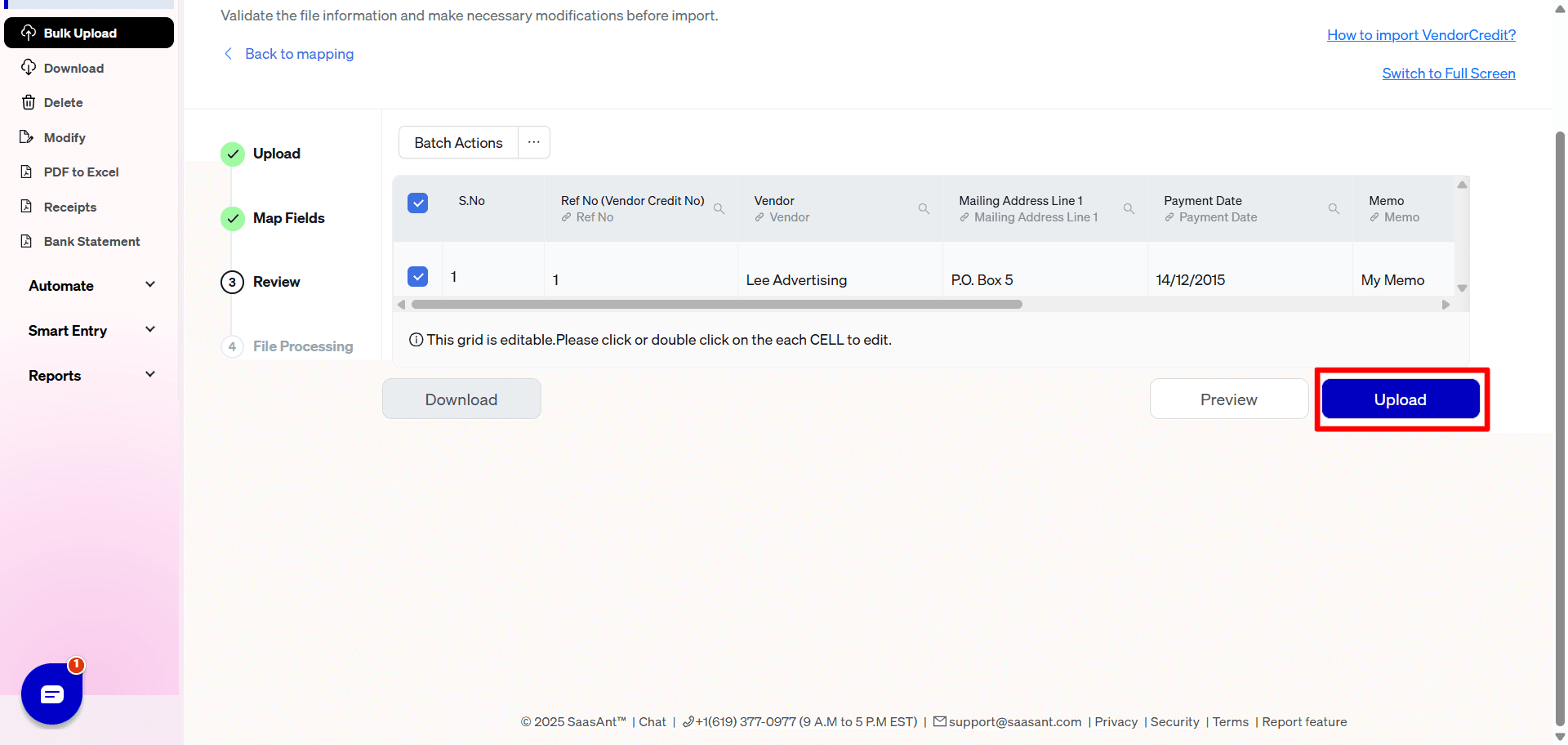

7) Select the Upload tab.

8) The data will be imported successfully into QuickBooks.

Let’s have a look at the SaasAnt Transactions Online Fields.

SaasAnt Transactions (Online) Fields

Field Name | Format | Description |

|---|---|---|

Ref No | 21 Characters | Reference number for the transaction. |

Vendor | Characters | Name of the vendor for this transaction. |

Payment Date | Date | The date entered by the user when this transaction occurred. |

Mailing Address Line 1 | 500 Characters | First line of the address. |

Mailing Address Line 2 | 500 Characters | Second line of the address. |

Mailing Address Line 3 | 500 Characters | Third line of the address. |

Mailing Address City | 255 Characters | City name. |

Mailing Address Postal Code | 31 Characters | Zip code. |

Mailing Address Country | 255 Characters | Country name. |

Mailing Address State | 255 Characters | State name. |

Memo | 4000 Characters | The Note about this transaction. |

Category Account | Characters | Reference to the Expense Account Name associated with the billing. |

Category Description | 4000 Characters | Free form text description of the Expense. |

Category Line Amount | Decimal | The amount of the line item. |

Category Billable Status | Boolean | The billable status of the Expense. |

Category Markup Percent | Decimal | The Markup value in Percentage for the Expense. |

Category Customer | Characters | Reference to the Customer associated with the Expense. |

Category Class | Characters | Reference to the Class for the Expense. |

Category Taxable | Boolean | Apply tax if it is true. |

Category Tax Amount | Decimal | The Tax amount applied for the Expense Line Item. Only applicable if the Global Tax Calculation is "TaxExcluded". |

Line Item | Characters | Reference to the Item. |

Line Item Description | 4000 Characters | Description of the Item. It will be populated from Item description entered in QuickBooks Online. |

Line Item Quantity | Decimal | The Quantity of the Item. |

Line Item Rate | Decimal | The Unit price of the Item. |

Line Item Amount | Decimal | The Total Amount of the Item. Not required if Line Item Quantity & Line Item Rate is present. |

Line Item Billable Status | Boolean | The billable status of the Item. |

Line Item Taxable | Boolean | Apply tax if it is TRUE. |

Line Item Tax Amount | Decimal | The Tax amount applied for the Expense Line Item. Only applicable if the Global Tax Calculation is "TaxExcluded". |

Line Item Markup Percent | Decimal | The Markup value in Percentage for the Item. |

Line Item Customer | Characters | The Customer name for the Item. |

Line Item Class | Characters | The Class name associated with this item. |

Accounts Payable Account Name | Characters | Specifies which Accounts Payable Account the bill will be credited to. |

Location | Characters | The Location of the transaction. |

Currency Code | Characters | Reference to the Currency in which all amounts on the associated transaction are expressed. |

Exchange Rate | Decimal | Default is 1, applicable if multi-currency is enabled for the company. |

Possible Failures & Troubleshooting Tips

The currency of the transaction is invalid for customer / vendor / account.

The given Currency is different than the default currency of the vendor. Please refer the Vendor's Currency in QuickBooks & update the same currency in Currency Field.

It is possible that Multi Currency feature in QuickBooks could be disabled. Please enable the feature.

Required parameter(s) missing: Line.

Please provide at least one Item Line details or Expense Account Line Details to process.

Transaction amount (Sum of line amounts) must be 0 or greater.

Please provide the valid amount (Non Negative) in Line Item Amount and Expense Amount.

Amount is not equal to Unit Price * Qty Supplied value: XXXX

Please provide valid Amount in Line Item Rate & Line Item Amount.

No Account or Product / Service is available for this line.

Please provide valid Account Name in Expense Account or valid name in Line Item Product / Service Field.

No matching Product/Service found (or) could be created for the provided details.

Please provide valid name in Product Field.

You might have disabled "Auto Create List Entities" Feature in Import Settings. By enabling this feature, QuickBooks will automatically create the product for the transaction

Duplicate Document Number Error : You must specify a different number. This number has already been used.

There is an another Expense has the same reference number. Please use the another reference number.

You have disabled "Assign Transaction Numbers from file" in Import Settings. By enabling this feature, QuickBooks will automatically assign numbers for the transaction.

No matching reference found for this account.

Please provide valid Expense account name in "Account" field.

Invalid account type: You need to select a different type of account for this transaction.

Please provide valid Expense account name in "Account" field.

Amount is missing in the request.

The Line Item amount is missing for the particular line item

Required parameter Line Amount is missing in the request.

The Line Item amount is missing for the particular line item.

Please check in QuickBooks company settings if the appropriate preferences are enabled for the successful upload of current data set. E.g. Shipping, Multi-Currency, etc.

If you have provided Shipping Address or Currency, then please make sure you have enabled Shipping & Multi-Currency feature in QuickBooks Online.

Requested entity/feature (BillableExpense) is not supported by QuickBooks per your subscription.

Billable Customer or Expense feature is not available for your QuickBooks Online Subscription. Please remove the values in Billable Fields (Expense Billable, Line Item Billable).

No matching reference found for this customer.

There is no match found for given Customer Name.

Please enable "Auto Creation of List Entities (Vendor, Customer)" feature in import settings to create the customer automatically

No matching vendor found (or) could be created for the provided details.

There is no match found for given Vendor Name.

Please enable "Auto Creation of List Entities (Vendor, Customer)" feature in import settings to create the customer automatically.

If the currency field has some value, Please enable Multi Currency feature in QuickBooks .

Business Validation Error: There is no account associated with the item "XXXXX". Is it marked for purchase, and has an account associated with it?

Please assign the Expense Account for Product / Service "XXXXX" in your QuickBooks Online.

Business Validation Error: You must select a customer for each split line that is billable.

Please enable the below features in your QuickBooks Online.

Track expenses and items by customer

Make expenses and items billable