How to Import Invoices into QuickBooks Online (U.S)?

August 20, 2025

Manual data entry has become a thing of the past now. A user can easily import bulk/batch invoices from Excel/spreadsheets/IIF/CSV/Text files directly into QuickBooks Online using SaasAnt Transactions (Online) in a few clicks. This process does not even take much time.

Here are the below-mentioned steps for users to understand how to import invoices into QuickBooks Online

Pre-Requisites:

A functional QuickBooks Online account

How to Connect QuickBooks Online Account to SaasAnt Transactions Online?

Visit QuickBooks AppStore

Connect your QuickBooks Online account to SaasAnt Transactions (Online) App

Select the "Get App Now" button

Note: Get the 30 day free trial for your QuickBooks Online. No credit card is required.

How to Import Invoices into QuickBooks Online (New User Interface 2.0)

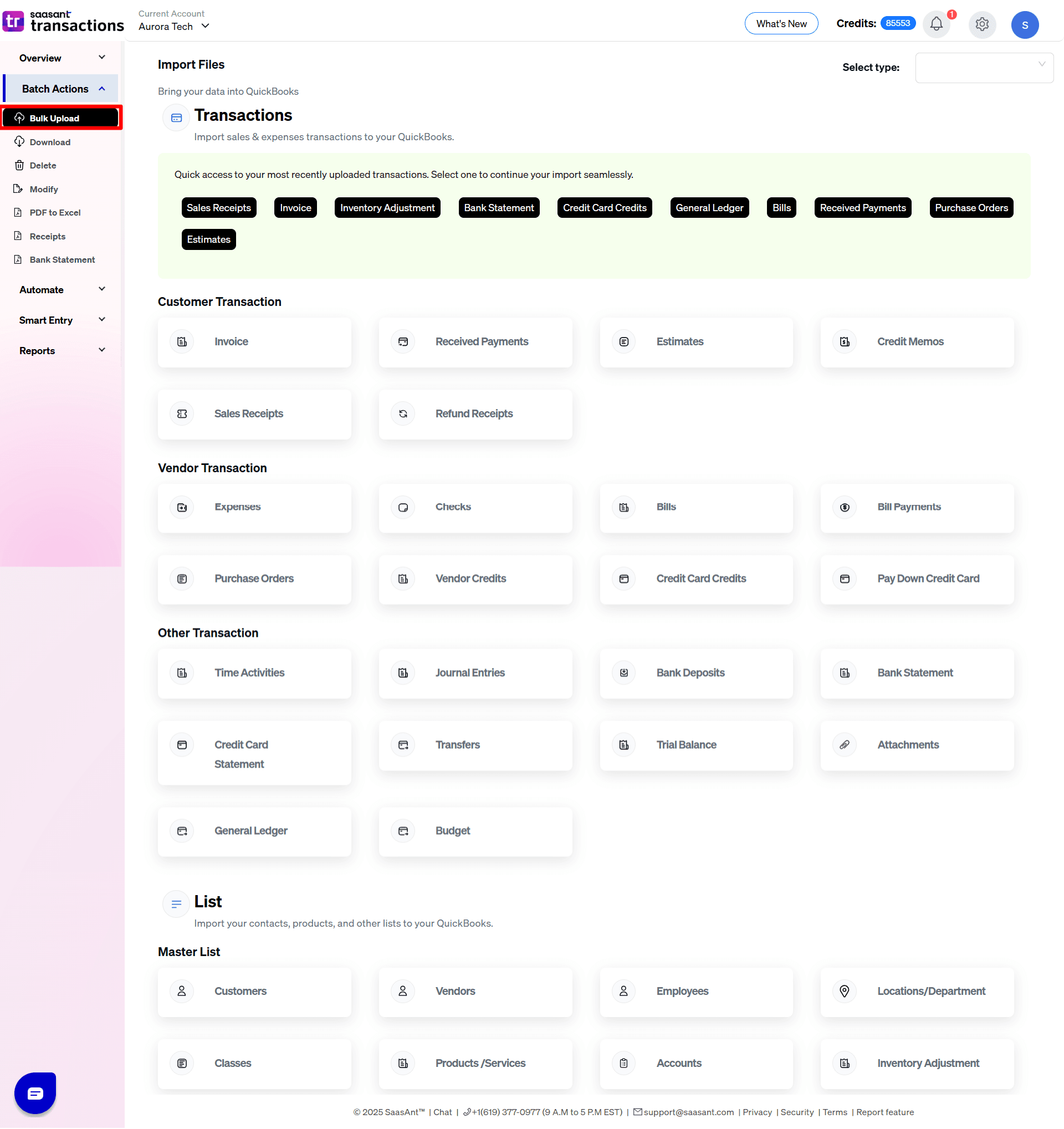

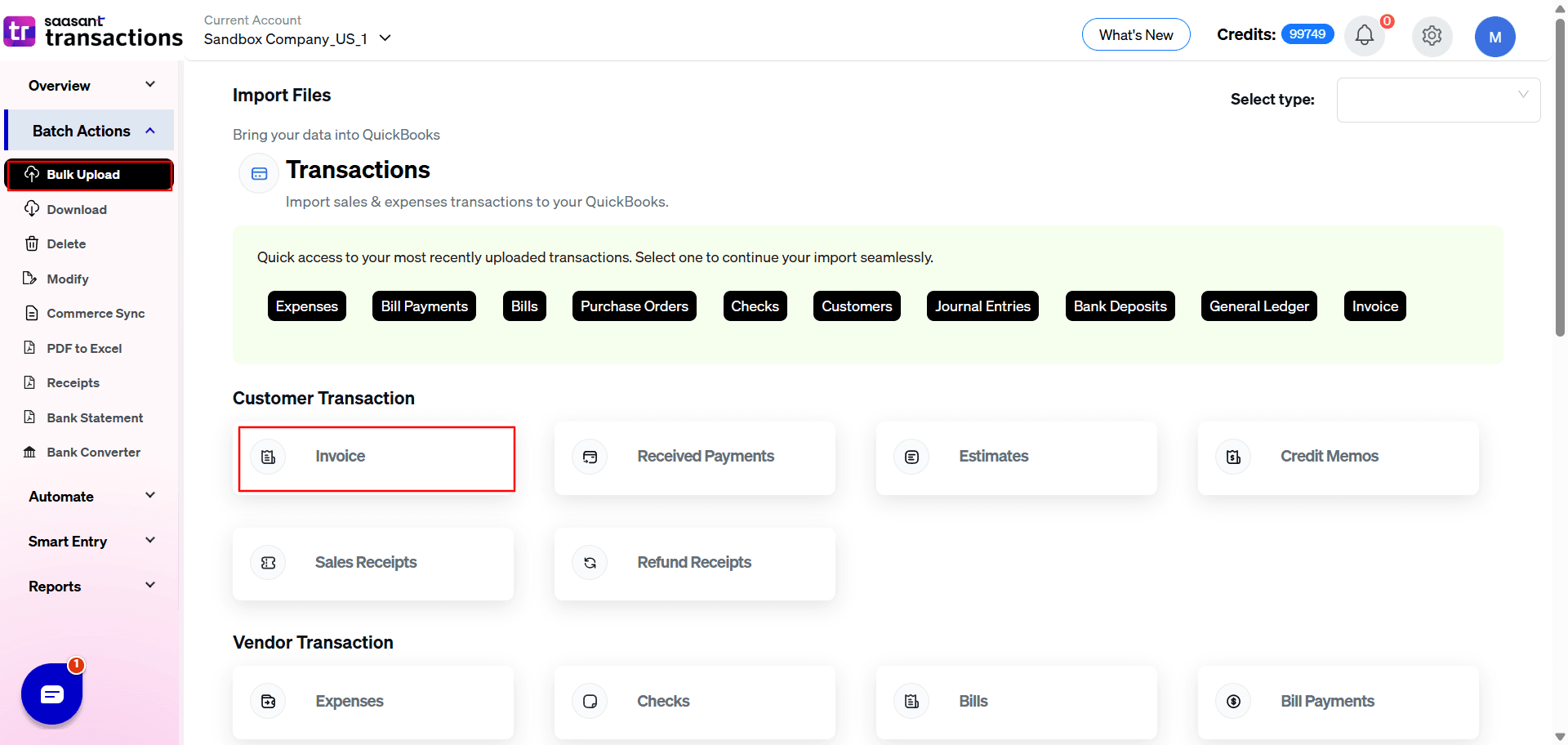

1) Login into SaasAnt Transaction Online

2) Select the Bulk Import Tab.

3) Select the QuickBooks entity as "Invoices"

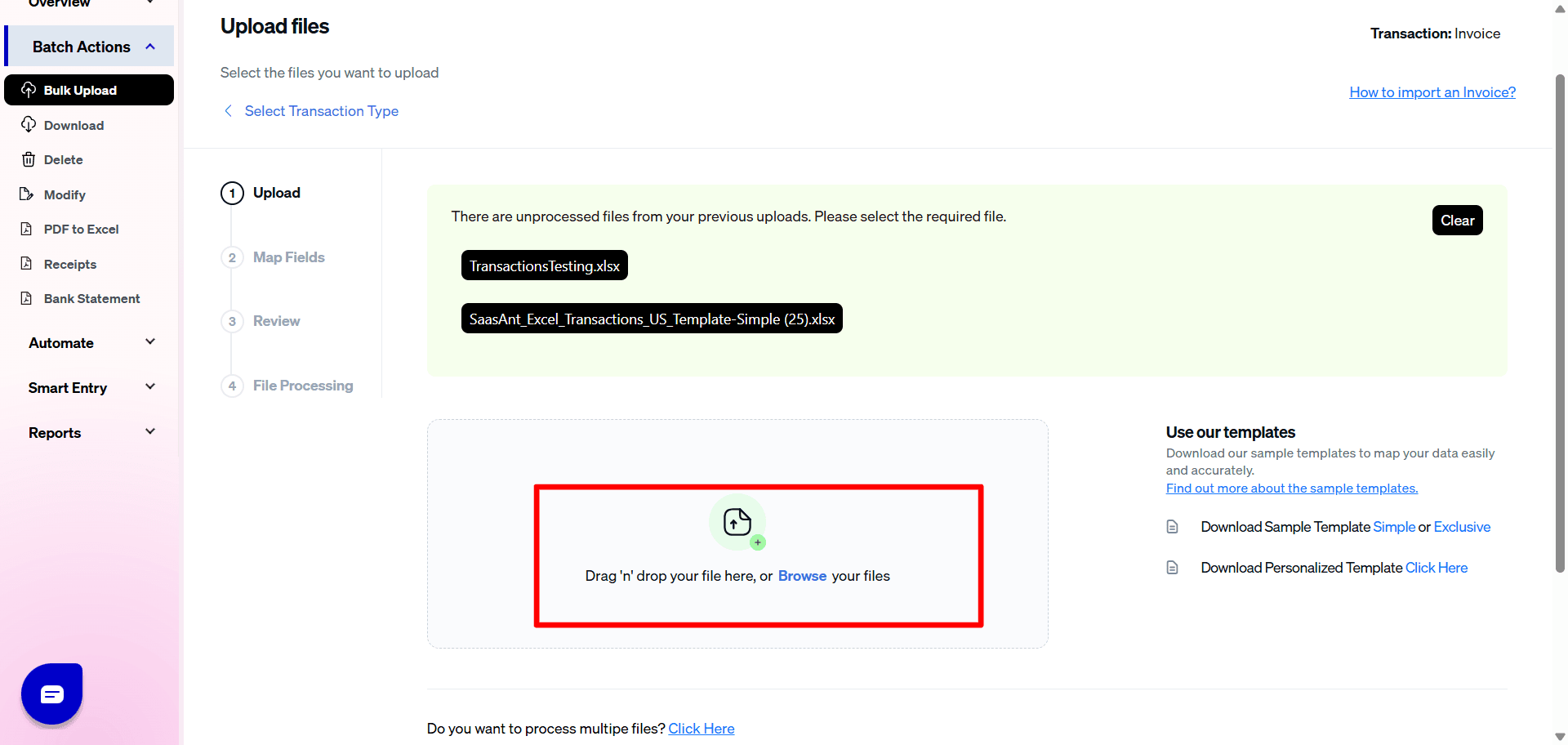

4) Select the files you want to upload

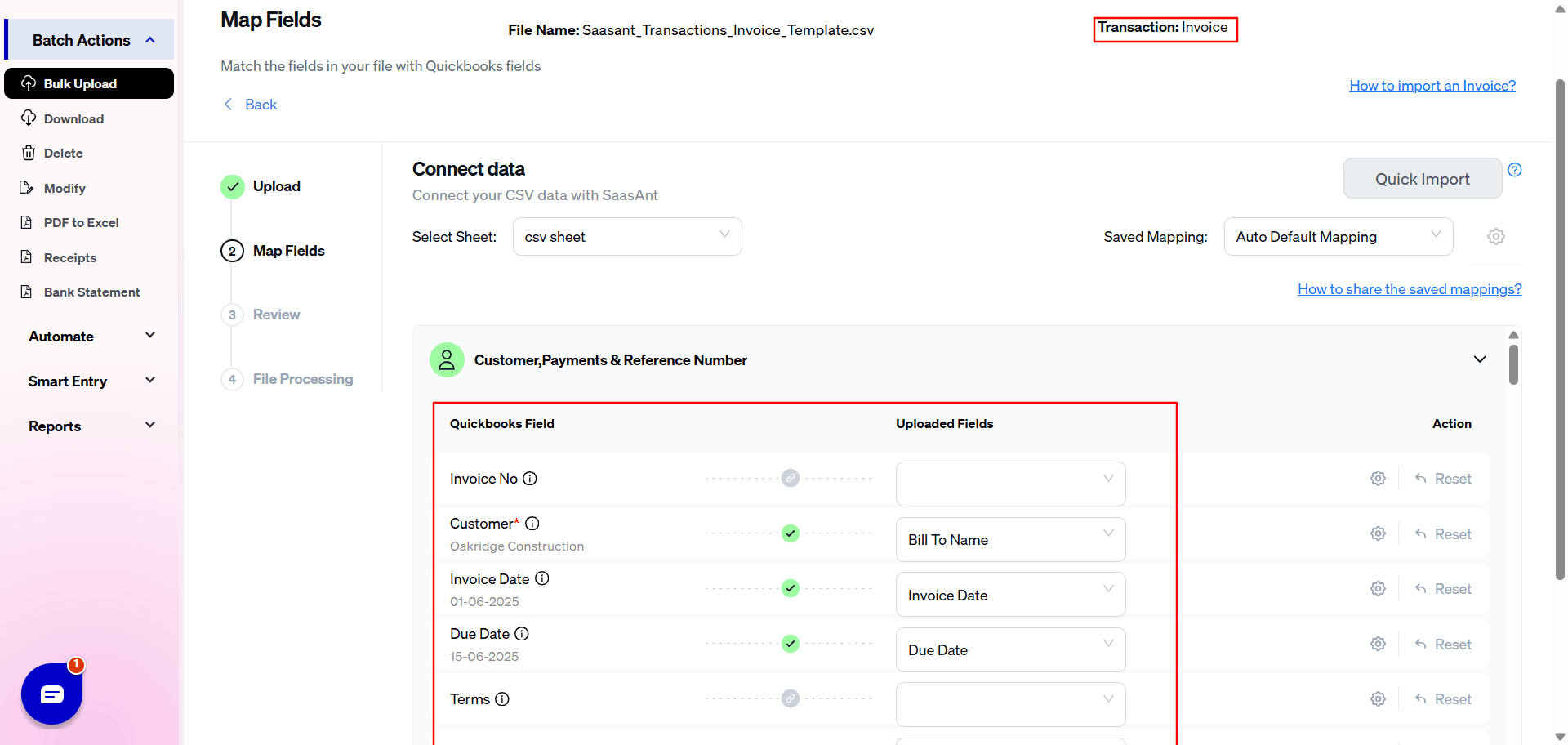

5) Set up the Mapping of the columns in your invoice

6) Select the "Preview Mapping" button to visualize current mapping based on QuickBooks

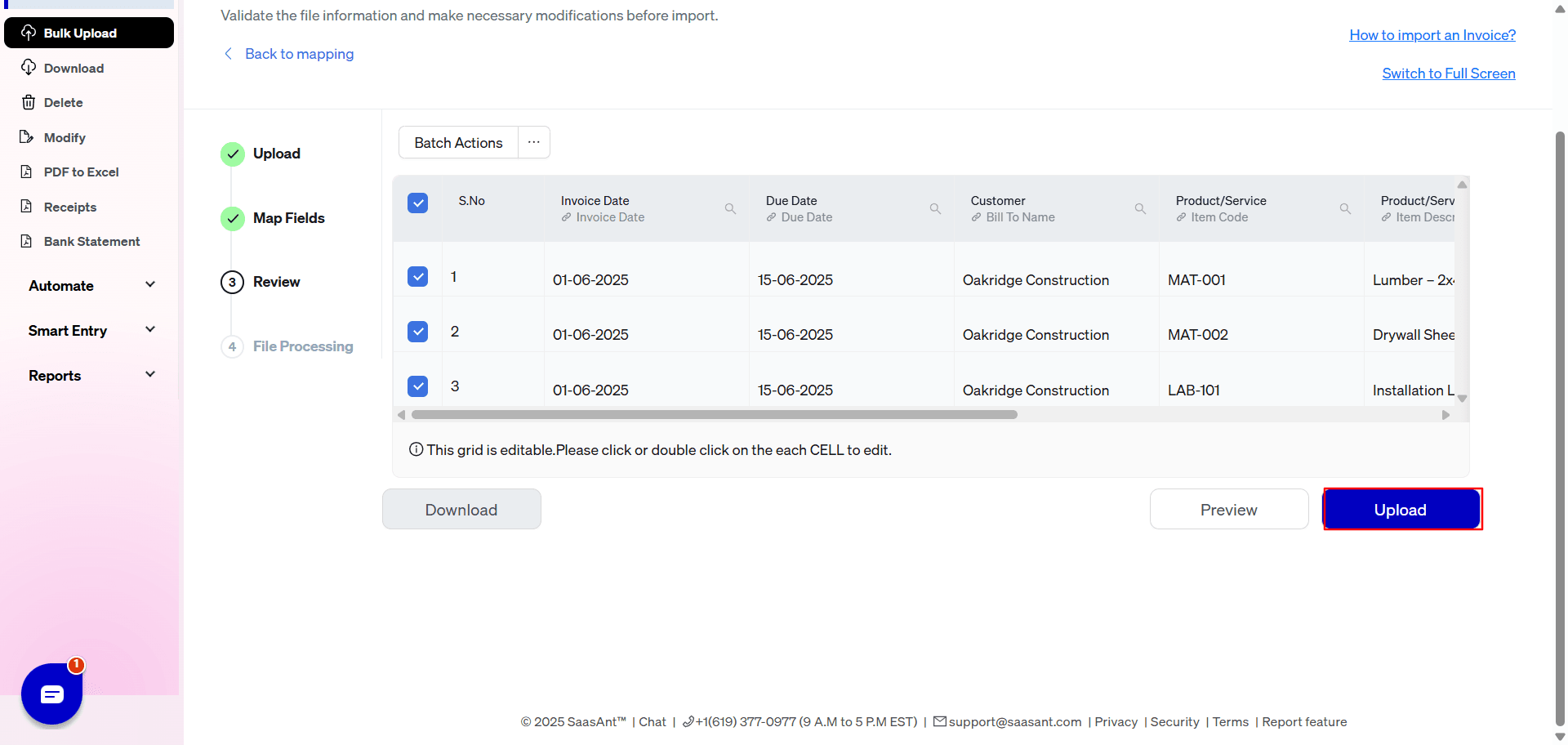

7) Select the Upload Tab

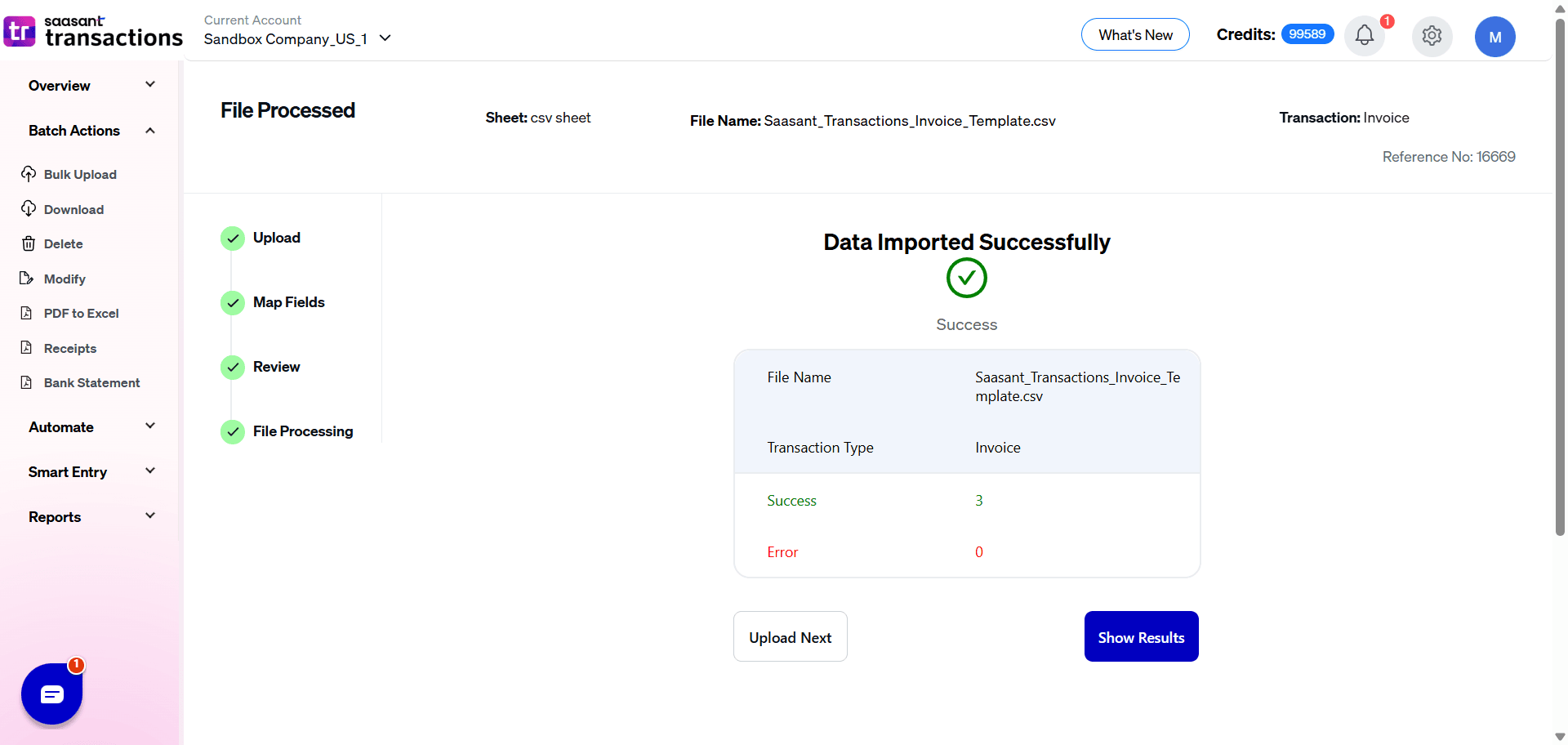

8) The data was imported successfully into QuickBooks.

Let’s have a look at the SaasAnt Transactions Online Fields-

SaasAnt Transactions (Online) Fields:

Field Name | Format | Description |

|---|---|---|

Invoice No | 21 Characters | Reference number for the transaction. By default, this value is used only for internal processing by SaasAnt Transactions (Online), and QuickBooks auto-generates a new value. This can be changed in the import settings. |

Customer | Characters | Name of the customer. |

Invoice Date | Date | Date of the transaction. |

Due Date | Date | Date when the payment of the transaction is due. If date is not provided, the number of days specified in the SalesTermRef added to the transaction date will be used. |

Shipping Date | Date | The date for the delivery of goods or services. |

Ship Via | 30 Characters | Reference to the ShipMethod associated with the transaction. |

Tracking No | 30 Characters | Shipping provider's tracking number for the delivery of the goods associated with the transaction. |

Terms | Characters | |

Billing Address Line 1 | 500 Characters | The first line of the billing address. |

Billing Address Line 2 | 500 Characters | The second line of the billing address. |

Billing Address Line 3 | 500 Characters | The third line of the billing address. |

Billing Address City | 255 Characters | City name. |

Billing Address Postal Code | 31 Characters | Zip code. |

Billing Address Country | 255 Characters | Country name. |

Billing Address State | 255 Characters | State name. |

Shipping Address Line 1 | 500 Characters | The first line of the shipping address. |

Shipping Address Line 2 | 500 Characters | The second line of the shipping address. |

Shipping Address Line 3 | 500 Characters | The third line of the shipping address. |

Shipping Address City | 255 Characters | City name. |

Shipping Address Postal Code | 31 Characters | Zip code. |

Shipping Address Country | 255 Characters | Country name. |

Shipping Address State | 255 Characters | State name. |

Memo | 4000 Characters | Organization-private note about the transaction. This note will not appear on the transaction records by default. |

Message displayed on invoice | 1000 Characters | User-entered message to the customer; this message is visible to end user on their transactions. |

100 Characters | Email address. The address format must follow the RFC 822 standard. | |

Email CC | 100 Characters | CC Email address. The address format must follow the RFC 822 standard. |

Email BCC | 100 Characters | BCC Email address. The address format must follow the RFC 822 standard. |

Print Status | Boolean | Print status. |

Email Status | Boolean | Email status. |

Shipping | Decimal | The shipping amount for this transaction. |

Sales Tax Code | Characters | The TaxCode associated with the sales tax for this transaction. |

Sales Tax Amount | Decimal | Total tax amount for this transaction. |

Discount Amount | Decimal | The discount amount. You may enter either a discount percentage or a discount amount. If the percent is specified, it will override the amount. |

Discount Percent | Decimal | Percentage by which the amount due is reduced, from 0% to 100%. To enter a discount of 8.5% use 8.5, not 0.085. You may enter either a discount percentage or a discount amount. If the percent is specified, it will override the amount. |

Discount Account | Characters | |

Apply Tax after Discount | Boolean | If false or null, calculate the sales tax first, and then apply the discount. If true, subtract the discount first and then calculate the sales tax. |

Service Date | Date | Date when the service is performed. |

Product/Service | Characters | Name of Product/Service |

Product/Service Description | 4000 Characters | |

Product/Service Quantity | Decimal | The number of items for the line. |

Product/Service Rate | Decimal | |

Product/Service Amount | Decimal | |

Product/Service Taxable | Boolean | If TRUE, marks the line amount for Tax calculation. |

Product/Service Class | Characters | The Class name associated with this line. |

Deposit | Decimal | The deposit made towards this invoice. |

Location | Characters | |

Show Sub Total | Boolean | If TRUE, It will add Sub Total Line |

Custom Field Name (1) | 15 Characters | Name of the custom field. |

Custom Field Value (1) | 31 Characters | Value of the custom field. |

Custom Field Name (2) | 15 Characters | Name of the custom field. |

Custom Field Value (2) | 31 Characters | Value of the custom field. |

Custom Field Name (3) | 15 Characters | Name of the custom field. |

Custom Field Value (3) | 31 Characters | Value of the custom field. |

Currency Code | Characters | Reference to the Currency in which all amounts on the associated transaction are expressed. |

Exchange Rate | Decimal | The default is 1, applicable if multi-currency is enabled for the company. |

Enable Online Payment | Boolean | Set True to enable Online Payment |

| Boolean | Set True to enable Intuit Payment |

Enable CreditCard Payment | Boolean | Set True to enable Credit card Payment |

Enable ACH Payment | Boolean | Set True to enable ACH Payment |

FAQ's

Most of us would have questions while moving data to your QuickBooks Online. Some of them for your reference below:

I want to import Invoices with Invoice Numbers into QuickBooks from File. Is it supported?

Yes. It is supported. More Info...

Will SaasAnt Transactions (Online) support QuickBooks Multi-Line Transactions?

Yes. It will. More Info...

I made some mistakes in the mapping. Your application was imported wrongly. So, my QuickBooks file got corrupted. Is there any way to undo or revert?

Sometimes, it happens due to the wrong mapping. It is possible to delete the entire transactions which went wrong. Our DELETE feature is the rescue. More Info...

I want to import Invoices using SKUs. Is it supported?

Yes. It is. You need to enable a couple of settings while importing. More Info...

I want to get an email for each Import. Is it possible?

Yes. It is. You need to enable a couple of settings while importing. More Info...

Are there any specific Import Settings?

Yes. We do have a couple of important settings for import. More Info...

Does SaasAnt Transactions (Online) support taxes?

Yes. It does. Tax model for U.S Companies.

I don't want to create products automatically for my invoices. I can't create products before each upload. Is it supported?

Yes. It is. You need to enable a couple of settings while importing. However, you can control this behavior. More Info...

My file has some specific date format. I don't want to change the file. Will your product support all date formats?

Yes. You can select the specific date format as per your requirements. More Info...

Do you have any sample templates?

Yes. We do have. Sample template for Imports.

What file types does SaasAnt Transactions Online support for QuickBooks Online imports?

For almost all entities in QuickBooks Online, SaasAnt Transactions Online supports XLS, XLSX, XLSM, CSV, TXT, Google Sheets, and IIF. Additionally, PDF, PNG, and JPEG are supported only for Receipts, Invoices, Bank Statements, Checks, and Expenses.

How do I report the issues if I am stuck?

Feel free to drop an email to support@saasant.com

Possible Failures & Troubleshooting Tips

The transaction currency is invalid for the customer/vendor/account.

The given Currency is different than the default currency of the Customer. Please refer to the Customer's Currency in QuickBooks and update it in the Currency Field.

Duplicate Document Number Error: You must specify a different number. This number has already been used.

There is another invoice that has the same reference number. Please use another reference number. You have disabled "Assign the Estimate / Invoice / Journal Entry / Sales Receipt Numbers automatically" in Import Settings. By enabling this feature, QuickBooks will automatically assign numbers.

The amount is not equal to Unit Price * Qty supplied value.

The given Quantity & Rate is not equal to the given Amount. Please verify those fields.

You can’t set both an amount and a discount percentage if the amount is not the sum of the discount and subtotal.

You have given the Discount in Percentage & Real Value. Please use one of the values.

No matching reference was found for this account.

Please provide a valid account name in "Discount Account" field.

Email Address does not conform to the syntax rules of RFC 822.

Kindly verify the given email address format. It should be in xxxx@xx.xx format.

The amount is missing in the request.

The Line Item amount is missing for the particular line item.

Please check in QuickBooks company settings if the appropriate preferences are enabled to upload the current data set successfully. E.g: Shipping, Multi-Currency, etc.

If you have provided Shipping Address or Currency, please ensure you have enabled Shipping & Multi-Currency feature in QuickBooks Online.

Please select a tax code for the shipping line.

Kindly provide the valid tax code in the Shipping Tax Code Field.

No matching reference was found for this customer.

There is no match found for the given Customer Name. Please enable the "Auto Creation of List Entities (Vendor, Customer)" feature in import settings to create the customer automatically.

Transaction amount (Sum of line amounts) must be 0 or greater.

Please provide a valid (Non-Negative) amount in the Line Item Amount Field.

The discount amount must be non-negative.

Please provide a valid (Non-Negative) amount in the Line Item Amount Field.