How to Import Bills into QuickBooks Online (UK, AU, CA, IN, FR & Other Regions)?

August 20, 2025

At a glance

Import Bills in bulk from CSV or Excel using SaasAnt Transactions Online. Best for vendor bills with Category or Item lines.

Applies to

Product: SaasAnt Transactions Online

Entity: Bills

Before you begin

Connect your QuickBooks Online company to SaasAnt Transactions Online from the QuickBooks App Store. A free trial is available.

Supported files: CSV, XLSX, XLS, XLSM, TXT, Google Sheets. You can even capture data from PDF and image files.

Vendors must exist or be auto created. Turn on Auto Create List Entities in Import Settings if needed.

To mark lines billable, enable these in QuickBooks Online: Track expenses and items by customer and Make expenses and items billable.

If you use multi currency, enable it in QuickBooks and ensure the Vendor currency matches your file’s Currency Code.

Use a small test file first to validate mapping.

Steps to Import Bills into QuickBooks Online

To import Bills into QuickBooks Online using the SaasAnt Transactions (Online) application, follow the steps below

Sign in to SaasAnt Transactions Online.

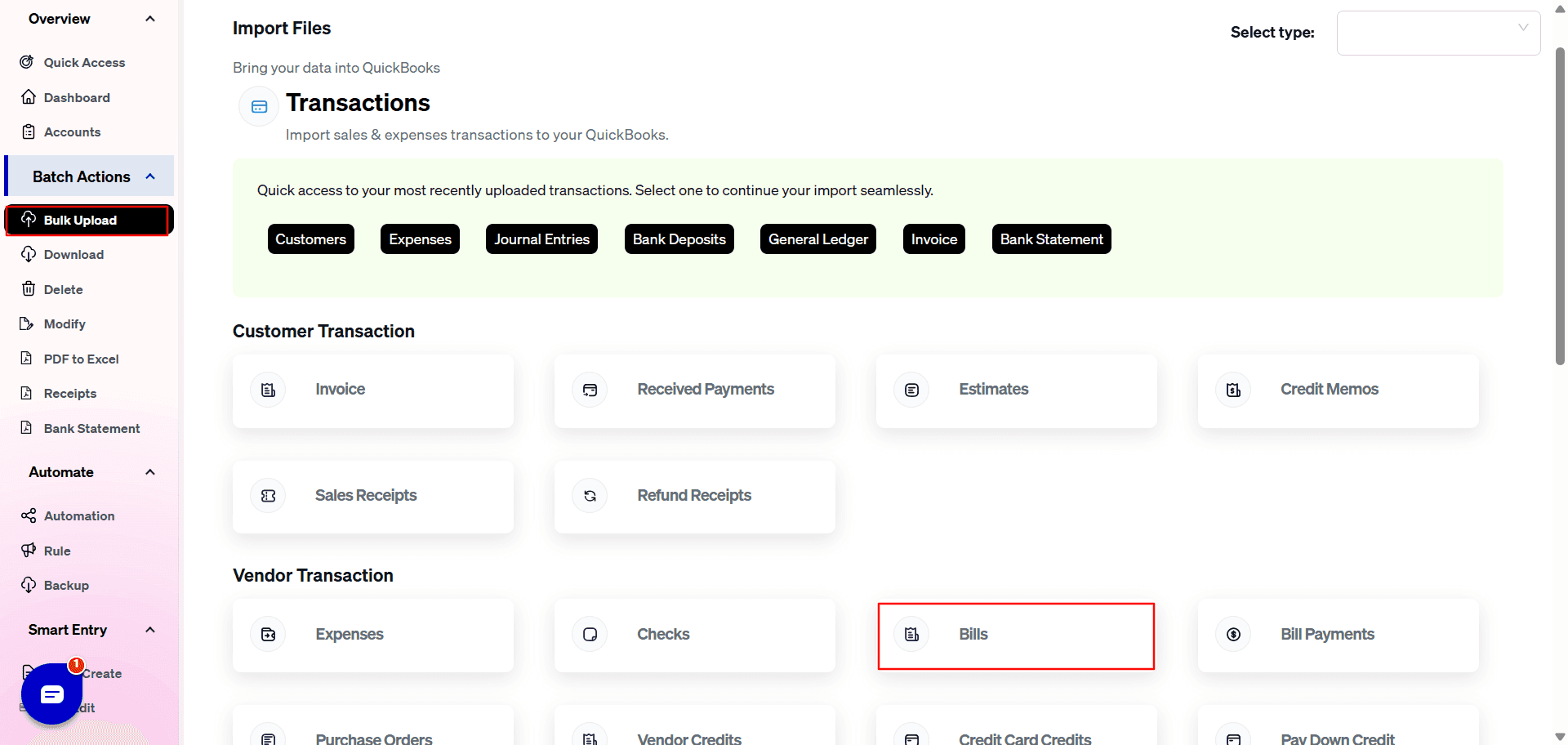

Open Bulk Upload.

From the entity list, choose Bills.

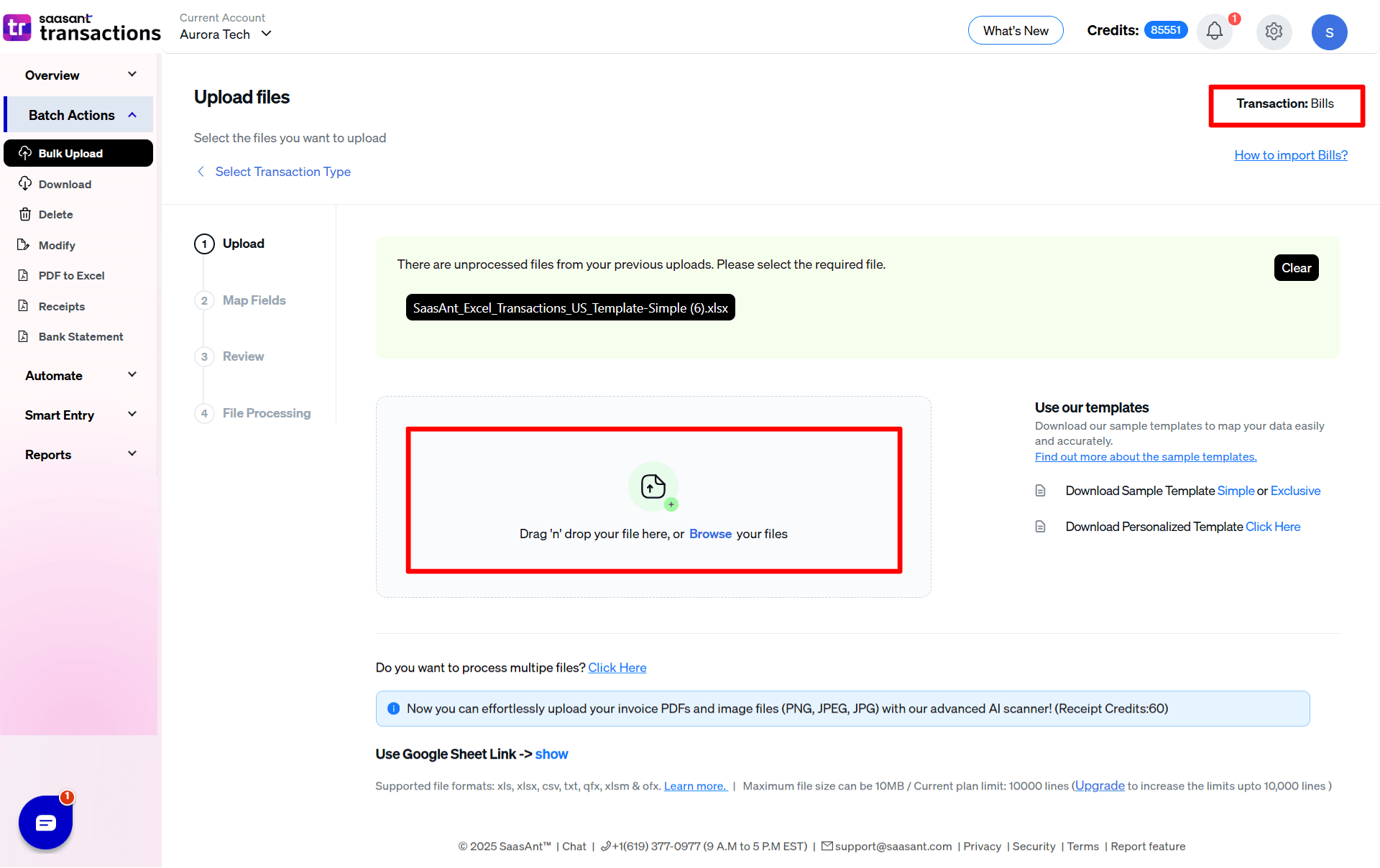

Click Upload and select your file.

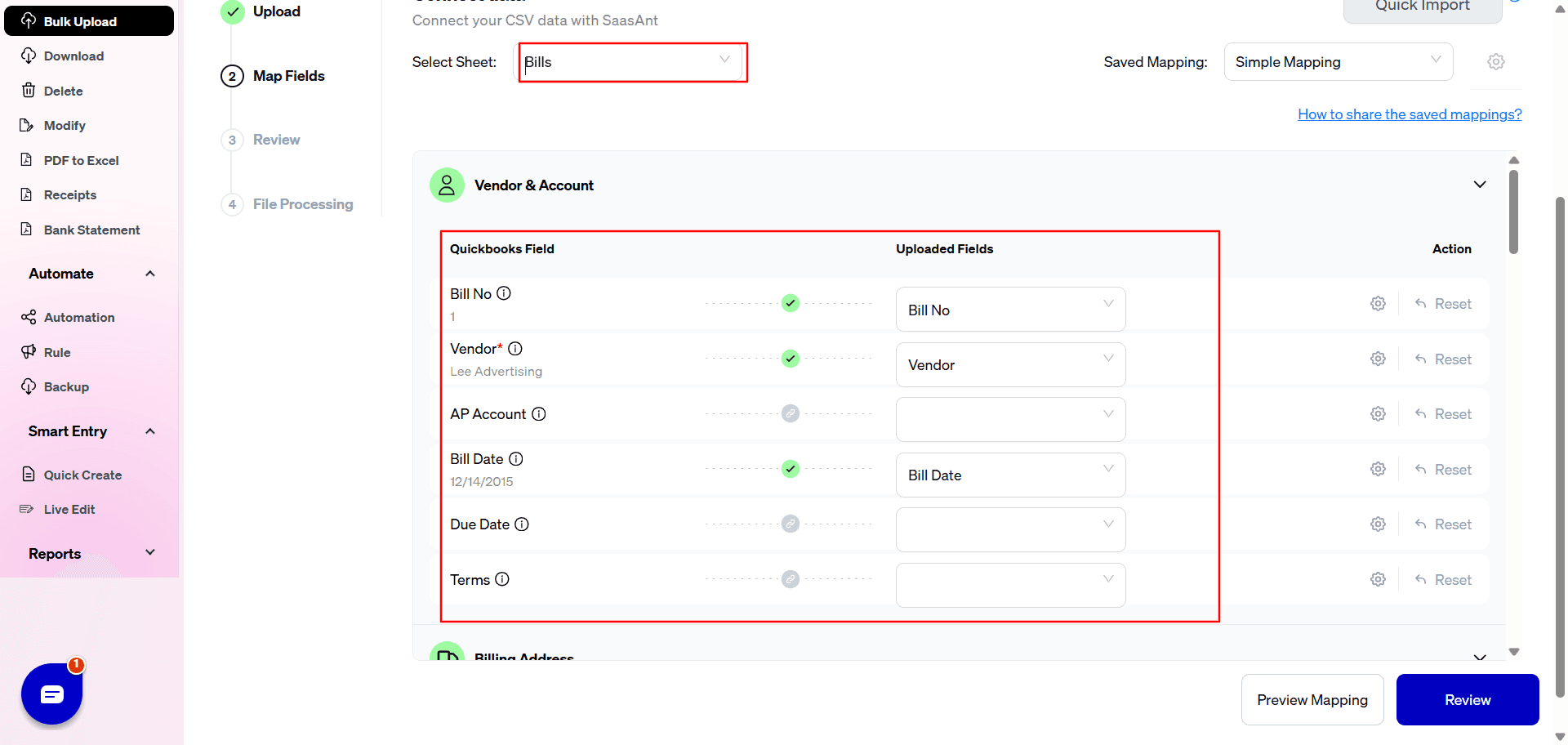

Map your columns to SaasAnt fields. Click Preview Mapping to verify alignment with the QuickBooks bill screen.

Click Review and fix any flagged rows.

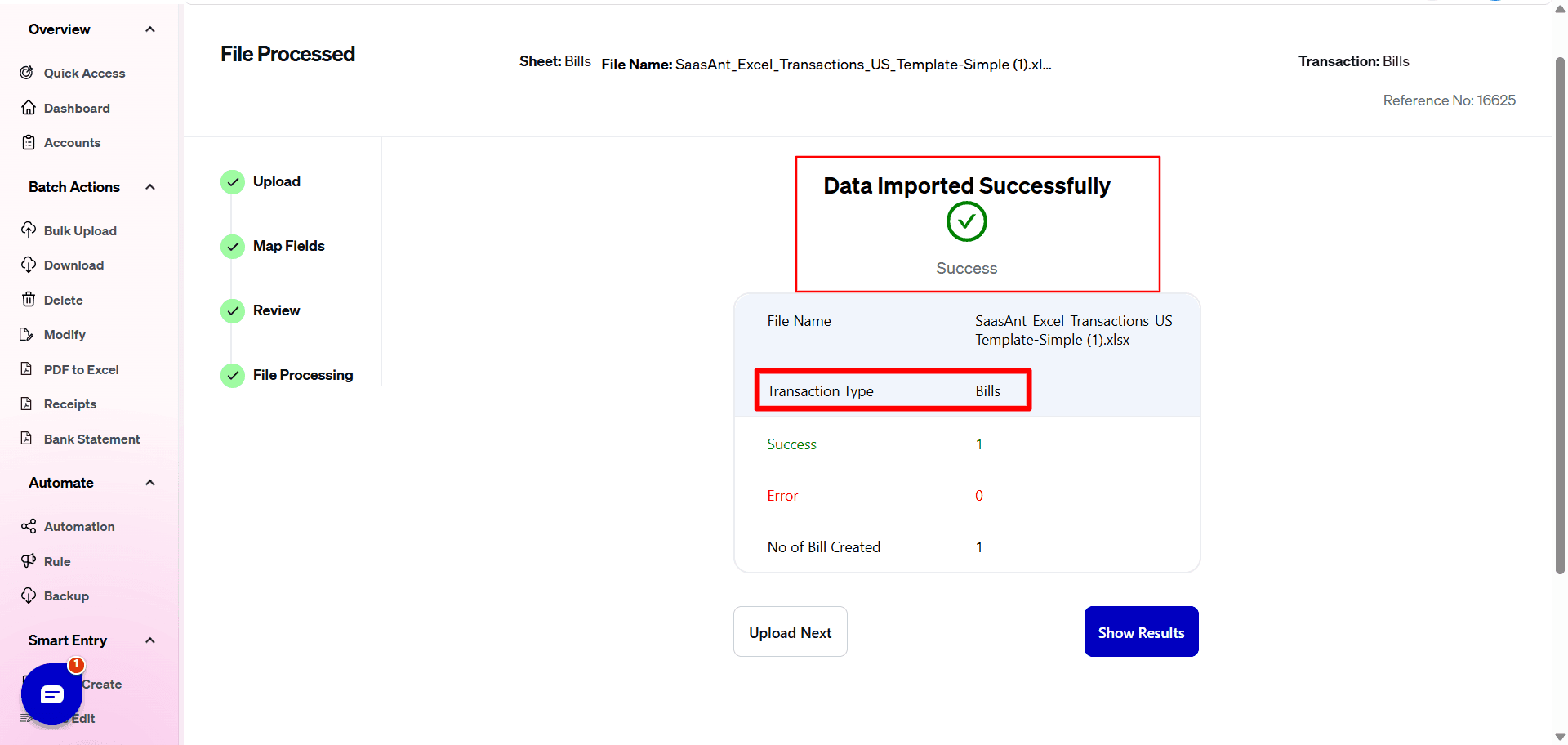

Click Import.

Download the error file if any rows failed, correct them, and reimport only those rows.

SaasAnt Transactions (Online) Fields

Field Name | Format | Description |

|---|---|---|

Bill No | 21 Characters | Reference number for the transaction. |

Vendor | Characters | Name of the vendor / Customer / Employee for this transaction. |

Account | Characters | Name of the Bank / Credit Card / Cash Account for this transaction. |

Bill Date | Date | The date entered by the user when this transaction occurred. |

Due Date | Date | Date when the payment of the transaction is due. |

Terms | 4000 Characters | Reference to the terms for the Bill. |

Memo | 4000 Characters | The Note about the Bill Transaction. |

Mailing Address Line 1 | 500 Characters | First line of the address. |

Mailing Address Line 2 | 500 Characters | Second line of the address. |

Mailing Address Line 3 | 500 Characters | Third line of the address |

Mailing Address City | 255 Characters | City name. |

Mailing Address Postal Code | 31 Characters | Postal code (zip code for USA and Canada). |

Mailing Address Country | 255 Characters | Country name |

Mailing Address Country Sub Division Code | 255 Characters | Region within a country |

Global Tax Calculation | Characters | Method in which tax is applied.

|

Expense Account Or Category Account | Characters | Reference to the Expense Account Name associated with the billing. |

Expense Description Or Category Description | 4000 Characters | Free form text description of the Expense. |

Expense Line Amount Or Category Line Amount | Decimal | The amount of the line item. |

Expense Billable Status Or Category Billable Status | Boolean | The billable status of the expense. |

Expense Markup Percent Or Category Markup Percent | Decimal | The Markup value in Percentage for the expense. |

Expense Customer Or Category Customer | Characters | Reference to the Customer associated with the expense. |

Expense Class Or Category Class | Characters | Reference to the Class for the Expense. |

Expense Tax Code Or Category Tax Code | Characters | Reference to the Purchase Tax Code |

Expense Account Tax Amount or Category Tax Amount | Decimal | The calculated tax amount for an Expense Account line . Applicable only for Tax calculated Transactions. This value will be ignored for Tax Inclusive Transactions. |

Line Item | Characters | Reference to the Item. |

Line Item Description | 4000 Characters | Description of the Item. It will be populated from Item description entered in QuickBooks Online. |

Line Item Quantity | Decimal | The Quantity of the Item. |

Line Item Rate | Decimal | The Unit Price of the Item. |

Line Item Amount | Decimal | The Total Amount of the Item. Not required if Line Item Quantity & Line Item Rate is present. |

Product/Service Expense Account | Characters | Expense Account Name or Number used in automatic product creation. |

Line Item Billable Status | Boolean | The billable status of the Item. |

Line Item Tax Code | Characters | The purchase tax code for the line Item. |

Line Item Tax Amount | Decimal | The calculated tax amount for a product line . Applicable only for Tax calculated Transactions. This value will be ignored for Tax Inclusive Transactions. |

Line Item Markup Percent | Decimal | The Markup value in Percentage for the Item. |

Line Item Customer | Characters | The Customer name for the Item. |

Line Item Class | Characters | The Class name for the Item. |

Location | Characters | The location of the transaction. |

Currency Code | Characters | The Currency Code for this transaction. |

Exchange Rate | Decimal | The exchange rate of the given currency against the home currency. |

Print Status | Boolean | TRUE / FALSE |

FAQs

Most of us would have questions while moving data to your QuickBooks Online. Some of them for your reference below:

Will your application support Multi Line Transactions?

Yes. It will. More Info...

I made some mistakes in the mapping. Your application imported wrongly. So my QuickBooks file got corrupted. Is there any way to undo or revert?

Sometimes, it happens due to the wrong mapping. It is possible to delete the entire transactions which went bad. Our DELETE feature is the rescue. More Info...

I want to import Bills using SKU's. Is it supported?

Yes. It is. You need to enable a couple of settings while importing. More Info...

I want to get an email for each upload. Is it possible?

Yes. It is. You need to enable a couple of settings while importing.

Does your app support taxes?

Yes. It does. Tax model.

I don't want to create products automatically for my invoices. I can't create products before each upload. Is it supported?

Yes. It is. You need to enable a couple of settings while importing. However, you can control this behavior. More Info...

My file has some specific date format. I don't want to change the file. Will your product support all date formats?

Yes. You can select the specific date format as per your requirements. More Info...

Do you have any sample templates?

Yes. We do have. Sample template for Imports.

What are the file types supported by your application?

txt, CSV, xls, xlsx files

How do I report the issues if I stuck?

Feel free to drop an email to support@saasant.com

Possible Failures & Troubleshooting Tips

The currency of the transaction is invalid for the customer/vendor/account.

The given Currency is different than the default currency of the vendor. Please refer to the Vendor's Currency in QuickBooks & update the same currency in the Currency Field. It is possible that Multi Currency feature in QuickBooks could be disabled. Please enable the feature.

Required parameter(s) missing:Line

Please provide at least one Item Line or Expense Account Line Details to process.

Transaction amount (Sum of line amounts) must be 0 or greater.

Please provide the valid (Non Negative) amounts in Line Item Amount and Expense Amount.

No matching Product/Service found (or) could be created for the provided details.

Please provide a valid name in the Product Field. You might have disabled "Auto Create List Entities" Feature in Import Settings. By enabling this feature, QuickBooks will automatically create the product for the transaction.

Duplicate Document Number Error : You must specify a different number. This number has already been used.

There is another Expense that has the same reference number. Please use another reference number.

You have disabled "Assign Transaction Numbers from file" in Import Settings. By enabling this feature, QuickBooks will automatically assign numbers for the transaction.

Invalid value for Global Tax Calculation.

Please provide one of the below values

TaxInclusive

TaxExlcuded

NotApplicable

One or more transaction lines do not have a tax code associated with it. Please assign a tax code for those line.

You have mentioned "Global Tax Calculation" as TaxIncluded or Tax Excluded, but the Tax code is missing for the line items. Please change the "Global Tax Calculation" to "NotApplicable" or provide valid Tax Code for each line item

No matching reference found for this account.

Please provide valid Expense account name in "Account" field.

Invalid account type: You need to select a different type of account for this transaction.

Please provide valid Expense account name in "Account" field.

Amount is missing in the request.

The Line Item amount is missing for the particular line item.

The required parameter Line Amount is missing in the request.

The Line Item amount is missing for the particular line item.

Please check in QuickBooks company settings to see if the appropriate preferences are enabled to successfully upload the current data set. E.g., Shipping, Multi-Currency, etc.

If you have provided Shipping Address or Currency, then please make sure you have enabled "Shipping & Multi-Currency" feature in QuickBooks Online.

Requested entity/feature (Billable Expense) is not supported by QuickBooks per your subscription.

Billable Customer or Expense feature is not available for your QuickBooks Online Subscription. Please remove the values in Billable Fields (Expense Billable, Line Item Billable).

No matching reference found for this customer.

There is no match found for given Customer Name.

Please enable "Auto Creation of List Entities (Vendor, Customer)" feature in import settings to create the customer automatically.

No matching vendor found (or) could be created for the provided details.

There is no match found for given Vendor Name.

Please enable "Auto Creation of List Entities (Vendor, Customer)" feature in import settings to create the customer automatically.

If the currency field has some value, Please enable Multi-Currency feature in QuickBooks.

Business Validation Error: There is no account associated with the item "XXXXX". Is it marked for purchase, and has an account associated with it?

Please assign the Expense Account for Product / Service "XXXXX" in your QuickBooks Online.

Business Validation Error: You must select a customer for each billable split line.

Please enable the below features in your QuickBooks Online.

Track expenses and items by customer

Make expenses and items billable.