How to Import Bill Payments into QuickBooks Online (UK, AU, CA, IN, FR & Other Regions)?

August 19, 2025

You can import Bill Payments from Excel spreadsheets or text files directly into QuickBooks Online using the SaasAnt Transactions (Online) application.

Pre Requisites:

Connect your QuickBooks Online to SaasAnt Transactions (Online) App from QuickBooks AppStore by clicking the "Get App Now" button. You can get a free trial of the product in the QuickBooks AppStore.

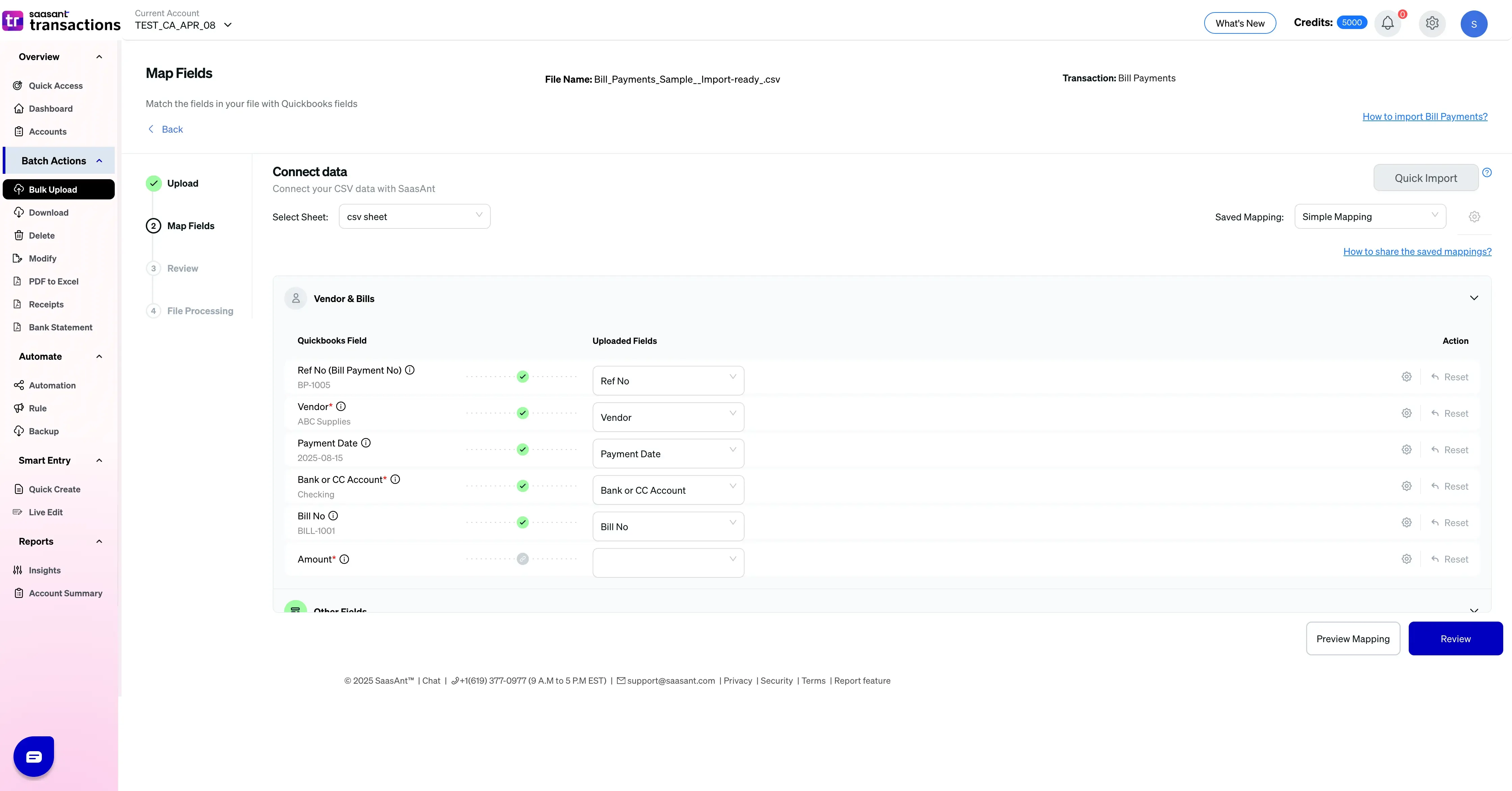

The important step in the import is to map your file headers to the QuickBooks field in Step 3 of the import. Some key steps below:

You need to map your file headers to "SaasAnt Transactions (Online)" fields.This mapping will enable us to import your transactions properly in to QuickBooks company.

In the mapping screen, we have the "Preview Mapping" button which can help you to visualize your current mappings as per the QuickBooks screen with your file headers.

Please refer basics of field mappings for more info. If you have any confusion or doubts, feel free to drop an email to support@saasant.com.

How to import Bill Payments into QuickBooks Online

1) Login into SaasAnt Transaction Online

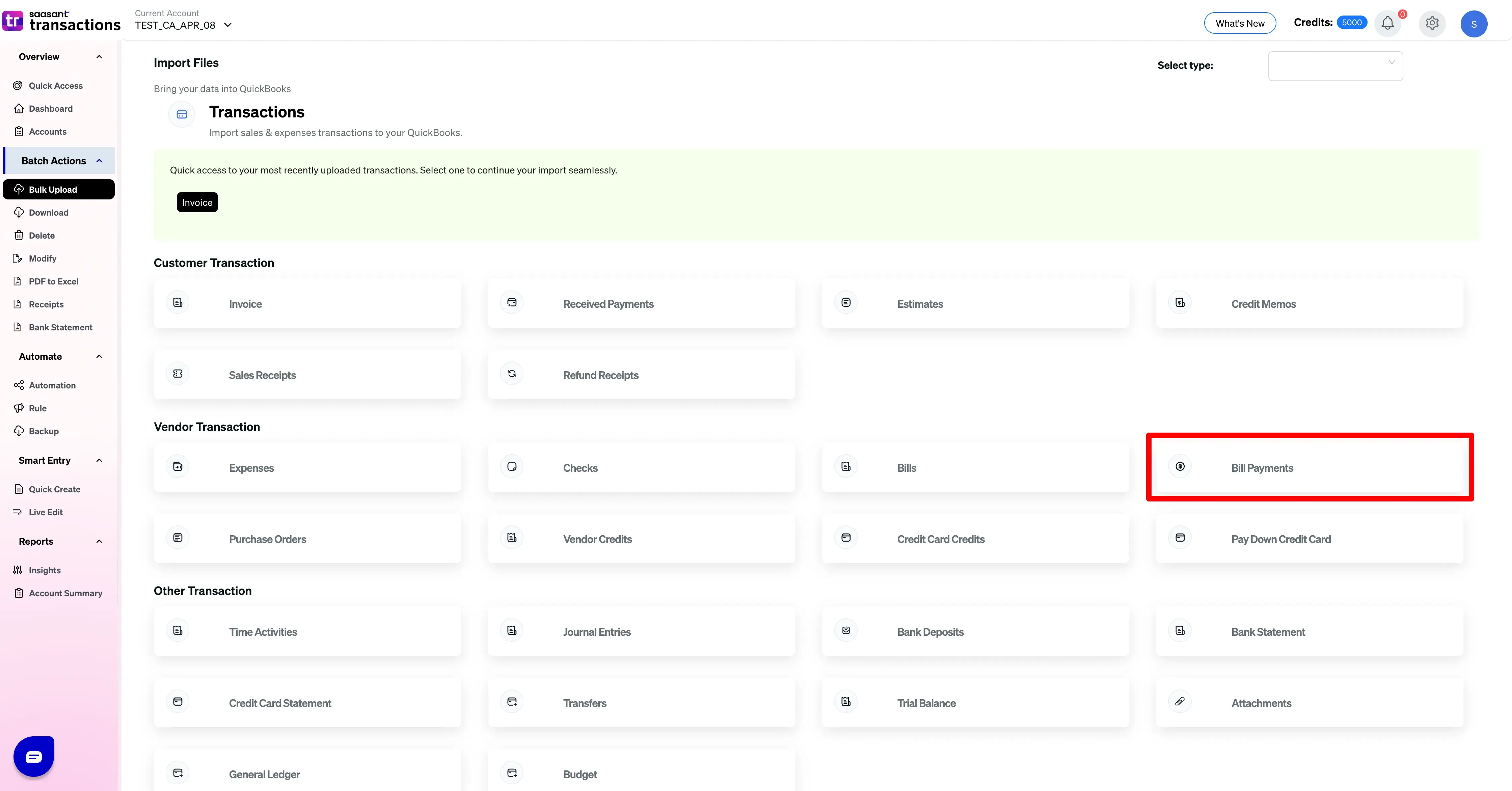

2) Select the Bulk Upload Menu

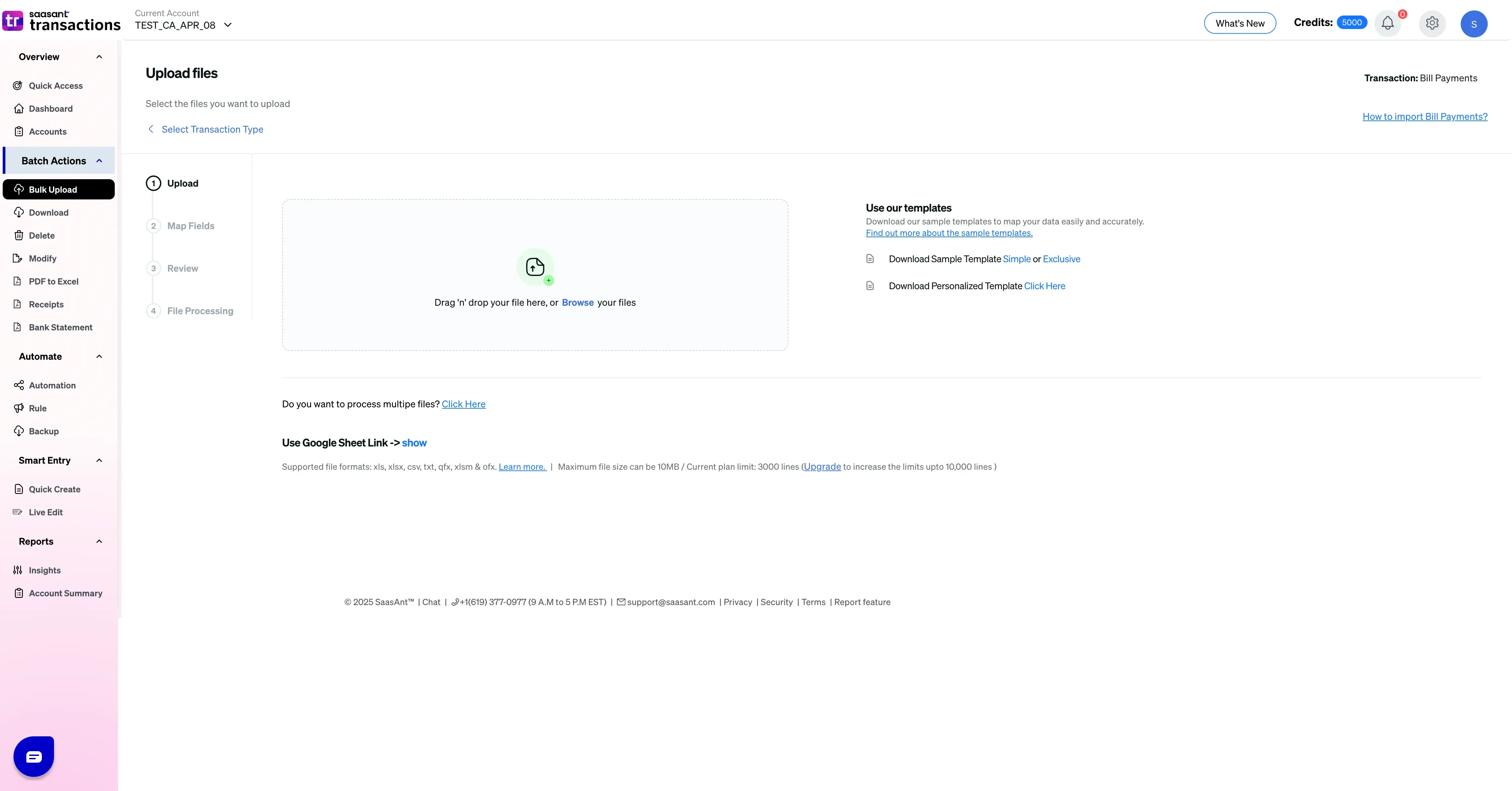

6) Select the files you want to upload

7) On Mapping, map your columns to QuickBooks fields. Use Auto map if available and save your mapping for next time.

8) Select the "Preview Mapping" button to visualize current mapping based on QuickBooks

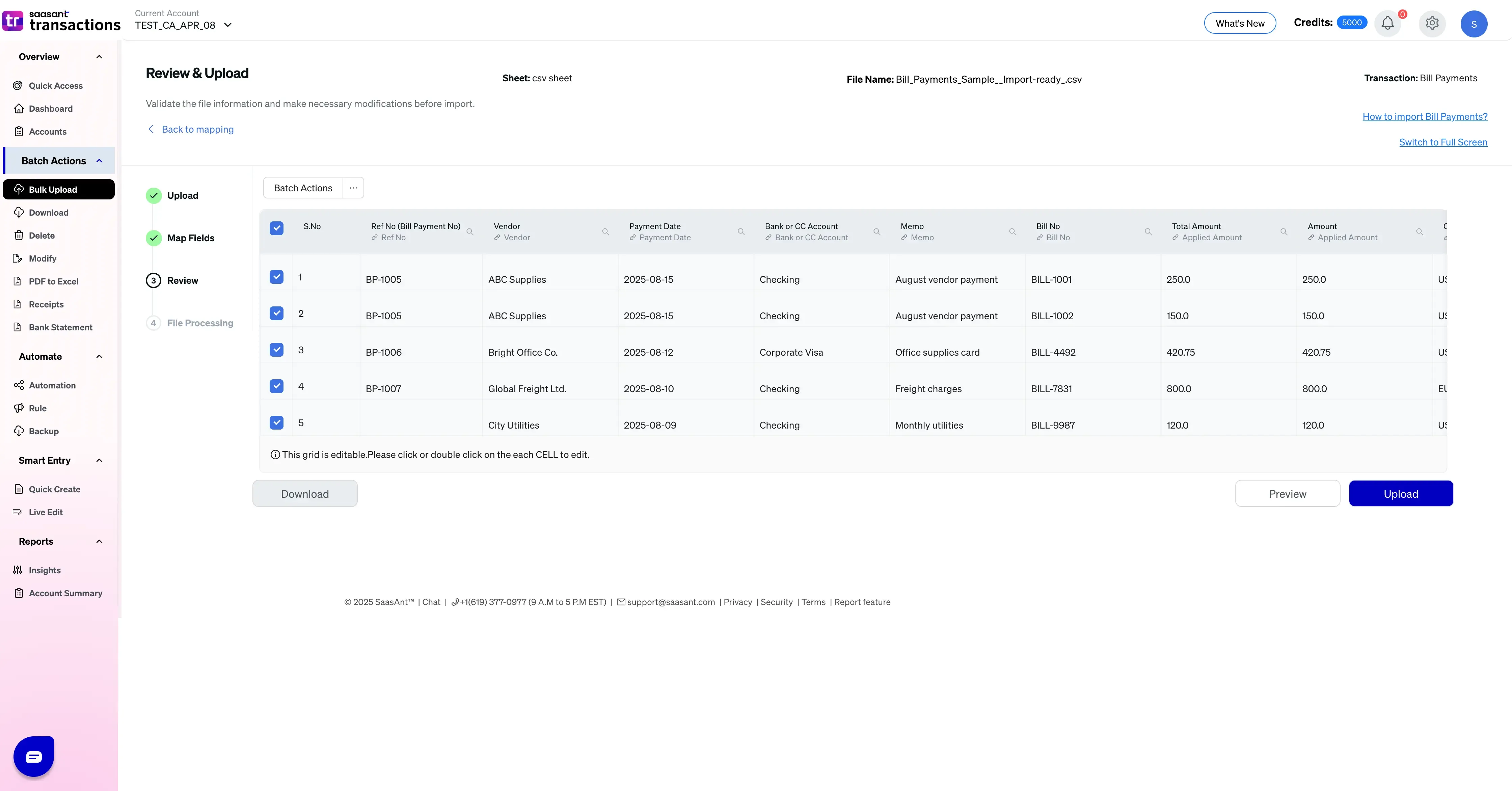

9) Click 'Review' once you confirm the mapping. You can make changes to any field in this screen and download the final input you are going to import as Excel.

10) Click 'Upload' and wait for the import to progress.

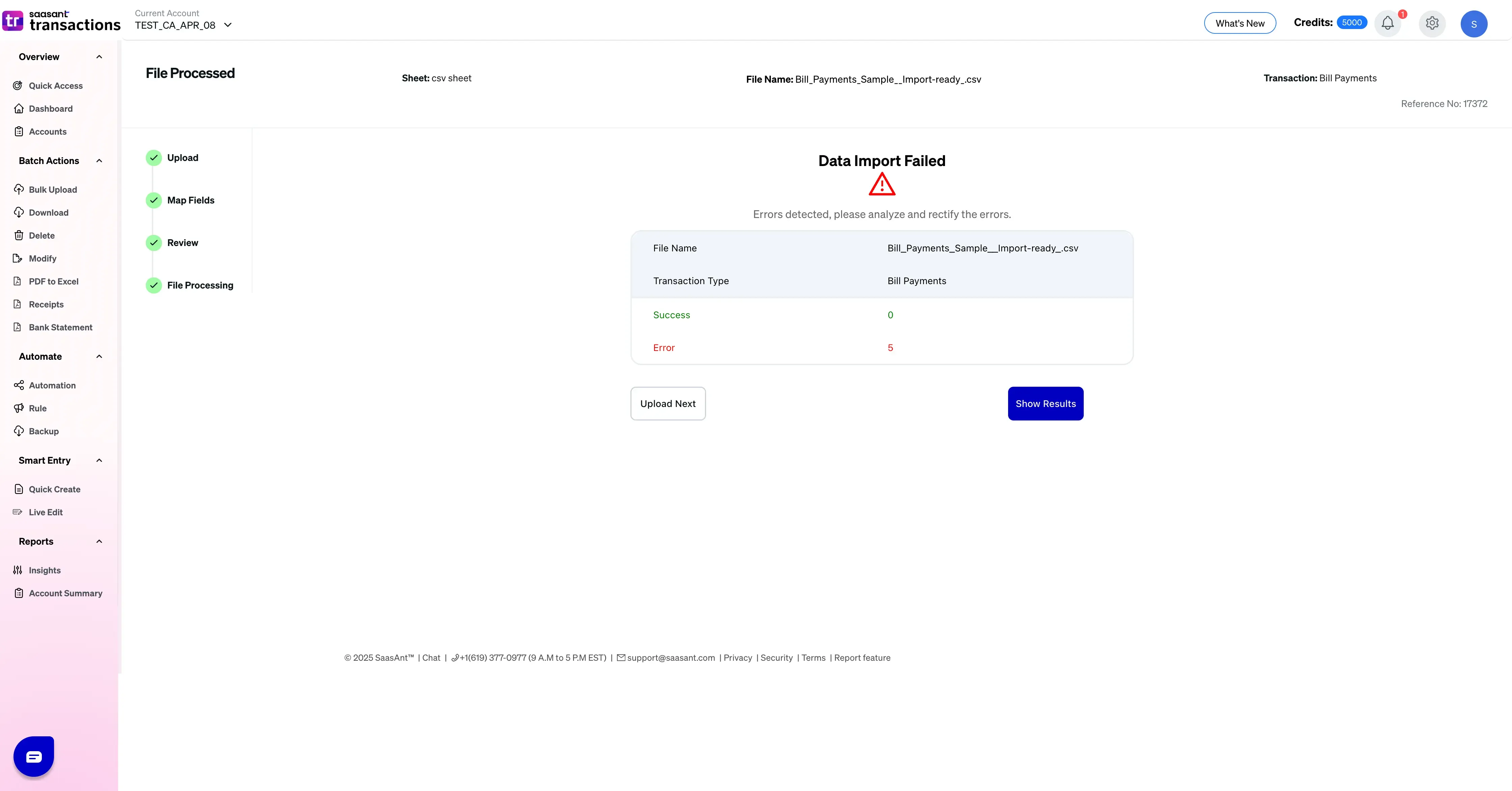

11) You will get the import summary with successful import details and errors (if the import failed). You can check the errors and correct them to finish the import successfully.

SaasAnt Transactions (Online) Fields

Field Name | Format | Description |

|---|---|---|

Ref No | 21 Characters | Reference number for the transaction. |

Vendor | Characters | Name of the vendor for this transaction. |

Payment Date | Date | The date entered by the user when this transaction occurred. |

Bank or CC Account | Characters | Name of the bank account / Credit card Account. |

Memo | Characters | Note about the bill payment. |

Bill No | Characters | The reference number of the bill being paid. |

Amount | Decimal | The total Amount of the Bill Payment. |

Currency Code | Characters | The currency code for this Bill Payment. |

Exchange Rate | Decimal | The exchange rate of the given currency against the home currency. |

Print Status | Boolean | The Print Status of the Bill Payment. |

FAQ's

Most of us would have some questions while moving data to your QuickBooks Online. Some of them for your reference below:

Will your application support Multi Line Transactions?

Yes. SaasAnt supports multi-line imports for most sales and expense transactions. You can structure lines either as multiple rows per transaction or with columns that represent repeated line sets. Make sure “Process each line as an individual transaction” is turned off if you want rows to combine into one transaction. Use the multi-line guides to map header fields and line fields correctly. More Info...

I made some mistakes in the mapping. Your application imported wrongly. So my QuickBooks file got corrupted. Is there any way to undo or revert?

Yes. Use SaasAnt’s Delete feature to remove the imported transactions, then fix the file or mapping and re-import. You can target deletes by date range, reference number, or type. Note that bank-feed transactions brought in through QuickBooks' Banking tab cannot be deleted by SaasAnt until they are unlinked in QuickBooks. More Info...

I want to get an email for each upload. Is it possible?

Yes. Turn on “Email me the Import Summary Report” in Import Settings to receive a completion email for each run. If you automate via Email or Zapier, you will also receive confirmation and error summaries as files are processed. More Info...

Does your app support taxes?

Yes. For QBO companies with tax enabled, provide the correct Tax Code at the line or header level. SaasAnt maps your code and lets QuickBooks calculate tax; you do not import a tax amount directly. For non-US companies, use Global Tax Calculation as needed. Tax model.

I don't want to create products automatically for my invoices. I can't create products before each upload. Is it supported?

Yes. It is. You need to enable couple of settings while importing. However. you can control this behavior. More Info...

My file has some specific date format. I don't want to change the file. Will your product support all date formats?

Yes. You can select the specific date format as per your requirement. More Info...

Do you have any sample templates?

Yes. We do have. Sample template for Imports.

What are the file types supported by your application?

For almost all entities in QuickBooks Online, SaasAnt Transactions Online supports XLS, XLSX, XLSM, CSV, TXT, Google Sheets, and IIF. Additionally, PDF, PNG, and JPEG are supported only for Receipts, Invoices, Bank Statements, Checks, and Expenses.

How do I report the issues if I stuck?

Feel free to drop an email to support@saasant.com

Possible Failures & Troubleshooting Tips

The currency of the transaction is invalid for customer / vendor / account.

The given Currency is different than the default currency of the Customer. Please refer the Vendor's Currency in QuickBooks & update the same currency in Currency Field.

Duplicate Document Number Error : You must specify a different number. This number has already been used.

There is an another Payment has the same reference number. Please use the another reference number.

You have disabled "Auto Create List Entities" in Import Settings. By enabling this feature, QuickBooks will automatically assign numbers for the transaction.

Invalid account type: You need to select a different type of account for this transaction.

Please provide valid deposit account in "Account" field.

No matching Bill found for given Bill No.

Kindly provide the valid Bill Number in "Bill No" Field.

Line amount should be greater than zero.

Please provide positive value in Amount Field.

Bill No. cannot be linked by QuickBooks. Check if, Bill No. matches with given Vendor.

Kindly provide the valid Bill Number & corresponding Vendor Name.

No matching vendor found (or) could be created for the provided details.

There is no match found for given Vendor Name.

Please enable "Auto Creation of List Entities (Vendor, Customer)" feature in import settings to create the Vendor automatically.